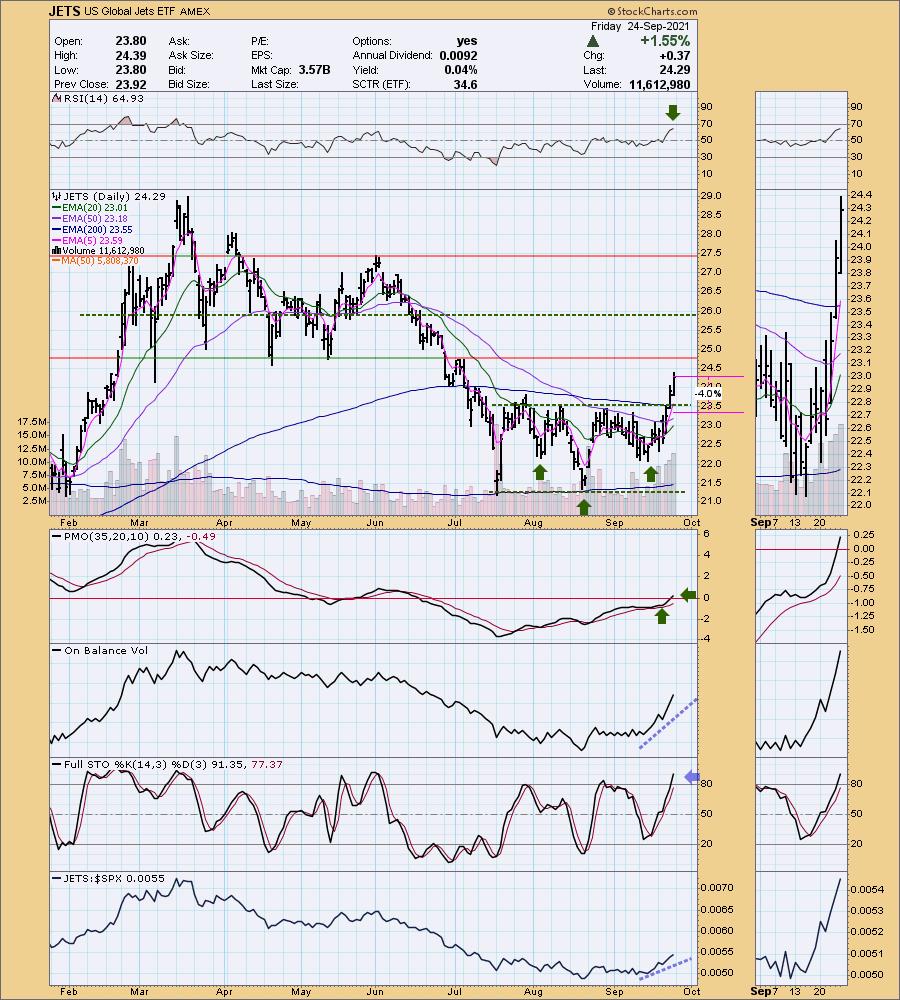

The best and worst industry groups this week are worth a review. The "Darling", Airlines (JETS) was up +6.77% this week while the "Dud", Uranium (URA) was down a whopping -9.62%. The question is whether JETS can continue to outperform and whether URA has a chance of turning it around going into next week.

The JETS chart reveals a large reverse head and shoulders pattern that was confirmed on yesterday's breakout. That breakout pushed price above the 200-EMA. Today's continuation has moved the PMO above the zero line. The RSI is positive and volume has been pouring in on the breakout. That generally means you will see follow-through on the breakout. Stochastics are overbought, but continue to rise. At this point, it is highly likely we will see a pullback when it hits overhead resistance. There is more upside potential. The minimum upside target of the reverse head and shoulders is around $26.

URA didn't have a parabolic rally, it had a vertical one. The steeper the rising trendline the harder it is to maintain. URA actually hit the skids last Friday with a huge decline that was followed by another deep decline on Monday. It was trying to rally back on Tuesday and Wednesday, but the bottom dropped out yesterday and today. The bounce on Tuesday was encouraging as it came off support at the 20-EMA and the June top.

Erin annotated the chart for the August 31st DP Diamonds Report. Diamonds readers were alerted to the bullish breakout and likelihood of follow-through to the upside. The position was up over 37% at the top. It has since lost almost 20% of the gain. We do have a possible support level at the 50-EMA and the May/June tops, but the RSI has moved negative and the PMO triggered a crossover SELL signal. Stochastics are not encouraging either. More than likely this support level will not hold. Might be a good idea to lock in profits until we see if that support level will hold. The outlook doesn't look good.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

MAJOR MARKET INDEXES

For Friday:

For the week:

SECTORS

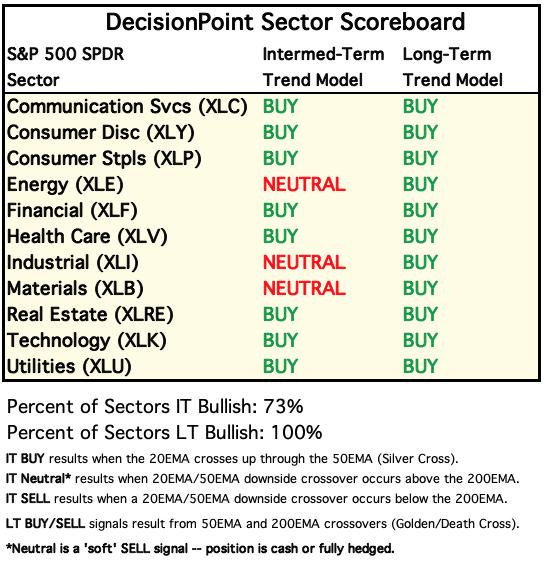

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

For Today:

For the Week:

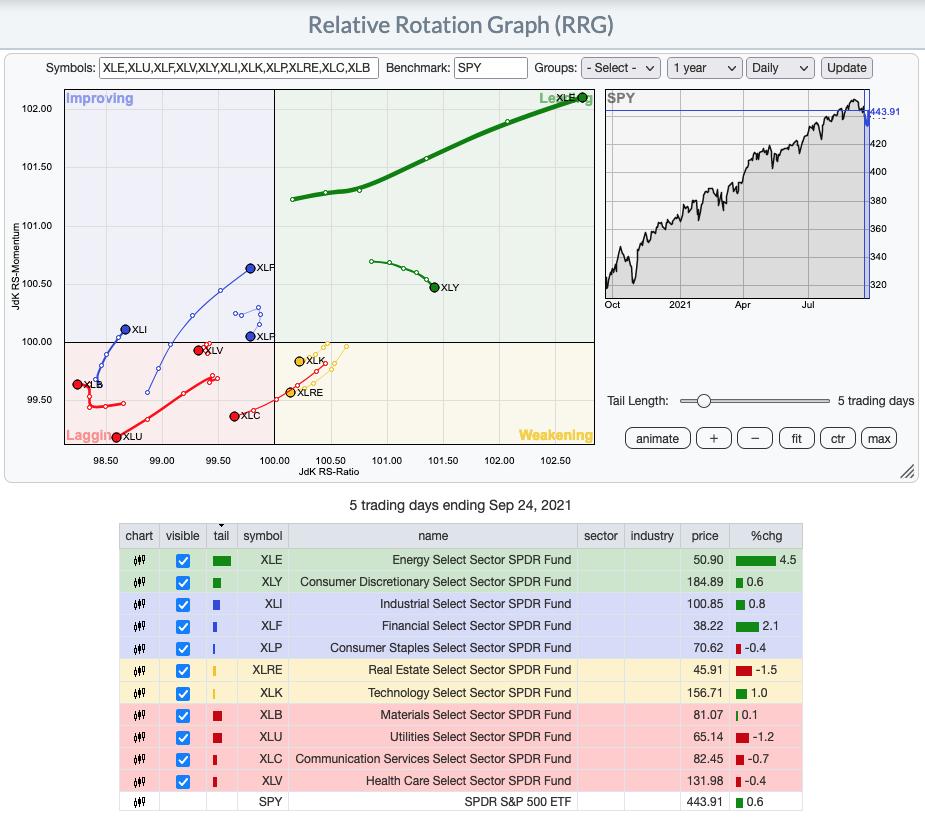

RRG® Chart: Financials (XLF) are heating up and should hit the Leading quadrant soon. This sector will be worth a closer look next week. XLY is still Leading but is beginning to rotate into Weakening. XLU is the worst relative performer is headed further into Lagging. Keep an eye on Industrials (XLI).

CLICK HERE for an animated version of the RRG chart.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

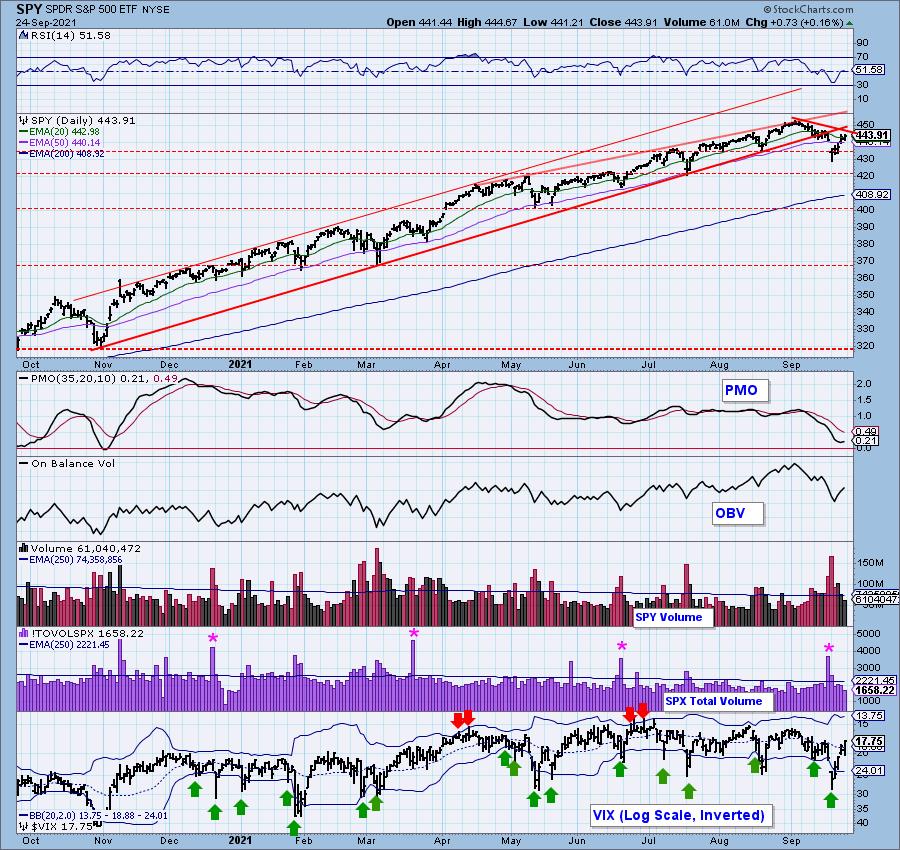

SPY Daily Chart: The short-term declining trend is still intact, but price did recapture the rising trend. The RSI is positive (barely) and the PMO is mostly flat. Neither is revealing much about the continuation of this week's rally.

Total volume has been trending lower on the tail end of this rally. The VIX remained above its EMA for a second day which is bullish.

SPY Weekly Chart: The weekly chart shows the breakdown from the bearish rising wedge on the weekly chart. Of course price did manage to finish back above the rising bottoms trendline. While the weekly RSI is positive, the declining PMO suggests the decline isn't quite over.

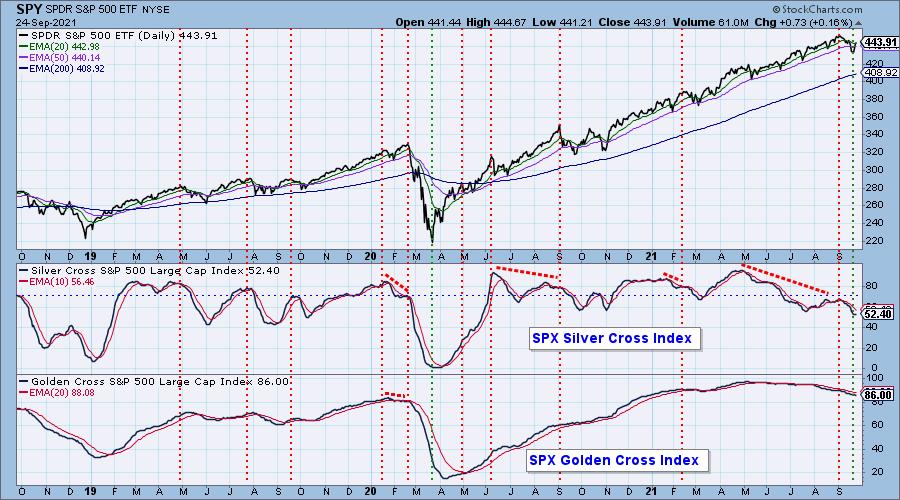

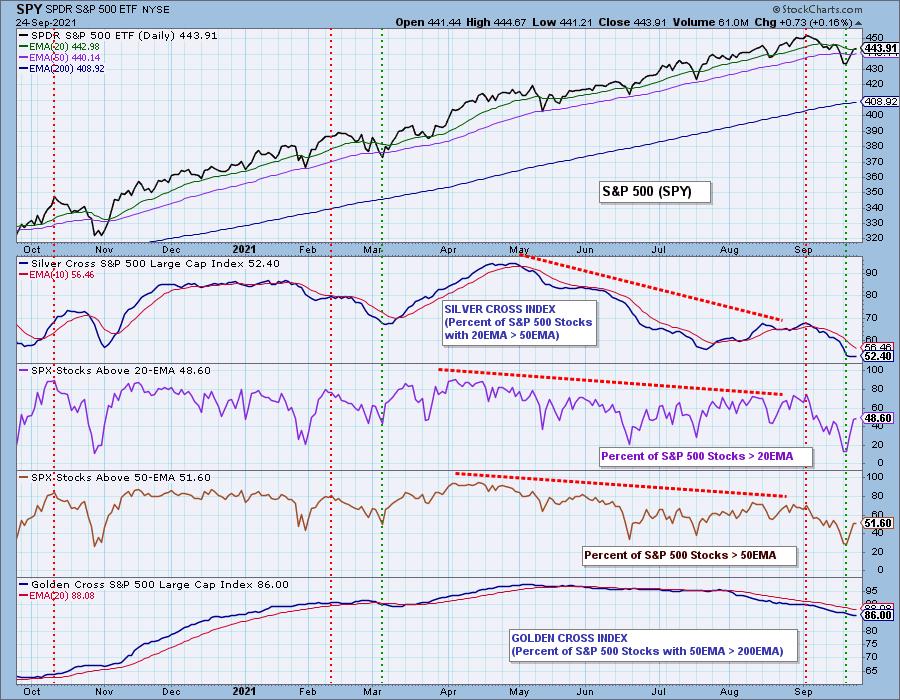

PARTICIPATION: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

It is hard to make out, but the SCI declined today. The GCI ticked up. The SCI is in near-term oversold territory, but we would like to see it to start rising.

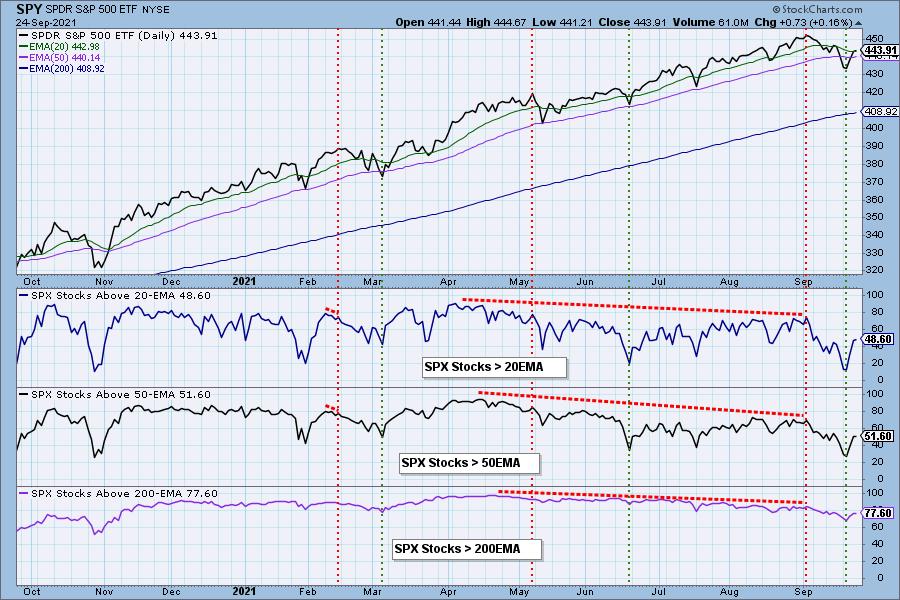

The Stocks > 20EMA and Stocks > 50EMA were very oversold on Monday, so we tend to believe the rally.

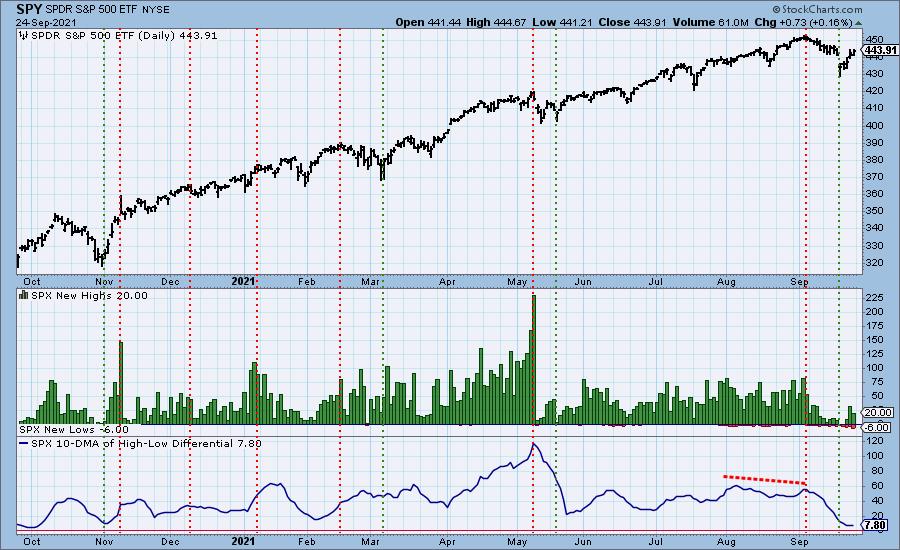

New Highs expanded on yesterday's upside exhaustion climax. New Lows increased today as New Highs contracted.

Climax Analysis: The downside exhaustion climax on Monday was over two weeks from the price high at the beginning of this month, and that set the market up for the current rally. The closing price low was on Tuesday, and on Wednesday we got an upside initiation climax, followed immediately by an upside exhaustion climax. Exhaustion climaxes can signal the end of a move, or a pause. When they come so soon after the price low as Thursday's did, we tend to expect the more bullish outcome.

*A climax is a one-day event when market action generates very high readings in, primarily, breadth and volume indicators. We also include the VIX, watching for it to penetrate outside the Bollinger Band envelope. The vertical dotted lines mark climax days -- red for downside climaxes, and green for upside. Climaxes are either initiation or exhaustion.

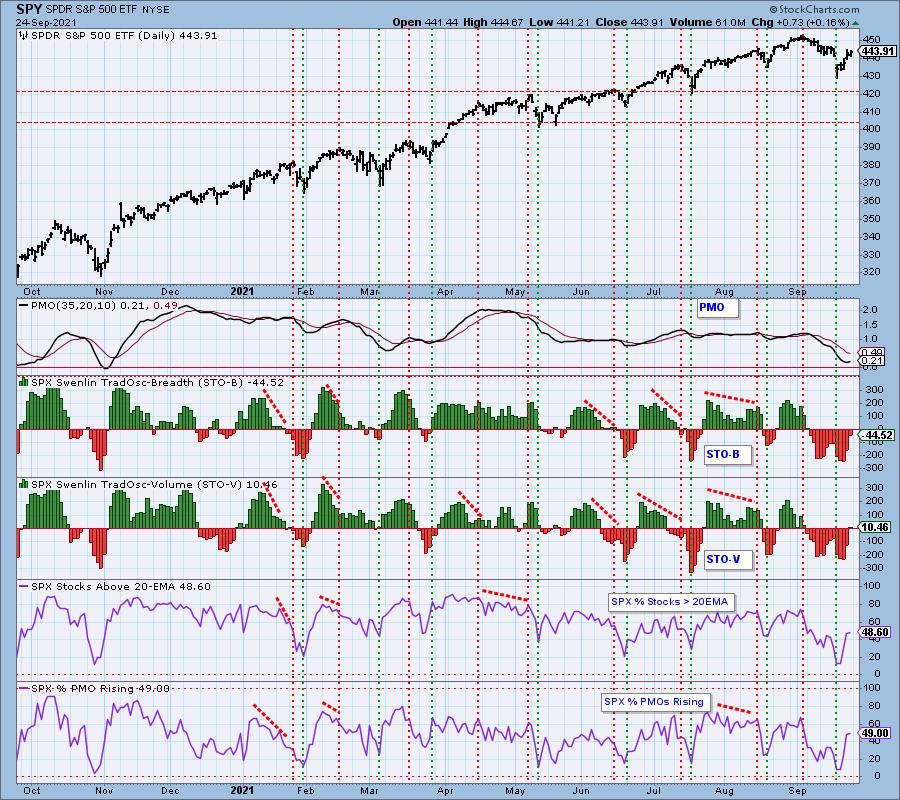

Short-Term Market Indicators: The short-term market trend is UP and the condition is NEUTRAL.

STOs are making their way out of oversold territory which is bullish for the market in the short term. We didn't see an increase in stocks with rising momentum, but the reading improved greatly this week, rising out of oversold territory.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is OVERSOLD.

The ITBM and ITVM turned the corner on yesterday's rally. They are still in oversold territory. It suggests we could see the rising trend out of the March low recaptured. %PMO crossover BUY signals finally turned back up this week.

Bias Assessment: The market bias is neutral in the short and intermediate terms. Participation readings are slightly lower than the SCI, but not by much.

CONCLUSION: While Carl was annotating our member chart books this week, he realized that he was putting a green, vertical dotted line through Monday's lows on most of the sector and market index charts. It remains to be seen, but his impression as he was making these notations was that we may have seen the end of the pullback, and that the market may advance another week or two.

There are two things that favor a continuation of the rally: (1) the fact that it began with an initiation climax, and (2) that internals were so oversold at the start. Both of these are short-term elements, and we will need to see intermediate-term indicators (like the Silver Cross Index) begin to show more improvement. The problem is that the big tech stocks are not coming to life, and while they supported the market as the smaller-cap stocks swooned, they may now be a drag on the market as the smaller-cap stocks attempt to revive.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

We are looking at a smaller version of the rounded top that appeared in the first part of the year. While price is currently testing the support at 42,000, we may see a retest of the 30,000 support level.

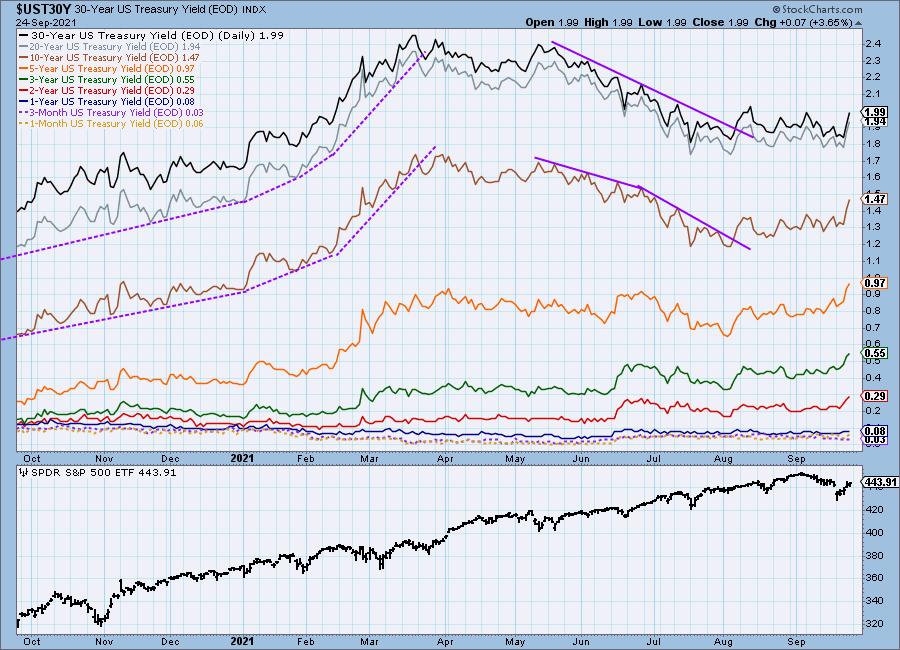

INTEREST RATES

Interest rates were up sharply this week, with the shorter-term yields holding rising trends. Longer-term rates are still range bound.

10-YEAR T-BOND YIELD

Fifth time was a charm as $TNX broke out from a bullish ascending triangle. The pattern suggests a likely test at 1.5%.

DOLLAR (UUP)

IT Trend Model: BUY as of 6/22/2021

LT Trend Model: BUY as of 8/19/2021

UUP Daily Chart: UUP finished the week almost unchanged. The RSI is positive and the PMO is on a BUY signal which suggests UUP will test overhead resistance at the August top.

More evidence that it will reach and likely break out is the short-term rising trend channel it has created out of the September low.

UUP Weekly Chart: The weekly chart is also bullish. The weekly PMO has now reached above the zero line and the weekly RSI is staying in positive territory.

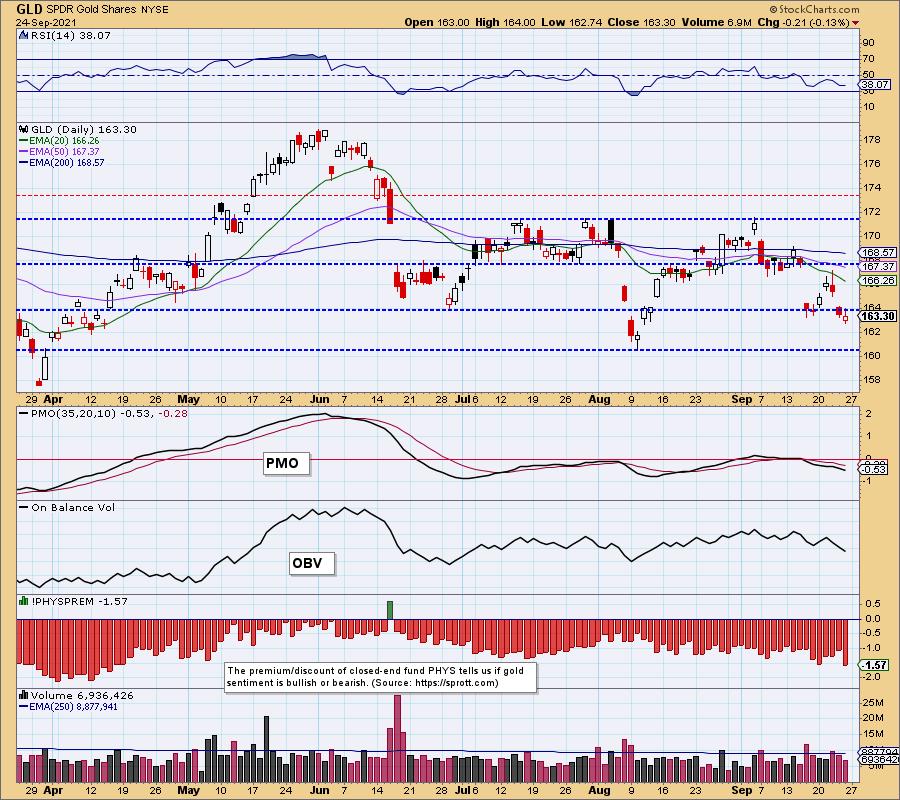

GOLD

IT Trend Model: NEUTRAL as of 6/24/2021

LT Trend Model: SELL as of 8/9/2021

GOLD Daily Chart: Gold was all over the place this week. It valiantly tried to hold onto support at the June low, but today it traded below that prior support level. (Full disclosure: Erin owns GLD)

Discounts moved sharply lower today which is generally bullish for Gold; however, the RSI is negative and the PMO is in decline. With a bullish outlook for the Dollar we have to assume Gold will continue lower.

GOLD Weekly Chart: The weekly PMO is now in negative territory. The weekly RSI is also in negative territory. A test of the 1675 level seems likely.

GOLD MINERS Golden and Silver Cross Indexes: Gold Miners are on their way to test the bottom of the bullish falling wedge. We are now seeing an oversold RSI, but the PMO is still quite negative. "Under the hood" indicators have no heartbeat. Given a bearish outlook for Gold, GDX will likely have to test the bottom of the wedge before we see improvement.

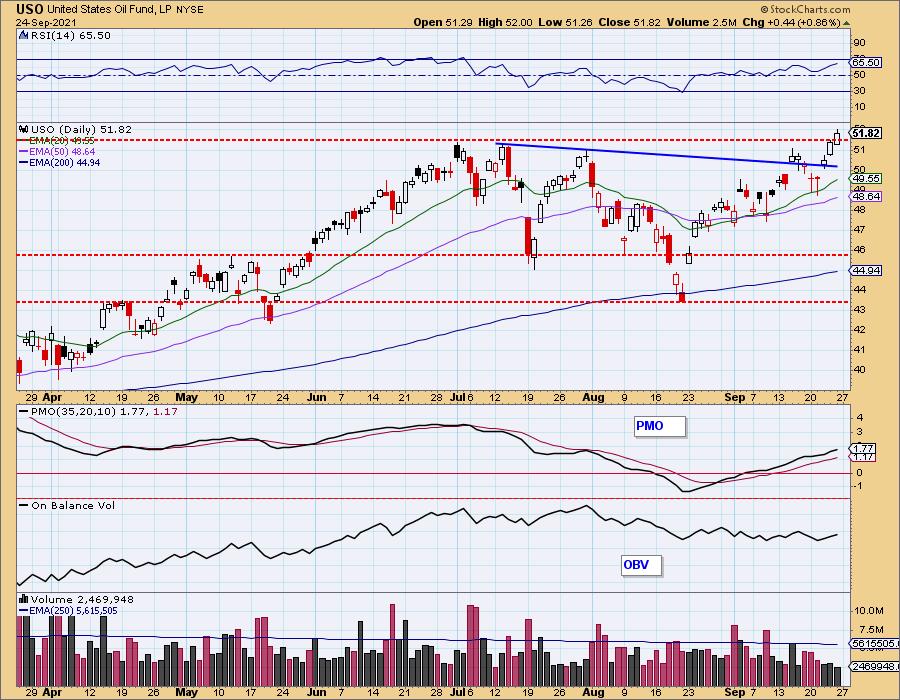

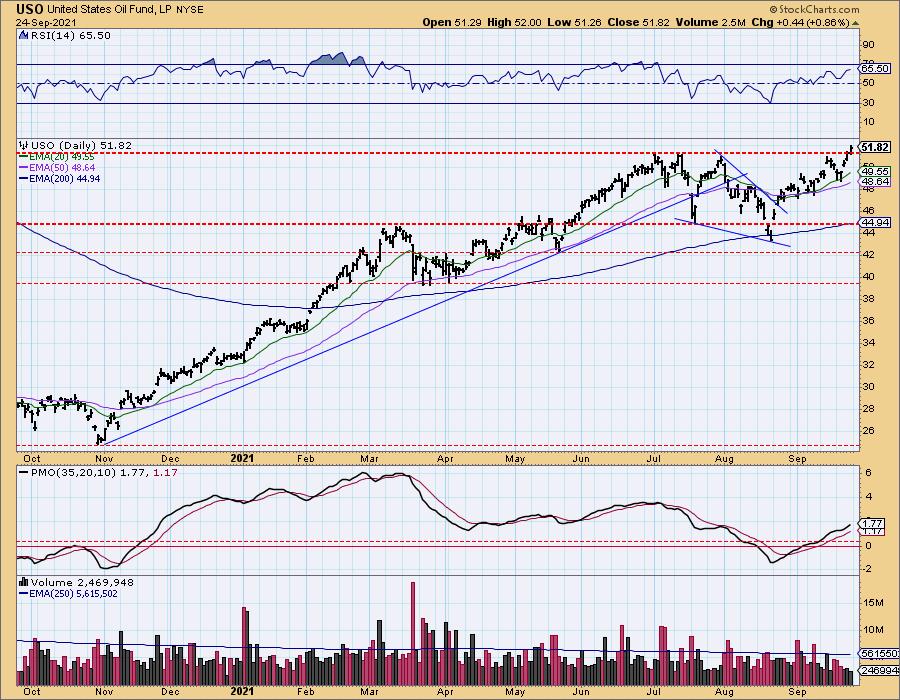

CRUDE OIL (USO)

IT Trend Model: BUY as of 9/3/2021

LT Trend Model: BUY as of 3/9/2021

USO Daily Chart: Crude Oil rallied strongly to finish the week. Price is now above overhead resistance at the July top. Given the positive and not overbought RSI and rising PMO, we expect USO to continue higher.

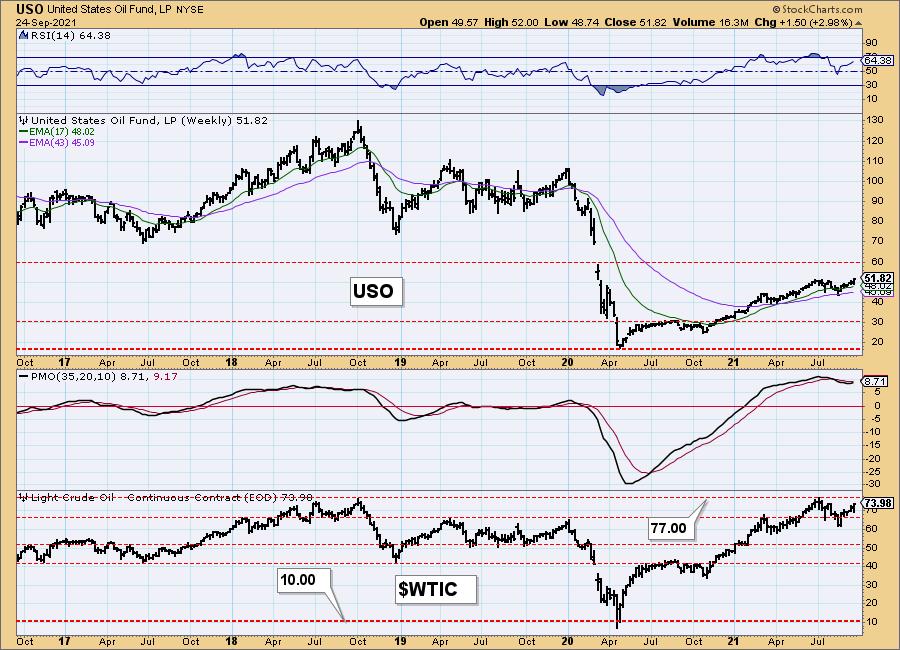

USO/$WTIC Weekly Chart: USO broke above resistance, but $WTIC hasn't tested it yet. More than likely it will push past resistance. The weekly PMO is rising again and the weekly RSI is positive and not overbought.

BONDS (TLT)

IT Trend Model: BUY as of 6/10/2021

LT Trend Model: SELL as of 1/8/2021

TLT Daily Chart: Bonds were hit hard by the strong rally in yields to finish the week. The short-term rising trend is still intact and it does line up with support at the 200-EMA.

This makes two failed attempts at an upside breakout from the symmetrical triangle. The yield chart is favorable and with a falling negative RSI combined with the new PMO crossover SELL signal, we suspect a breakdown will occur at the 200-EMA.

TLT Weekly Chart: The weekly chart has a bearish bias. Price has been range bound for weeks. The weekly RSI is declining and the weekly PMO is decelerating and looks toppy. A loss of support at the 2019 top would mean a big decline, possibly to the $130 level.

Technical Analysis is a windsock, not a crystal ball.

-- Carl & Erin Swenlin

(c) Copyright 2021 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.