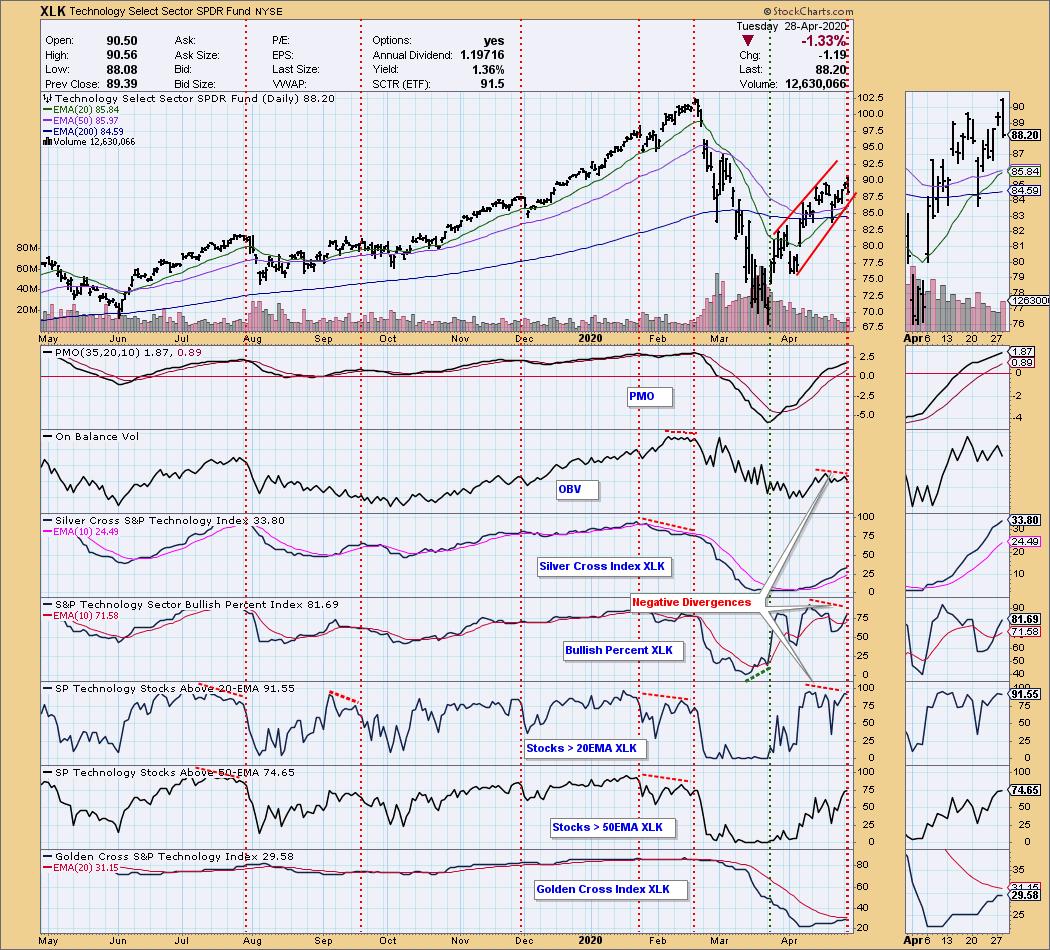

The Technology Sector (XLK) 20EMA is on the verge of crossing up through the 50EMA, a Silver Cross, which will generate an IT Trend Model BUY signal. Since price is well above the 20EMA, the crossover will probably take place tomorrow, or the day after. One thing that could prevent this outcome would be if price dropped below the 20EMA on Wednesday. Considering the large percentage moves we've seen lately, that is not out of the question.

As investors we want to accomplish two basic things: (1) Determine the trend and condition of the market, and (2) select stocks that will ride that tide. The DecisionPoint Alert helps with the first step, and DecisionPoint Diamonds helps with the second. Go to DecisionPoint.com and SUBSCRIBE TODAY!

With that bullish evidence also comes some bearish signs -- three of the indicators are showing negative divergences, which have proven quite prescient in the last few months. Which evidence should we believe?

The IT Trend Model BUY Signal comes quite late in the rally, which is always a problem when price moves too far and too fast in one direction. The crash from the February top was one such move, and price moved well below the EMAs, causing an unusual separation between them. It took a monster rally to bring them back together. Now that the 20EMA is close to an upside crossover, we must consider that the rally may be close to exhaustion. Even if the crossover is completed, it may be a whipsaw.

Without trying to predict the future, my confidence in this possible BUY signal is not high. The market is moving too fast, and it has moved too far, and the Trend Model doesn't perform well under those conditions. It may prove to be a profitable signal, but the setup is weak.

Happy Charting! - Carl

Technical Analysis is a windsock, not a crystal ball.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

erge of a BUY Signal