It isn't always the case, but today I had a few "big" large-cap names hit my scans that I think could be "diamonds in the rough." At the same time, though, I had a very low-volume stock hit the radar among these giants. I'm still uneasy that the Diamond Scan continues to produce a very limited number of results that I feel shouldn't be the case in this market environment that has produced new all-time highs. Today's advice is to set stops right now. I'm guilty of not putting in hard stops and, like many of you, I've paid for that. When I feel uneasy about the market, I do put them in so that I can either preserve a nice gain or prevent a disaster. I recently did a workshop on my philosophy for setting stops that you can view here.

I love to get your feedback on DP commentary, so shoot me an email at erinh@stockcharts.com. I read every one of them and try to answer them all! Your insight helps me to tailor my commentary to what my readers and viewers want to hear about.

Welcome to "DecisionPoint Daily Diamonds," a newsletter in which I highlight five "diamonds in the rough" taken from the results of one of my DecisionPoint scans. Remember, these are not recommendations to buy or sell, but simply stocks that I found interesting. The objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

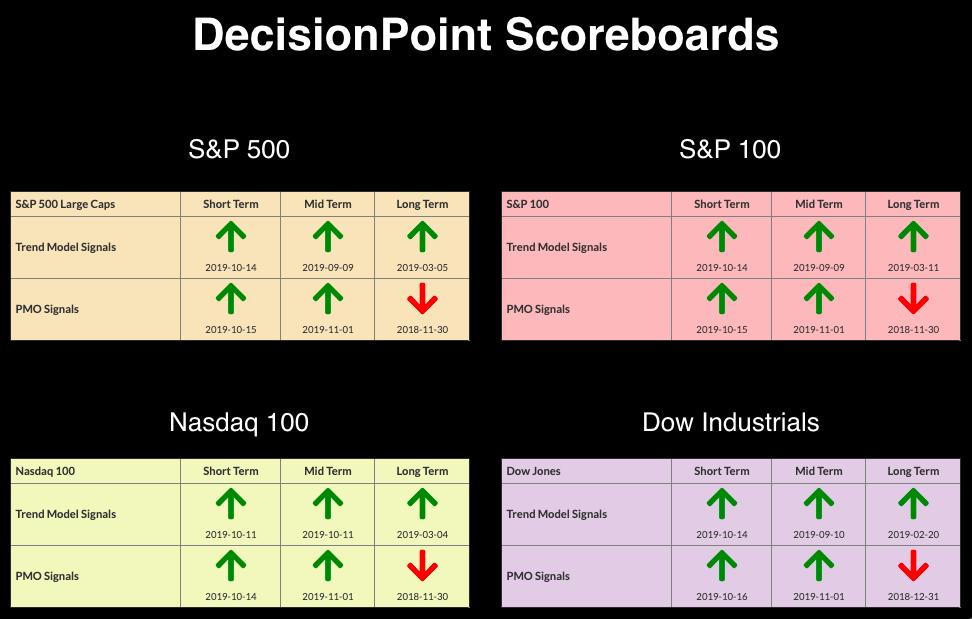

Current Market Outlook:

Market Trend: Currently, we have Trend Model BUY signals in all three timeframes on the DP Scoreboard Indexes.

Market Condition: The market is overbought and we have Price Momentum Oscillator (PMO) BUY signals on the DP Scoreboards. One thing I have learned that honestly drives me crazy is that overbought conditions can persist in a bull market. I am still cautious with my investing right now based on the market being overbought, but it certainly can be frustrating to watch the markets continue to rise.

Market Environment: It is important to consider the odds for success. Here are the current percentages on the Silver and Golden Cross Indexes:

- Silver Cross Index: 68.34% SPX IT Trend Model Buy Signals (20-EMA > 50-EMA)

- Golden Cross Index: 71.54% SPX LT Trend Model Buy Signals (50-EMA > 200-EMA)

Diamond Index:

- Diamond Scan Results: 4

- Diamond Dog Scan Results: 11

- Diamond Bull/Bear Ratio: 0.36

Boeing Co (BA) - Earnings: 1/28 - 2/3/2020

Boeing has been in a trading range most of the year since the deep decline on news back in March. Price is in the middle of the trading range, which I typically like to avoid, but recent price action is good, with a breakout above the 20-EMA and a pullback today to that breakout point. The PMO is turning up in oversold territory and is very near a crossover BUY signal. I'm expecting a test of the top of this trading range. Note the OBV and SCTR are traveling in the right direction to confirm this rally.

Price hasn't yet closed above the 17/43-week EMAs and the PMO is technically in decline. However, the PMO is decelerating on this recent rally and could turn around above the zero line.

Citizens Financial Group Inc (CFG) - Earnings: 1/17/2020

The breakout on CFG is what caught my eye today on the CandleGlance chart. When I clicked on it, I liked the chart. The PMO is rising strongly and just look at that SCTR move! The OBV is trending higher. Today, price pulled back after the breakout yesterday and remained above support.

This week's breakout could execute a bullish ascending triangle pattern. Overhead resistance lies at about $40, but, if the triangle executes as it should, the upside target would be the 2018 top.

Deckers Outdoor Corp (DECK) - Earnings: 1/29 - 2/3/2020

Here is another lovely breakout. Price did pullback below yesterday's low, but it closed slightly higher. The PMO bottomed above the signal line, which I always find to be especially bullish. The OBV is confirming this breakout. The SCTR has been on the rise for some time. Overhead resistance is around $171, with the next level being around $180.

The weekly chart is encouraging. There is a double-bottom pattern that has executed this week. The PMO is bottoming and turning higher.

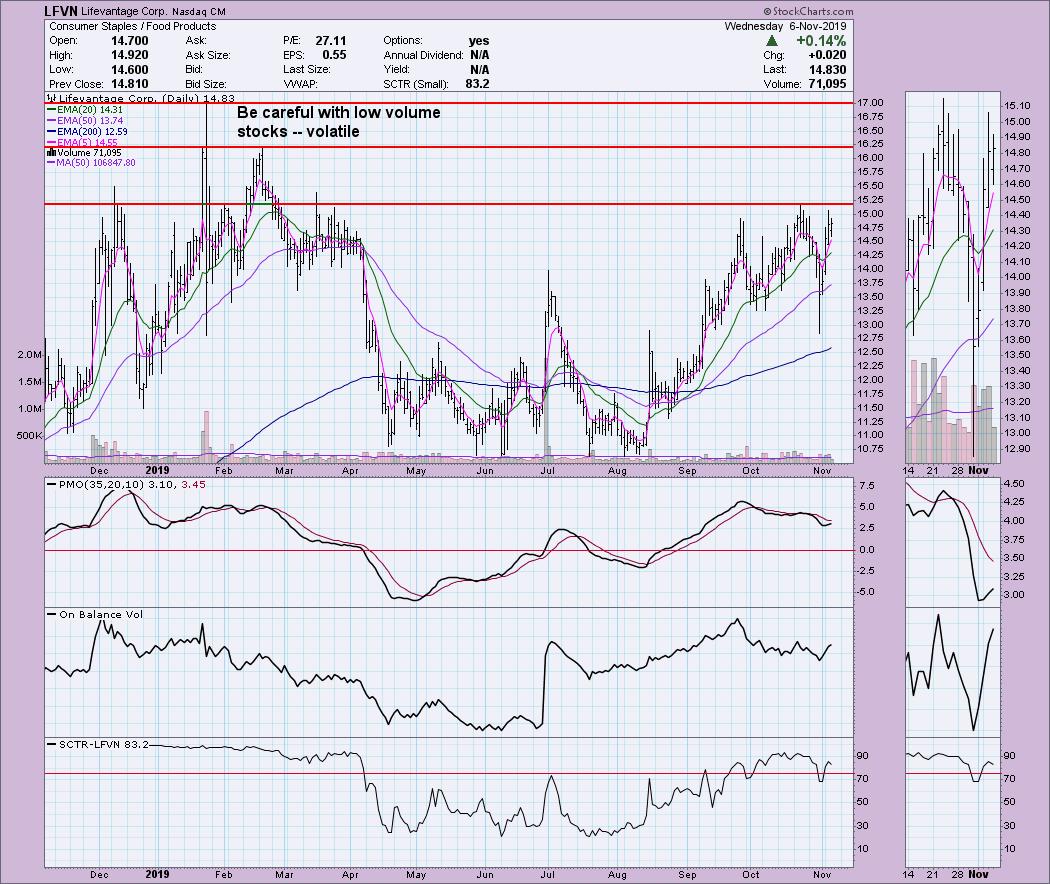

Lifevantage Corp (LFVN) - Earnings: 2/3 - 2/7/2020

We don't have a breakout yet on LFVN and so be careful with low-volume stocks. As you can see, price action can be volatile. I still like LFVN; the SCTR is healthy and the PMO is bottoming. The OBV is confirming the recent rally as volume is pouring in.

You can see the double-bottom on a weekly chart better than on the daily chart above. The pattern has executed and, according to the weekly chart, the next area of overhead resistance lies at the 2016/2019 highs. I really like the reaction of the PMO to this last leg of the rally.

Owens Corning Inc (OC) - Earnings: 10/23/2019

Here is "big guy" number two. OC has been in a nice rising trend; today, it successfully tested the 20-EMA before closing near the highs for the day. The OBV is flat, which is better than seeing it trending lower. The PMO is flattening, but is still rising. Its SCTR rank has been in the "hot zone" since September, which implies internal and relative strength.

The weekly chart does show us that stiff overhead resistance is nearing but, with a strongly rising PMO, I am looking for a breakout.

Full Disclosure: I don't own any of the stocks I've presented today and I don't plan on adding any to my portfolio at this time. The market has been rallying, but I am still cautious. I'm currently about 60% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**