It appears yesterday's climactic readings on Net A-D and Net A-D Volume were a buying exhaustion. Today we saw climactic negative readings which I believe are the earmarks of a selling initiation. Looking at the 10-minute bar chart it appears fairly bullish, but I believe the big problem is the inability to close the gap on the rally back from the depths and hitting overhead resistance and failing at the July 21st and 22nd support lines. I suppose you could look at today's action as a bull flag with an RSI that is positive, but the PMO is clearly turning over. I moved my portfolio into trailing stops early this week. I've had a few trigger and I expect to see more trigger as we enter a period of consolidation and probably decline.

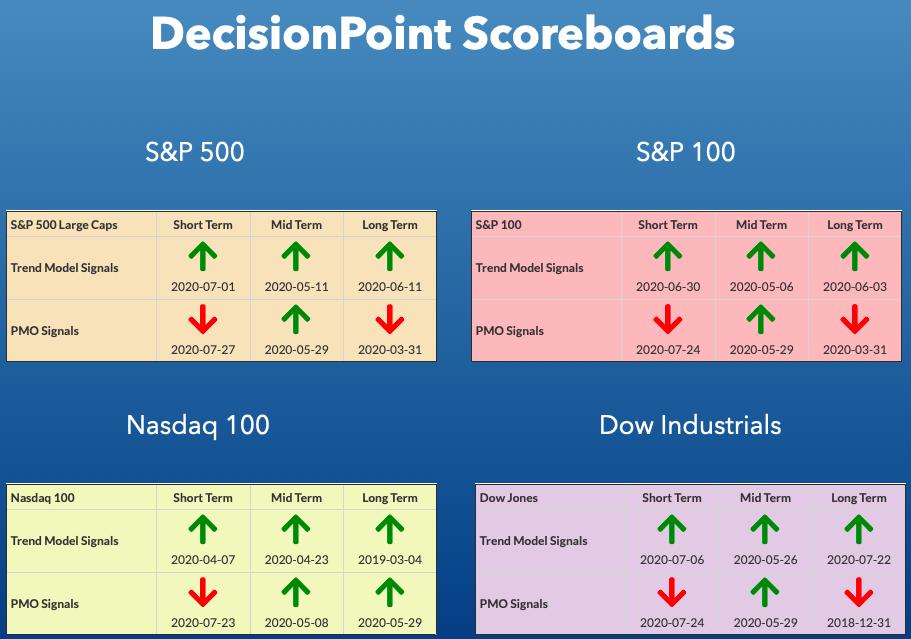

DP INDEX SCOREBOARDS:

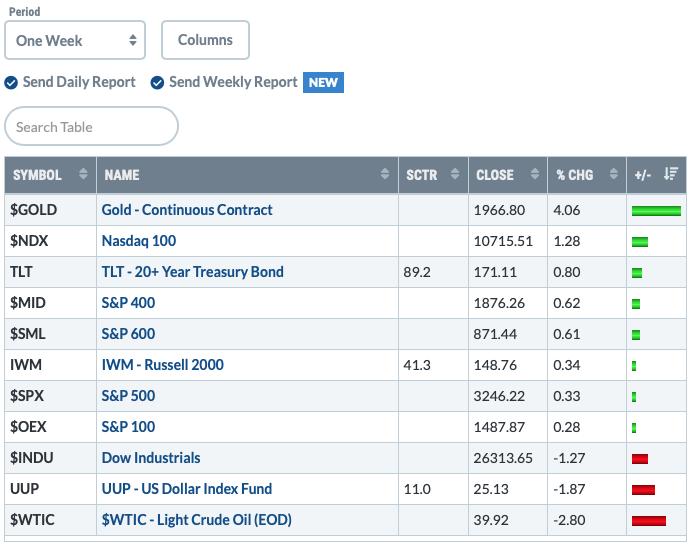

TODAY'S Broad Market Action:

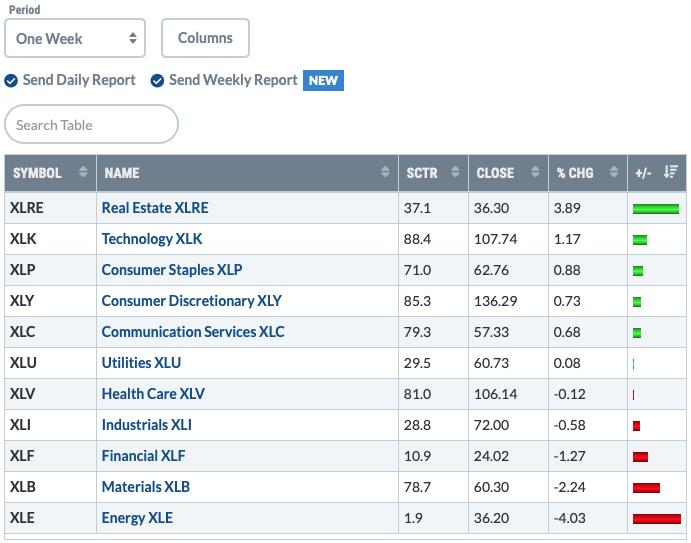

One WEEK Results:

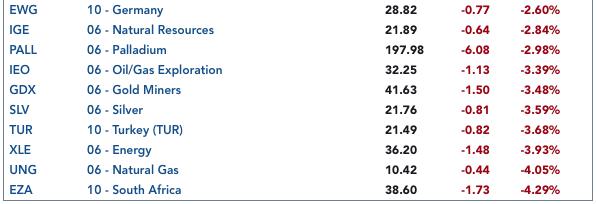

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

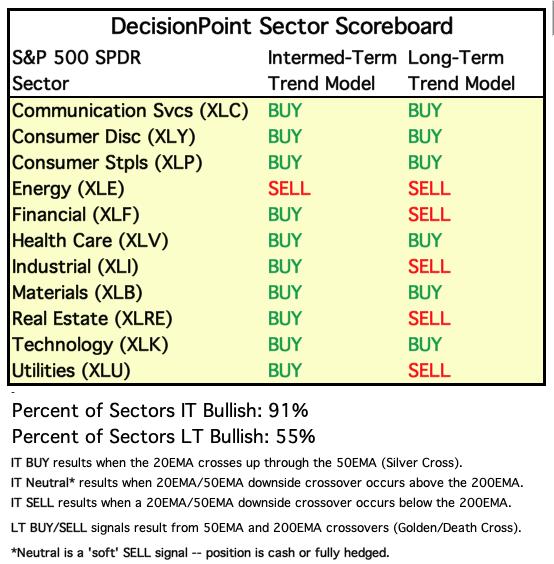

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

One WEEK Results:

STOCKS

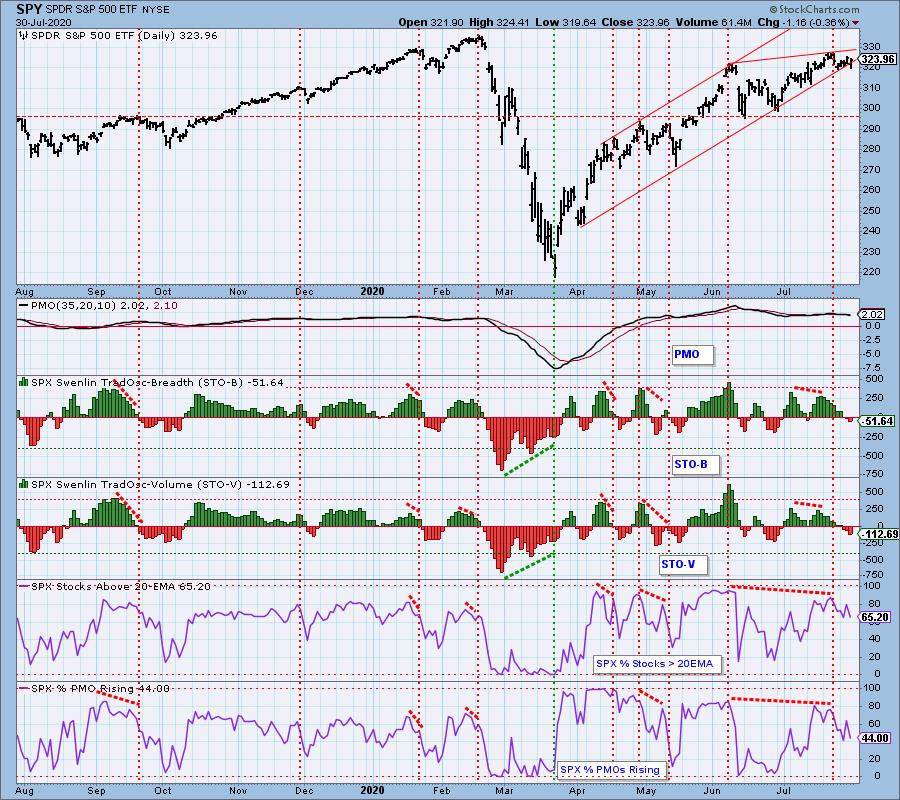

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: The 20-EMA did hold as support today, but I really don't like the look of that PMO. The OBV is currently confirming this very short-term declining trend.

Climactic Market Indicators: As noted in the opening, Net A-D numbers came in strongly negative. The VIX is beginning to move lower and will likely be below its EMA on the inverted scale. I would look at this as a selling initiation. This means that we should see a continued decline going into Friday and Monday. I am not looking for a crash or big correction. My target would be the 50-EMA.

Short-Term Market Indicators: The short-term market trend is UP and the condition is NEUTRAL. Based upon the STO ranges, market bias is SOMEWHAT BEARISH. The negative readings continue on the STOs and today saw both %Stocks indicators ticking down.

Intermediate-Term Market Indicators: The Silver Cross Index (% of SPX stocks 20EMA > 50EMA) and Golden Cross Index (% of SPX stocks 50EMA > 200EMA) are both rising which is positive, but the BPI has turned down creating a negative divergence. It hasn't dropped below its signal line so there is hope.

The intermediate-term market trend is UP and the condition is OVERBOUGHT. With most of the ITBM/ITVM readings since the end of April being above the zero lines, the market bias is BULLISH. Unfortunately, these indicators continue to unwind. As they move lower, they are showing a negative divergence with price and in the very short term, their decline is confirming the current declining tops.

CONCLUSION: Yesterday did turn out to be a buying exhaustion and today we are seeing a continuation of that through a selling initiation. I don't see any bright spots today on the indicators so I'm a bear going into the weekend.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: Yesterday's comments still apply:

"The Dollar continues to drop and I don't see any support available until we hit the bottom of the "Pinocchio" bar (a Martin Pring phrase) during the March crash. The PMO is showing no signs that this decline is ending. The RSI is very oversold so we could see a consolidation or at least a breather from this plunge."

GOLD

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Yesterday's comments still apply:

"Carl wrote an excellent 'free' article on Gold that really covers it perfectly. His analysis is spot on, as usual! I would only add, since Carl doesn't use the RSI, that it is terribly overbought which does suggest we need a breather. I've marked previous times we've seen these overbought readings and overall the declines weren't horrendous. The virus crash was the worst and that was egged on by frenzied selling. I think we are looking at something similar to August 2019 where we saw the same type of overbought RSI readings and the result was a consolidation and eventual move higher."

Full Disclosure: I am holding GLD. I will lock in profit if I see a big decline setting up, but that position is in my long-term holdings account and as such has quite a profit so it will take a drop below the 20-EMA for me to pull the plug.

GOLD MINERS Golden and Silver Cross Indexes: Today I was stopped out of Newmont Mining (NEM) and I'm completely fine with that. I booked a nice gain and no point in riding it down now that the rising trend has been broken. This was a necessary pullback. We aren't seeing much deterioration of the indicators/components of GDX so I will watch to see if support holds around the 20-EMA. I do like that the RSI isn't as overbought. I think we will get another good entry on Miners soon.

CRUDE OIL ($WTIC)

The oil market is under severe pressure due to a lack of demand, and we do not believe that USO is an appropriate investment vehicle at this time. Until further notice we will use $WTIC to track the oil market. Since this is a continuous contract dataset, it doesn't "play well" with our Trend Models, and we will not report Trend Model signals for oil.

$WTIC Daily Chart: I'll admit I was surprised to see a big breakdown on Oil. It was maintaining support along the 20-EMA and the PMO had left overbought territory on a sideways consolidation. Now it appears Oil will be testing the 50-EMA and likely the $35 level.

BONDS (TLT)

IT Trend Model: BUY as of 6/26/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: I still own TLT and will continue. Really excited to a breakout today on TLT. The RSI is getting overbought, but not too overbought. The PMO looks very positive and isn't overbought. My upside target is the March top.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount AND get the LIVE Trading Room for free! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

ANNOUNCEMENT:

The MoneyShow Las Vegas has been canceled "in person", but I will still be presenting during their video production. As soon as I have information, I will forward it! In the meantime, if you haven't already, click to get your free access pass!

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

.