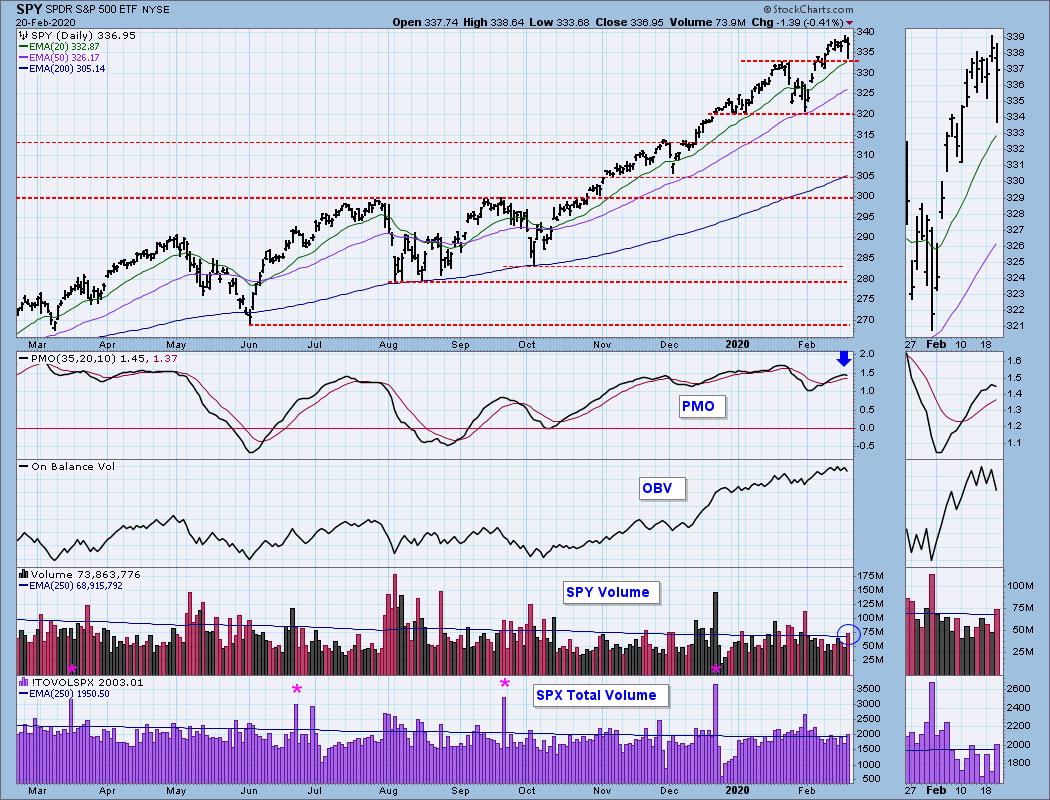

Yesterday I redrew the rising wedge pattern. I received a text from Carl with the chart below after today's close accompanied by the statement that I used as today's headline. We had a different rising bottoms trendline. On Tuesday, it executed and then of course, we saw a rally that gave us a new rising bottoms trendline. Today, we saw the breakdown from that wedge. I note that the intraday low tapped on support at the January top. I have to wonder if this will materialize into a correction. I've been looking at the 50-EMA or possibly $320 for the SPY as support on a corrective move.

TODAY'S Broad Market Action:

Top 10 from ETF Tracker:

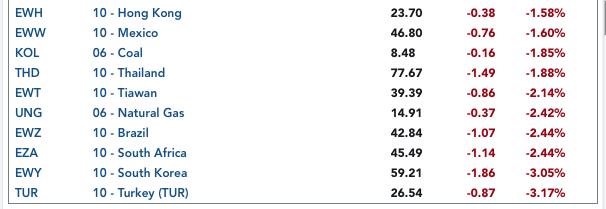

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

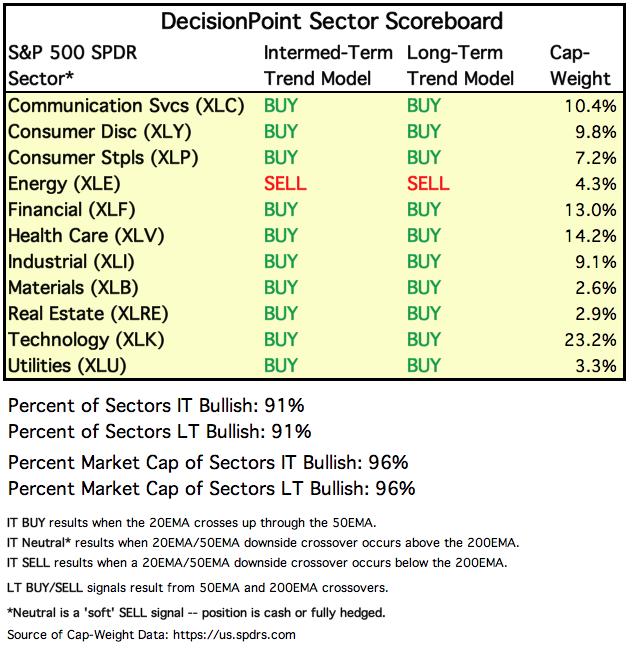

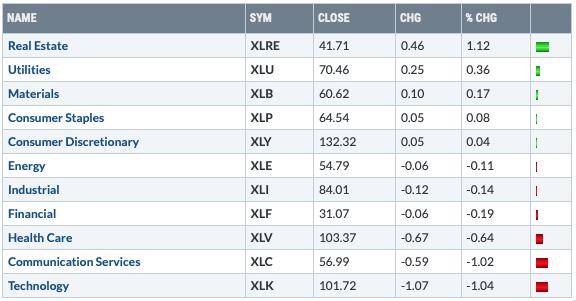

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

STOCKS

IT Trend Model: BUY as of 9/6/2019

LT Trend Model: BUY as of 2/26/2019

SPY Daily Chart: The PMO has topped, but it only ticked lower. One big issue today would be the high volume on both the SPY and SPX on a negative day.

Climactic Market Indicators: I was hoping for some direction on the climactic indicator chart, but I was disappointed. We saw New Highs finally contract, but the other readings were neutral. The VIX set up a long tail that brought it very close to the bottom Bollinger Band. I want to see that as typically a penetration of the lower band leads to higher prices. We're not there yet.

Short-Term Market Indicators: The ST trend is UP and the market condition is NEUTRAL based upon the Swenlin Trading Oscillator (STO) readings. Both STOs have now reached completely neutral territory. They continue to deteriorate which usually means we will see price deteriorate. The market doesn't want to break down, but with declining STOs, I'm not expecting it to be able to hold out much longer.

Intermediate-Term Market Indicators: The Silver Cross Index (% of SPX stocks 20EMA > 50EMA) and the Golden Cross Index (percent of SPX stocks 50EMA > 200EMA) are flattening. Right now both are directionless and not providing any help.

The IT trend is UP and the market condition is NEUTRAL based upon the ITBM and ITVM readings, and SOMEWHAT OVERBOUGHT based upon the PMO and Silver Cross/Golden Cross Index readings. The ITBM/ITVM are flattening, but they continue to avert a negative crossover. These indicators are still overall positive for the intermediate term.

CONCLUSION: The ST and IT trend are UP. Market condition based on ST and IT indicators is NEUTRAL to MODERATELY OVERBOUGHT. The new short-term rising wedge activated today. I am looking for price to breakdown further in the next few days. Overall I'm still comfortable with the intermediate term.

(Not a Diamonds subscriber? Add it to your DP Alert subscription and get a discount! Contact support@decisionpoint.com for your limited time coupon code!)

DOLLAR (UUP)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: There appears to be no stopping the Dollar. That could account for many of the global ETFs taking big hits over the past week. As I talked about yesterday, the PMO appears to be extraordinarily overbought. However a peek at a long-term daily chart and you'll note that the range is 1.25 to -1.25. A reading of 0.64 is not at overbought extremes, it's moderately overbought. I keep expecting it to pullback, but not so. Nothing here to tell us it will start dropping so I'll stay bullish on the Dollar.

GOLD

IT Trend Model: BUY as of 12/26/2019

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Today we got a continuation of the rally and price overtook the January top. The PMO triggered a BUY signal yesterday. Right now the correlation with the Dollar is positive so even though they generally travel in opposite directions, currently they are traveling in concert. I expect both to continue higher.

GOLD MINERS Golden and Silver Cross Indexes: No change on the day for Miners, but it did put in a nice intraday high that put it above the previous cardinal high. I'm surprised we aren't seeing improvement on the SCI and GCI. If GDX is going to breakout, it will need participation from more than just 56% of components.

CRUDE OIL (USO)

IT Trend Model: Neutral as of 1/27/2020

LT Trend Model: BUY as of 12/16/2019

USO Daily Chart: USO continues to rally from the bottom of the trading range. There certainly is quite a bit of accumulation of USO based on the above average positive daily volume bars. The PMO recently generated a BUY signal. Right now it's looking pretty good.

BONDS (TLT)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: A reader requested TLT for the Diamonds Report. Here's what I said about the daily and weekly charts: "I've been a fan of TLT since the PMO BUY signal at the beginning of the year. It did start to consolidate into a symmetrical triangle. Those are continuation patterns, so I was looking for some more upside which we got. Overhead resistance is nearing though. I think the question is how low can rates and yields go to support even higher prices on TLT? I don't know, but the PMO is rising again and the OBV is showing interest is still there and the SCTR is improving."

Weekly Chart: "The weekly chart certainly suggests higher prices with a very large bull flag formation. The PMO just triggered an IT BUY signal. This is a steady in my portfolio, although I currently don't own in. Not a bad place to park right now."

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

Erin Swenlin will be presenting at the The MoneyShow Las Vegas May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)