I honestly don't keep track of all of the Diamonds that I present, but now and then I am sure that there are repeats. Three of today's Diamonds were reported to you in the past; obviously they've continued to perform or else they wouldn't have shown up. Yesterday's Methode Electronics (MEI) came up again today in two different scans. I reviewed it yesterday if you're interested in my analysis of it. The three repeats are ANSS, BCO and WYND. I'm starting to track which stocks I write about, so next time I promise to have links back to original articles.

I love to get your feedback on DP commentary, so shoot me an email at erinh@stockcharts.com. I read every one of them!

Welcome to "DecisionPoint Daily Diamonds," a newsletter in which I highlight five "diamonds in the rough" taken from the results of one of my DecisionPoint scans. Remember, these are not recommendations to buy or sell, but simply stocks that I found interesting. The objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

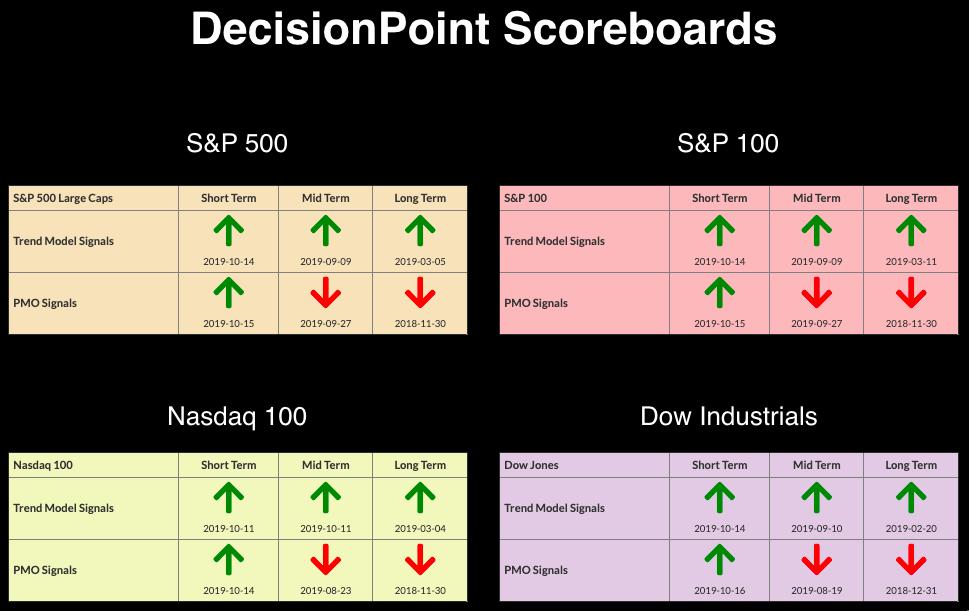

Current Market Outlook:

Market Trend: Currently, we have Trend Model BUY signals in all three timeframes on the DP Scoreboard Indexes.

Market Condition: The market is overbought and we have Price Momentum Oscillator (PMO) BUY signals on the DP Scoreboards. Caution is still warranted as volume, breadth and DP indicators are not confirming these new all-time highs (see today's DP Mid-Week Alert).

Market Environment: It is important to consider the odds for success. Here are the current percentages on the Silver and Golden Cross Indexes:

- Silver Cross Index: 63.4% SPX IT Trend Model Buy Signals (20-EMA > 50-EMA)

- Golden Cross Index: 69.4% SPX LT Trend Model Buy Signals (50-EMA > 200-EMA)

Diamond Index:

- Diamond Scan Results: 4

- Diamond Dog Scan Results: 20

- Diamond Bull/Bear Ratio: 0.20

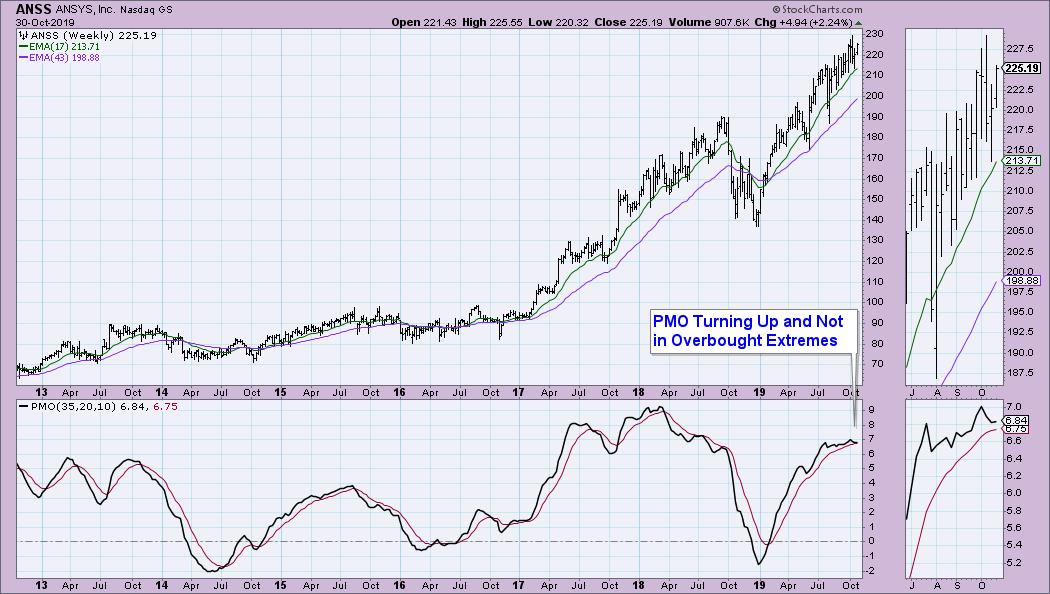

ANSYS Inc (ANSS) - Earnings: 11/6/2019

ANSS is in a solid rising trend channel and, given the PMO "scoop" higher, I suspect it will be moving to test the top of the channel. Earnings are due next week so keep that in mind. The PMO hasn't done much, but, with the acceleration of price remaining mostly constant during the formation of this rising trend channel, that is to be expected and it isn't a bad thing. Price is holding the 20-EMA easily.

The weekly PMO is not in overbought territory yet and it flattened out during the steady price rise, so, again, nothing to worry about. It has been twitching around but ultimately it is rising again and has remained above its signal line.

Brink's Co (BCO) - Earnings: 10/23/2019

I remember this one hitting my scans for about three days in a row sometime in September when I reported it to you (I'm sorry, I don't remember which report). I like that it has pulled back to the breakout point and it remains in a steady rising trend. The PMO is not overbought. There are a few things I don't care for, but I believe the positives outweigh the negatives, with the negatives being a possible reverse divergence with the OBV top in July and the most recent one. The recent price top was well below the July price, which could indicate that, despite an influx of volume, price couldn't make it back to the original July high. You can also see a possible rising wedge.

I really like the weekly chart. Price popped above overhead resistance at the 2017/2018 tops and there is an accompanying weekly PMO BUY signal.

CVR Energy Inc (CVI) - Earnings: 10/23/2019

CVI has been in a nice ricing trend channel and the PMO has been confirming the whole way. The OBV is mediocre, but the SCTR has just reentered the "hot zone" above 75.

The rising trend channel on the weekly chart is impressive. An added positive is that the low from August didn't need to test the bottom of the channel before the bounce. The PMO has turned up above the zero line.

Stag Industrial Inc (STAG) - Earnings: 11/5/2019

This diamond may need a little more time, but I think getting in now would work out. It closed on its high today, which is challenging the June top. Technically, today's close was higher than the June closing high. The volume is coming in and has been mostly increasing on the rally to this point. The SCTR is a respectable 68.4.

It appears we will have a new weekly PMO BUY signal on Friday when the weekly chart "goes final." The PMO crossover BUY signals on the weekly chart have been clean and mostly profitable.

Wyndham Destinations Inc (WYND) - Earnings: 10/30/2019

This one I believe I looked at a few weeks ago. Today's short-term breakout looks good and price closed above the overhead resistance at the earlier October high. The PMO has triggered a BUY signal and volume is coming in. The OBV is breaking out. Today they had an "okay" earnings report that clearly investors were also okay with. I'm looking for a move to challenge the July and September highs.

There is a rising trend channel on the weekly chart, but it is wide. The rising trend could remain intact even if price falls to $42. I believe it will continue higher given the PMO reaching above its previous top and the fact that it isn't overbought.

Full Disclosure: I currently own MODN and plan to continue holding it. My stop is currently at $26. I don't own any of the others and don't plan on adding any to my portfolio at this time. I'm being patient as I don't trust this market. I'm currently about 60% in cash.

SAVE THE DATE!!

Erin Swenlin will be presenting at the TradersExpo in New York City on March 15-17, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**