The Energy Sector has been a top performer in the last six weeks, rallying over 50% since the October low. Now it is beginning to look as if it is in the process of topping. On the chart below we can see that wedge patterns have played a major role in the last half of this year. First we have a falling wedge extending off the June top. As we normally expect, this pattern resolved to the upside and gave us a nice rally.

Now a short-term rising wedge is forming, and we expect that pattern to resolve downward. In addition to the bearish price pattern, most of the other indicators on the chart are very overbought. To be clear, we could be surprised with an upside resolution, but, after such a strong rally, a pullback is highly likely.

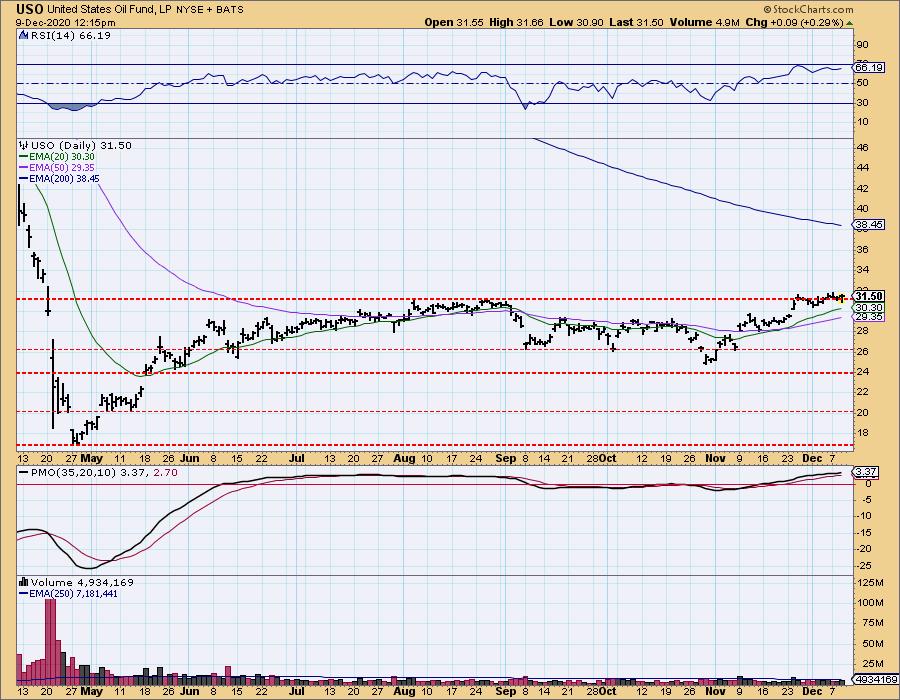

Presumably, the price of oil will have a great deal to do with Energy Sector performance, so we should take a look at that. Note that USO is at the top of the range established as price stabilized after the crash earlier this year. The daily PMO and RSI are overbought, and it is reasonable to expect that price will drift back toward the bottom of the range.

Conclusion: While it appears that the Energy Sector is setting up for a pullback, an actual breakdown hasn't happened yet. Nevertheless, internals are overbought, and the rising wedge is likely to break down. That said, I think a long-term low is in, and that any correction will not threaten this year's lows.

Click here to register in advance for the recurring free DecisionPoint Trading Room! Recordings are available!

Technical Analysis is a windsock, not a crystal ball.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.