In one of my favorite Monty Python movies, a scene opens in a town dealing with the plague. A man is ringing a bell telling everyone to "Bring out yer dead! Bring out yer dead!". Someone tosses a body on the pile in the wheelbarrow and you here a faint, "Uh, I'm not dead yet...in fact, I'm feeling a bit better now..." The market did break down today from the steeper rising bottoms trendline, but the short-term rising trend (annotated in red) has not yet been broken. The market and bulls are telling us "we're not dead yet". The RSI is still positive, albeit falling and the PMO is rising, albeit decelerating. Total volume fell on today's decline and the VIX is staying above its EMA on the inverted scale; both of which are positive. So why am I not bullish? It's the indicators under the surface that have me bothered.

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 10/12 trading room? Here is a link to the recording (access code: qE58C9.E). For best results, copy and paste the access code to avoid typos.

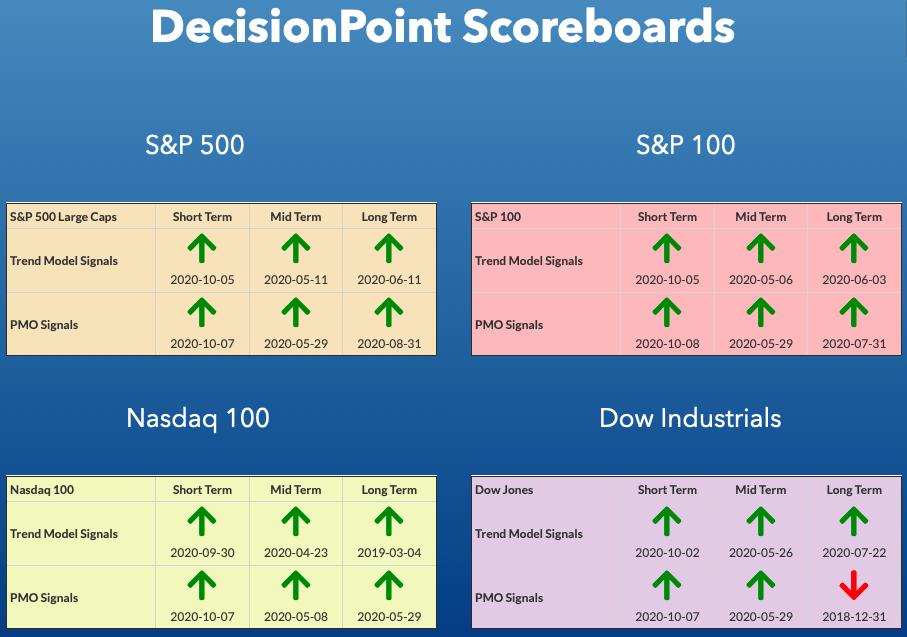

DP INDEX SCOREBOARDS:

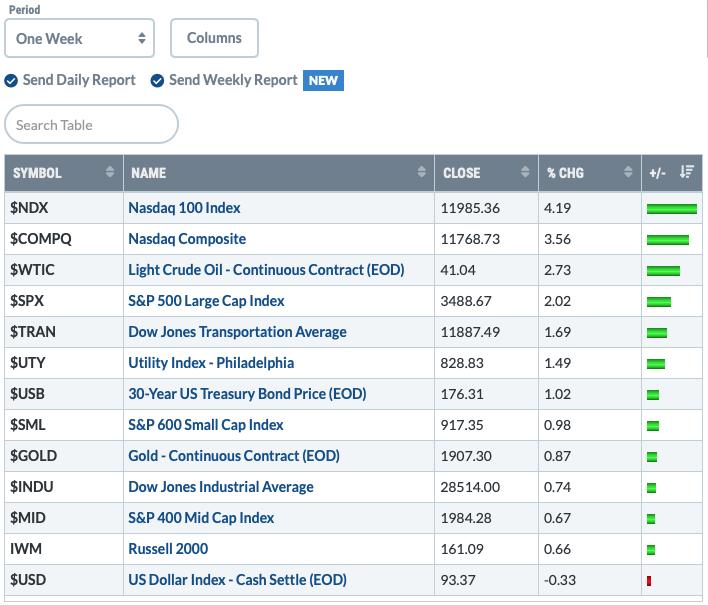

TODAY'S Broad Market Action:

One WEEK Results:

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

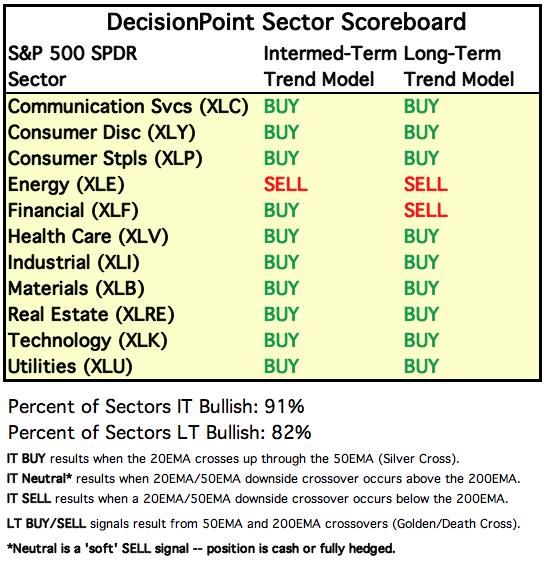

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

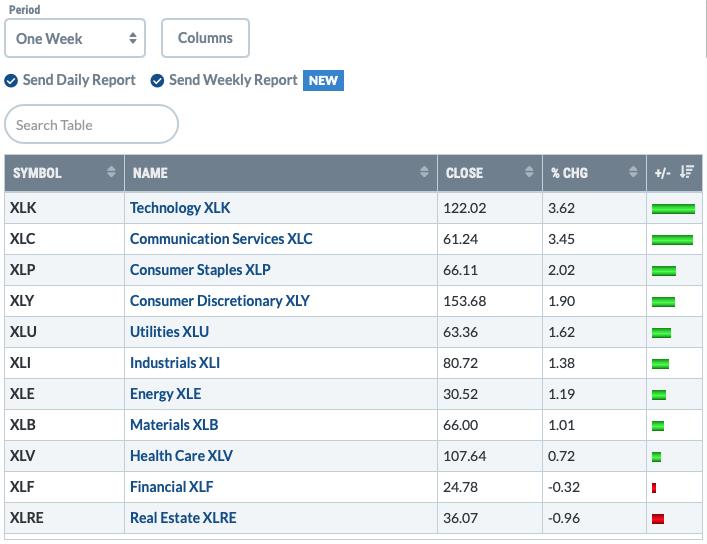

TODAY'S RESULTS:

One WEEK Results:

STOCKS

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

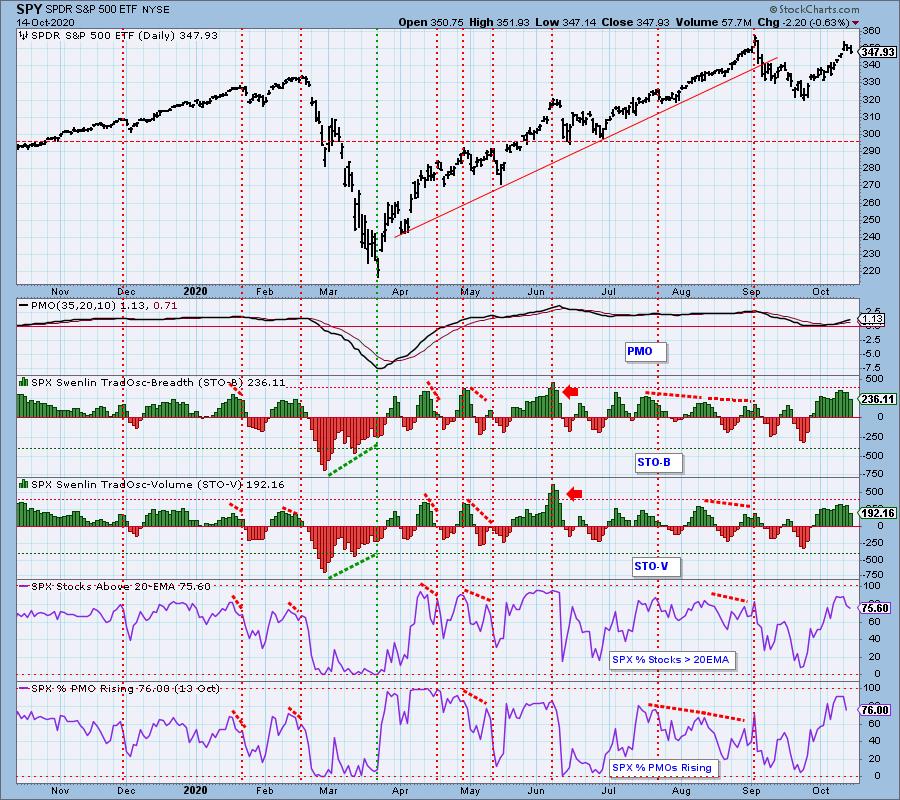

SPY Daily Chart: The bearish rising wedge is still there and suggests that price will break down.

Climactic Market Indicators: No climactic readings here, but New Highs continue to contract. Not surprising given two days of decline.

Short-Term Market Indicators: The short-term market trend is UP and the condition is OVERBOUGHT. Based upon the STO ranges, market bias is BULLISH.

STO readings dropped significantly today, yet they are still overbought. These indicators nearly always peak before declines or, at best, before consolidation zones consolidation zones.

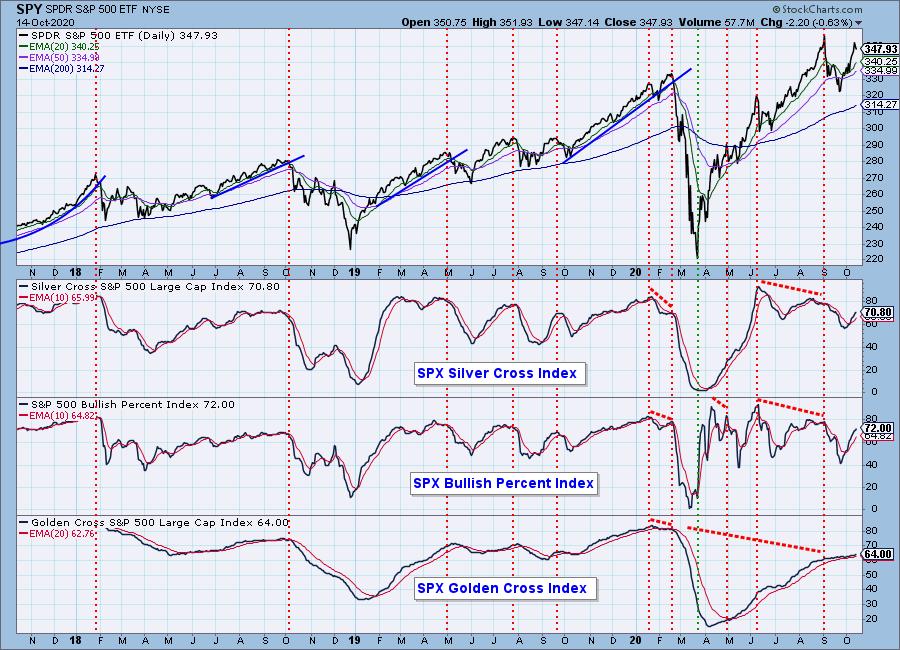

Intermediate-Term Market Indicators: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI shows the percentage of SPX stocks on Point & Figure BUY signals.

The GCI was stagnant. It is good to see the SCI and BPI undeterred by two days of decline.

The intermediate-term market trend is UP and the condition is OVERBOUGHT. The market bias is BULLISH.

All of these indicators are rising, but are now overbought. When these peak, we need to heed the warning.

CONCLUSION: The STOs are still a problem and suggest that we should expect this decline to continue. IT indicators are overbought and could turn on us at any time. If the short-term rising trend is broken and the selling begins, IT indicators will confirm the drop pretty quickly. Sentiment is becoming a topic again as market participants are starting to change their bullish bias. Sentiment is contrarian but that only applies (in my mind) when it is very lopsided. Hearing some of my bullish colleagues beginning to get worried has my attention as they tend to be right. The rest of the crowd won't come into play until they completely capitulate and it will be far too late. A subscriber wrote to me that making money "is not this easy ever" and I agree. The market tide will shift. Be ready.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: Yesterday's comments still apply:

"I still believe the cup and handle pattern is a valid one. If it drops below $25, I'll scuttle it. We got a nice rally on UUP today, but not enough to breakout from the 'handle'. The RSI did an about-face today with price, nearly jumping back into positive territory. The PMO is on a SELL signal right now, but that huge black volume bar is a good sign."

GOLD

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Gold rallied today not only on the decline of the dollar but also on added buyers. We still don't have a PMO BUY signal and the RSI remains negative. Today we had a new IT Trend Model Neutral signal trigger as the 20-EMA dropped below the 50-EMA while the 50-EMA was above the 200-EMA. Had this occurred below the 200-EMA it would have been a SELL signal. Gold is within a bullish falling wedge, but it is struggling with a breakout above the 2011 top. It's poised and ready, but looks like it needs another test of the bottom of the wedge.

Full Disclosure: I own GLD.

GOLD MINERS Golden and Silver Cross Indexes: The GDX chart looks a bit better. The PMO has just given us a crossover BUY signal and the RSI turned up before getting negative. The SCI and BPI have had positive crossovers. We are still looking at overbought readings on the other indicators, and while they do tell us there is a foundation of performers within the Miners, overbought readings eventually will need to be relieved. Also, if the Dollar breaks out it will be a headwind not a tailwind.

CRUDE OIL (USO)

IT Trend Model: SELL as of 9/8/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Finally a little something to talk about on the Oil chart. The RSI turned positive and today USO traded completely above the 50-EMA. The PMO has given us a crossover BUY signal. While it was a powerful upside move today, it didn't breakout. I also notice that volume has been declining, not rising on this rally.

BONDS (TLT)

IT Trend Model: Neutral as of 8/27/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: TLT gapped up again today, but is now up against resistance at the 50-EMA and earlier summer lows. The RSI is still negative, but the PMO has decided to turn up. Mixed messages, we will know more when we find out what price does with this resistance level.

Full disclosure: I own TLT.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Get in on the new "DecisionPoint Diamond Mine" trading room that is part of that subscription! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)