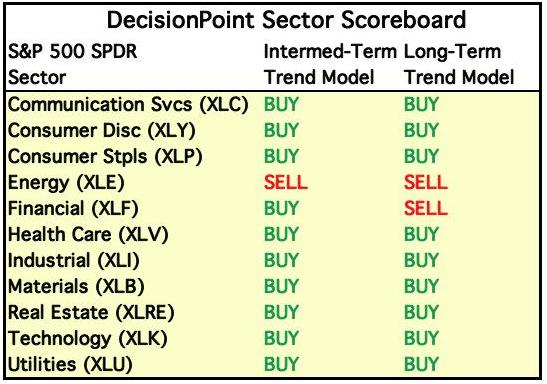

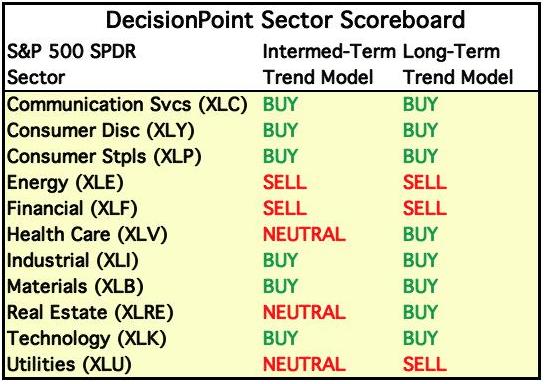

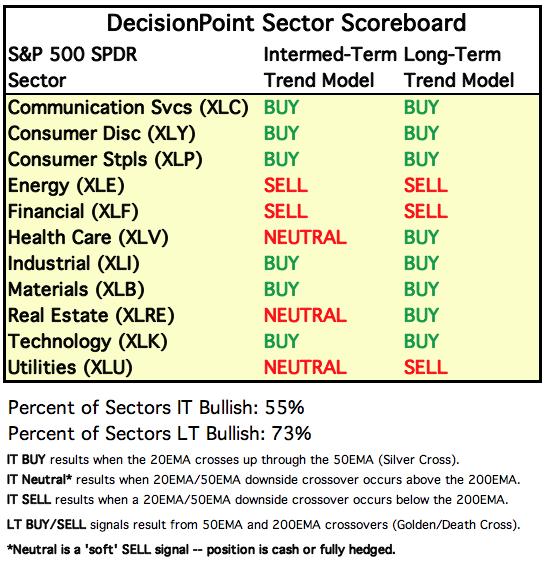

Normally, when there is a sector or market index signal change, we feature it in our comments; however, this week five BUY signals were replaced with NEUTRAL or SELL signals. Erin covered one of them yesterday (Utilities), but there were four more today, which would make for chart and commentary overload, so I'll show before and after signal tables. Here is last Friday's (9/18) . . .

. . . and here is today's (9/25):

You can check the charts on our Sector Chart List for subscribers.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

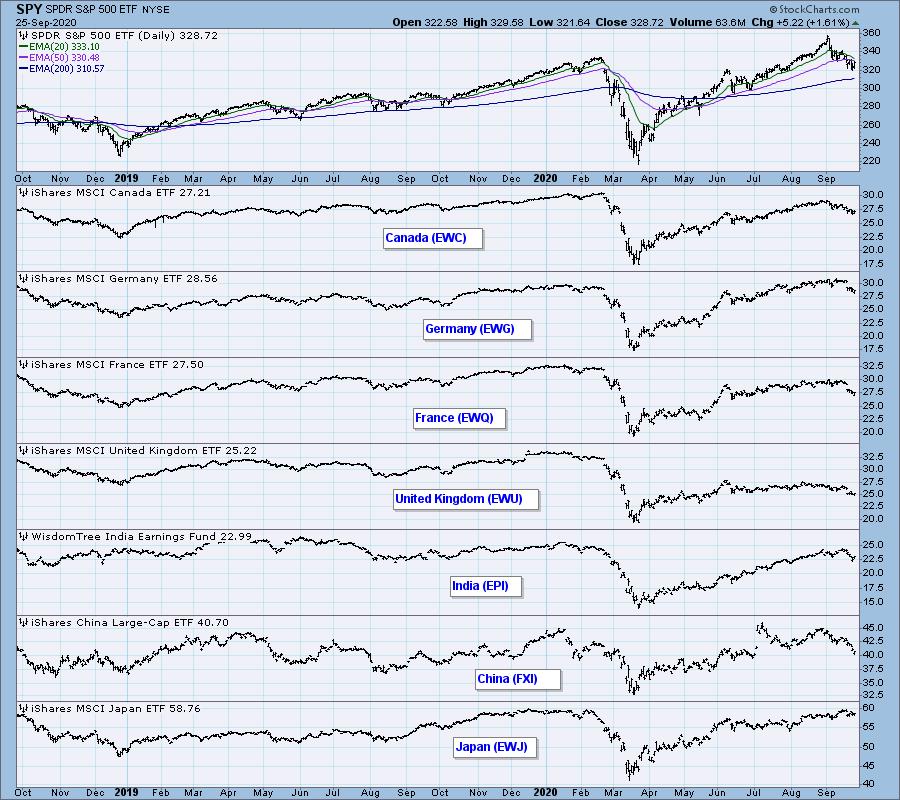

GLOBAL MARKETS

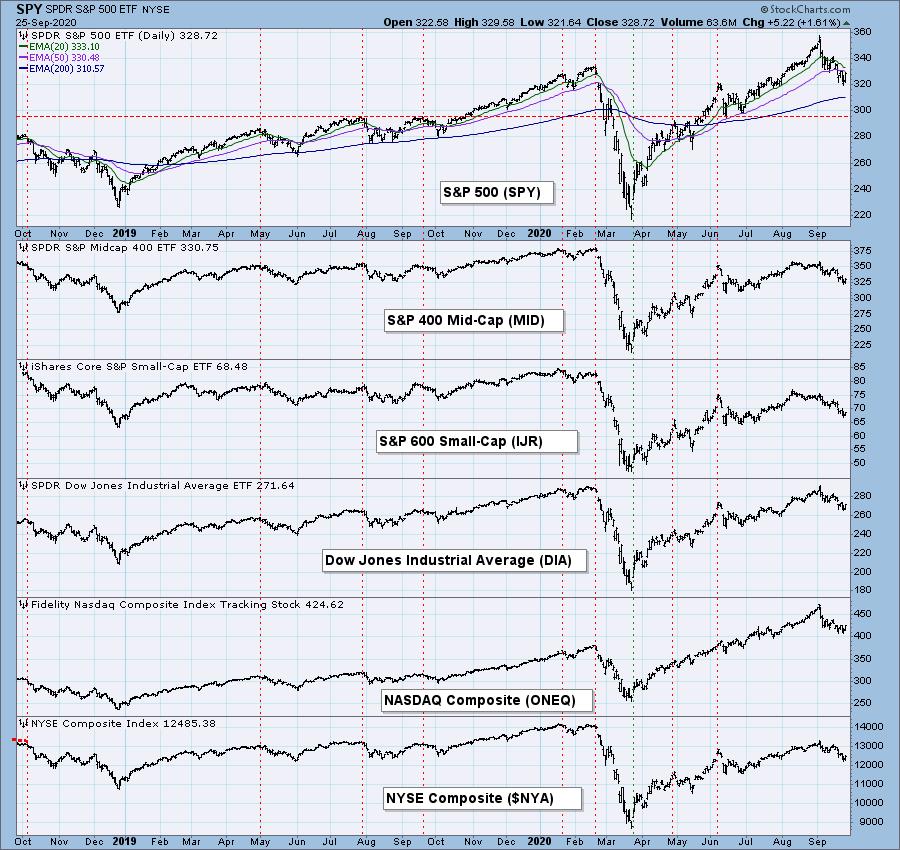

BROAD MARKET INDEXES

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

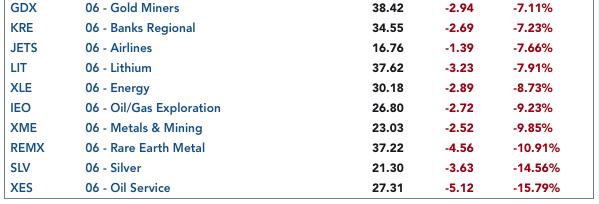

ETF TRACKER: This is a list of about 100 ETFs intended to track a wide range of U.S. market indexes, sectors, global indexes, interest rates, currencies, and commodities. StockCharts.com subscribers can acquire it in the DecisionPoint Trend and Condition ChartPack.

Top 10 . . .

. . . and bottom 10:

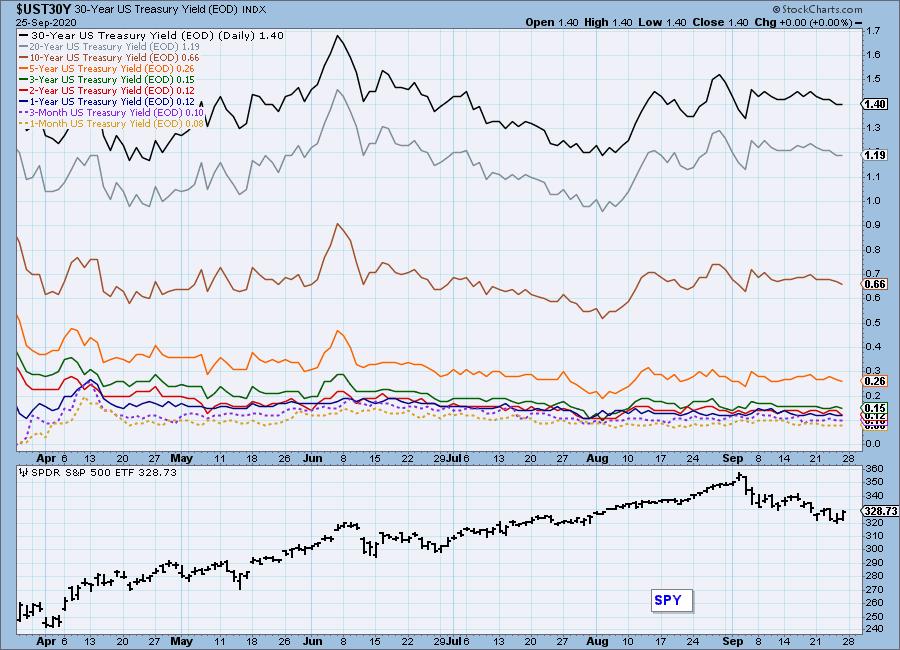

INTEREST RATES

This chart is included so we can monitor rate inversions. In normal circumstances the longer money is borrowed the higher the interest rate that must be paid. When rates are inverted, the reverse is true.

STOCKS

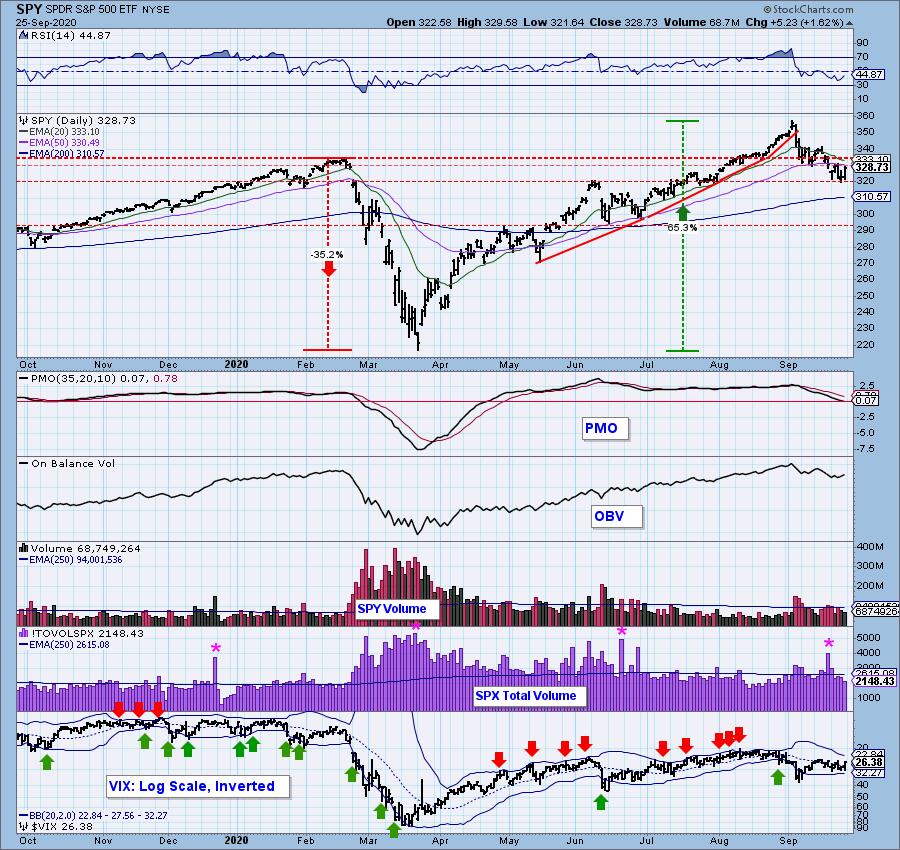

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

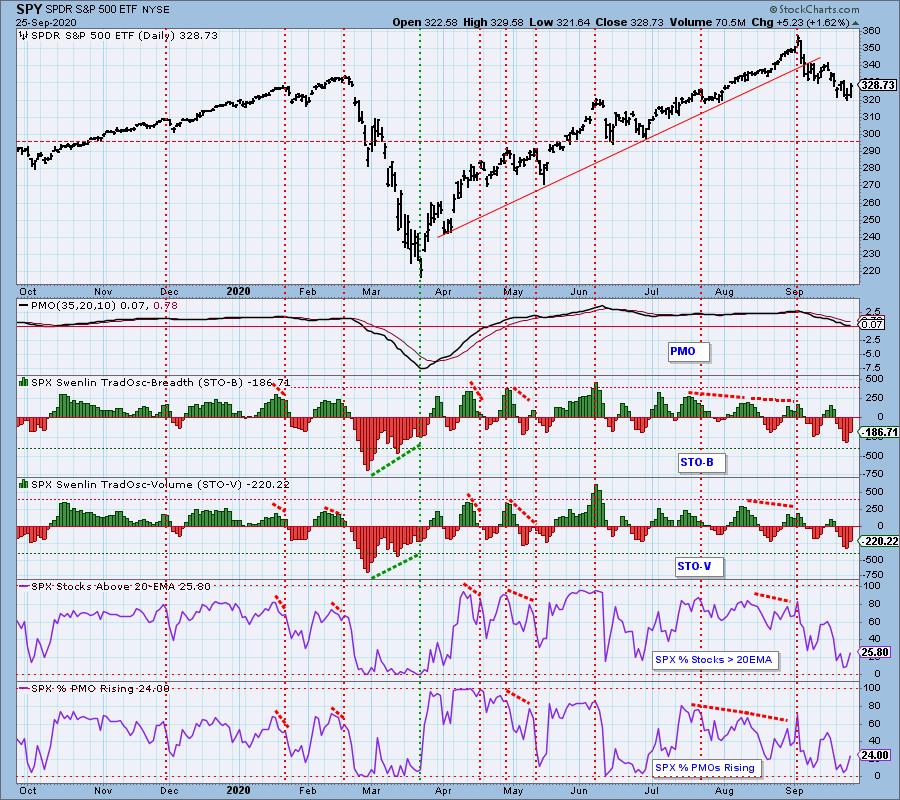

SPY Daily Chart: SPY barely broke out of the falling wedge, as we normally expect will happen, but it was stopped by the line of resistance drawn under the short consolidation above. The 50EMA is also a barrier.

The break above the February high was decisive (+7%), so the breakout was supposed to hold. But no. The break below the support was also decisive (-4.5%), so now we wait to see if the breakdown will hold.

SPY Weekly Chart: The weekly PMO is overbought and it has topped. This is strong evidence that the correction has more to go. Note that SPY has closed down four weeks in a row.

S&P 500 Monthly Chart: Even though there are three more trading days remaining in September, I'm going to cover the monthly charts today. If significant changes occur between here and Wednesday, Erin will cover them next week. So far this month SPY is in decline, and it is the first down month since March. The monthly PMO is decelerating, but it will take substantially more price decline to get it to top.

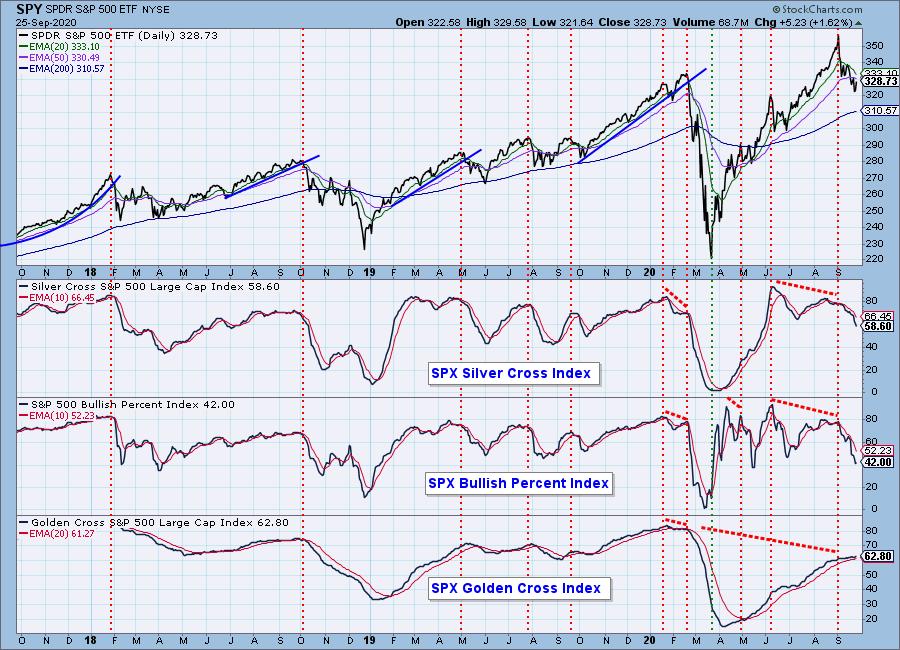

Participation:The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

The SCI and BPI have reached levels that are oversold if we consider other lows reached since the March low. In other words, they have reached levels where we should start looking for a bottom for the correction. The GCI, on the other hand, is -25% lower than it was at the February top, showing weak long-term participation.

I have decided to add this chart as another manifestation of participation. I look at it every day, and it finally occurred to me that this needs to be in the DPA regularly! Note that the 20EMA and 50EMA indicators are at normal oversold levels, but their levels in March show us how very oversold they can get, and how long they can stay at that level.

Climactic Market Indicators: The market made a downside exhaustion climax on Wednesday. Sometimes that can signal the bottom of a decline, but sometimes it means that the market will meander before resuming its decline. On Friday we got climactic activity on Net A-D, but Net A-D Volume was a little short. Also, SPX Total Volume contracted, which doesn't confirm the price surge. We should not disqualify the rally, but let's be a little less confident that we'll see follow through on Monday.

Short-Term Market Indicators: The short-term market trend is DOWN and the condition is OVERSOLD. The market bias is slightly negative in this time frame.

Intermediate-Term Market Indicators: The intermediate-term market trend is NEUTRAL and the condition is somewhat OVERSOLD. The market bias is NEUTRAL.

CONCLUSION: The big question at the moment is whether or not the correction is over. The climactic indicators were weak on that point on Friday, and it was wishful thinking to believe we got an upside initiation climax. It is possible, of course, that one will be delivered on Monday if there is upside follow through. More weighty evidence is the overbought SPY weekly PMO, which has topped and implies that the correction is going to continue. For now, let's look for little more upside, then a continuation of the decline. That accommodates both the short-term climax issues and the longer-term implications of the weekly PMO top.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: For almost two months UUP was forming an island cluster that implied a potential island reversal. Didn't happen, but price did edge up across the gap, so I guess we should expect higher prices anyway. The daily PMO still has a long way to go before conditions become overbought. ext overhead resistance is at 25.90.

UUP Weekly Chart: The weekly PMO has turned up. Bullish.

UUP Monthly Chart: In spite of the rally, the monthly PMO has not turned up yet.

GOLD

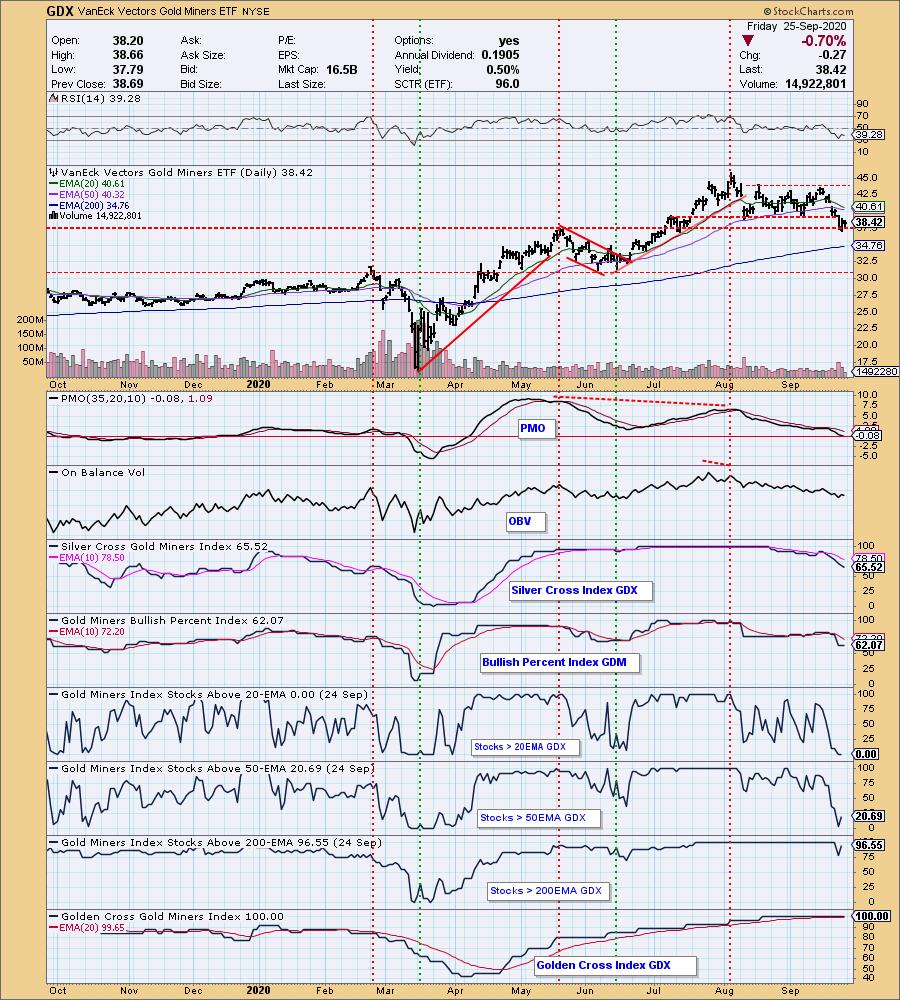

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Gold has been hit by recent strength in the dollar, but most of the weakness is attributable to the trading pressures in the gold market. To clarify, if the dollar is up +0.1%, gold should be down -0.1%. If gold is down more than that, it is because sellers are anxious to exit, and vice versa if gold is up when the dollar is up. Price dallying around the line of support drawn across the August low (1875), but I don't see that as a strong support level with the daily PMO still falling. The next support level is 1830, at which point gold will have given back most of the July/August rally gains. Nevertheless, I'll be looking for a possible opportunity to go long there. We'll see.

GOLD Weekly Chart: Gold has been advancing on rising trend lines that have ever-increasing angles of ascent. This week the steepest line finally failed, as the recent weekly PMO top warned that it might. I address this breakdown further on the monthly chart.

GOLD Monthly Chart: While I have been addressing the ever-increasing angle of ascent on the weekly chart, it occurred to me that I should highlight the parabolic rise from the bear market low in this time frame. I'm not saying it's going to happen, but, since the parabolic arc has broken down, we should prepare for a potential decline to 1455, which is about half the advance from the bear market low. I know, that's pretty severe, but not out of the question with a parabolic break. I should also say that I haven't given up hope for some kind of high-level consolidation either. In any case, I don't see going long gold being an option yet.

GOLD MINERS Golden and Silver Cross Indexes: Until gold perks up, it is hard to get positive on the miners.

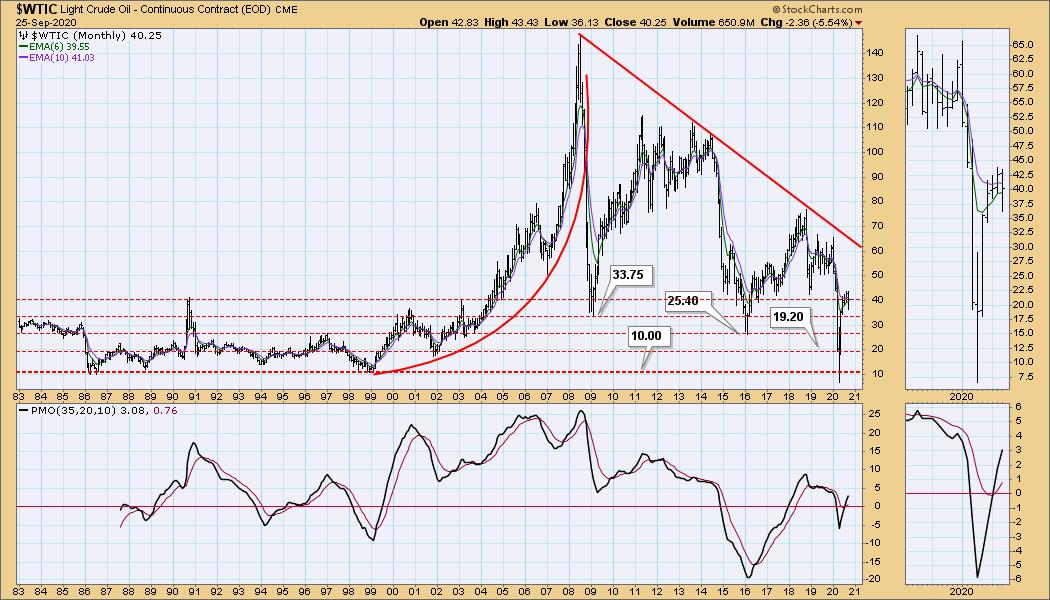

CRUDE OIL (USO)

IT Trend Model: SELL as of 9/8/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: I'm waiting to see if USO makes it to the top of the current trading range. If not, then the recent low will probably be tested.

USO/WTIC Weekly Chart: In the current environment I don't think crude (WTIC) has much potential above 40.00. As for the downside, I don't think it will retest this year's lows either, but I also think prices lower than the recent lows. Waiting to see how that shakes out.

$WTIC Monthly Chart: In this time frame we can get a better idea of potential support levels.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 8/27/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: TLT seems to be heading for another 20/50EMA upside crossover, which would generate a new IT Trend Model BUY signal, but price is in a narrow range and the new signal doesn't excite me under those conditions.

TLT Weekly Chart: If price continues sideways, the weekly PMO will sink to the zero line and flatten.

TLT Monthly Chart: The consolidation is catching up with the monthly PMO, which is decelerating and will soon top, but I don't think it will happen this month.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Carl

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)