Today was an exciting day as new all-time highs were hit on many of the broad market indexes. I was salivating waiting to see what my Diamond Scan results would be! To my surprise, I only had four results. Meanwhile, the bearish Diamond Dog Scan produced 8 results. So, on a day when the market hit new all-time highs, I had more results on my bearish scan. Caution continues to be warranted as breadth and volume aren't confirming these all-time highs either. I ran a grab bag of my scans and did find five interesting diamonds in the rough for your review.

I love to get your feedback on these reports, so shoot me an email at erinh@stockcharts.com. I read every one of them!

Welcome to "DecisionPoint Daily Diamonds," a newsletter in which I highlight five "diamonds in the rough" taken from the results of one of my DecisionPoint scans. Remember, these are not recommendations to buy or sell, but simply stocks that I found interesting. The objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Current Market Outlook:

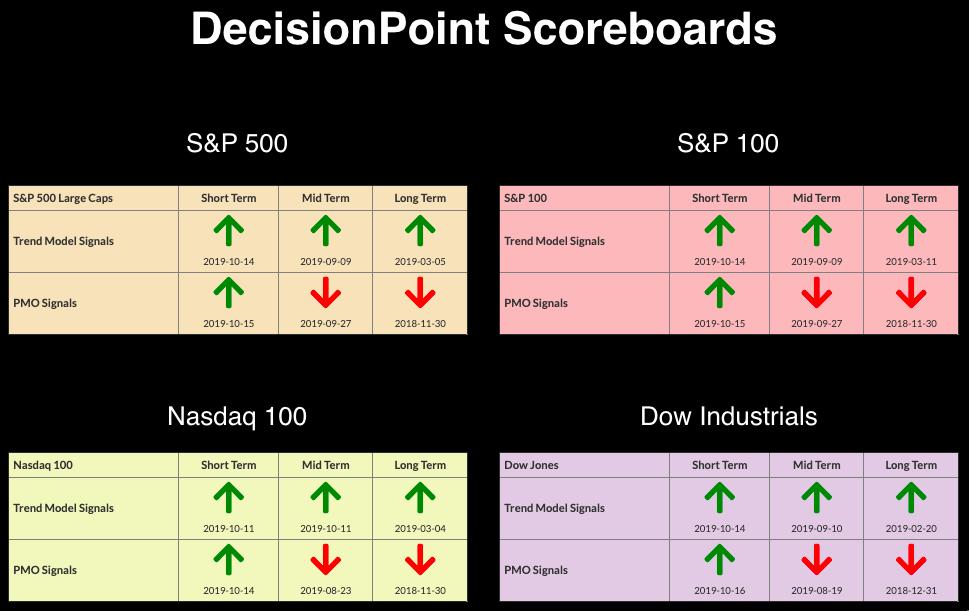

Market Trend: Currently, we have Trend Model BUY signals in all three timeframes on the DP Scoreboard Indexes.

Market Condition: The market is overbought and we have Price Momentum Oscillator (PMO) BUY signals on the DP Scoreboards. Caution is still warranted as volume and breadth are not confirming these new all-time highs.

Market Environment: It is important to consider the odds for success. Here are the current percentages on the Silver and Golden Cross Indexes:

- Silver Cross: 60.8% SPX ITTM Buy Signals (20-EMA > 50-EMA)

- Golden Cross: 67.6% SPX LTTM Buy Signals (50-EMA > 200-EMA)

Diamond Index:

- Diamond Scan Results: 4

- Diamond Dog Scan Results: 8

- Diamond Bull/Bear Ratio: 0.50

AdvanSix Inc (ASIX) - Earnings: 11/1/2019

We currently have a double-bottom in play here. Note the declining price lows as the OBV lows are rising; this is a positive divergence. Price closed above the 20-EMA for the first time since the price shock in early October. The PMO is rising nicely. One caveat is that, while I don't use candlesticks, I do recognize a "shooting star" even with OHLC bars. Basically, price opened on its low, proceeded toward intraday highs and then pulled way back toward the lows on the day. Typically, this candlestick formation precedes a decline the next day. The double-bottom hasn't executed yet, but, if price does close above the confirmation line, the minimum upside target would put price right at overhead resistance at the September high.

The weekly chart shows a PMO bottom above the signal line, which I generally find especially bullish. Price has bounced off important support and could be ready for a move toward those lows in early 2018, around $32.00.

Bank of Montreal (BMO) - Earnings: N/A

Today, the 50-EMA crossed above the 200-EMA on BMO. This means that BMO is now in a bull market configuration, having broken a declining trend that began off the May high. Granted, overhead resistance is fairly close at $76, but I'm looking at an upcoming challenge of the May high.

The weekly PMO just triggered a BUY signal last Friday. Overhead resistance at $77.50 is clear, but I like a target at $80.

Cass Commercial Corp (CASS) - Earnings: 10/24/2019

CASS was in a screaming decline for the last month, but it seems to have righted the ship as it formed a nice cup after breaking away from the steep declining trend. The PMO turned up just above zero, which is positive. I also note that we have seen nice, clean PMO crossovers that have worked out well this year.

$54 is the high from 2016 and it does appear price is knocking on the resistance ceiling. The PMO looks very healthy; I don't think it will have a problem with that level. Target is $60.

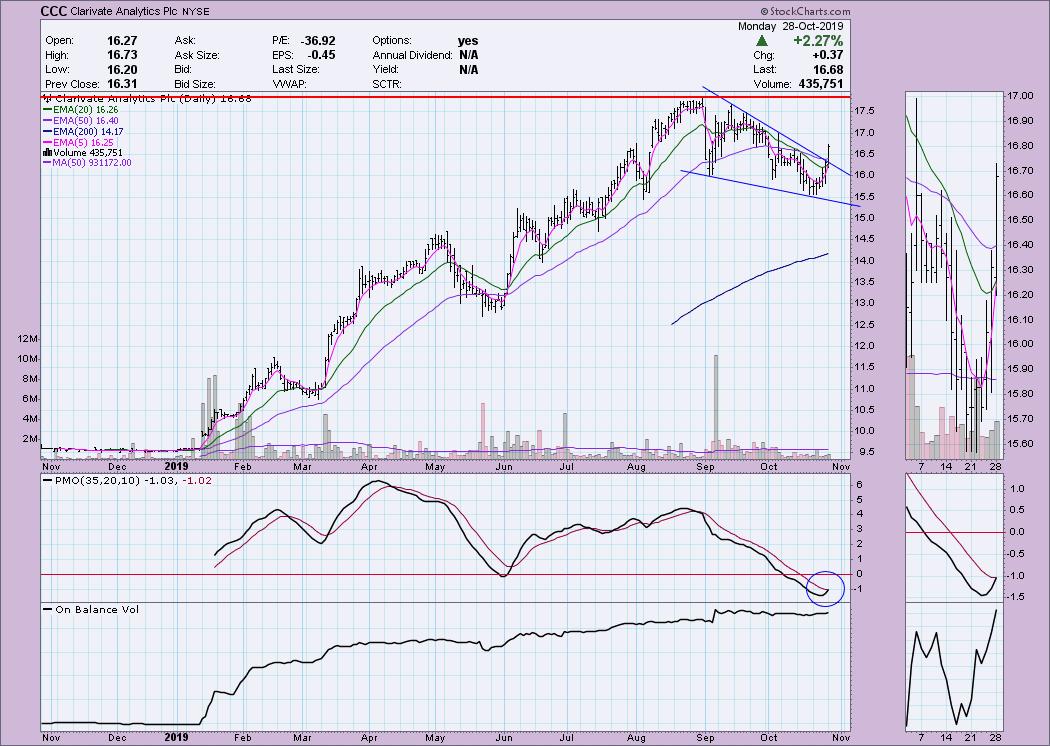

Clarivate Analytics Plc (CCC) - Earnings: 11/5/2019

After closing above its 20-EMA on Friday, CCC followed up with a nice breakout from a bullish declining wedge. The PMO has nearly generated a crossover BUY signal. We may see a pullback on this one, which would make a slightly better entry.

There isn't much historic data on this one, but I did note the bullish flag formation on both the daily above and the weekly chart below. Unfortunately, we have to go blind with the PMO as it needs more data before it can begin calculating.

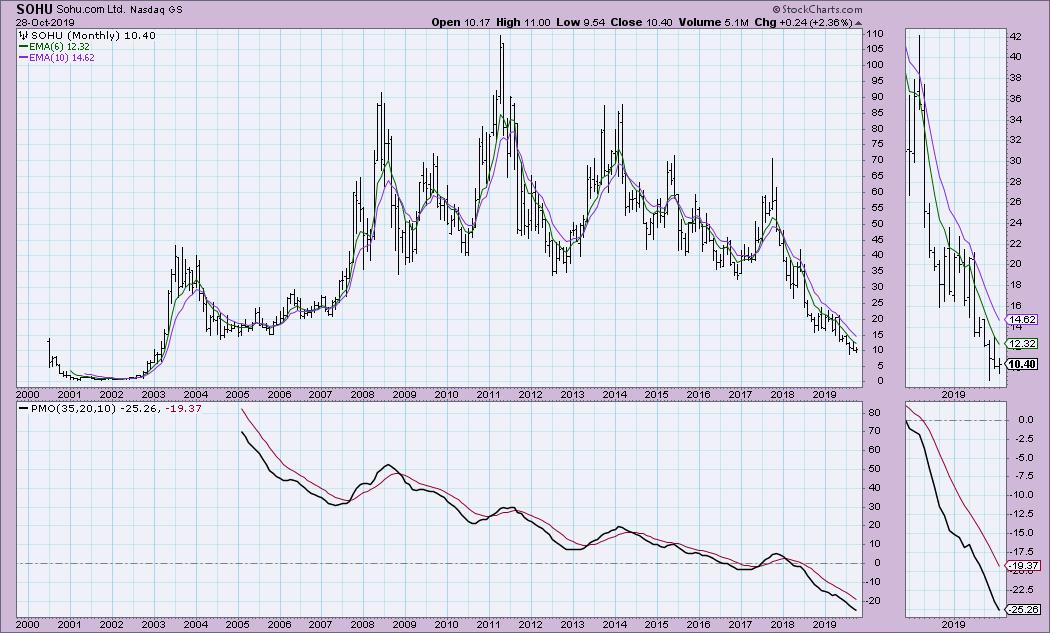

Sohu.com (SOHU) - Earnings: 11/4/2019

SOHU had been in a wide trading range and has now reached the bottom of it. The PMO is rising nicely. Price closed above the 20-EMA today, which I also find bullish. This is a bottom-fishing stock, no doubt about it. It could be high risk. One might be concerned about a head-and-shoulders pattern within that trading range. Don't be. Head and shoulders are "reversal" patterns, meaning they must appear after a price rise, not decline.

As you can see, it is trading at multi-year lows. Think GE. I did check the monthly chart (below the weekly chart below) and, after its initial offering at about this price, it declined and did trade at about $1.00. Set your stop tightly; you don't want to get caught holding this bag at under a dollar. Some might wonder why I included this at all - it's for my bottom fishers that have been in touch and are always interested.

Full Disclosure: I do not own any of the stocks above and won't be adding them to my portfolio. I'm being patient as I don't trust this market. I'm currently about 60% in cash.

SAVE THE DATE!!

Erin Swenlin will be presenting at the TradersExpo in New York City on March 15-17, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**