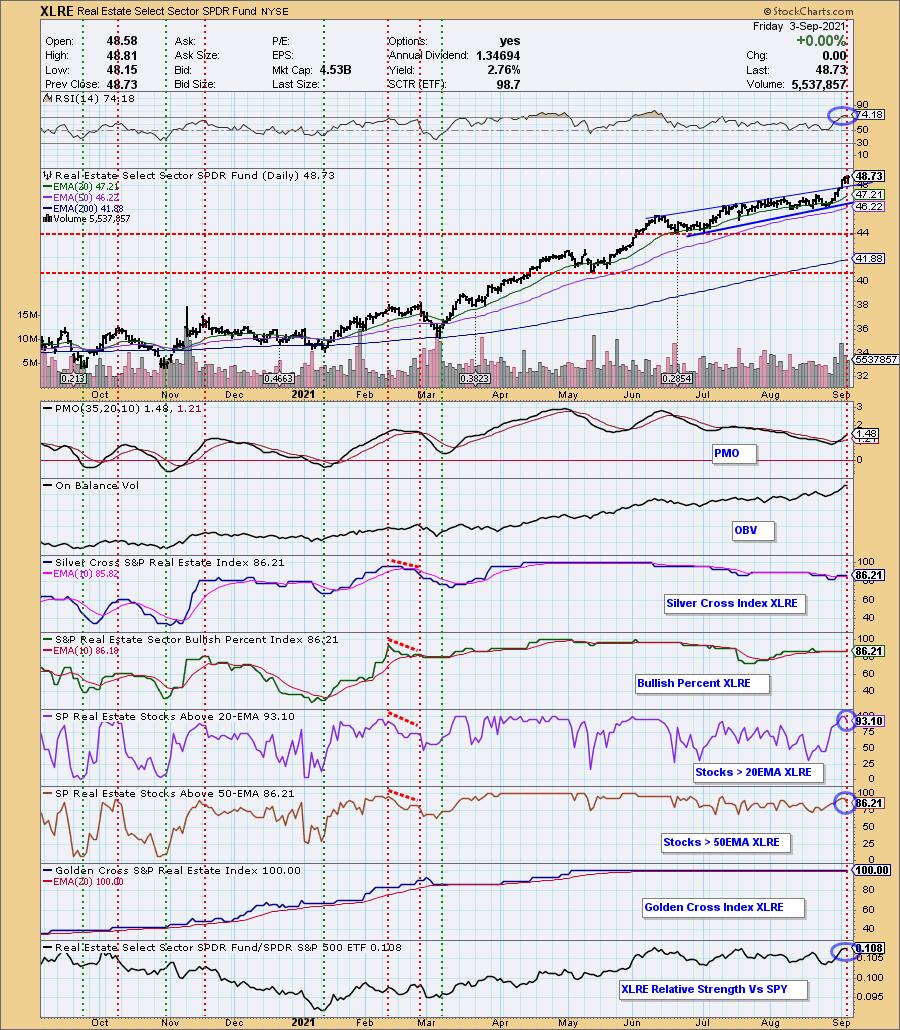

This week's clear winner among all of the sectors was Real Estate (XLRE). It finished over 4% higher this week with Technology as the second best performer gaining 1.65%. Is the Real Estate sector too overbought after this magnificent week?

XLRE broke above the bearish rising wedge today which is especially bullish. The PMO generated a new crossover BUY signal and volume was impressive. However, there are problems to consider moving forward in this sector.

The RSI is overbought (although we've seen in April and June that it can stay overbought). Participation is now deteriorating somewhat despite the stellar week. Those participation numbers are headed lower out of oversold territory. It might be time for XLRE to cool either with sideways consolidation or a decline to test support at the August top. To see what our other sector charts look like, click here to view the Sector ChartList on DecisionPoint.com.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

MAJOR MARKET INDEXES

For Friday:

For the week:

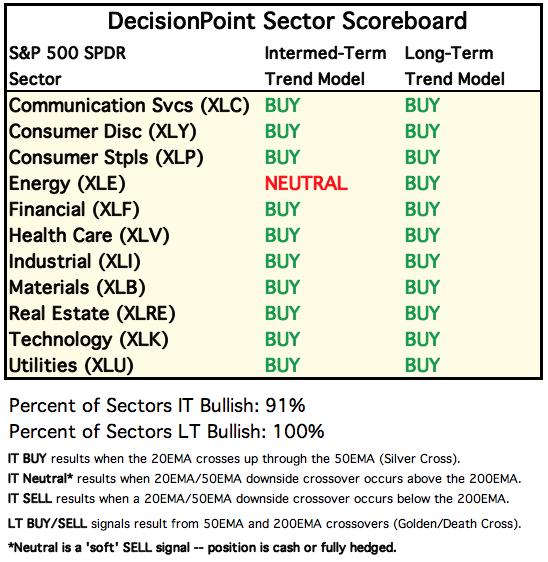

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

For Today:

For the Week:

RRG® Chart: Clearly the most improved sectors are XLE, XLY, XLC and XLRE as the are traveling in the bullish northeast heading and sit in the Improving and Leading sectors. Not far behind is XLI which has a bullish heading but is still in Lagging. XLK is losing some steam, but remains within Leading.

CLICK HERE for an animated version of the RRG chart.

CLICK HERE for Carl's annotated Sector charts.

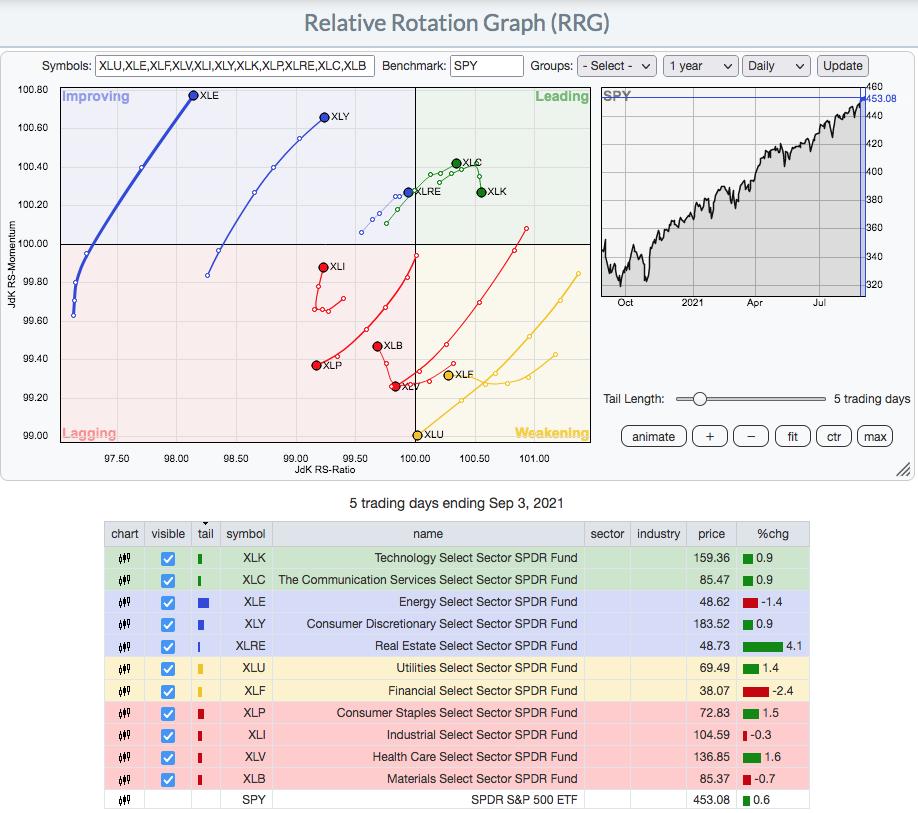

THE MARKET (S&P 500)

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

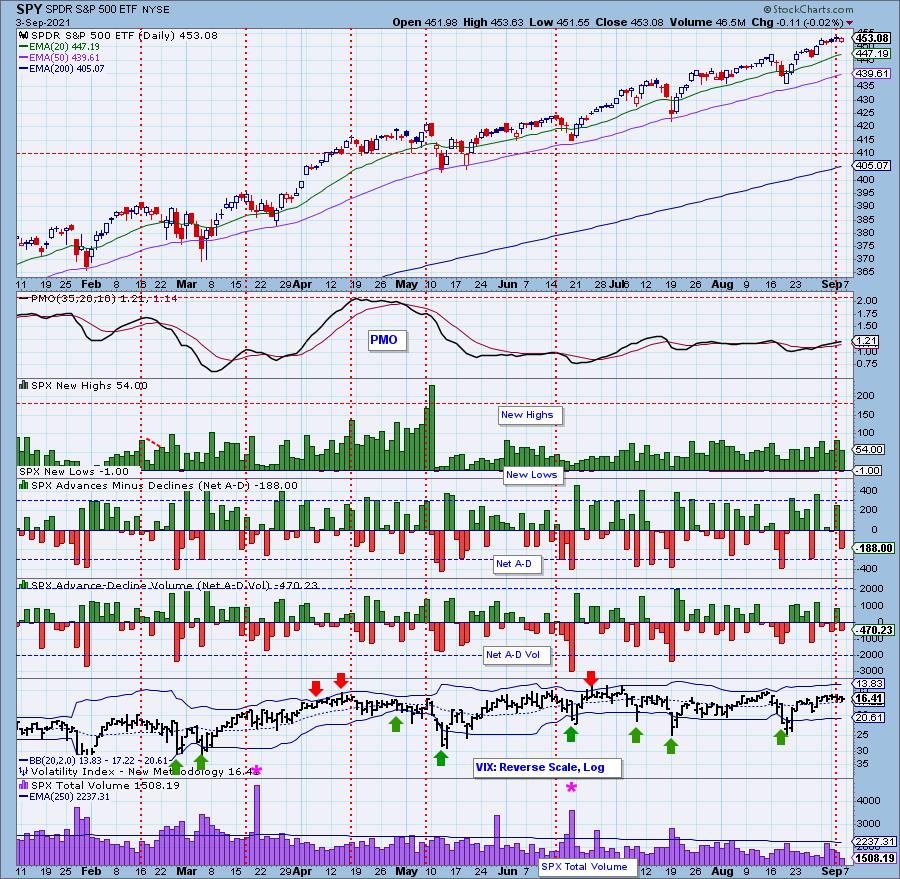

SPY Daily Chart: The market trickled higher this week closing up 0.63%. Price spent the entire week above the bearish rising wedge. You can now make a case for a rising trend channel developing. While a rising trend channel is inherently bullish, we note that it is tapping against the top of the channel. It could be time for price to go back down and test the bottom of the channel.

The RSI remains positive, but the PMO is beginning to flatten once again. Its sideways movement tells us that overall the rising trend is steady--not showing any acceleration, but conversely not showing any deceleration.

SPY Weekly Chart: The rising wedge on the weekly chart is prominent. The weekly RSI is staying in overbought territory and the weekly PMO is on a SELL signal and is still technically in decline.

PARTICIPATION: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

The SCI climbed higher this week, moving from a reading of 65.8% to a whopping 67.0%, not particularly impressive. The GCI fell 0.2% and now has a reading below 90. Both indicators have negative divergences with rising tops on price and falling tops on indicators.

Participation slumped today and was lower on the week. The %Stocks > 20-EMA was down 4.8% and %Stocks > 50-EMA was down 2.8%. Negative divergences are still a problem.

Climax Analysis: No climaxes this week. There was a bearish bias on today's mostly unchanged trading day as Net A-D and Net A-D Volume were in the red. The VIX remains above its EMA which is bullish in the very short term. However, we note that it is forming a rounded top. Total Volume moved lower after Tuesday's pop despite rallies.

NYSE Up/Down and Down/Up volume ratios are also climax detectors. The 9:1 ratio suggested by the late Dr. Martin Zweig in his book, Winning on Wall Street, is especially significant, but we primarily look for spikes outside the normal range to clarify a particular event. We have an NYSE and S&P 500 version of the ratios, and normally they will only be published when there is a notable reading.

As noted above, there were no climaxes on the Volume Ratios this week.

The S&P 500 version can get different results than the NYSE version because: (a) there are only 500 stocks versus a few thousand; and (b) those 500 stocks are all large-cap stocks that tend to move with more uniformity.

We came close to an upside exhaustion climax on the Up/Down Volume Ratio for the SPX, but there was no confirmation on our Climax indicators chart.

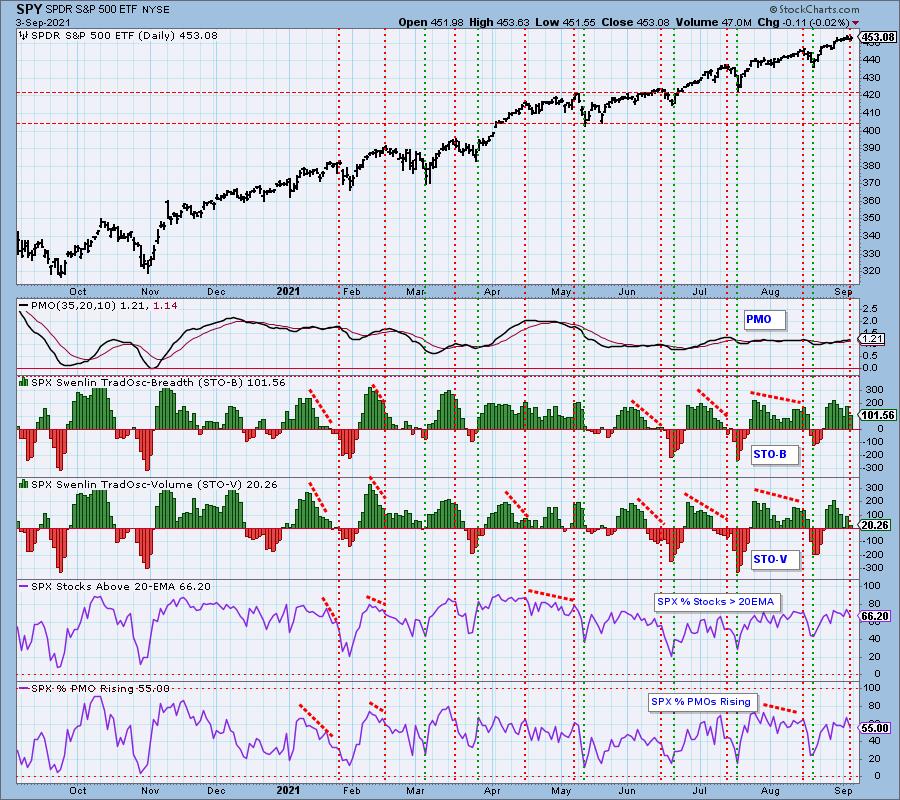

Short-Term Market Indicators: The short-term market trend is UP and the condition is OVERBOUGHT to NEUTRAL.

The STOs trended lower on the week despite new all-time highs being logged. We about half of the stocks in the SPX with rising momentum. If the mega-caps that have been holding this index up begin to lose steam, there really aren't many stocks to pick up the slack.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is OVERBOUGHT.

It isn't easy to see, but today both the ITBM and ITVM topped. It wasn't by much, but it does cement the negative divergences on yesterday's all-time high. Only 58% of stocks are on PMO crossover BUY signals. Another indication that there could be trouble if mega-cap leaders begin to fail. Who will pick up the load?

Bias Assessment: The market bias is neutral to bearish. The SCI and participation indicators are at about the same percentage meaning there is 'fresh blood' to move the SCI higher. Its drop isn't encouraging. Additionally, the %Stocks > 20/50-EMAs are retreating from near-term overbought territory.

CONCLUSION: Overall the market bias is neutral leaving us vulnerable to the downside and unsure about upside potential. The market did move higher, but this cemented many of the negative divergences that were already dominating the indicator charts. Participation remains weak when compared to overall price action. This is likely due to mega-cap stocks keeping the ship upright. Our concern moving into next week are indicators that are beginning to retreat from overbought territory. A new rising trend channel is beginning to form in the shorter term, but with price sitting against the top, we are vulnerable to a decline to test the bottom of the channel. Overall we would enter next week with caution. Keep your stops in play or harden them in case this neutral bias decides to move bearish. Erin is 70% exposed to the market currently.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

Bitcoin is traveling within a bearish rising wedge. The RSI is positive, but we negative divergences on the PMO and OBV. The PMO is in decline. Currently price is holding above the 20-EMA, but the bearish PMO and divergences suggest that will not continue.

INTEREST RATES

After spending time in a long-term declining trend, yields have been moving mostly sideways.

10-YEAR T-BOND YIELD

$TNX has a short-term bearish double-top; however, price has yet to test the confirmation line. In fact, the 10-year yield poked back above the 50-EMA. The RSI is rising in positive territory and the PMO is trending up toward the zero line. There is a high likelihood we could see this bearish pattern busted next week.

DOLLAR (UUP)

IT Trend Model: BUY as of 6/22/2021

LT Trend Model: BUY as of 8/19/2021

UUP Daily Chart: The Dollar had a terrible week. UUP is now testing support at the August low after losing its short-term rising trend. Price was traveling in a bearish rising wedge so it should be too surprising. The RSI is negative and not oversold and the PMO continues to fall. We are bearish on the Dollar.

UUP Weekly Chart: The weekly chart shows a busted double-bottom pattern. Price hit overhead resistance and capitulated. This week's close was below both the 17/43-week EMAs. The weekly RSI has tipped into negative territory and the PMO flattened below making it above the zero line. The longer-term picture is bearish.

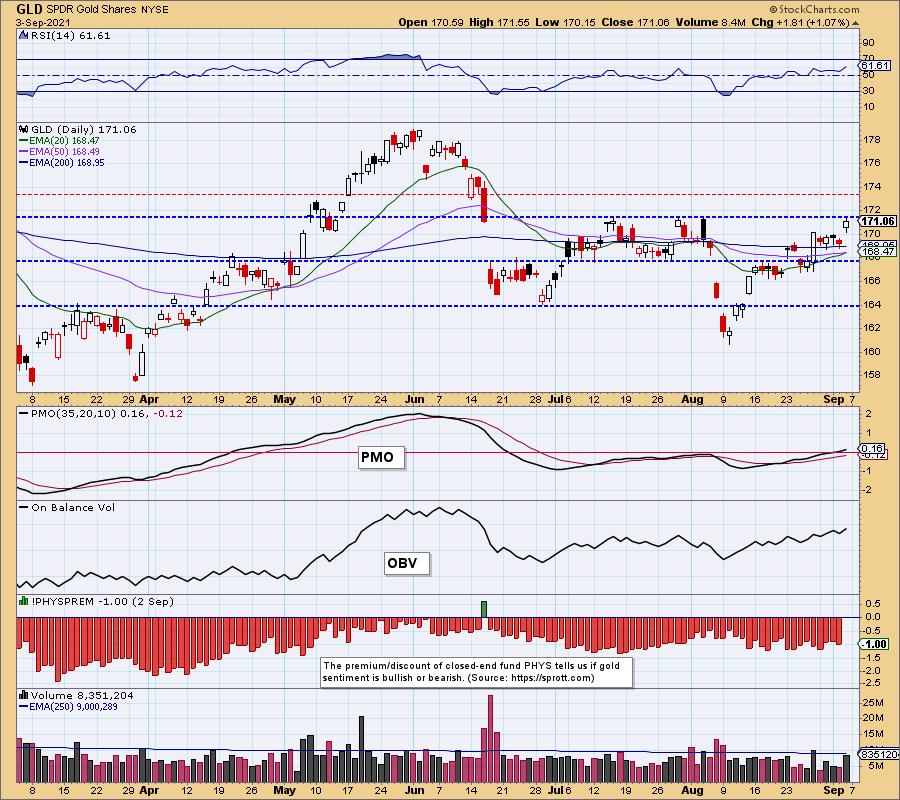

GOLD

IT Trend Model: NEUTRAL as of 6/24/2021

LT Trend Model: SELL as of 8/9/2021

GOLD Daily Chart: It took until today for Gold to really take advantage of the weakening Dollar. GLD nearly triggered an IT "Silver Cross" BUY signal today. We should see it on Tuesday. (Full Disclosure: Erin owns GLD)

$Gold nearly broke above resistance at the July tops. The RSI is positive and the PMO has now reached above the zero line on a BUY signal. Discounts suggest the traders are still bearish on Gold overall. Bearish sentiment is good for Gold. We would look for a breakout next week.

GOLD Weekly Chart: The declining trend channel saw a failed breakout June, but support was ultimately found so the long-term rising trend was not broken. We have another upside breakout and a positive crossover of the 17/43-week EMAs. We could be looking at a giant bull flag. The weekly PMO is still on a SELL signal, but it has flattened out and appears ready to have a positive crossover right above the zero line. The weekly RSI has just reached positive territory. The outlook is good for Gold.

GOLD MINERS Golden and Silver Cross Indexes: Gold Miners spent most of this week consolidating sideways but today they gapped up and tested the top of the falling wedge and the 50-EMA. They weren't able to breakout. The positive and rising RSI and the PMO rising on a BUY signal both suggest a breakout is imminent. Participation rocketed higher in the short term while %Stocks > 50/200-EMAs also saw improvement. The falling wedge and positive indicators suggest a breakout ahead for the Gold Miners.

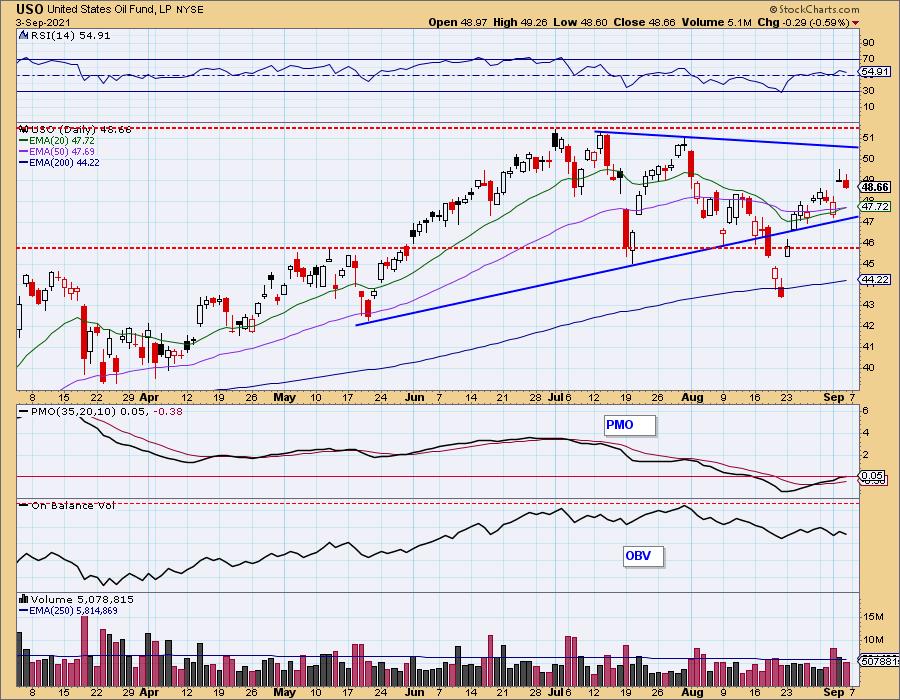

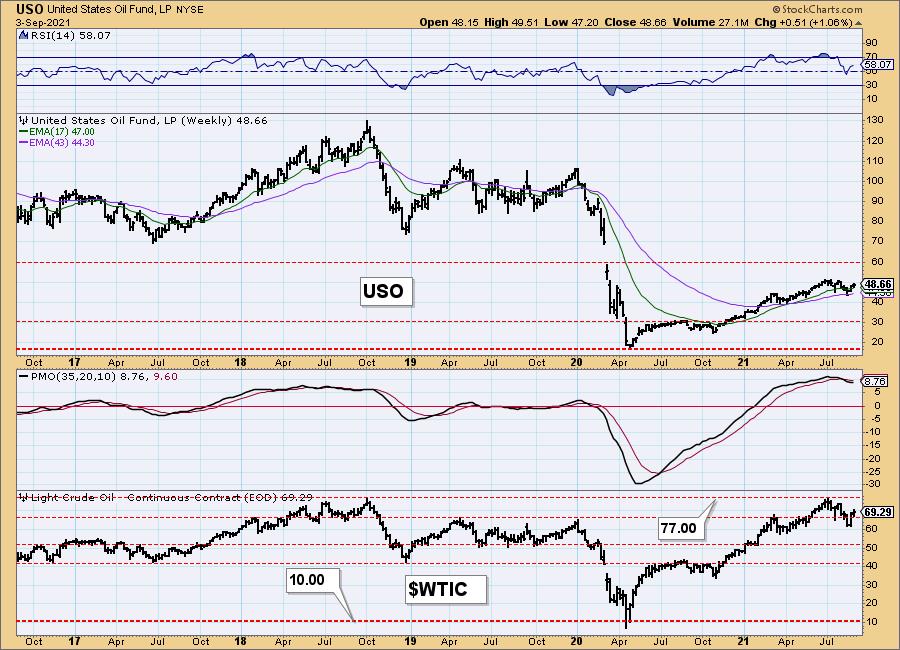

CRUDE OIL (USO)

IT Trend Model: BUY as of 9/3/2021

LT Trend Model: BUY as of 3/9/2021

USO Daily Chart: USO finished the week higher on rocky trading. This was enough to trigger an IT Trend Model "Silver Cross" BUY signal today. The now positive PMO sitting alongside a positive RSI suggest Crude Oil will continue to make its way up to test the short-term declining trend.

On the one-year chart we see a breakout from the bullish falling wedge. The pattern suggests we will get another test of the highs from July.

USO/$WTIC Weekly Chart: The weekly chart was deteriorating last week, but with the over 1% rally this week the indicators are looking up. The PMO has decelerated and could be ready to take out the prior crossover SELL signal and the weekly RSI is positive. One problem, the weekly PMO is very overbought.

BONDS (TLT)

IT Trend Model: BUY as of 6/10/2021

LT Trend Model: SELL as of 1/8/2021

TLT Daily Chart: Price is meandering sideways within a symmetrical triangle. These formations are continuation patterns, meaning the prior trend is likely to continue. That would mean an upside breakout for TLT. However, the indicators aren't in agreement as the RSI has fallen into negative territory and the PMO continues to decline on a crossover SELL signal.

Price dropped below support at the January low and early July top. A drop to the bottom of the triangle seems likely.

TLT Weekly Chart: The weekly chart is favorable with a possible flag pole and pennant. We also saw a positive crossover of the 17/43-week EMAs. The weekly PMO has just entered positive territory. The bias is bullish for TLT in the intermediate term.

Technical Analysis is a windsock, not a crystal ball.

-- Carl & Erin Swenlin

(c) Copyright 2021 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.