It has likely arrived too late, but we did get a "Silver Cross" or 20/50-EMA positive crossover which triggered an IT Trend Model BUY signal. If price dips below the 50-EMA, that signal would be lost quickly. It's a real possibility given the topping PMO and OBV confirmation of declining tops on price.

Free Live Trading Room - Tuesdays/Thursdays

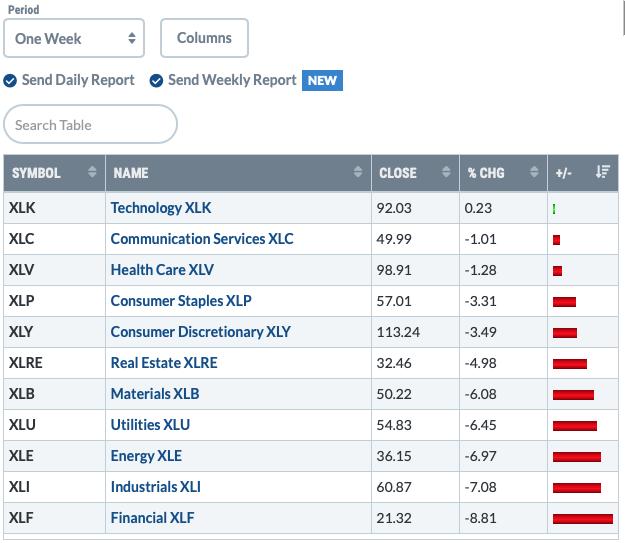

TODAY'S Broad Market Action:

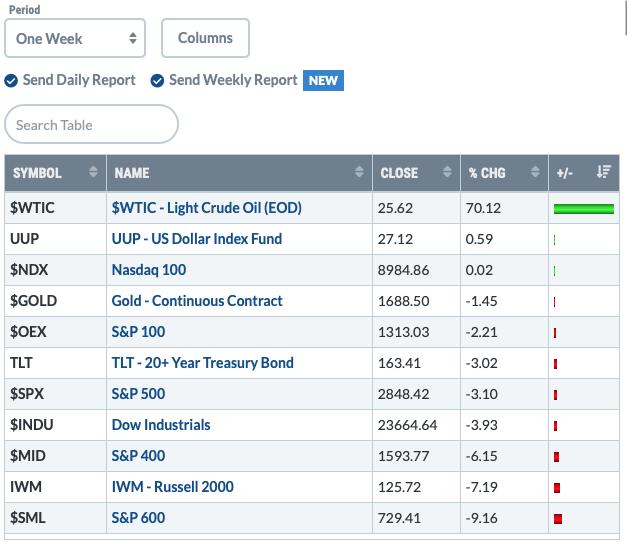

Past WEEK Results:

Top 10 from ETF Tracker:

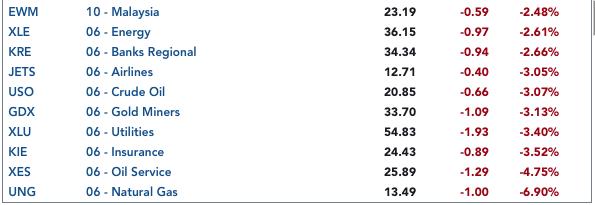

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

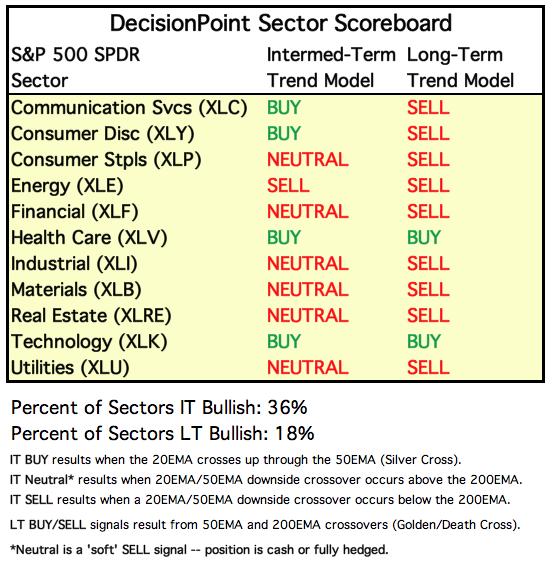

SECTORS

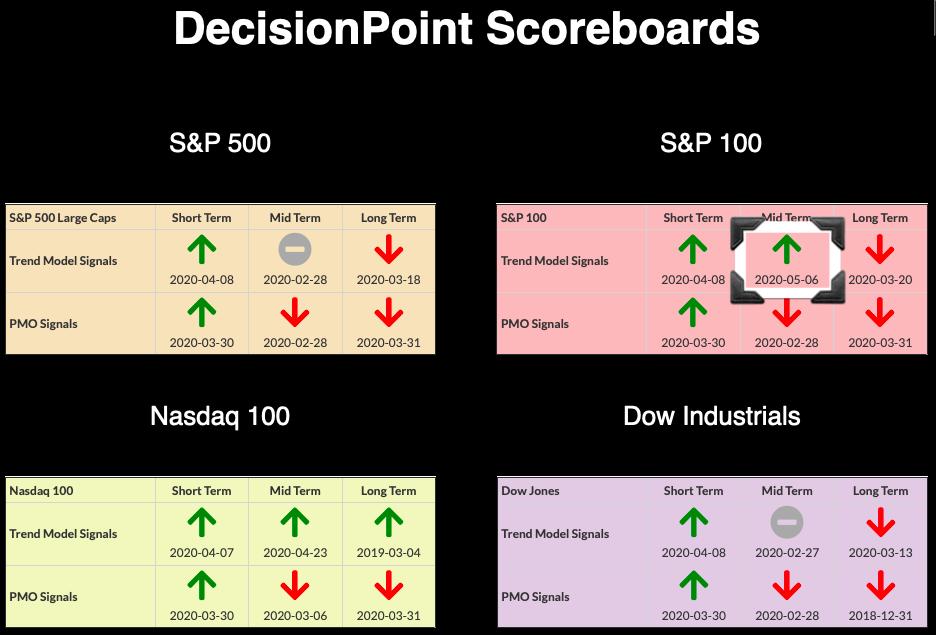

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

One WEEK Results:

STOCKS

IT Trend Model: NEUTRAL as of 2/28/2020

LT Trend Model: SELL as of 3/19/2020

SPY Daily Chart: We just saw that the OEX had a "Silver Cross" of 20/50-EMAs. The SPX is lagging and given the indicators price will likely fall below the 20/50-EMAs. We have a negative divergence on the OBV and a topping PMO. Price technically broke downward out of the wedge, but now price is bounded by the 50/200-EMAs and moving sideways.

We had a reversal during today's trading with the market opening on its high, consolidating around yesterday's close and then finally seeing a big sell-off in the last half hour of trading. Price was already fading and bouncing below the rising trend. The question is whether we will see follow-through on that decline.

Climactic Market Indicators: I would say we have somewhat climactic readings to the negative side. Given these negative readings on Net A-D indicators, I suspect this is a selling initiation. The VIX is still above its average on the inverted scale, but it is falling.

Short-Term Market Indicators: The ST trend is UP and the market condition is SOMEWHAT OVERSOLD based upon the Swenlin Trading Oscillator (STO) readings. No arguing with these negative readings. Everything is in decline which suggests more short-term decline.

Intermediate-Term Market Indicators: The Silver Cross Index (% of SPX stocks 20EMA > 50EMA) and the Golden Cross Index (percent of SPX stocks 50EMA > 200EMA) are both rising. The GCI and SCI are still rising which is positive, but the more sensitive BPI is continuing to decline which is bearish.

The IT trend is UP and the market condition is NEUTRAL based upon the ITBM and ITVM. Today we had a negative crossover on the ITVM and very nearly had one on the ITBM. Now is the time to start worrying about the intermediate term.

CONCLUSION: The ST is UP and IT trend is also UP. Market condition based on ST indicators is SOMEWHAT OVERSOLD and on IT indicators is NEUTRAL. I'm going to be tightening up my stops tonight. Short-term and intermediate-term indicators are all bearish. The support area for the SPY is around 265-270. I would look for that level to be tested very soon.

(Not a Diamonds subscriber? Add it to your DP Alert subscription and get a discount! Contact support@decisionpoint.com for your limited time coupon code!)

DOLLAR (UUP)

IT Trend Model: BUY as of 3/12/2020

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: I'm tiring of looking at double-tops and bottoms, I studied the UUP chart and the bearish descending triangle seems to be the best pattern. The expectation is a breakdown below the support at $26.75. I do note that the PMO is turning back up, so we may see a test of that declining tops trendline. A breakout from this pattern would be very bullish.

GOLD

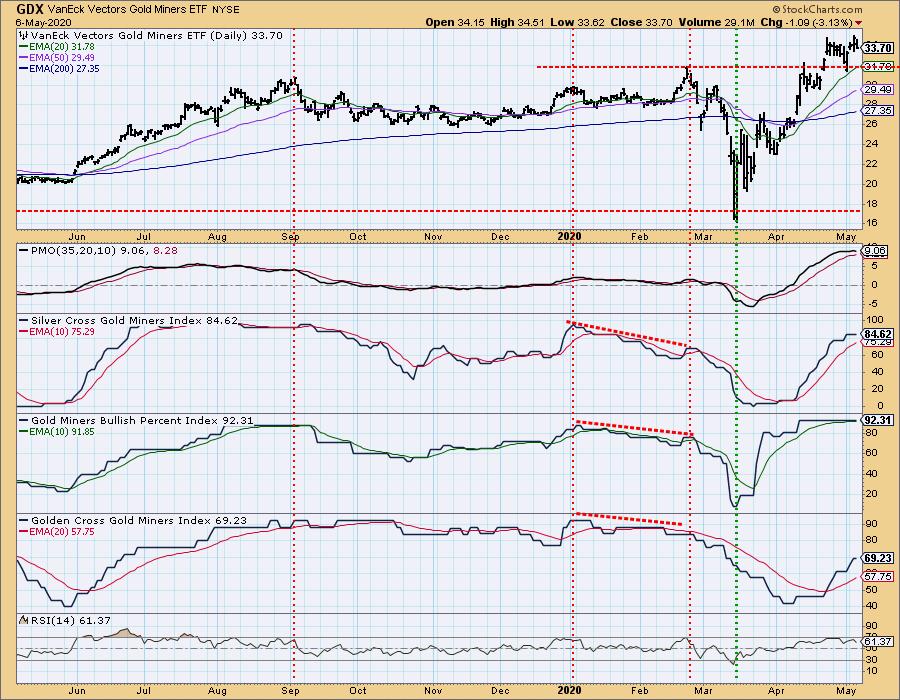

IT Trend Model: BUY as of 12/26/2019

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: The symmetrical triangle is still valid. The expectation of this continuation pattern is an upside breakout. The previous trend was up before this pennant or triangle formed. The PMO isn't really in agreement and the RSI is starting to head below 50 or "net neutral". While the pattern calls for an upside breakout, there are too many bearish forces at work here right now.

GOLD MINERS Golden and Silver Cross Indexes: Miners took back yesterday's gains. the PMO is now trying to top in overbought territory and the SCI and BPI have flattened. The RSI is still positive, so I'd be holding but tightening my stops. I think there will be a better entry later.

CRUDE OIL ($WTIC)

The oil market is under severe pressure due to a lack of demand, and we do not believe that USO is an appropriate investment vehicle at this time. Until further notice we will use $WTIC to track the oil market. Since this is a continuous contract dataset, it doesn't "play well" with our Trend Models, and we will not report Trend Model signals for oil.

$WTIC Daily Chart: What appears to be a natural snapback occurred today after the giant 29% gain yesterday. The 50-EMA and the April top seems to have caused strong overhead resistance. The PMO is shooting upward, but not a surprise given the giant leap yesterday. We may have found the bottom on Oil. I would look for price to stay within this trading range between $20 and $30.

BONDS (TLT)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: The double-top technically executed today, but price managed to close right on the confirmation line. Given the PMO and big move upward in yields, I would look for price to hit the minimum downside target around $156.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)