What happens in Vegas, stays in Vegas... including your money. Again, thank you for your patience as the publishing schedule continues to vary as I travel. Right now I'm looking out on this beautiful view from our "glamping" tent in Zion. I'm writing in the open air and looking up periodically to enjoy the change in the shadows. Our country is truly stunning in so many different ways.

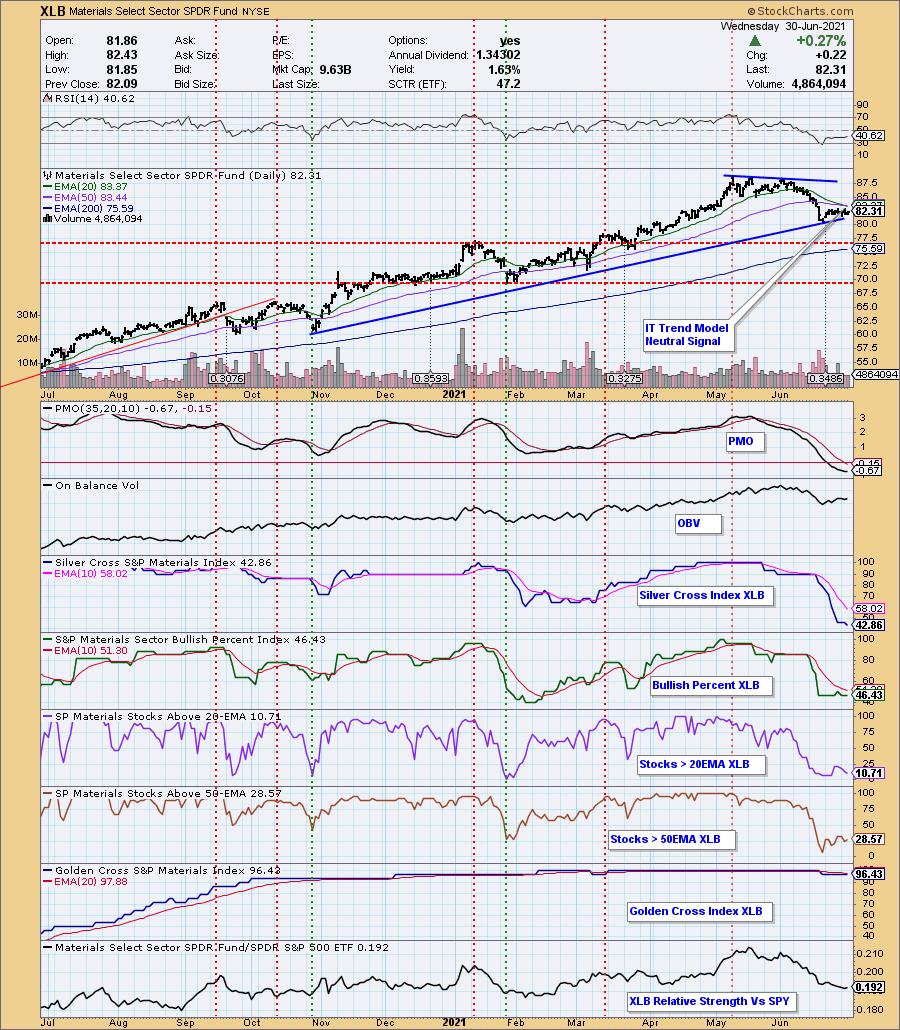

Onto stock news. Yesterday, the 20-EMA was equal to the 50-EMA. Today the 20-EMA did fall below the 50-EMA, officially triggering an Intermediate-Term Trend Model Neutral signal. With the demise of Gold and Gold Miners, etc. I wasn't surprised when I was notified of this new signal. Currently price is holding onto a long-term rising trend without a breakdown. Participation has been crashing and is mostly oversold, although if you look at Gold Miners chart further down, then you'll really see some oversold readings. XLB's participation is likely to sustain even more damage.

On the bright side, while the PMO is in decline, it is beginning to decelerate suggesting this rising trend could hold up. However, trying to time an entry here would be like the proverbial "catch a falling knife". We will continue to monitor this sector and look for a great beat down entry point.

** ON VACATION - June 28th to July 9th **

It's that time of year again! Last year it was a road trip to Alabama and back, this year it is a road trip to Utah and back! We finished Las Vegas and have reached our "glamping" camp site in Zion. After this onto Spanish Fork, Bryce Canyon, back to the Grand Canyon, Bull Head City and finally back home.

I plan on writing, but all trading rooms will be postponed until I return home. Blog articles may be delayed depending on WIFI service and/or our travel for the day.

DP Alert subscribers: The DP Alert will be published daily at varying times while I'm traveling. I will try to keep as close to our regular schedule as possible. Rest assured, you will ALWAYS have the report prior to market open the next day.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockChartsTV.com and YouTube here!

MAJOR MARKET INDEXES

SECTORS

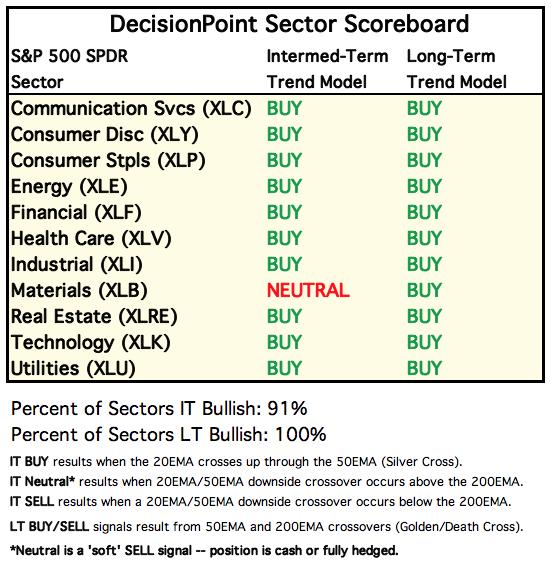

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

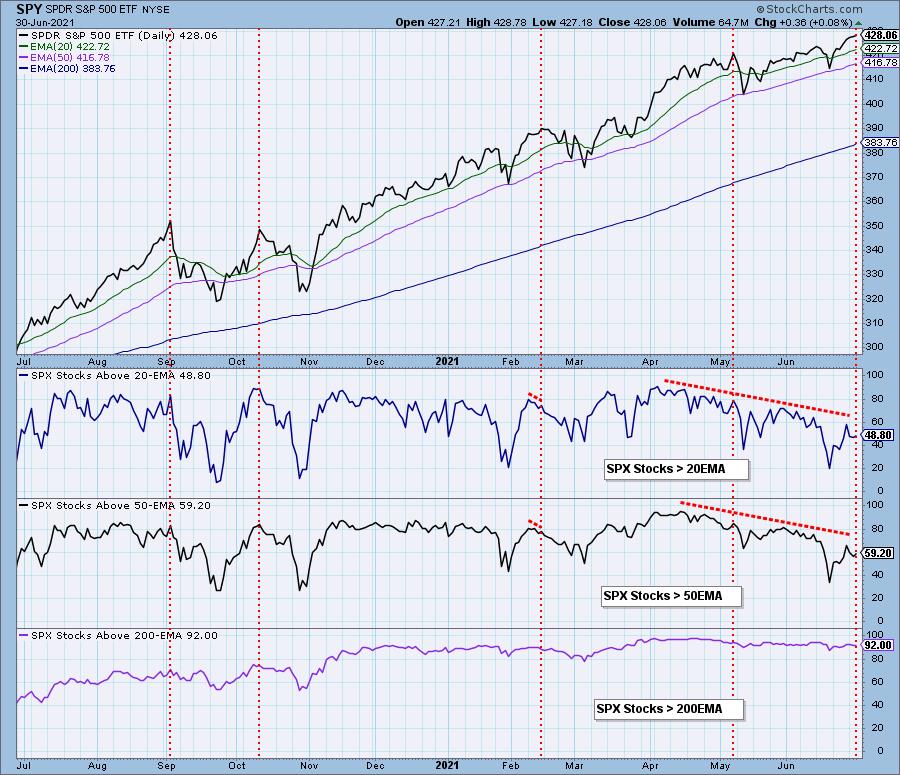

SPY Daily Chart: Price appears to be rounding into a downside reversal. At least the OBV is beginning to challenge previous highs along with price and the RSI and PMO are positive.

While price did have a very bullish upside breakout from the bearish rising wedge, the move already appears to be exhausting.

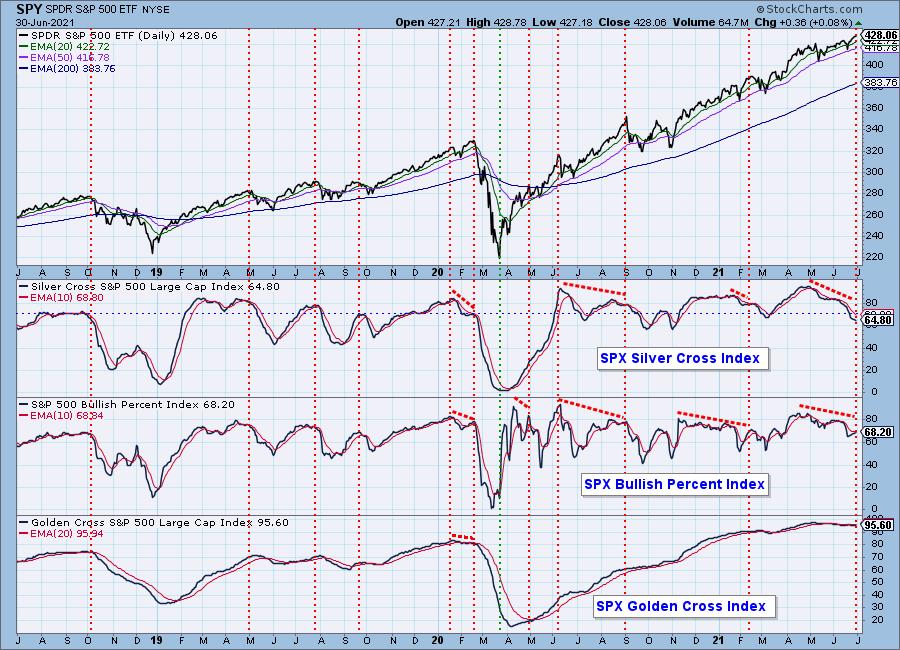

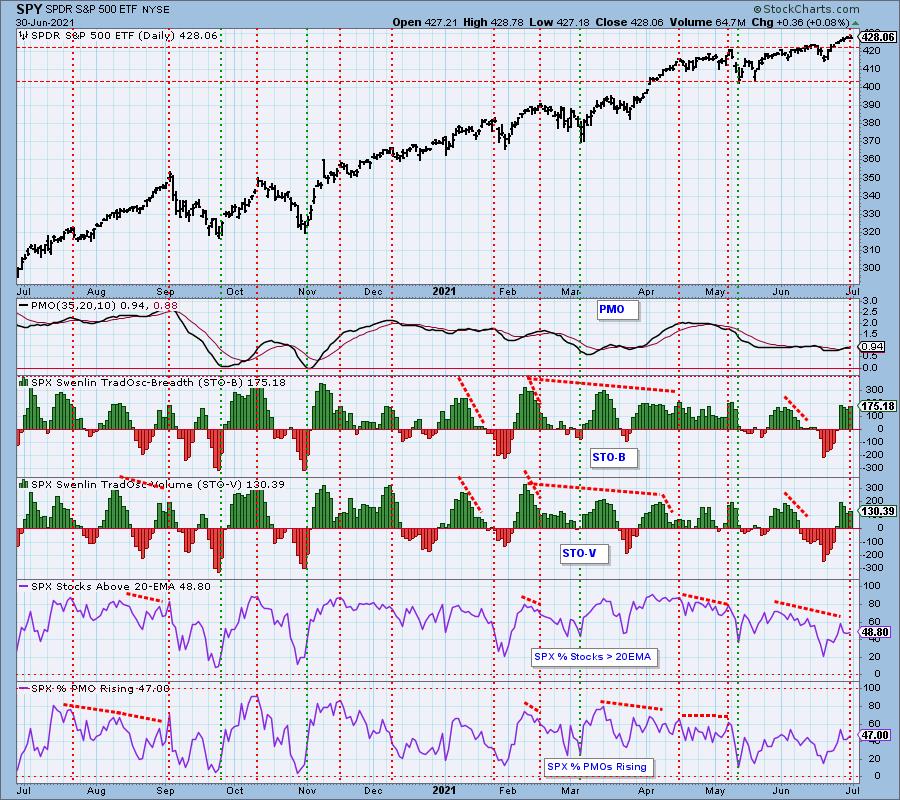

Participation: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

The BPI did cross above its signal line, but the SCI is still seeing damage. The GCI is holding in extremely overbought territory. Price is rising and making new highs, but the SCI has given us a strong negative divergence.

Participation didn't change much. It still holds a negative divergence with price, particularly in the short and intermediate terms. In the long term, there is a fairly solid foundation with nearly all stocks in the SPX having their price above their 200-EMAs.

Climax Analysis: No climax today. Total volume did increase today, but nothing out of the ordinary. The VIX is hanging above its EMA on the inverted scale suggesting internal strength in the very short term. However seeing the rounding off of price, I wouldn't expect to see price rise too much longer.

Short-Term Market Indicators: The short-term market trend is UP and the condition is OVERBOUGHT.

STOs did turn back up today, suggesting we'll see a price rise tomorrow; however, they are overbought and like price, could turn on a dime. It is hard to imagine that the SPX could continue much higher given more than half of the members have PMOs that are pointed downward.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is NEUTRAL. The market bias is NEUTRAL.

While these indicators have been rising, they are still in neutral territory and not rising with any urgency. With only 34% of stocks on BUY signals, who is going to keep pushing this index higher?

CONCLUSION: We like to invest with a high confidence factor. That factor continues to get smaller and smaller as fewer and fewer stocks participate in this short-term rally. If only 47% of these stocks have rising momentum, confidence is cut more than half. If you're a momentum trader, your confidence factor is only 34% given there are only 34% of stocks in the SPX on PMO BUY signals. Given the STOs are rising again, alongside a positive PMO and RSI, I'm holding my positions, but prefer not to open new positions right now given that confidence factor is low.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

Bitcoin made it back above the 20-EMA. In the process it triggered a bullish double-bottom pattern. The pattern's minimum upside target is at resistance at the prior May/June tops. The RSI isn't quite positive, but the PMO is looking bullish as it rises out of overbought territory.

INTEREST RATES

Long-term yields failed at overhead resistance and are headed lower again.

10-YEAR T-BOND YIELD

$TYX fell today and is now testing testing primary support between 14.0 and 14.5. It is also testing this month's lows. Price is tapping on the bottom of a bullish falling wedge which would suggest we could see yields rebound here. However, we also see that the intermediate-term rising trendline has been broken. $TYX is at a decision point. If we see the bottom of the falling wedge broken, that would be a bearish conclusion to a bullish chart pattern, making it especially bearish. A bounce here would solidify support and likely lead to a breakout. At this point I would look for a breakdown.

DOLLAR (UUP)

IT Trend Model: BUY as of 6/22/2021

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: Price has now closed above the 200-EMA again. While this is bullish, I don't like the wick on that candlestick. There is a good chance we will see the Dollar fall like we did earlier this month on the breakout above the 200-EMA. The RSI is positive and the PMO is picking up speed, so if anything it would be a hiccup on the road to higher prices.

The one-year chart is very bullish as we see the breakout from the bullish cup and handle pattern. This rally may need a moment to catch its breath after this breakout, but higher prices should continue. Next stop is the confirmation line (April top) of a very large double-bottom pattern.

GOLD

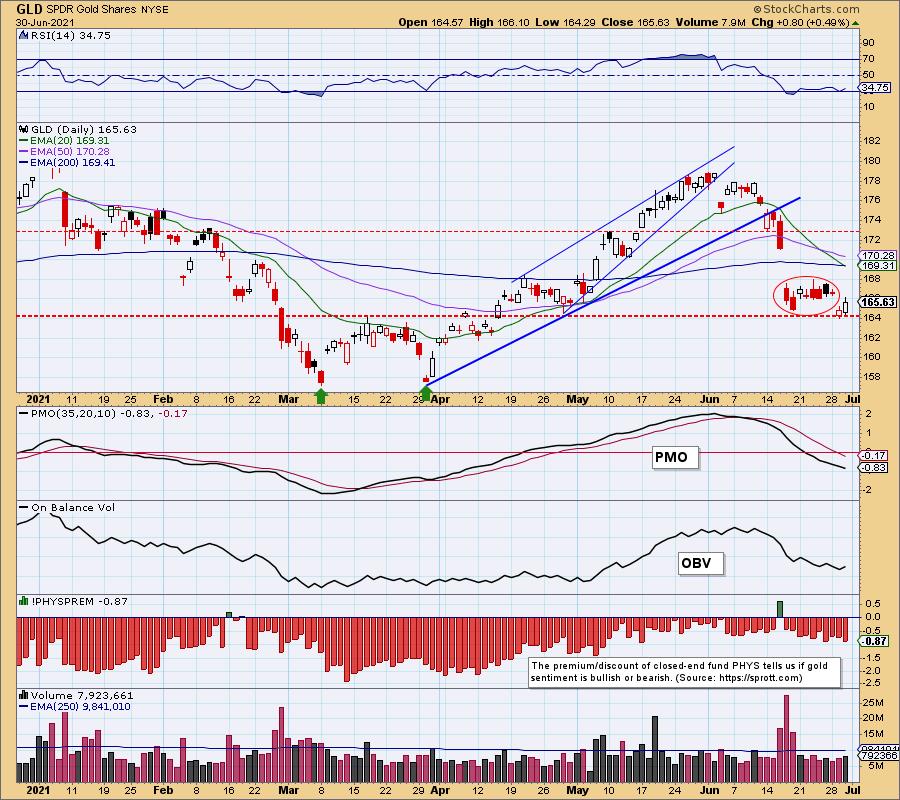

IT Trend Model: NEUTRAL as of 6/25/2021

LT Trend Model: BUY as of 5/24/2021

GLD Daily Chart: Gold rose a half a percent despite a strong move by the Dollar. Price bounced off support at the April low, but hasn't retraced back through the gap caused by yesterday's price decline. The RSI is still negative although it does appear ready to rise out of oversold territory. I won't be convinced of a recovery for Gold until the PMO turns up.

We have a very defined bearish reverse flag formation. The flag is falling which does take the sting away slightly. The textbook formation should see a rising flag so we may not see the intense selling that those formations typically precede.

CRUDE OIL (USO)

IT Trend Model: BUY as of 11/23/2020

LT Trend Model: BUY as of 3/9/2021

USO Daily Chart: Crude Oil continues to maintain its rising trend.

The RSI is positive and not overbought. The PMO looks less bullish but so far it is holding onto the crossover BUY signal. This seems a natural consolidation along a strong rising trend.

BONDS (TLT)

IT Trend Model: BUY as of 6/10/2021

LT Trend Model: SELL as of 1/8/2021

TLT Daily Chart: TLT moved higher today, but we have a shooting star candlestick which suggests we will see lower prices tomorrow. The 200-EMA held last time as resistance, so the candlestick formation seems on point.

Happy Charting!

Erin Swenlin

Technical Analysis is a windsock, not a crystal ball.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.