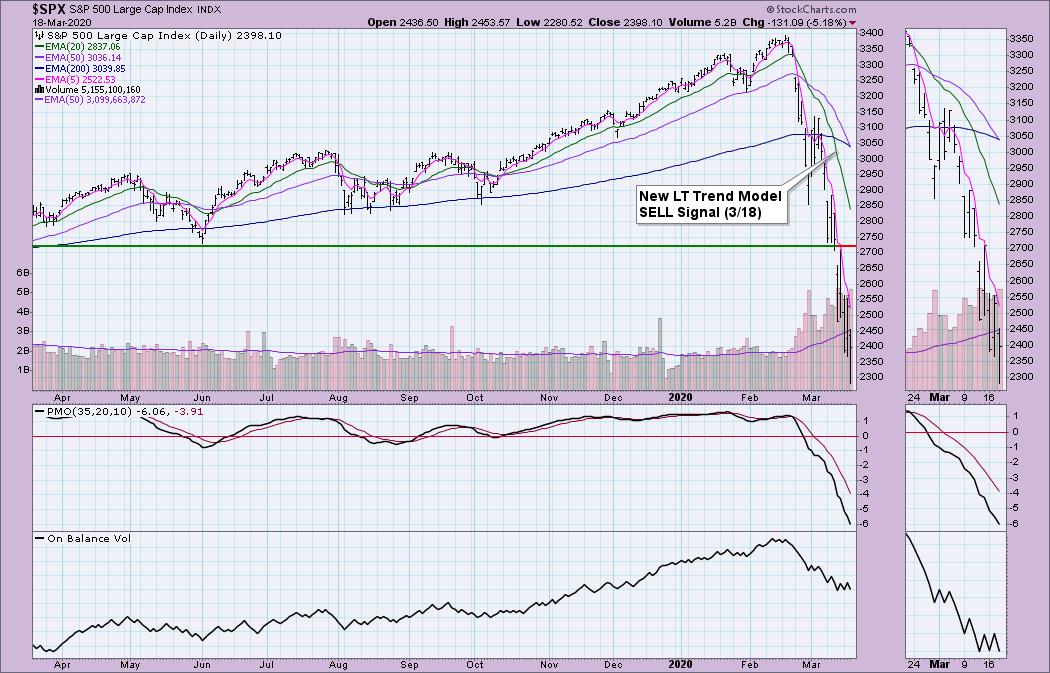

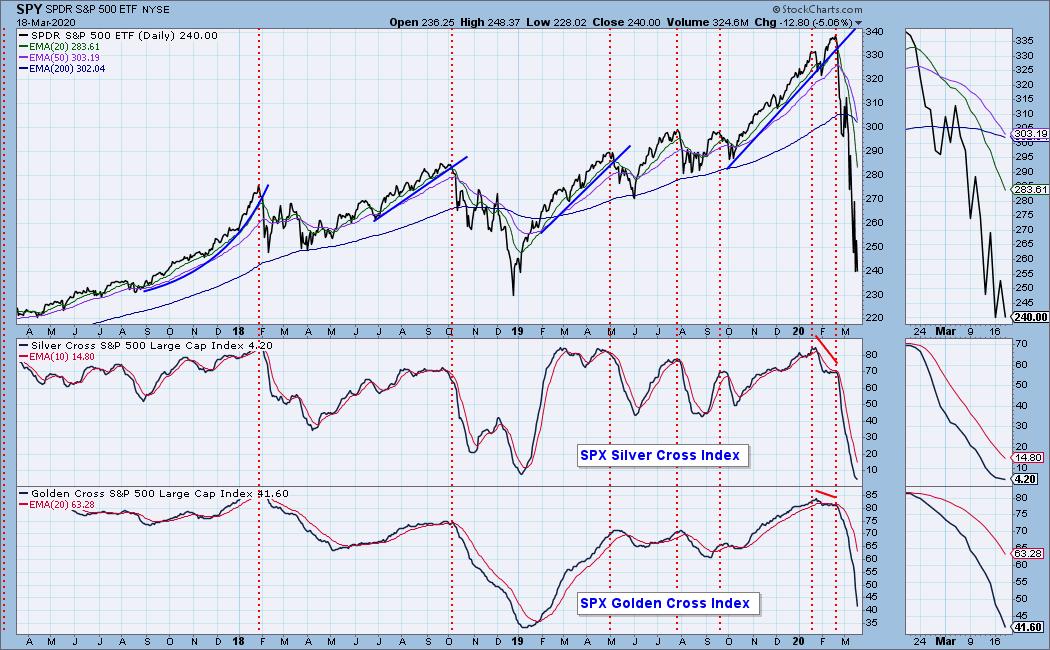

The SPX triggered a new Long-Term Trend Model SELL signal as the 50-EMA crossed below the 200-EMA. We use the SPY as our benchmark for the DecisionPoint signals that we report to "Timer Digest". The SPY is still on a Long-Term Trend Model BUY signal. I'll be giving you the big headline likely tomorrow, when we see the SPY trigger the same SELL signal. The only way for the SPY to avoid that SELL signal is for price to get back above the 200-EMA which is around $300...not likely.

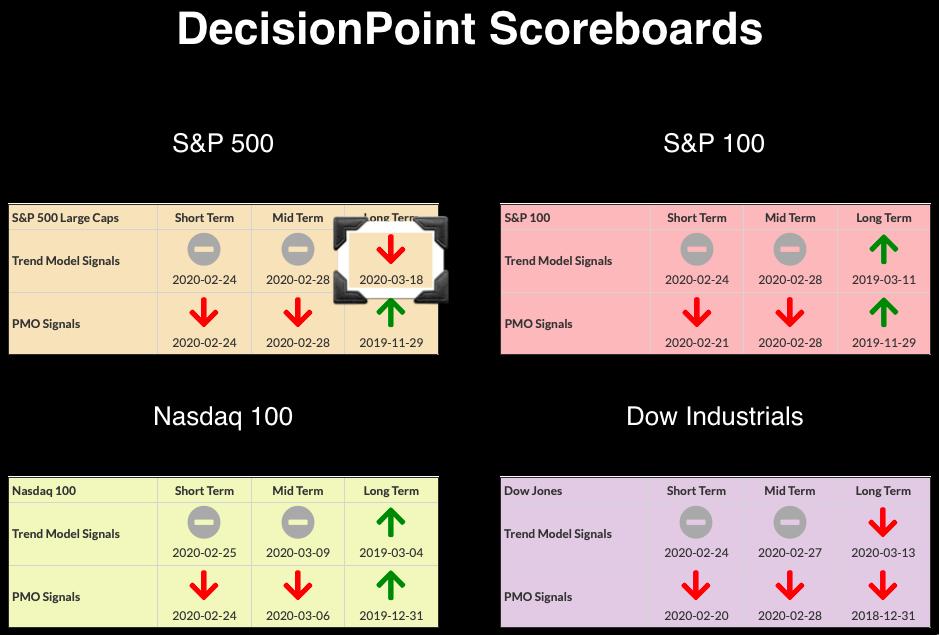

CURRENT BROAD MARKET DP Signals:

The market signals that we give to "Timer Digest" are based on the SPY, not the SPX. However, I did want to note that the SPX did trigger a new Long-Term Trend Model SELL signal as the 50-EMA crossed below the 200-EMA today.

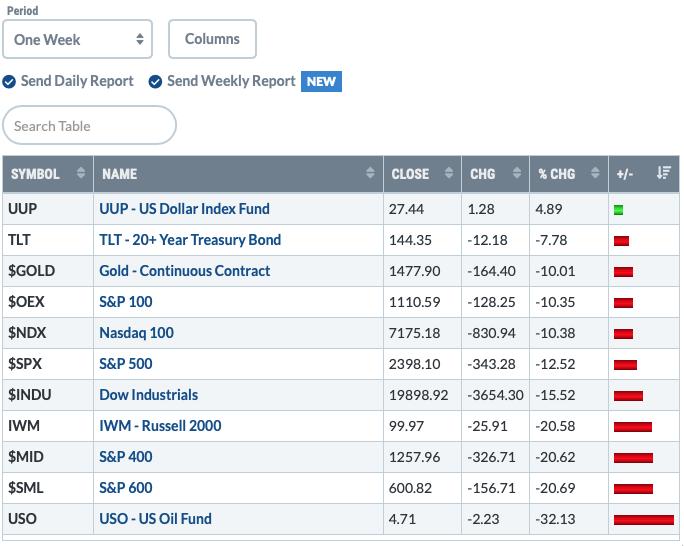

TODAY'S Broad Market Action:

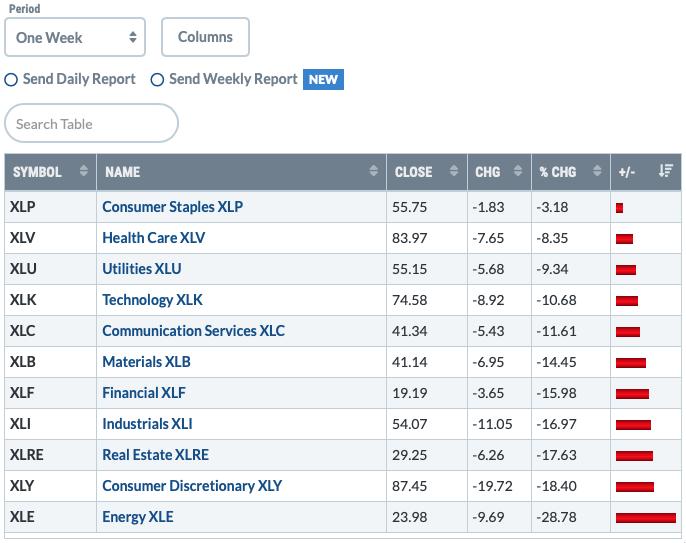

Past WEEK Results:

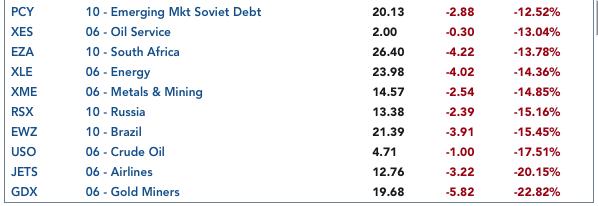

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

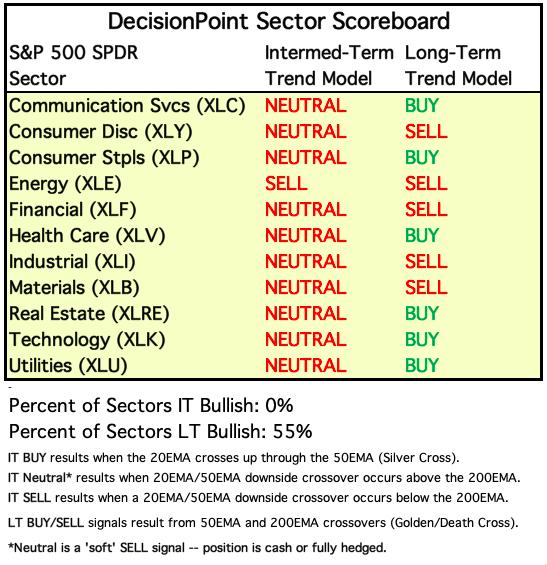

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

One WEEK Results:

STOCKS

IT Trend Model: NEUTRAL as of 2/28/2020

LT Trend Model: BUY as of 2/26/2019

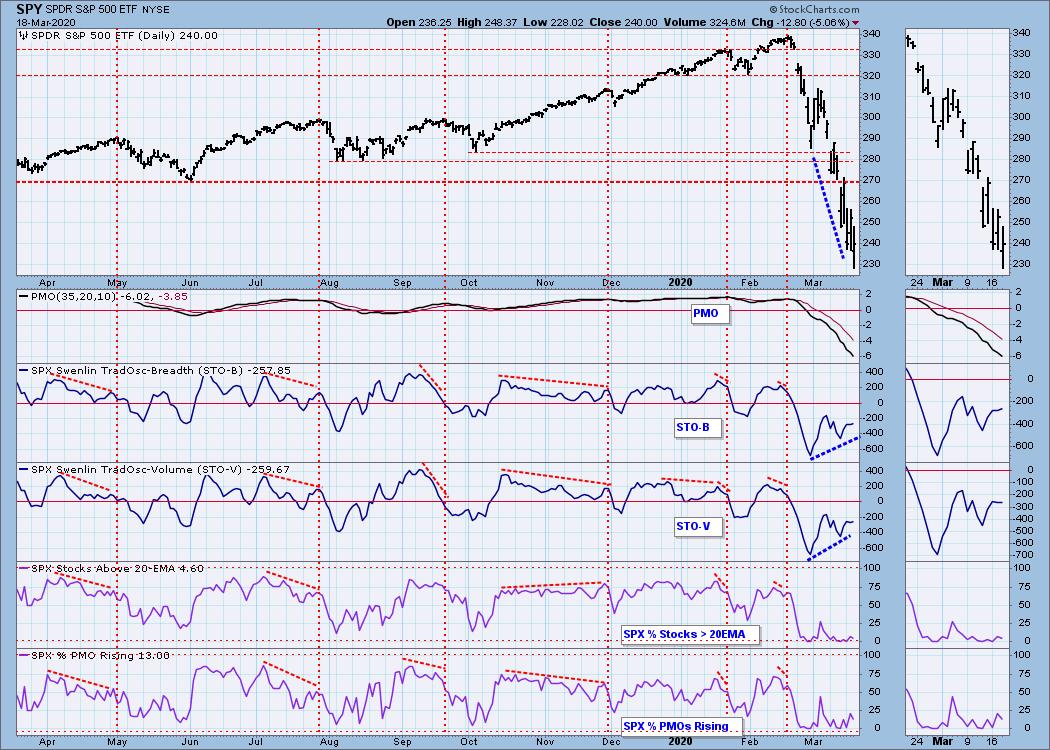

SPY Daily Chart: While the SPX logged a new LT Trend Model SELL signal, the SPY is still holding onto its LT Trend Model BUY signal. The 235 support level has been broken, but price did manage to close above that important level of support.

Climactic Market Indicators: We continue to see highly climactic readings. There isn't much to deduce here. I think it is excellent proof that highly negative climactic numbers do not translate to higher prices in a bear market. Volume increased today on the decline which is rarely a good thing. I do not think we have hit the 'capitulation' phase that we need to turn the market around. A VIX reading of over 76 screams 'sidelines' to me.

Short-Term Market Indicators: The ST trend is DOWN and the market condition is OVERSOLD based upon the Swenlin Trading Oscillator (STO) readings. The STOs show a positive divergence, but we likely will see tops on both the STOs and that would set up a 'confirmation' between short-term tops and price tops.

Intermediate-Term Market Indicators: The Silver Cross Index (% of SPX stocks 20EMA > 50EMA) and the Golden Cross Index (percent of SPX stocks 50EMA > 200EMA) are declining. The SCI is decelerating, but it is near zero. The GCI is oversold, but likely will fall further. When it hits oversold territory at the 2019 bottom, I'll begin looking for bullishness on other indicators.

The IT trend is DOWN and the market condition is EXTREMELY OVERSOLD based upon all of the readings on the indicators below. We are seeing deceleration on these oscillators, but remember, oscillators must oscillate. While we can't necessarily bound their readings, we know that at extreme levels they will reverse to alleviate those oversold extremes. A bottom on these indicators could be a sign of a market bottom, but i will likely be looking for the upside crossover before getting too excited.

CONCLUSION: The ST and IT trends are DOWN. Market condition based on ST and IT indicators is VERY OVERSOLD. I don't see anything that suggests a market bottom right now. One thing I will be looking for is a positive divergence with the OBV. This has signaled the bottom of bear markets previously. I'll show you those charts tomorrow!

(Not a Diamonds subscriber? Add it to your DP Alert subscription and get a discount! Contact support@decisionpoint.com for your limited time coupon code!)

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 3/9/2020

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: Wild swings in the Dollar seem to be the rule not the exception right now. You can see over the past year (and beyond on a longer-term chart) that we do not see this type of volatility. This is just another example of why this time is different. Overall the indicators are favorable for a higher dollar.

GOLD

IT Trend Model: BUY as of 12/26/2019

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: The important 1450 level is still holding up. The PMO is now below zero. The 20-EMA is about ready to trigger an IT Trend Model Neutral signal as it gears up for a negative cross below the 50-EMA.

GOLD MINERS Golden and Silver Cross Indexes: The volatility here is unbelievable. The SCI is now very oversold, but we should see more decline in order to work out the neutral to overbought condition of the GCI.

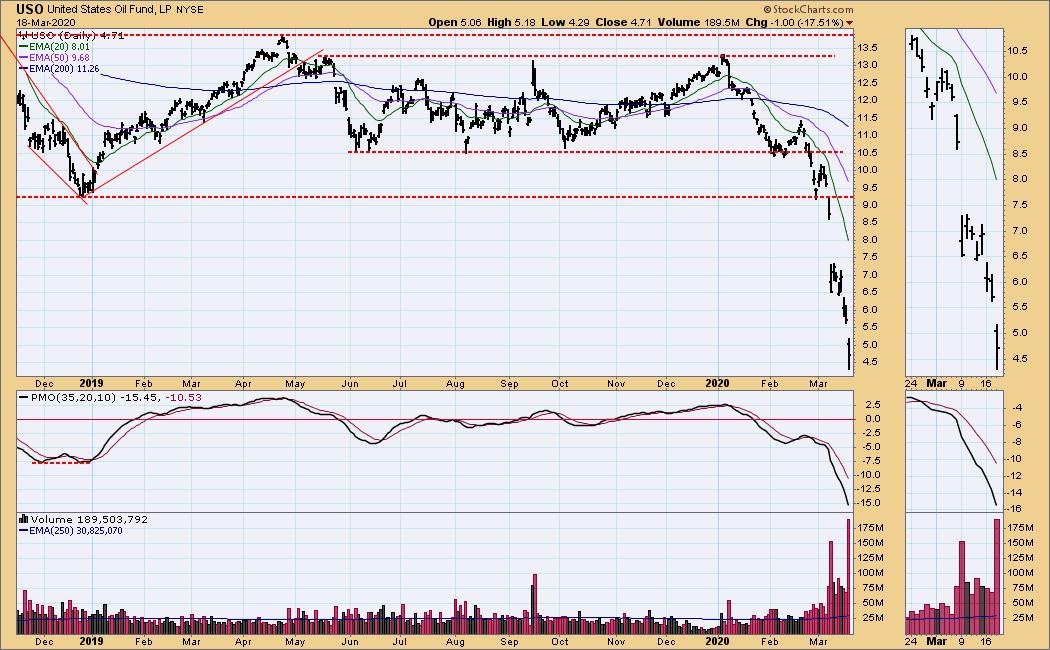

CRUDE OIL (USO)

IT Trend Model: Neutral as of 1/27/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: I used the word "breathtaking" on Monday to describe the continued market crash. Well, the Oil charts are quite breathtaking. We are now at oil prices that we haven't seen since 2003! Unfortunately, it appears it will move lower as UAE continues to ramp up production levels. The big concern here is the likely bankruptcies we will see from the smaller oil producers and in the shale industry. The next level of support is $17.00!!

BONDS (TLT)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: Bonds are getting hit hard after the breakdown of the parabolic. It has reached the 200-EMA which is within the last basing pattern. I would expect the acceleration downward to ease and prices to begin to trade within that last basing pattern's trading channel. The PMO is very negative with the new crossover SELL signal today.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

If there is a Money Show in May, I will be there! Erin Swenlin will be presenting at the The MoneyShow Las Vegas May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!!

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)