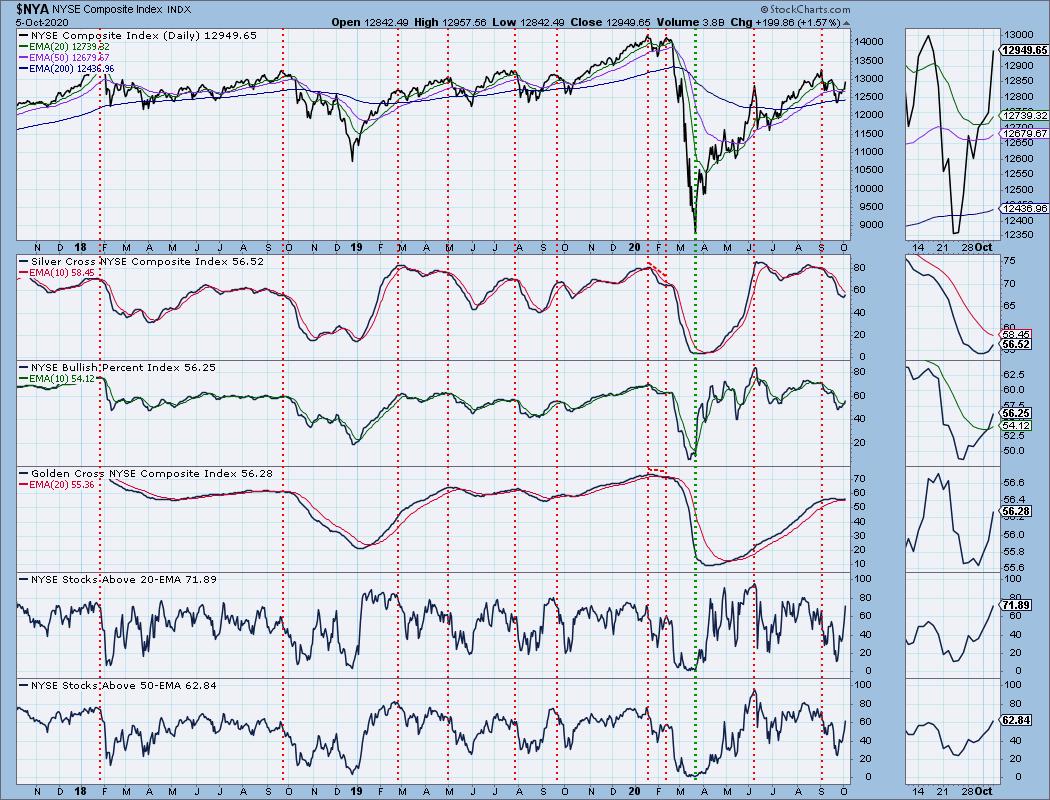

Market rallied strongly today. The news makers suggest it was due to CARES stimulus discussions supposedly making headway and the health of the president as he returns to the white house tonight. However, let's look under the hood. Below is the NYSE line chart with our Silver and Golden Cross Indexes (SCI and GCI) as well the BPI and %Stocks above their 20/50-EMAs. This is a great indicator for noting "participation". We want to see strong improvement across the board. The BPI had a positive crossover and you can see the impulse of %Stocks above their 20/50-EMAs shooting upward. We aren't quite to overbought territory on these indicators. The SCI has turned up and along with the GCI.

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 10/5 trading room? Here is a link to the recording (password: J942MF*c). For best results, copy and paste the password to avoid typos.

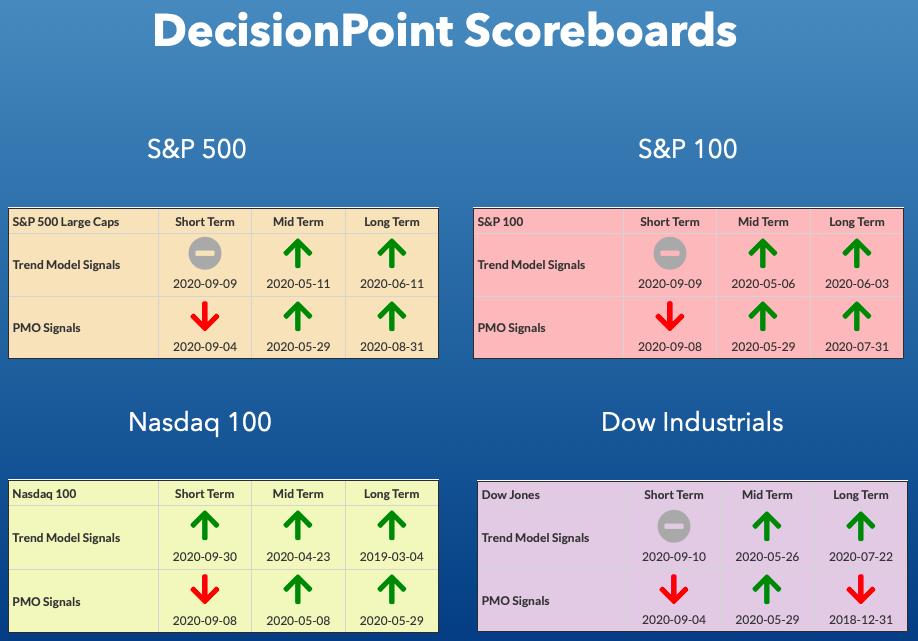

DP INDEX SCOREBOARDS:

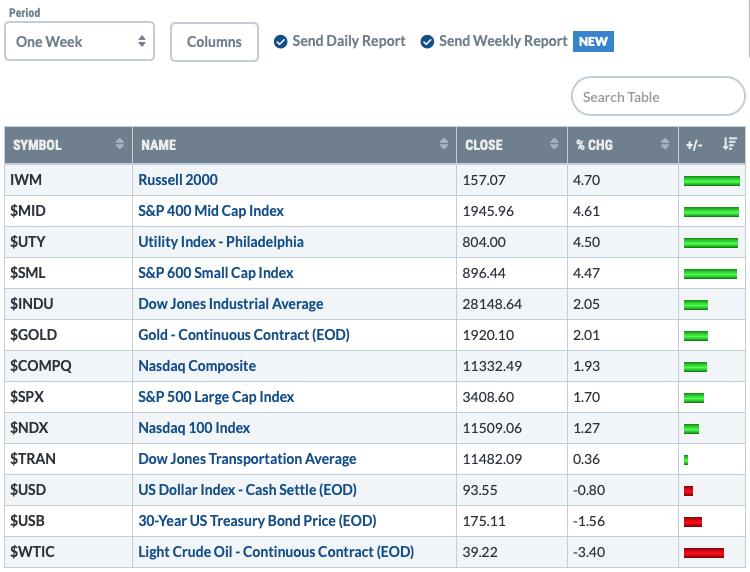

TODAY'S Broad Market Action:

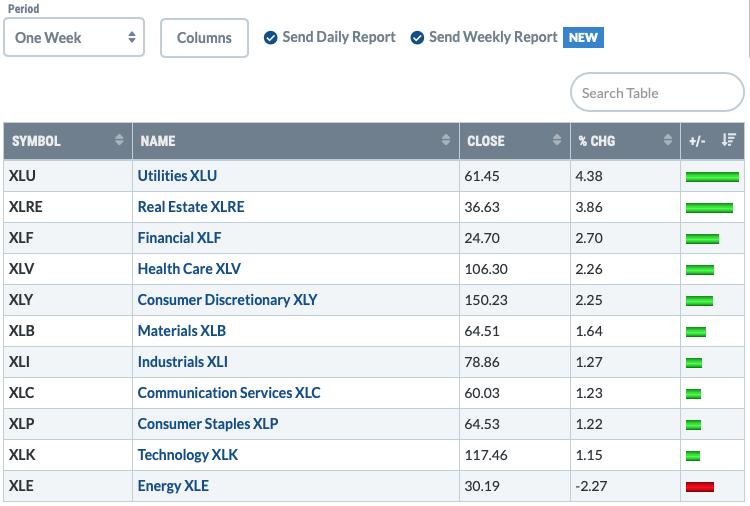

One WEEK Results:

Top 10 from ETF Tracker:

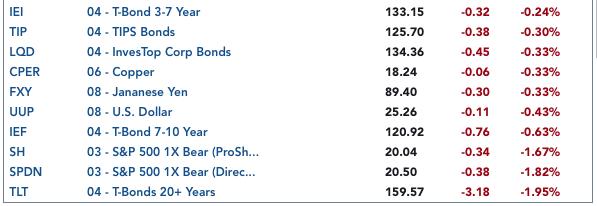

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

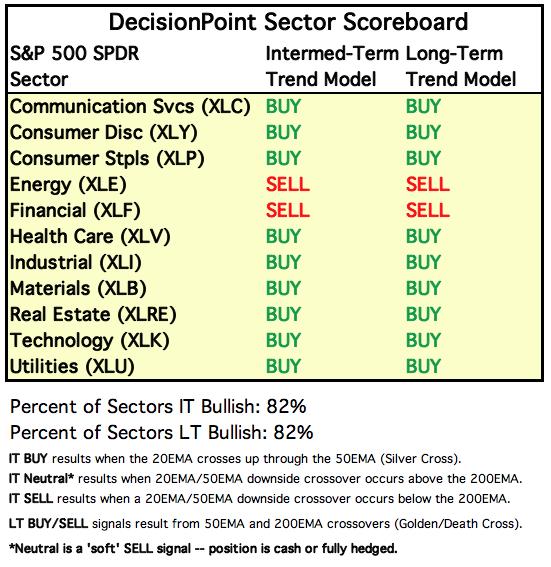

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

One WEEK Results:

STOCKS

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

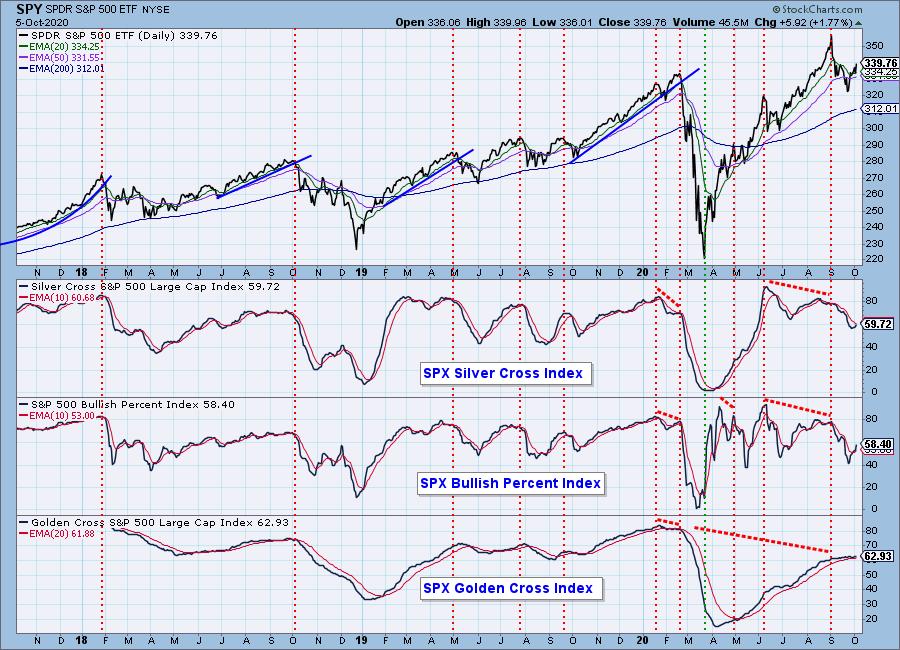

SPY Daily Chart: Today's price action shows that price is still traveling under overhead resistance. However, the more I look at this chart, the more I'm beginning to see a possible reverse head and shoulders which is a bullish pattern. The RSI just entered positive territory and the PMO is reaching up toward a crossover BUY signal.

Climactic Market Indicators: Very high climactic positive readings today on breadth. Additionally we saw a spike in New Highs. Carl and I discussed this on today's DecisionPoint Show. My first reaction was a buying exhaustion. So many positive climactic readings have arrived bunched together that I think you could possibly look at it that way. Carl admitted to not knowing what to make of it right now. I'm leaning toward an exhaustion based on these indicators. The VIX has been squeezed tightly and it is now underneath its EMA on the inverted scale. At the same time, the bands have squeezed so tightly and that being above or below the EMA is somewhat inconsequential. I think we should also note that volume was thin on this rally.

Short-Term Market Indicators: The short-term market trend is UP and the condition is OVERBOUGHT. Based upon the STO ranges, market bias is BULLISH.

These indicators still look good although they moved slightly lower today. The main issue is that they overbought and are beginning to decline. %Stocks indicators are starting look overbought as well.

Intermediate-Term Market Indicators: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI shows the percentage of SPX stocks on Point & Figure BUY signals.

All of these indicators are rising. The BPI had a positive crossover which generally is bullish. The GCI and SCI are also rising and we will see a positive crossover the signal line on the SCI very soon.

The intermediate-term market trend is DOWN and the condition is NEUTRAL. The market bias is NEUTRAL.

ITBM and ITVM have now reached positive territory which is bullish. %Stocks with rising PMOs is not overbought and looks bullish as it springs upward.

CONCLUSION: Although one could read the climactic indicators as possibly showing a buying exhaustion, the indicators themselves are very bullish. I am also looking at a possible bullish reverse head and shoulders that a breakout would execute. I don't think we are out of the woods, but given the health of the rising indicators, I can't be bearish.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: The cup and handle pattern continues to mature. The expectation is an upside breakout...soon. The PMO has reached positive territory. The RSI has dipped into negative territory. If we lose the $25 support level, I would call this cup and handle pattern a bust.

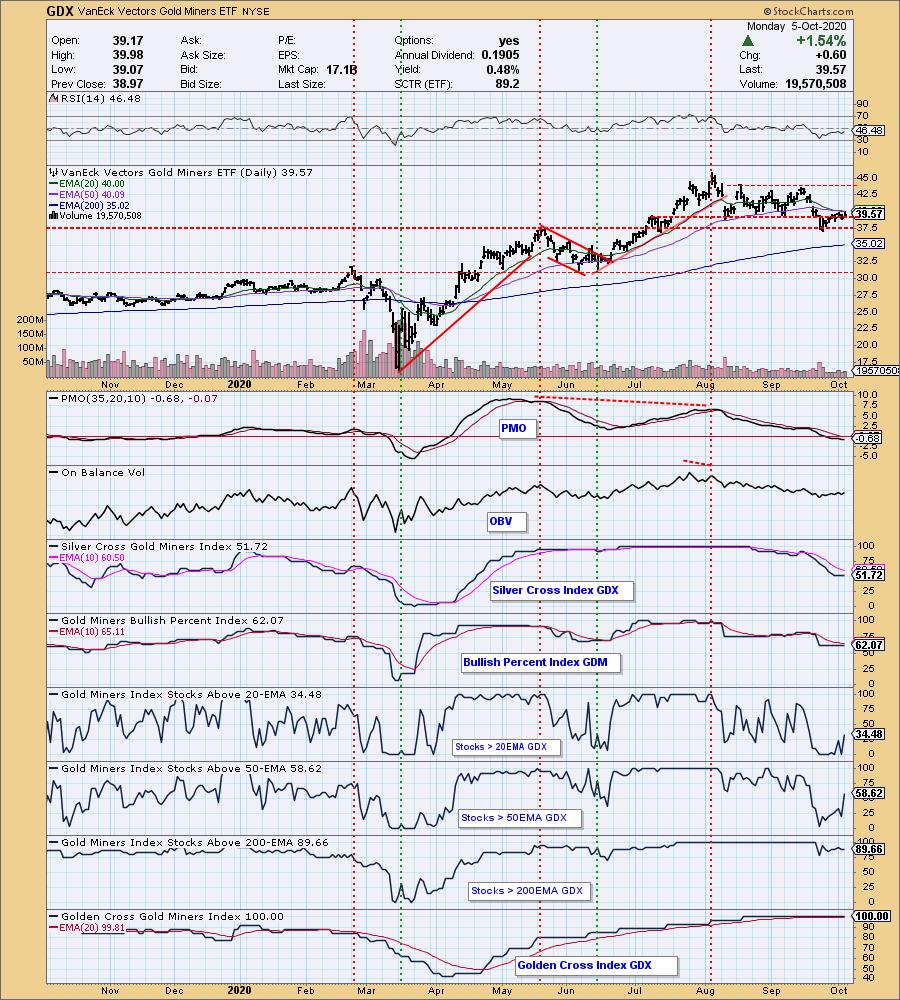

GOLD

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Gold rallied today but remains underneath overhead resistance at the 2011 top. With this short-term rally, the PMO has turned up nicely and the RSI has nearly reached positive territory. We are still seeing discounts on PHYS and that is bullish for Gold. Given the bullish pattern on the Dollar, I'm not counting on Gold to breakout here. However, the PMO and RSI certainly suggest we will see a nice breakout. I'm just not sold.

Full Disclosure: I own GLD.

GOLD MINERS Golden and Silver Cross Indexes: Miners are struggling with resistance at the 20/50-EMAs. Unfortunately, the 20-EMA just crossed below the 50-EMA for a Neutral signal. However, if price can get back above the 50-EMA that signal will whipsaw back to a BUY. The PMO hasn't turned up yet. The RSI is rising but still negative. I own a Gold Miner and intend to continue to hold. My concern is that it will test the 200-EMA before it starts to rally. If the Dollar gets involved here, Miners will have some difficulty as the price of Gold will begin to fall if the Dollar rises.

CRUDE OIL (USO)

IT Trend Model: SELL as of 9/8/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Huge uptick in Oil today. It doesn't change the price chart much, but it does appear we will see a move back to the top of the trading range. In today's DecisionPoint Show we discussed some of the areas we are "stalking" in Energy. I do want to point out on the 6-month chart below that the 200-EMA is finally becoming visible in the upper left-hand corner. Talk about 'beat down'!

BONDS (TLT)

IT Trend Model: Neutral as of 8/27/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: Big breakdown in Bonds as yields marched higher. We were already seeing some deterioration last week, but today there is no quibbling about the bearishness of this chart. The PMO turned down beneath its signal line and the RSI is negative. The only possible "good things" about this chart would be that the RSI is getting oversold and the 200-EMA is nearing as support. I suppose we could be looking at a possible reverse island, but losing that important support level and the accompanying bearish indicators tells me not to look for higher prices.

Full disclosure: I own TLT.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Get in on the new "DecisionPoint Diamond Mine" trading room that is part of that subscription! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)