Carl and I exchanged text messages last night regarding the possibility of a bounce soon. He reminded me that just as in a bull market where overbought conditions can persist without a decline, so it goes in bear markets where oversold conditions can persist without a bounce. Our indicators have hit major oversold extremes and while that indicates a price reversal to upside is close, it doesn't mean we won't grind out more decline. I am still optimistic as we haven't seen these types of extremes since some of the major lows in 2018. The chart below tells the story of oversold extremes. I've circled the values of these indicators to really let it sink in how oversold we really are getting. Right now less than 7% of SPX components are ABOVE their 20-EMAs. Only 21% are above their 50-EMAs. My caveat here is for you to note what happened in October of 2018. We had some seriously oversold readings which did result in some upside, but the deeper decline was yet to come.

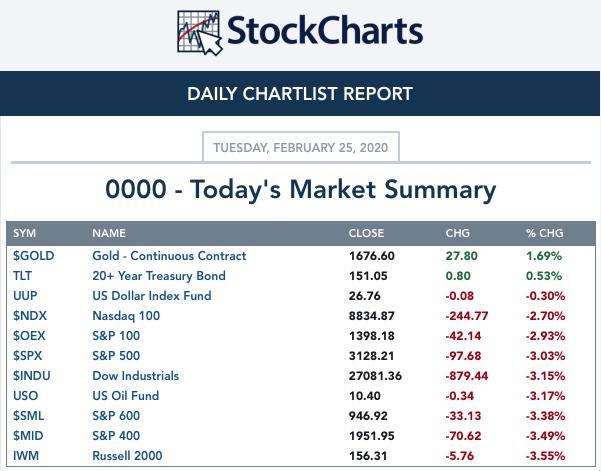

TODAY'S Broad Market Action:

This WEEK SO FAR:

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

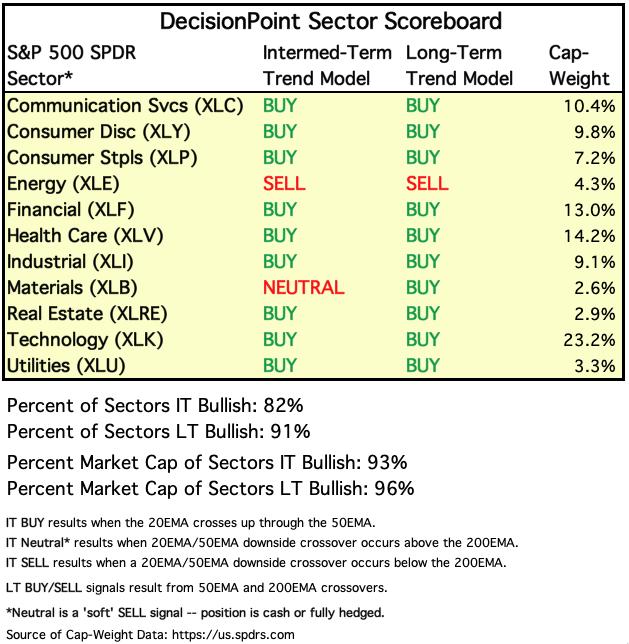

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

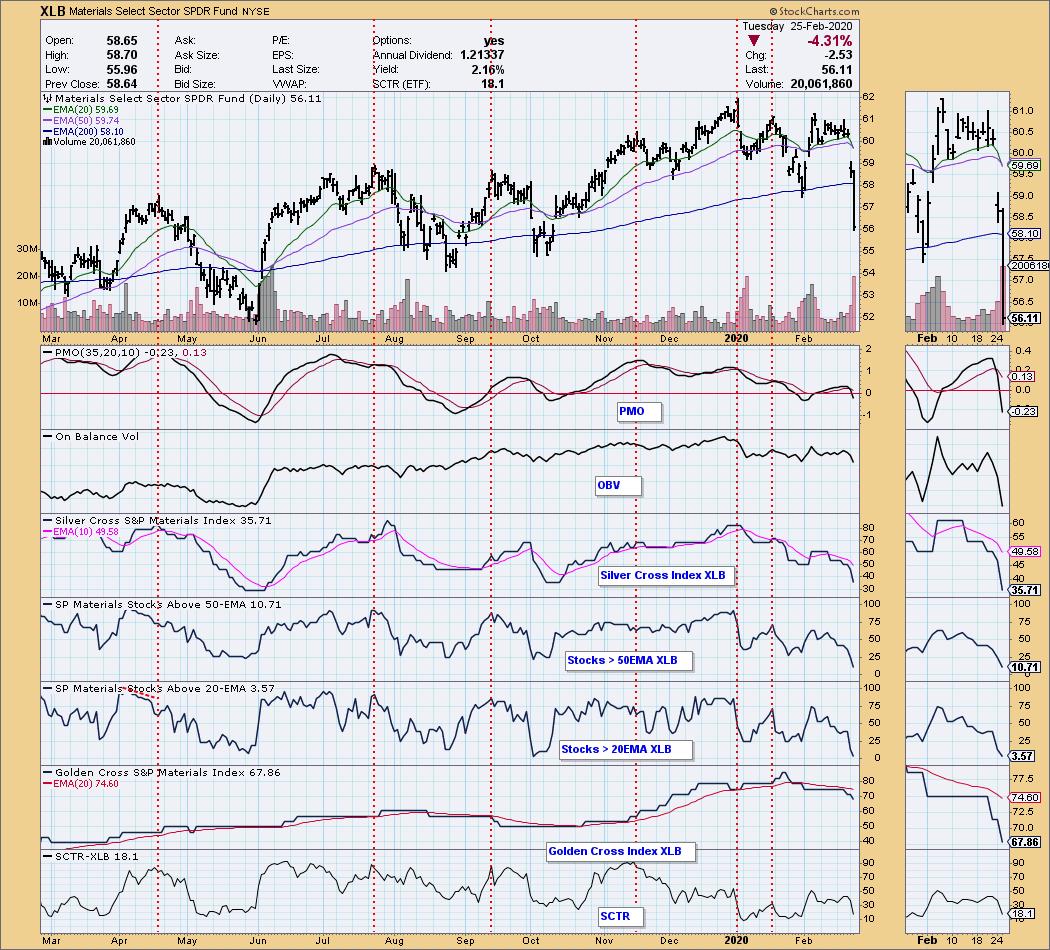

You'll note that we added a Neutral signal to our Sector Signal Table. Below is XLB. You can see the signal generated when the 20-EMA crossed below the 50-EMA while the 50-EMA was above the 200-EMA. Had the 50-EMA been below the 200-EMA it would've resulted in a SELL signal. Despite metals doing well, that sector is not performing well. The next area of support is all the way down at $51 with the possibility of support at $54.

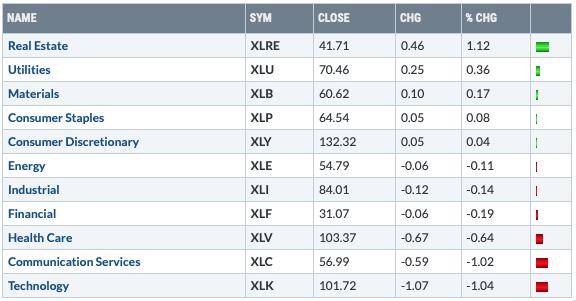

TODAY'S RESULTS:

This WEEK SO FAR:

STOCKS

IT Trend Model: BUY as of 9/6/2019

LT Trend Model: BUY as of 2/26/2019

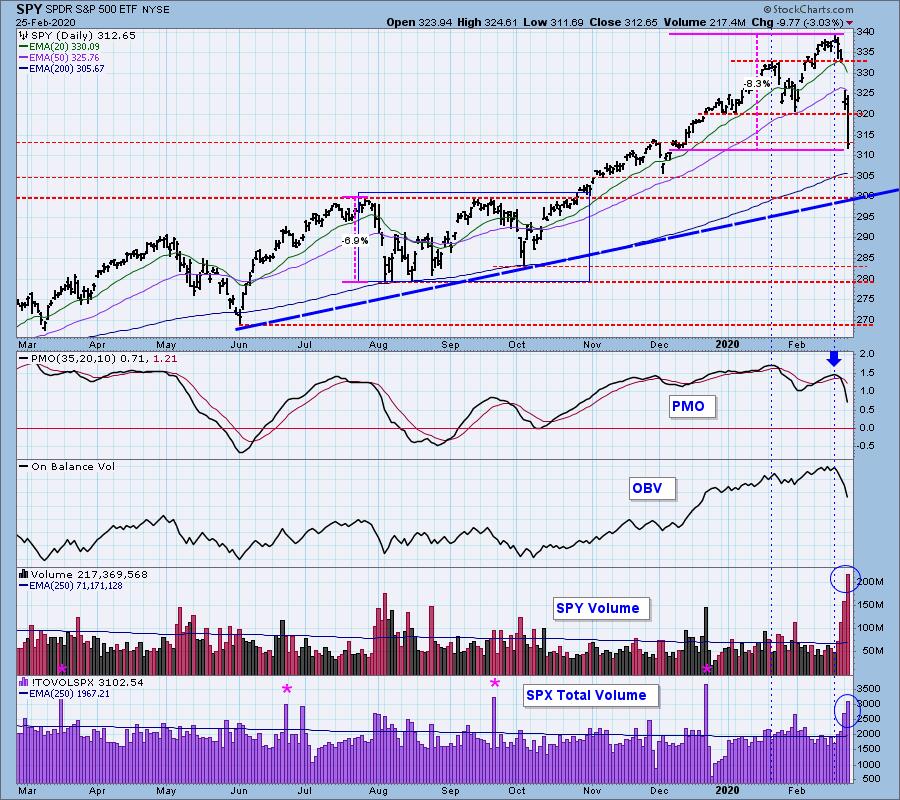

SPY Daily Chart: The disaster that has been this week is clear. Volume was off the charts today for the SPY and total volume on SPX was near the highs we generally see during options expiration. I've been looking at August as an example of what I think is ahead, but this first giant drop down has already surpassed the loss of August's initial drop.

Climactic Market Indicators: More climactic readings. I believe we are still in the selling initiation phase. My expectation is price to test the 200-EMA before switching overall direction. These climaxes are generally a good thing to observe as they do tend to come along with market bottoms. Again, though, look at August. I don't think this is over.

Short-Term Market Indicators: The ST trend is DOWN and the market condition is OVERSOLD based upon the Swenlin Trading Oscillator (STO) readings. Oversold is a technical term bulls like to hear, but as I said earlier, these conditions can continue in a bear market environment. Let's look for them to begin bottoming before we get too excited by their oversold readings.

Intermediate-Term Market Indicators: The Silver Cross Index (% of SPX stocks 20EMA > 50EMA) and the Golden Cross Index (percent of SPX stocks 50EMA > 200EMA) are moving lower quickly and in all honesty, they aren't oversold. I'd say the Golden Cross Index is still overbought and the Silver Cross Index is neutral.

The IT trend is still UP when measured by the green rising trendline and the market condition is NEUTRAL based upon the PMO, ITBM and ITVM readings, and SOMEWHAT OVERBOUGHT based upon the Silver Cross/Golden Cross Index readings. The ITBM/ITVM continue lower. The ITVM has now reached below zero. The simply aren't oversold and could easily move lower.

CONCLUSION: The ST is DOWN and the IT trend is UP (barely). Market condition based on ST and IT indicators is OVERSOLD to NEUTRAL. I believe we are nearing a short-term bounce based on the climactic readings and oversold indicators, I just don't think it will stick. I'm strapping myself in and tightening my stops.

(Not a Diamonds subscriber? Add it to your DP Alert subscription and get a discount! Contact support@decisionpoint.com for your limited time coupon code!)

DOLLAR (UUP)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: The Dollar is pulling back toward support at the October top. The PMO is moderately overbought based on the top of its range at 1.25. It has topped, but no negative crossover yet. In any case, I own UUP and plan on tightening my stop to $26.60 from $26 to preserve profit and allow that money to go to work elsewhere.

GOLD

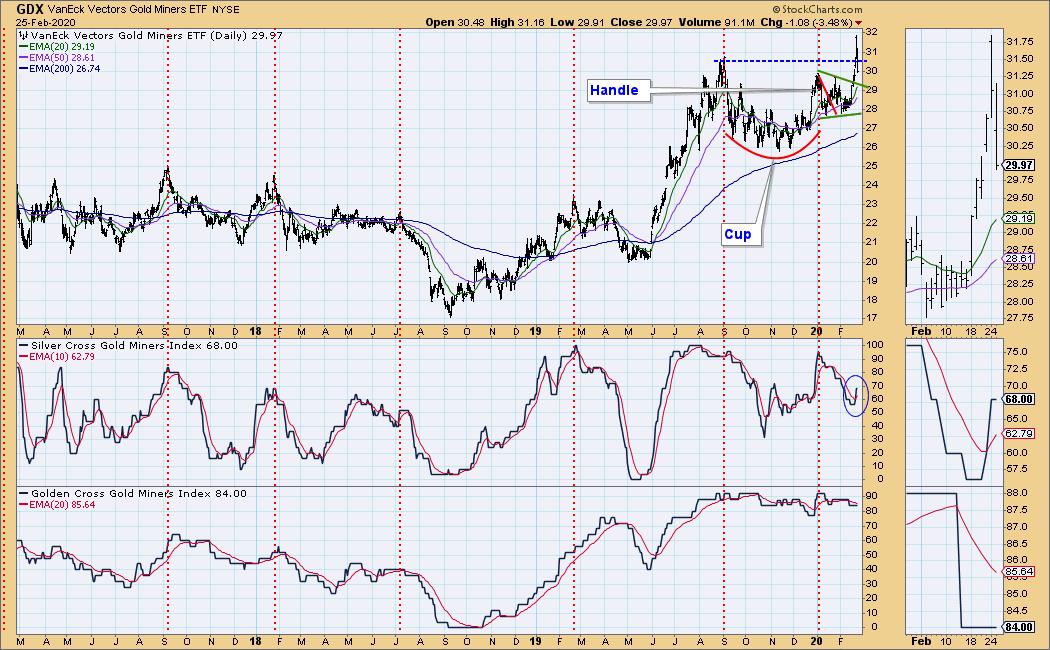

IT Trend Model: BUY as of 12/26/2019

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Gold was due for a pullback and honestly could use more. The short-term parabolic move was unsustainable. However, the PMO is still rising and support is close by. I'm looking for higher prices.

GOLD MINERS Golden and Silver Cross Indexes: The Silver Cross Index is improving unfortunately today's pullback was painful and brought price down below what looked like a good support level. Given the improvement in components moving to IT Trend Model BUY signals, I believe like Gold, GDX needed a pullback.

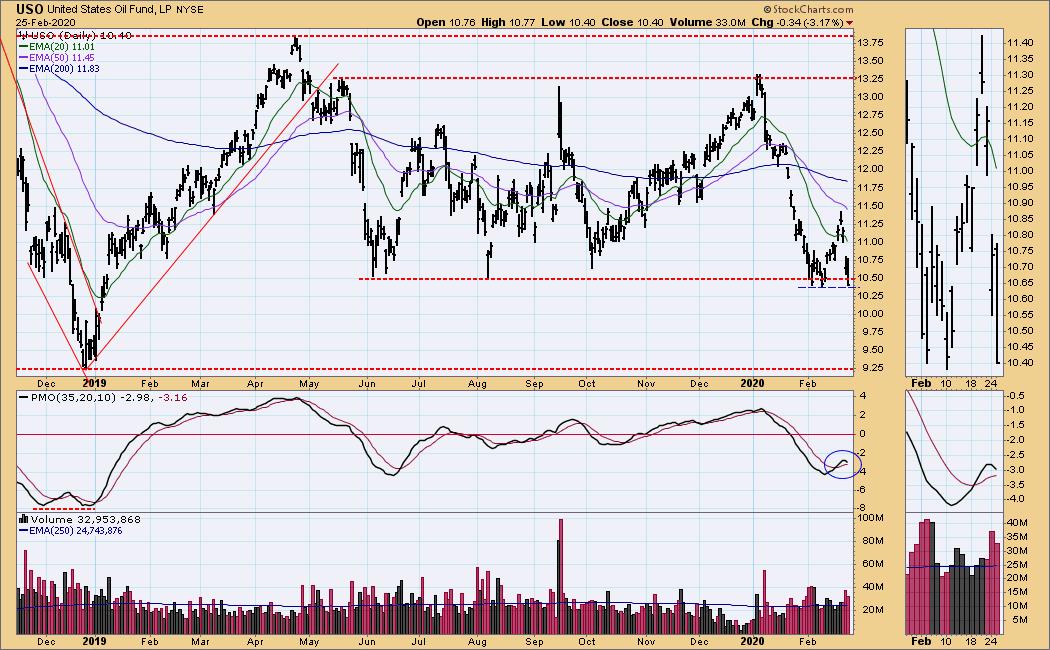

CRUDE OIL (USO)

IT Trend Model: Neutral as of 1/27/2020

LT Trend Model: BUY as of 12/16/2019

USO Daily Chart: USO is flirting with short-term support. The PMO suggests it won't hold and I'm of the same mind. I hope that this level will hold, but I do not to trade on hope. A bottom like the one we saw earlier this month would be constructive, setting up a possible double-bottom. Let's wait to talk about that chart pattern seriously. USO has work to do.

BONDS (TLT)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: The breakout from the symmetrical triangle (green), and a near vertical move to the upside reminds me of the Gold chart. We haven't really seen a pullback yet and with scared money out there, we could see TLT continue higher before that pullback. Notice the increase in the volume bars since Thursday. Interest in bonds is still high.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

Erin Swenlin will be presenting at the The MoneyShow Las Vegas May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)