I've covered Natural Gas (UNG) quite a bit. In fact, it has been a "Diamond in the Rough" in the Diamonds Report numerous times. The latest was on April 14th. It is up almost 10% since then. However, I'm getting a little concerned about how price is coming up against overhead resistance at both the 200-EMA and the October low. It has been consolidating for over a week now. This could turn out to be a bull flag. Given that the RSI is still positive and the PMO is still rising and not overbought, I would expect to see overhead resistance overcome.

However, we need to be aware that it is coming up against resistance. I own a position myself and I have raised my stop level to about $10.40. When UNG fails, it usually fails quickly so be on your toes!

I just had my 2nd vaccine so today I will be brief.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockChartsTV.com and YouTube here!

MAJOR MARKET INDEXES

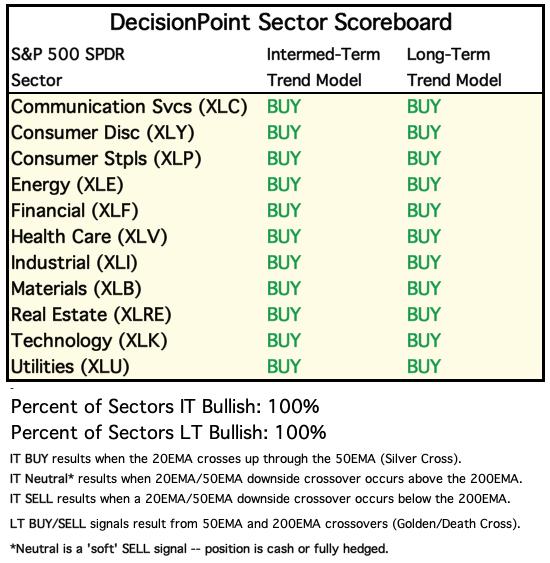

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

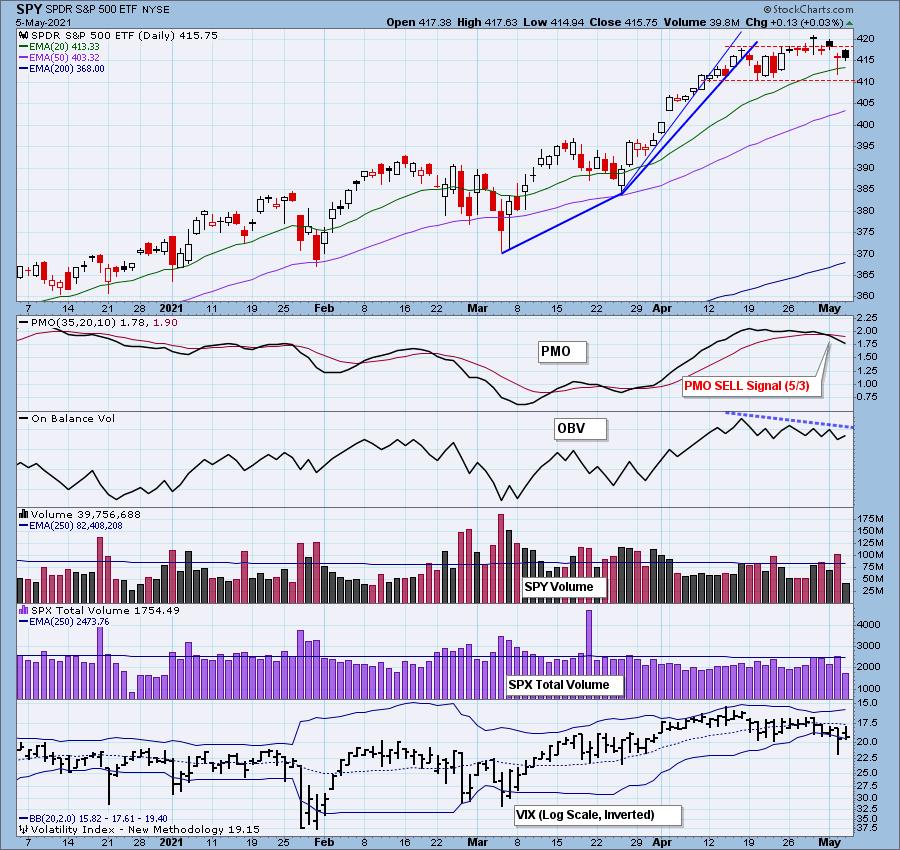

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: We had a positive close today, but just barely. Price remains in the consolidation zone.

The RSI is positive, but the PMO is declining on a crossover SELL signal.

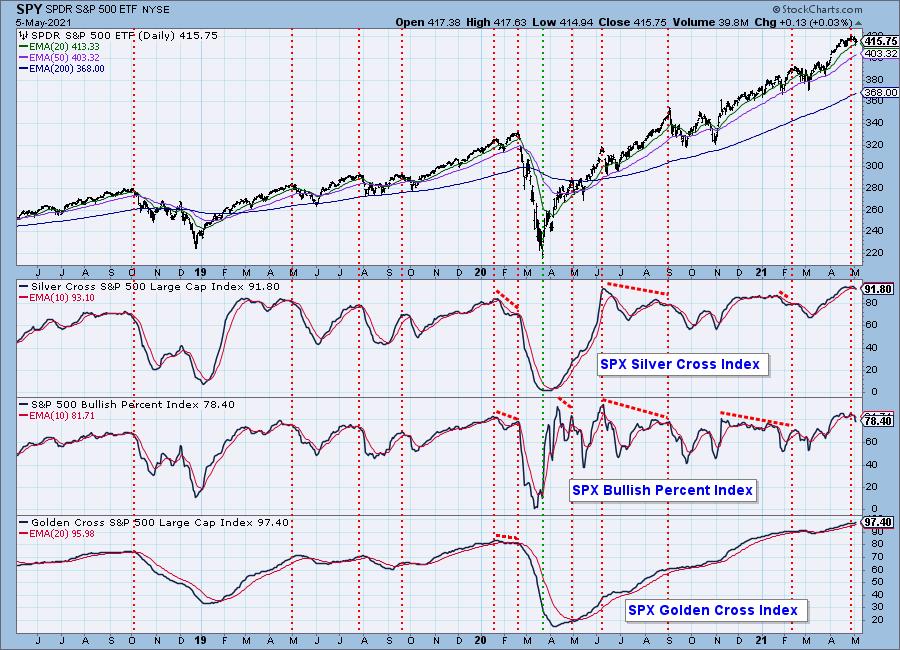

Participation: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

The GCI is unchanged since last Friday, but is sitting in very overbought territory. The BPI actually ticked up today, but the SCI crossed below its signal line for the first time since January. This is a powerful sell signal in my estimation.

Not much change in participation on today's small gain.

Climax Analysis: What hit me most on this chart was the very very low total volume. Investors seem to be watching and waiting right now. No climactic readings, although we did continue to see quite a few New Highs.

The VIX penetrated the lower Bollinger Band again today. Notice the Bands are beginning to expand now.

Keep in mind: When the Bands squeeze it makes any penetration of the Bollinger Bands less useful since it is easy for them to punch through the upper Band one day and immediately puncture the bottom of the Band the next.

A Bollinger Band squeeze also signals that volatility is ahead. The Bands can't remain squeezed together forever and the only way to have them expand is on high volatility. I've never seen a VIX squeeze finish with a powerful thrust to the upside. High volatility is almost always bad.

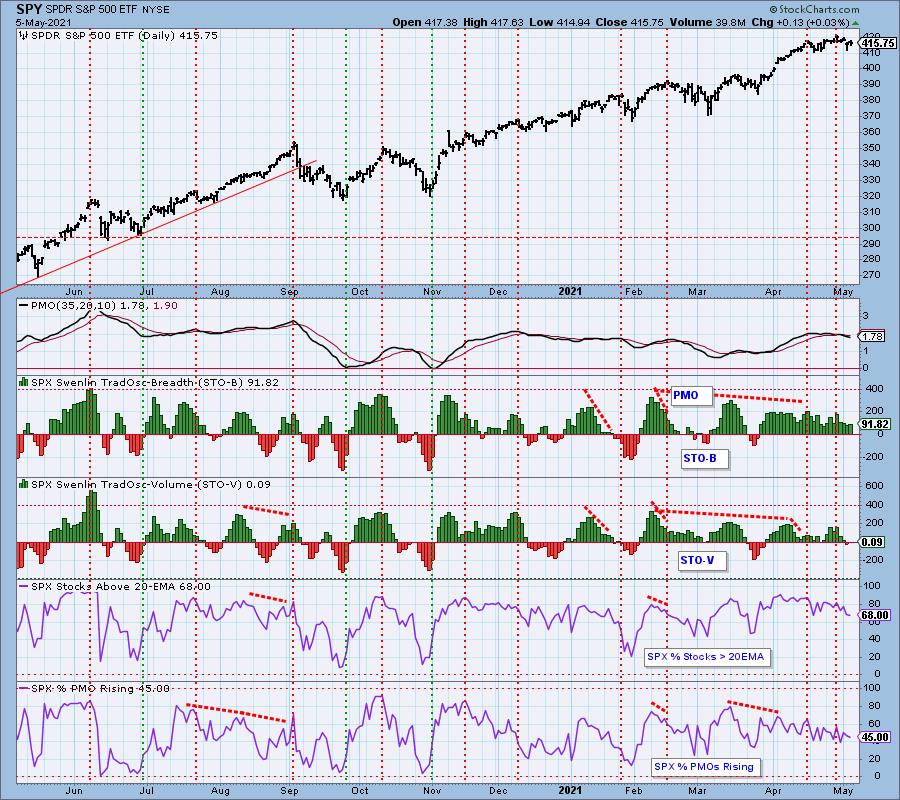

Short-Term Market Indicators: The short-term market trend is DOWN and the condition is NEUTRAL.

Interestingly the STO-B did tick up slightly. I'm not putting much stock (no pun intended) in what normally would be a bullish signal. The STO-V is still declining and is in negative territory so a tick higher on the STO-B doesn't impress me much.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is OVERBOUGHT. The market bias is BULLISH.

The ITBM/ITVM continue to contract. Like yesterday, we didn't see much damage to the %Stocks with PMO BUY signals. What is important note is that it is less than 50% of stocks with PMO BUY signals.

CONCLUSION: The market was mostly unchanged today on very low volume. Our outlook hasn't changed, the market is in a short-term declining trend. The SCI dropping below its signal line was significant. We are looking for more downside. Consider finding opportunities in the Energy and Materials Sectors which seem to be getting more healthy even as the market travels sideways.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

Bitcoin indecision is clear. We had a bullish head and shoulders, but right after it executed, price fell below both the 20/50-EMAs. Today's pop managed to extinguish the PMO SELL signal that had just been generated and now the RSI is back above net neutral (50). While today was a powerful upside move, overhead resistance is near.

INTEREST RATES

Yields continue to fall. We'll be watching support at the April lows.

DOLLAR (UUP)

IT Trend Model: SELL as of 4/26/2021

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: The Dollar (UUP) is still struggling to overcome resistance at the 20-EMA and the March lows. The RSI is still negative and although the PMO is beginning to bottom, I'm not expecting a breakout.

While we could see UUP rise a bit more to test the 50-EMA and February top, I expect it to fail. $24.40 will likely be tested again soon.

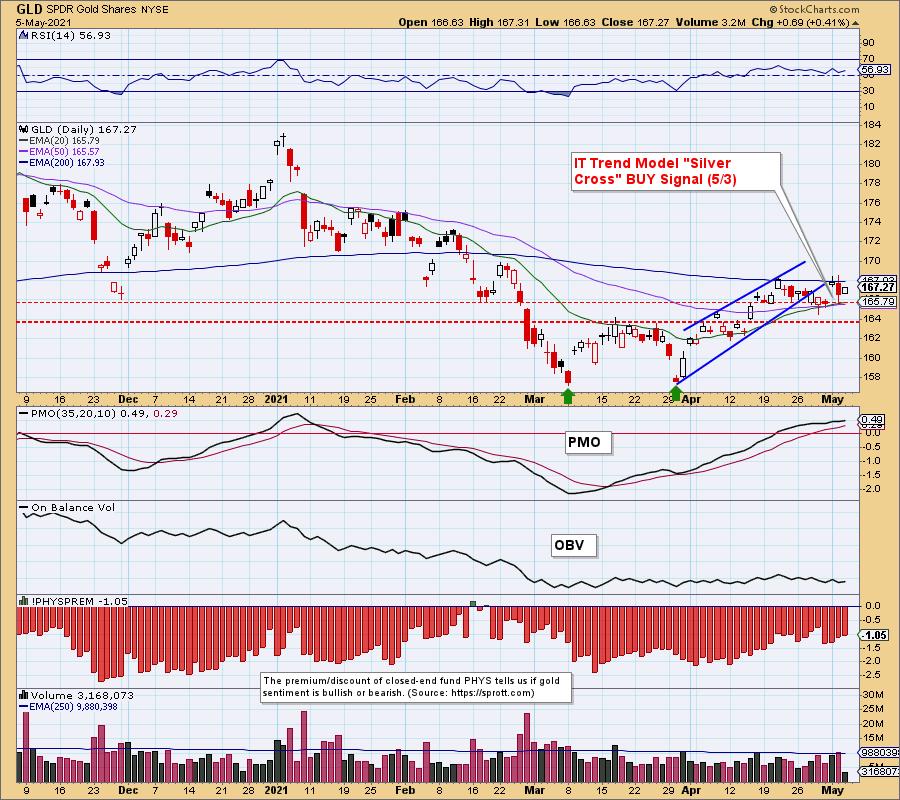

GOLD

IT Trend Model: BUY as of 5/3/2021

LT Trend Model: SELL as of 3/4/2021

GLD Daily Chart: Gold rallied today but didn't make up much ground. Resistance at the 200-EMA is still a problem. The PMO is still rising slightly and the RSI is positive.

Given that discounts on PHYS continue to contract, we see that investors are getting less bearish on Gold. If support is lost at the 50-EMA, we could lose the recent IT Trend Model "Silver Cross" BUY signal. I'm still slightly bullish on Gold and am looking for a breakout, not a breakdown.

GOLD MINERS Golden and Silver Cross Indexes: Miners rallied with a little help from Gold's rally. The PMO is still on a crossover SELL signal, but it appears that will change very soon (tomorrow?). Participation looks good and is not overbought.

CRUDE OIL (USO)

IT Trend Model: BUY as of 11/23/2020

LT Trend Model: BUY as of 3/9/2021

USO Daily Chart: Although USO closed lower on the day, it held support. The RSI is still positive and the PMO is still rising slightly.

I still like Crude Oil and believe that there are some great investing opportunities in the Energy sector related to Oil.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 8/27/2020

LT Trend Model: SELL as of 1/8/2021

TLT Daily Chart: Yesterday's comments still apply:

"The PMO bottomed above its signal line today which is especially bullish. The RSI has now entered positive territory. Yields started falling last week and that has pushed TLT up to its 50-EMA."

Yields aren't likely to move much lower, but we are watching support closely on yields. If that is broken, Bonds will definitely be back in favor. Remember when the 50-EMA is that far below the 200-EMA, the stock or ETF has a strong bearish bias so you should expect bearish outcomes rather than bullish ones.

Happy Charting!

Erin Swenlin

Technical Analysis is a windsock, not a crystal ball.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.