I briefly mentioned the Rare Earth/Strategic Metals ETF (REMX) under the "Gold Miners" section of yesterday's DP Alert. I decided to borrow a more detailed discussion from today's DP Diamonds Report:

"We know that China already has a near monopoly on rare earth materials, but Afghanistan also has rare earth materials. China is poised to 'help' Afghanistan with their mining of these materials. This means that China could have an even bigger piece of the pie. We are seeing the impact of raw materials scarcity on the production of everything from autos to iphones. Here is an article a subscriber recently sent that discusses this in more detail.

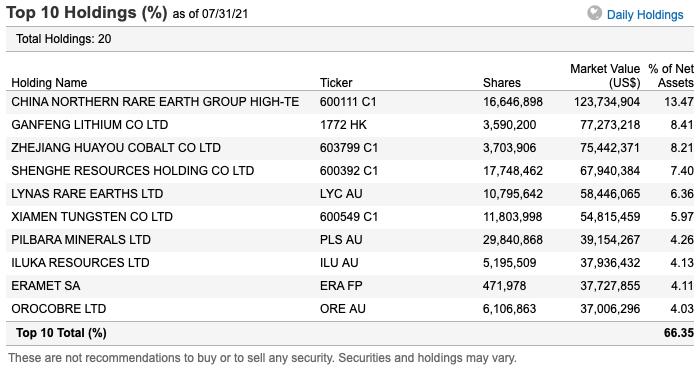

I discussed the Rare Earth Materials ETF (REMX) briefly in Friday's DP Diamonds Recap, but now I want to dive into the chart. I took a look at some of the holdings in REMX. Most aren't conventional investments, but it did steer me in the right direction for investigating other potential "diamonds in the rough" for today's report.

VanEck Vectors Rare Earth/Strategic Metals ETF(REMX)

EARNINGS: N/A

REMX tracks an index of global companies that mine, refine, or recycle rare earth and strategic metals.

REMX is up +0.59% in after hours trading. There is still plenty of upside potential despite the recent runaway rally out of the lows this month. The pullback moved the RSI out of overbought territory. The PMO is a bit late to the party, but it should give us a crossover BUY signal shortly. I've set a 9% stop but I really doubt it will be hit.

The weekly chart is looking good. The only detractor is the overbought weekly RSI. However, this one can hold onto overbought territory for weeks and months. We will want to view this weekly chart periodically, because when the RSI does turn back down, we see some significant pullbacks. "

(Full Disclosure: I own shares of REMX)

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

MAJOR MARKET INDEXES

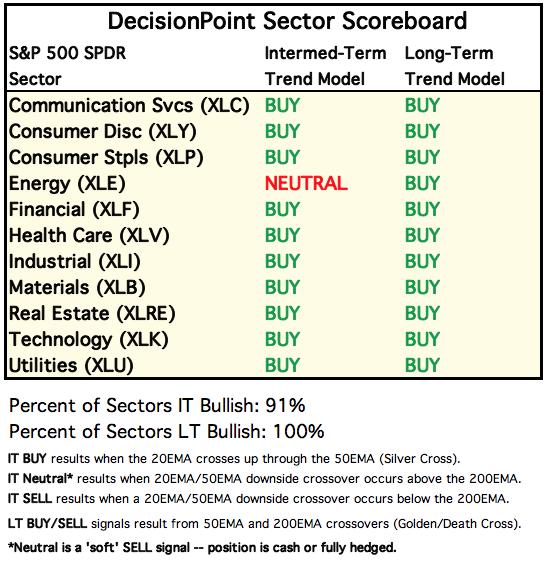

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

RRG® Chart: Technology (XLK) has recaptured leadership as the only sector in the "Leading" quadrant. The other sectors that are moving in the bullish north east heading are XLY, XLC and XLRE. The demise of the other sectors is staggering. Energy (XLE) is trying to improve on relative strength, but has more work to do.

CLICK HERE for an animated version of the RRG chart.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

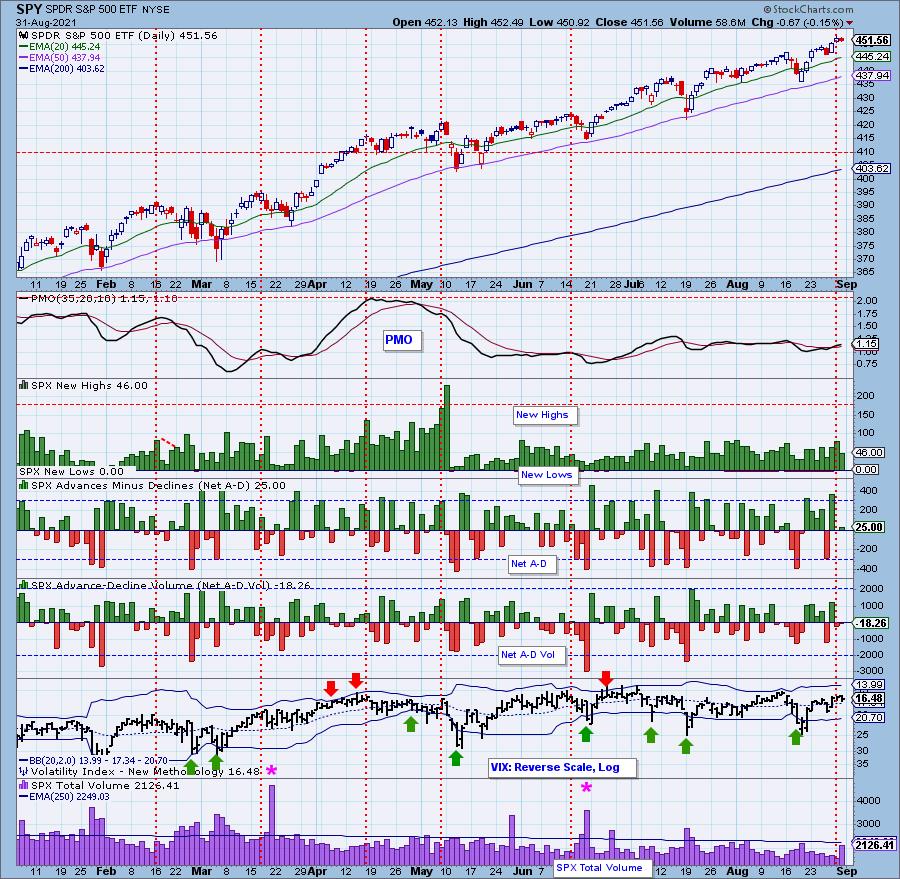

SPY Daily Chart: The market pulled back slightly to but the candlestick remains on top of the bearish rising wedge.

The RSI turned down but remains in positive territory. The PMO is holding onto yesterday's BUY signal, but just barely. Total Volume spiked on today's decline, but we don't have a confirmed climax to associate with this spike.

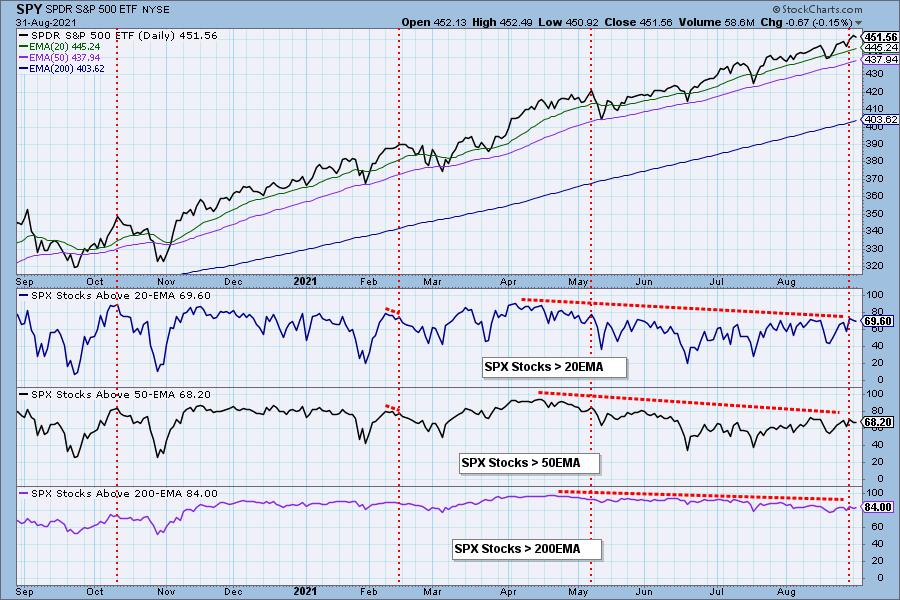

Participation: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

On Monday (8/9) Carl discussed the concept of a "stealth correction" during the DecisionPoint show. You can watch it HERE.

The GCI turned up today, but only added 0.2% to its reading. I am encouraged seeing it turn up, but the change is so slight that I hesitate to call it "meaningful". The SCI did move higher, but is holding at around 66%.

Participation didn't change much on the decline. Yesterday when it fell on the rally, we were given some inkling that price would top today.

Climax Analysis: No climax today, but as I mentioned above, we did see a spike in Total Volume. New Highs contracted which isn't surprising. The VIX remains above its EMA on the inverted scale which is positive.

Short-Term Market Indicators: The short-term market trend is UP and the condition is OVERBOUGHT.

The STOs continued to pull back today, but remain overbought. There is still a slim majority of stocks with rising momentum.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is OVERBOUGHT.

The ITBM/ITVM continue to rise but are now in overbought territory. Negative divergences remain. We did see a few more PMO BUY signals within the SPX, but the reading is still quite low given the advance in price along this intermediate-term rising bottoms trendline.

Bias Assessment: We've added this new section called "bias assessment". It occurred to us that one of the ways we can measure market bias is to compare the SCI to the percent of stocks above their 20/50-EMAs. When the percentages are lower than the SCI, the market bias is bearish and if they are higher, it is bullish. Any "mechanical" signal requires additional analysis to confirm the numbers.

Market bias is slightly bullish, but given we are losing participation in the short and intermediate terms, I would read it as more neutral than bullish.

CONCLUSION: The topping STOs and lower readings in participation yesterday hinted that we would likely see a market decline today. The STOs are still falling and are still overbought. IT indicators sport negative divergences although we did see some improvement despite today's decline. Technology is the only sector in the "Leading" category on the RRG with defensive sectors plummeting out of favor. When the big cap leadership technology stocks begin to lose steam, the market will likely begin a decline in earnest. For now, they continue to hold it up. I would expect to see market churn rather than a deep decline or strong rally this week. I am 60% exposed to the market.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

Bitcoin did dip out of the bearish rising wedge, but it wasn't a decisive move. Currently it is holding onto support at $47,000. Given the PMO crossover SELL signal and negative OBV divergence, we would expect to see a breakdown or at best more consolidation above support.

INTEREST RATES

Yields are moving mostly sideways since breaking out of their declining trend.

10-YEAR T-BOND YIELD

$TNX has formed a short-term double-top. The expectation is a breakdown below the confirmation line. At best, we could see it hold up at that confirmation line, but more than likely we will see a test of support at the July/August lows.

DOLLAR (UUP)

IT Trend Model: BUY as of 6/22/2021

LT Trend Model: BUY as of 8/19/2021

UUP Daily Chart: The Dollar was unchanged again today. However, a lower low and lower high were set. Price is holding above the 50-EMA which is positive.

The one year chart shows us a breakdown from the bearish rising wedge. Support will need to hold at the 200-EMA, but given the negative RSI and declining PMO, I'm looking for a break below the 200-EMA.

GOLD

IT Trend Model: NEUTRAL as of 6/24/2021

LT Trend Model: SELL as of 8/9/2021

GLD Daily Chart: GLD finished slightly higher and formed a bullish engulfing candlestick.

(Full disclosure: I own GLD)

GOLD Daily Chart: $GOLD has a rising RSI that is in positive territory. Today the PMO made its way above the zero line. Price is now holding above the intermediate-term rising bottoms trendline as well as all of the key moving averages. The outlook is positive for Gold moving forward, especially given the bearish configuration of the Dollar chart.

GOLD MINERS Golden and Silver Cross Indexes: Gold Miners rallied today and closed above the 20-EMA. We now have a new PMO crossover BUY signal. Participation in the short-term has improved greatly with more than 70% of members having price above their 20-EMA. Given the SCI is at 0%, this group has a strong bullish bias. Resistance is arriving soon, but given the bullish falling wedge, I believe Gold Miners are ready to make a move.

CRUDE OIL (USO)

IT Trend Model: NEUTRAL as of 8/18/2021

LT Trend Model: BUY as of 3/9/2021

USO Daily Chart: USO was down today after overhead resistance was hit yesterday. This seems a natural reaction to hitting overhead resistance. The indicators aren't showing damage as the RSI is positive and the PMO is still rising. Price will likely test the 20/50-EMAs, but given the oversold PMO BUY signal, I would expect to see Oil prices rise again.

BONDS (TLT)

IT Trend Model: BUY as of 6/10/2021

LT Trend Model: BUY as of 8/10/2021

TLT Daily Chart: TLT dropped and closed beneath the 20-EMA. The PMO is basically flat and the RSI is mostly neutral.

Given the double-top on $TNX which I covered above and $TYX chart below with its own double-top and failure to break above the declining trendline, we should see an upside breakout on TLT.

Technical Analysis is a windsock, not a crystal ball.

--Erin Swenlin

(c) Copyright 2021 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.