First, thank you so much for your patience today! Graduation was spectacular for our niece! We braved 90+ degree temperatures on a football field to see her special moment and it was well worth it. It was priceless!

When I recorded Chartwise Women with Mary Ellen McGonagle earlier today, we noticed that indexes were fractured or bifurcated. Look at the three charts below to see what I mean.

Today, the S&P600 was down a massive -1.84%. It got a new PMO SELL signal and broke below its 50-EMA. The RSI has just moved into negative territory. You can see that it is clearly underperforming the SPX. Working in its favor is a rising trend channel that hasn't been breached.

Next up, the Dow continued its breakdown from its rising trend channel. In fact, today it lost support at the 50-EMA. The RSI is negative and not really oversold. The PMO has been trending lower since April/May on a SELL signal. Working in its favor would be the strong area of support at the March top and May low.

On the same day that the S&P600 was down -1.84%, the Nasdaq was up +0.87%! Clearly, technology is looking strong. In fact, we have a positive and not overbought RSI, a rising PMO on a BUY signal and a bullish ascending triangle. It nearly triggered the pattern with today's sharp rally.

Now onto the SPX!....

** UPCOMING VACATION - June 28th to July 9th **

It's that time of year again! Last year it was a road trip to Alabama and back, this year it is a road trip to Utah and back! We plan on dropping in Las Vegas, Zion, Spanish Fork, Bryce Canyon, back to the Grand Canyon, Bull Head City and finally back home.

I plan on writing, but all trading rooms will be postponed until I return home. Blog articles may be delayed depending on WIFI service and/or our travel for the day.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockChartsTV.com and YouTube here!

MAJOR MARKET INDEXES

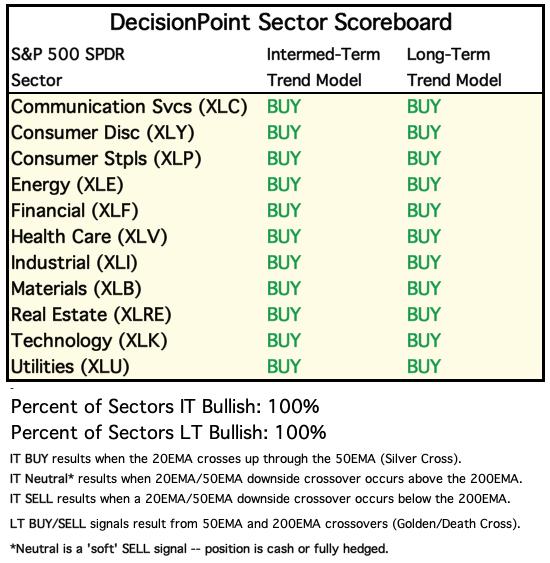

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: We saw the action on the SP600, Dow and Nasdaq. The SPX was middle of the road, finishing almost unchanged. Price is still staying above the 20-EMA as far as the close and support is very near at the June low as well as the 50-EMA. Today's volume was quite high on the selling.

The PMO is still holding onto yesterday's SELL signal, but we do see that the RSI is positive and the rising trend channel remains intact.

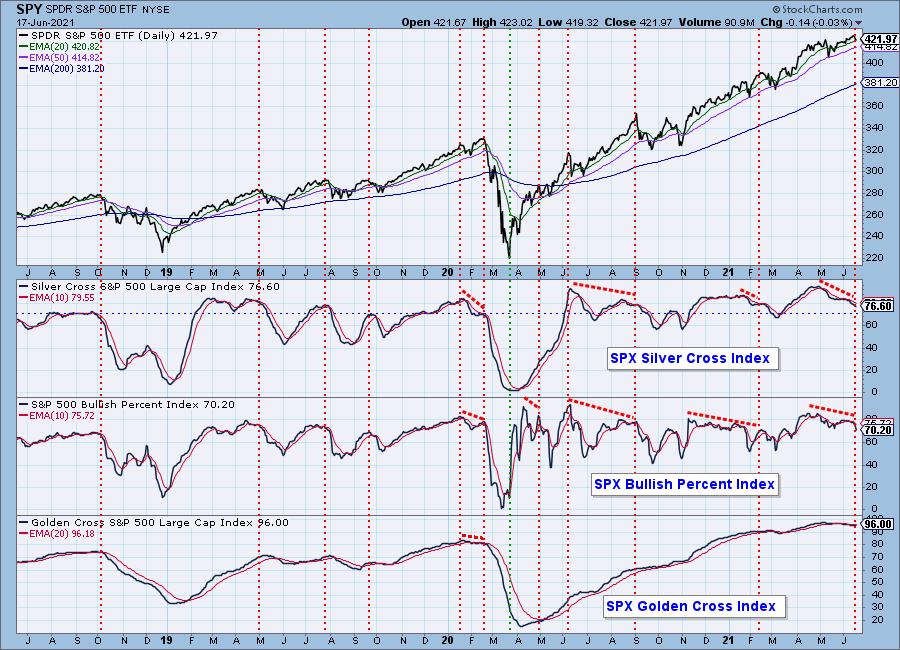

Participation: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

The GCI actually rose slightly today, but the deterioration of the SCI and BPI continue. Also note that these readings are NOT oversold yet.

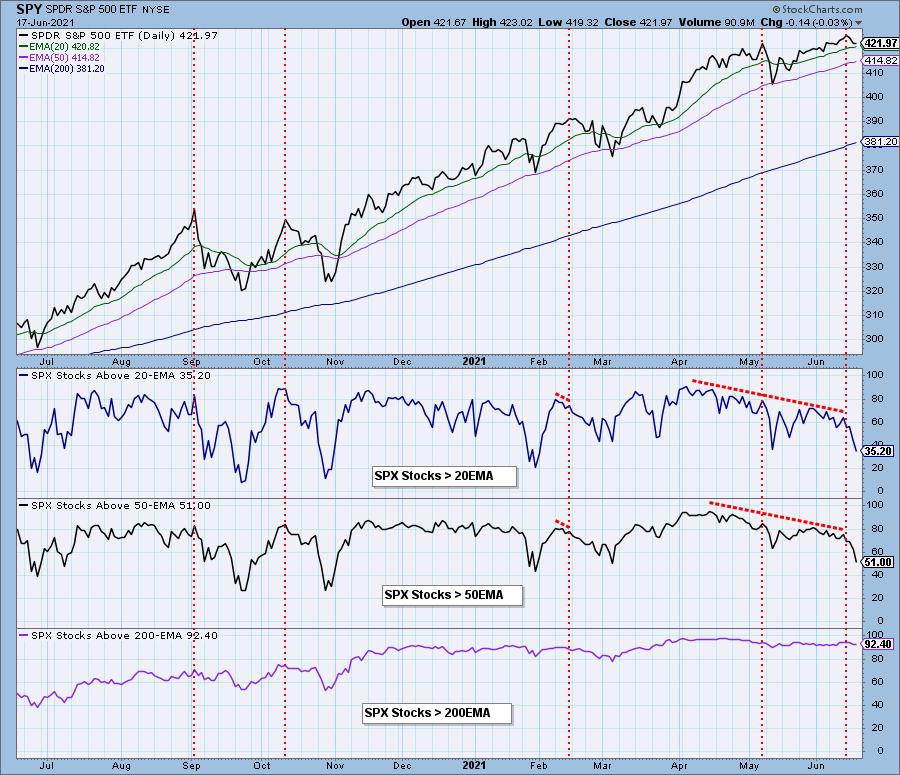

We see that participation continues to decline. On the bright side these indicators are getting oversold, but they are still pointed firmly downward. Many stocks have lost support at their 20-EMAs and only about half of the SPX have price above their 50-EMAs. It will take some work to get this turned around.

Climax Analysis: It wasn't a climax day per se, but seeing the elevated volume is concerning given price did touch below the 20-EMA. The VIX is getting squeezed again which tells us to expect volatility soon. We want to see a VIX close below the lower Bollinger Band on the inverted scale. That would give us a more bullish outlook in the short term. However, it's not there yet and Net A-D volume was quite elevated to the negative side.

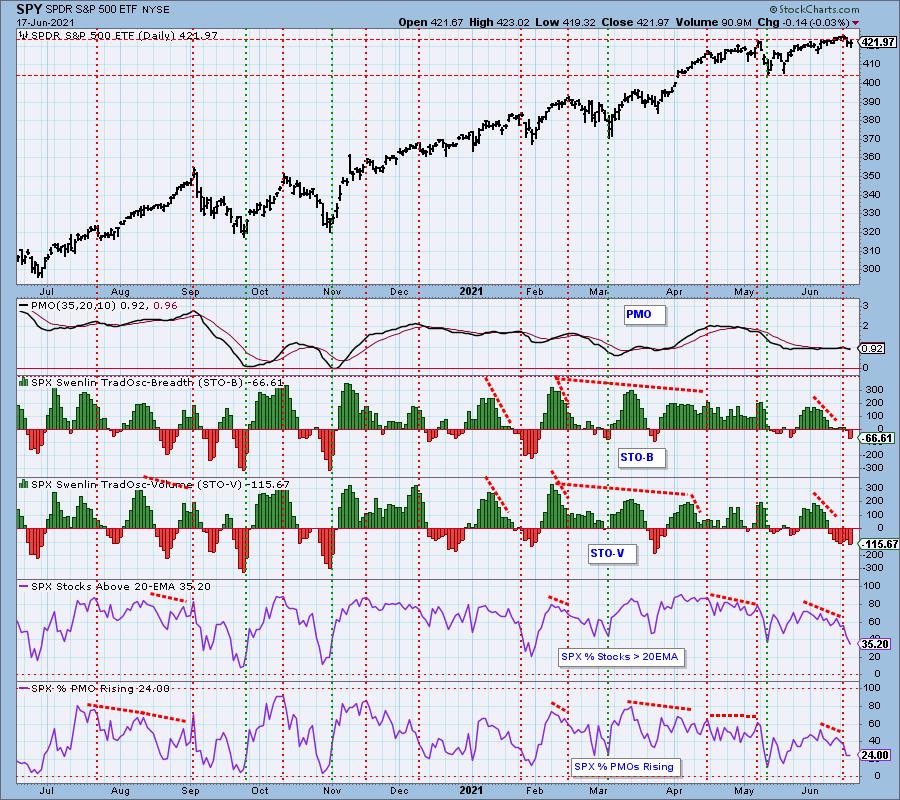

Short-Term Market Indicators: The short-term market trend is DOWN and the condition is OVERSOLD.

These indicators have both dropped into near-term oversold territory. %PMOs rising didn't get hit as hard as participation.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is NEUTRAL. The market bias is BULLISH.

We do not have oversold readings on the ITBM/ITVM. Neither has hit negative territory yet. Stocks continue to lose PMO BUY signals, but that reading is beginning to get a bit oversold. But like the other indicators, it is pointed straight down right now.

CONCLUSION: The broad markets are traveling in different directions with the SPX basically unchanged. The drop on small-caps is particularly concerning. Sustained rallies need small-cap support. Additionally, a rising Dollar could put pressure on large-cap growth stocks. The SPX indicators are getting oversold which is a good thing. However, they do not look ready to reverse anytime soon. The negative divergences gave us warning and now the pullback is on. As Carl reminded us on Friday, tomorrow is quadruple-witching options expiration. Tomorrow's volume will likely be very high, but do not confuse this volume spike with excess greed or fear. Overall, we suggest preparing for a longer-term decline. Until more of our indicators get oversold, it is likely we will continue to see prices move much lower.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

Bitcoin continues to decline after its failed attempt to break above overhead resistance. The RSI has moved negative which also suggests lower prices. The PMO is technically rising, but you can see that it is decelerating well-below the zero line. I'm looking for a test of 30,000 again very soon.

INTEREST RATES

After rebounding yesterday, yields fell today. This tells us there is strong overhead resistance at the April/May lows

10-YEAR T-BOND YIELD

$TNX pulled way back after the strong rise yesterday. The rising trend drawn from the December/January bottom is still intact, but given $TNX was unable to hold above the 20/50-EMAs, this rising trend will likely give way.

DOLLAR (UUP)

IT Trend Model: SELL as of 4/26/2021

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: Another strong rally for the Dollar today. UUP is now ready to challenge resistance at the 200-EMA. This rally took price above strong resistance...easily. The PMO is nearing the zero line. The RSI is getting overbought, so price will need to digest this rally. I'm looking for consolidation above $24.60.

There is a double-bottom formation that tells to expect a breakout above $25.20. However, it first will need to break not only above the 200-EMA, but resistance at the September and November lows. This is a very bullish rally, but as I said earlier, it needs to digest the current rally.

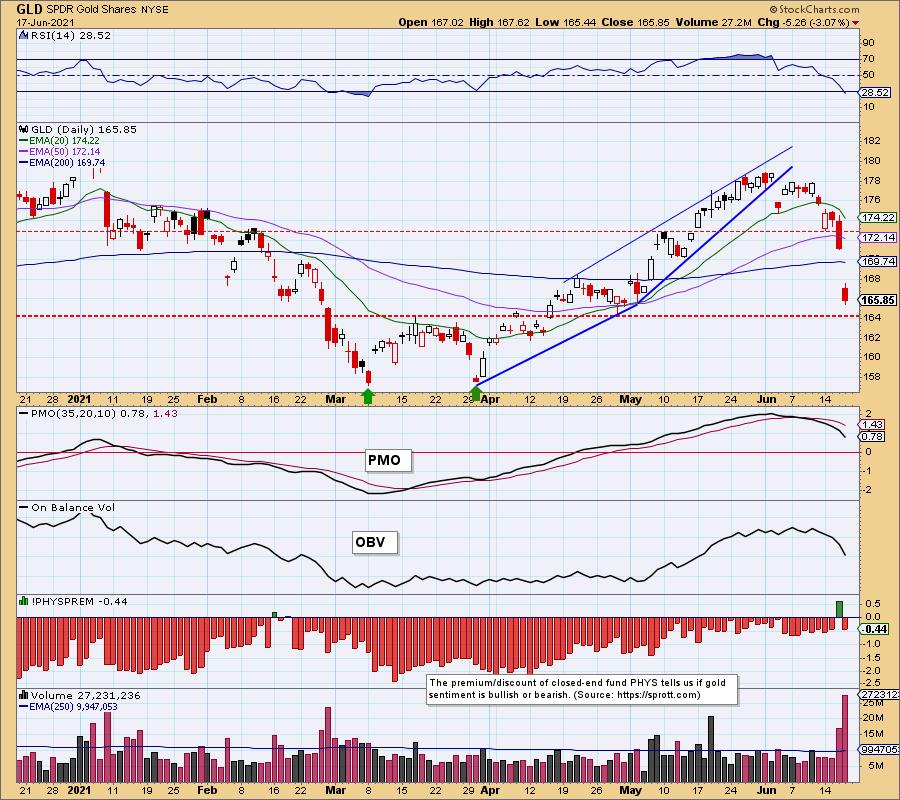

GOLD

IT Trend Model: BUY as of 5/3/2021

LT Trend Model: BUY as of 5/24/2021

GLD Daily Chart: With the Dollar rallying strongly, Gold fell off a cliff, leaping past the 200-EMA. It is already nearing support at the March top (confirmation line of the March double-bottom). The RSI is now oversold. Volume was very high. This looks like a possible selling exhaustion.

(Full Disclosure: I own GLD)

Price took out the minimum downside target of the double-top, hence why we call them "minimum" downside/upside targets. Sentiment is not that bearish. In fact we had a premium yesterday, meaning Gold investors were bullish on Gold. That is typically when you'll see a decline given sentiment is contrarian. Like the Dollar, Gold needs to digest today's move. With support at that March top near, we should see that soon.

GOLD MINERS Golden and Silver Cross Indexes: I wrote yesterday, "200-EMA here we come!" Well, price dropped well below that on a 5% decline. The next level of support is at the November low. Participation readings are very oversold; we have 0% of Gold Miners with price above the 20-EMA. Unfortunately, the SCI and GCI are still quite overbought. I would look for a test of support at $33. We will watch this chart closely, when Miners are ready to pivot and rally, we will want to get on board.

CRUDE OIL (USO)

IT Trend Model: BUY as of 11/23/2020

LT Trend Model: BUY as of 3/9/2021

USO Daily Chart: USO broke down and out of the thin rising trend channel. This was constructive. Price is still comfortably above the 20-EMA and this took the RSI out of overbought territory. The PMO is attempting to turn lower and heavy volume on the decline could suggest more decline ahead.

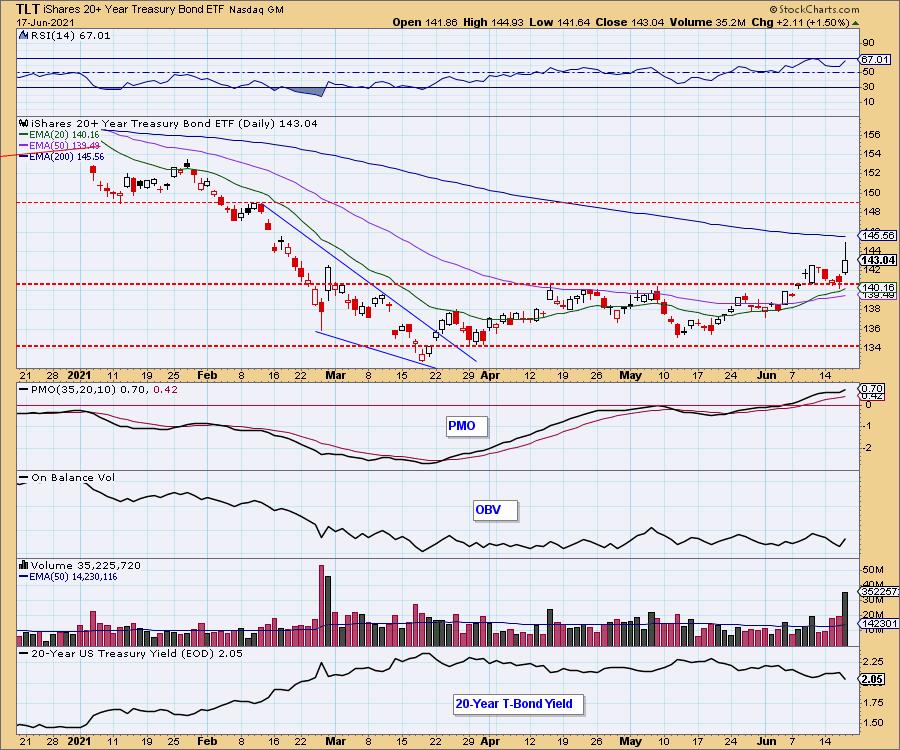

BONDS (TLT)

IT Trend Model: NEUTRAL as of 8/27/2020

LT Trend Model: SELL as of 1/8/2021

TLT Daily Chart: TLT rallied strongly as yields fell. The PMO has bottomed above its signal line which is especially bullish. The RSI is positive and not yet overbought. The 200-EMA is likely the next stop for TLT.

Happy Charting!

Erin Swenlin

Technical Analysis is a windsock, not a crystal ball.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.