I decided to lead with the new Intermediate-Term Trend Model SELL signal on Oil (USO) today rather than beat to death the demise of the Nasdaq and Technology which I believe was covered plenty on the business channels. Oil hit overhead resistance at the end of August and promptly began its slide lower. The gap down today on USO was substantial. The PMO which had been flat since June diverted from its signal line enough that we can see the separation between the two. The gap down took price below support at the July low. At this time I would watch for gap support from May as the next 'do or die' area for USO to hold.

Click here to register in advance for the recurring free DecisionPoint Trading Room (Next one is 9/14)!

Did you miss the 8/31 trading room? Here is a link to the recording (password: V#^P89Yv).

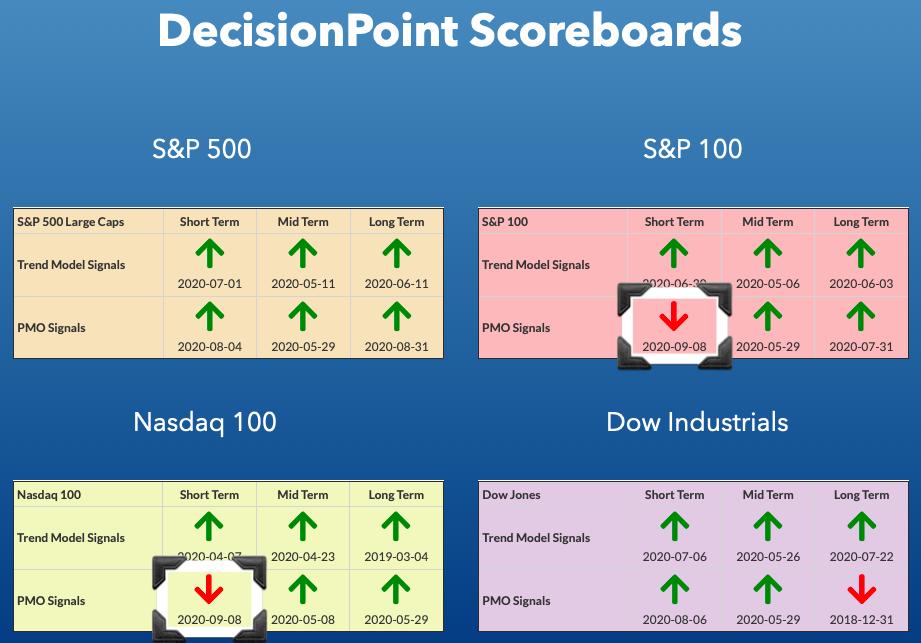

DP INDEX SCOREBOARDS:

Both the NDX and OEX triggered PMO SELL signals today that wiped out the BUY signals from 8/5. I added the charts below the updated DP Scoreboard. At this point, 50-EMA is holding up as support, but the rising trends are now in peril.

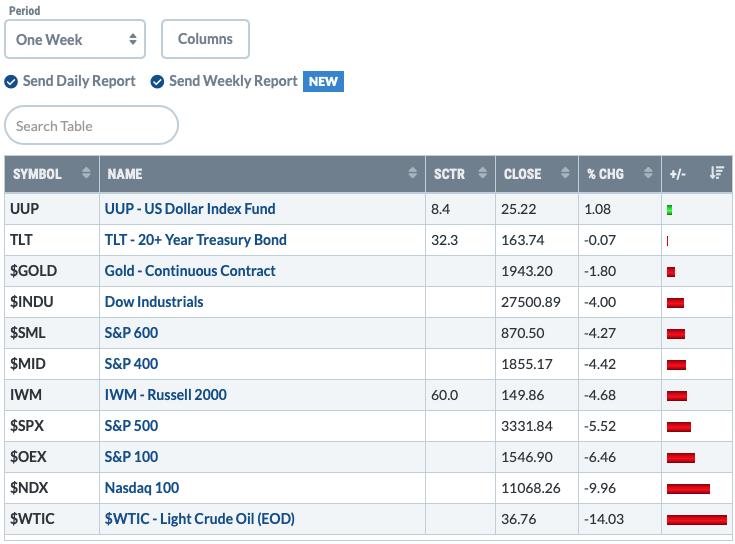

TODAY'S Broad Market Action:

One WEEK Results:

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

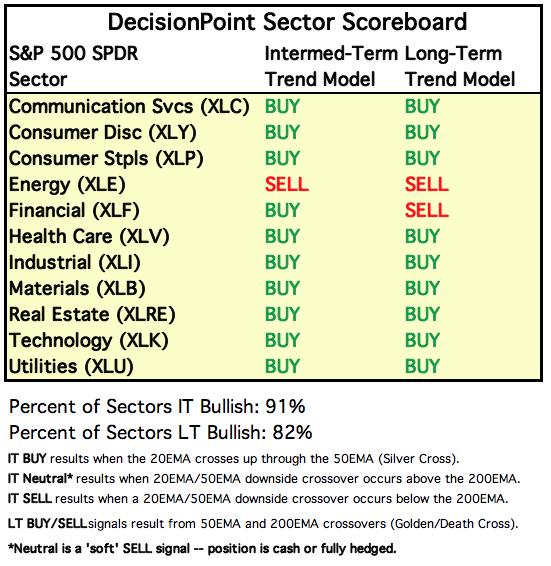

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

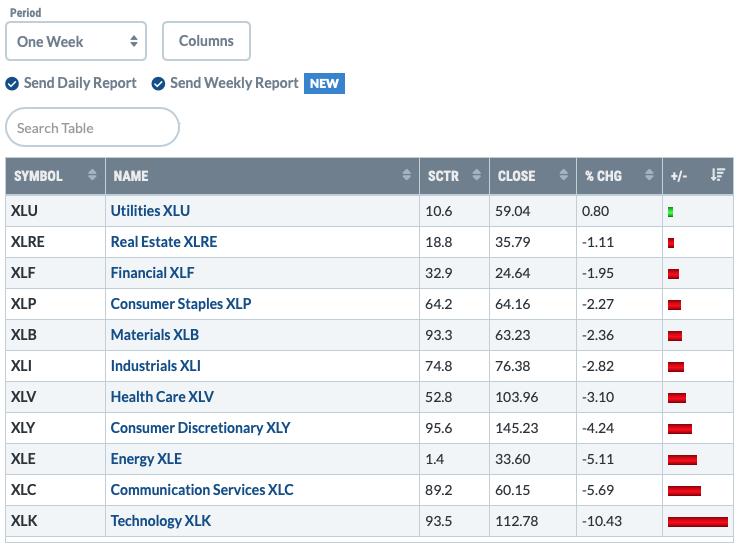

One WEEK Results:

STOCKS

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

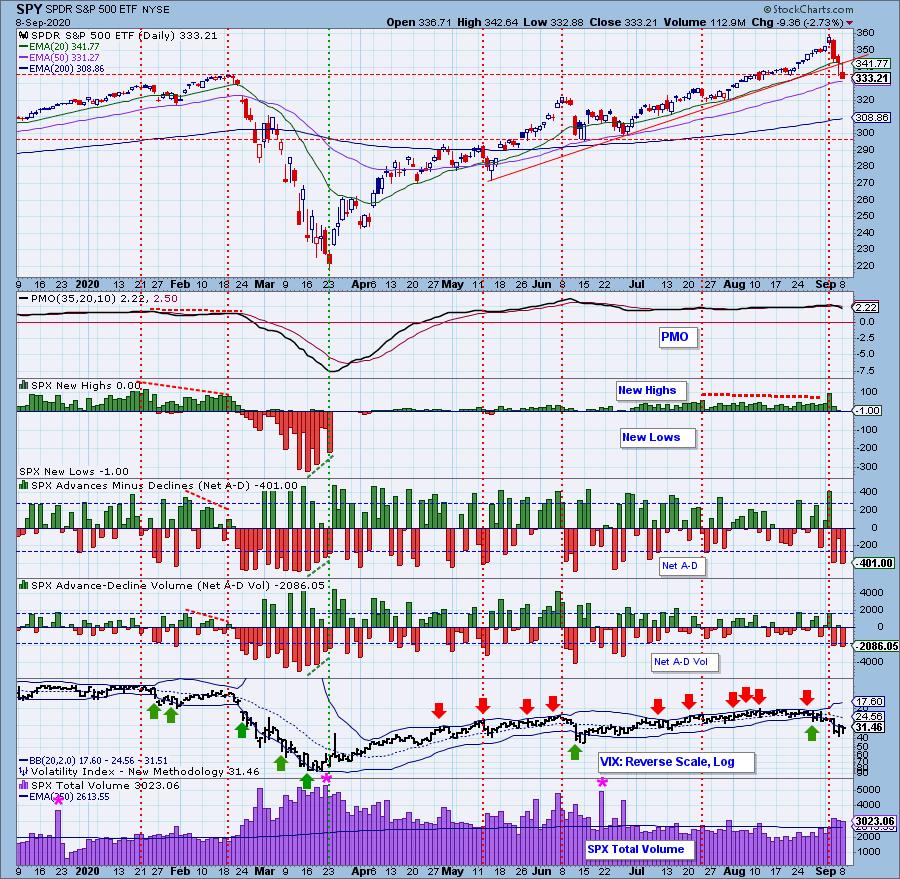

SPY Daily Chart: As with the NDX and OEX, price is holding just above the 50-EMA. The one big difference is that the SPY lost its rising trend. The VIX contracted slightly and is still outside the lower Bollinger Band on the inverted scale. I have marked the current level of the VIX so I might compare it to previous readings. What I note is that the June price low had the VIX a bit lower than we do now on the inverted scale. It could mean that we have more downside, or it could mean we've hit the lows. If the VIX pushes even lower than in June, that would likely indicate we have more decline to endure.

Climactic Market Indicators: Another day of climactic activity to the downside. It is coming off two days of serious decline which leads me to believe it is a selling exhaustion. This doesn't mean we will have a great rally ahead, but it typically means we will see a rally pop in the next day or two.

Short-Term Market Indicators: The short-term market trend is DOWN and the condition is NEUTRAL. Based upon the STO ranges, market bias is NEUTRAL. I think that June is a good comparison point on our %Stocks indicators. Note that we had to see even more oversold readings before price turned around. The STOs are still declining and are now in negative territory. They are getting close to oversold readings, but not there yet.

Intermediate-Term Market Indicators: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI shows the percentage of SPX stocks on Point & Figure BUY signals.

As noted last week, the negative divergences on these indicators are playing out with this decline.

The intermediate-term market trend is UP and the condition is NEUTRAL. The market bias is NEUTRAL.

Indicators continue to move lower. They aren't as low as the June readings, so it may take another day or two before the selling exhaustion plays out.

CONCLUSION: Negative climactic readings are coming in after another day of frenzied selling. I would read these as a selling exhaustion which could mean an upside rally or even a pause. I suspect we will get an upside reversal before the end of the week. How long will that last? I'll have to see the indicators afterward.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: I have been writing over and over that I wasn't going to pay the rally in the Dollar much mind until it broke its declining trend. Well, it has and it finally got above the 20-EMA. The PMO is on a BUY signal and rising and the RSI has just hit positive territory above net neutral (50). $25.50 will be a 'make or break' of the rally as price will have to close the gap from late July.

GOLD

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Gold is still holding up. It found support along the 50-EMA and the 2011 top. It wasn't able to recapture the rising trend or the 20-EMA. The PMO is still in distress which is worrisome, but discounts remain high and that is generally bullish for Gold. And, of course, it is considered a safe haven during a market decline which could work in its favor.

Full Disclosure: I own GLD.

GOLD MINERS Golden and Silver Cross Indexes: Support is holding for now, but it does give us a descending triangle which is bearish and suggests a breakdown. Again I will point to June where you can see that indicators were much more oversold than they are now. However, we have hit near-term oversold territory based on the August readings. The RSI has moved negative and the PMO continues to drop. I'll be watching the $37.50 very closely.

CRUDE OIL (USO)

IT Trend Model: SELL as of 9/8/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: This is a longer-term chart than the one at the beginning of the article. I think it gives you some perspective. The RSI is now oversold, but we can see those readings can continue for awhile.

BONDS (TLT)

IT Trend Model: Neutral as of 8/27/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: TLT faltered on Friday but made up some of the loss today. I never like to see price close on the intraday low. The PMO is mostly flat right now. The RSI is still negative.

Full disclosure: I own TLT.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Get in on the new "DecisionPoint Diamond Mine" trading room that is part of that subscription! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)