I was surprised to see the DJ Transportation Average ($TRAN) spike up 14.3%. Notice on the 5-minute bar chart that the average began rising quickly this morning. It pulled back half of those gains before lunch, but still logged a gain of +6.88% at day's end. Apparently we have a new meme stock, Avis Budget Group (CAR). The company had exceptional earnings and was heavily shorted. It also said it was in the market for Tesla autos. That combination was potent today.

I had to use a log scale in order to see prior price movement after today's spike. It was up over 200% at one point today but gutted it by half... of course, that is still a 108% gain on the day. Stochastics are pointed down and the RSI is now completely overbought. What's its future? I'm not sure, but I can guarantee it will be a volatile ride regardless.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

MAJOR MARKET INDEXES

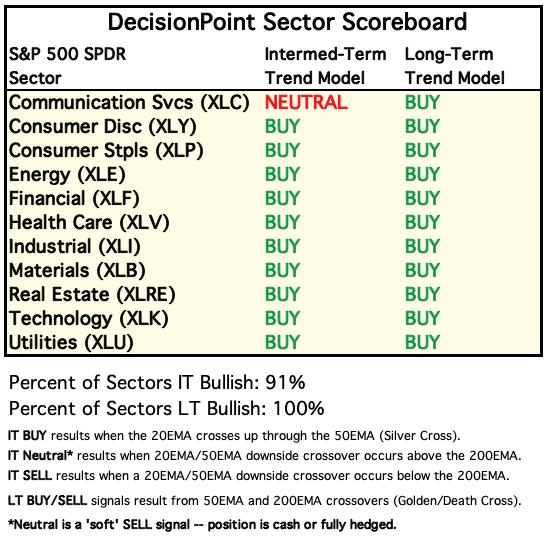

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

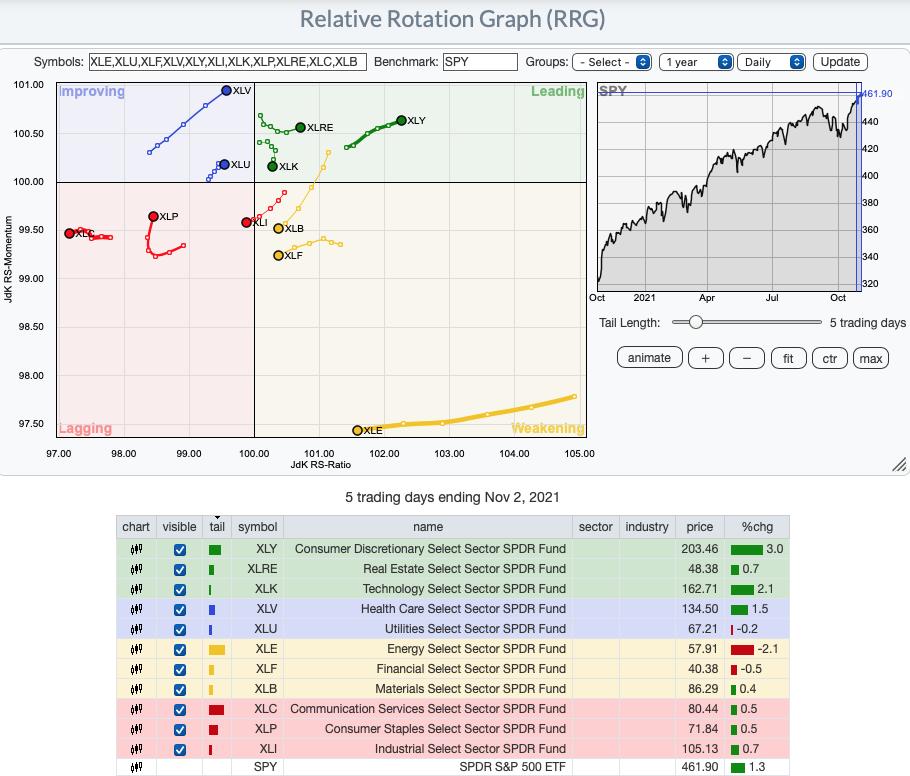

RRG® Chart: XLY and XLRE are the strongest relative performers. XLV is moving strongly in the bullish northeast direction and should reach the Leading quadrant soon. XLU has reversed and is also moving northeast. XLP is making the turn, but is still Lagging. XLK is in Leading but is proximity to the center tells us it is performing closer in line to the SPY.

CLICK HEREfor an animated version of the RRG chart.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

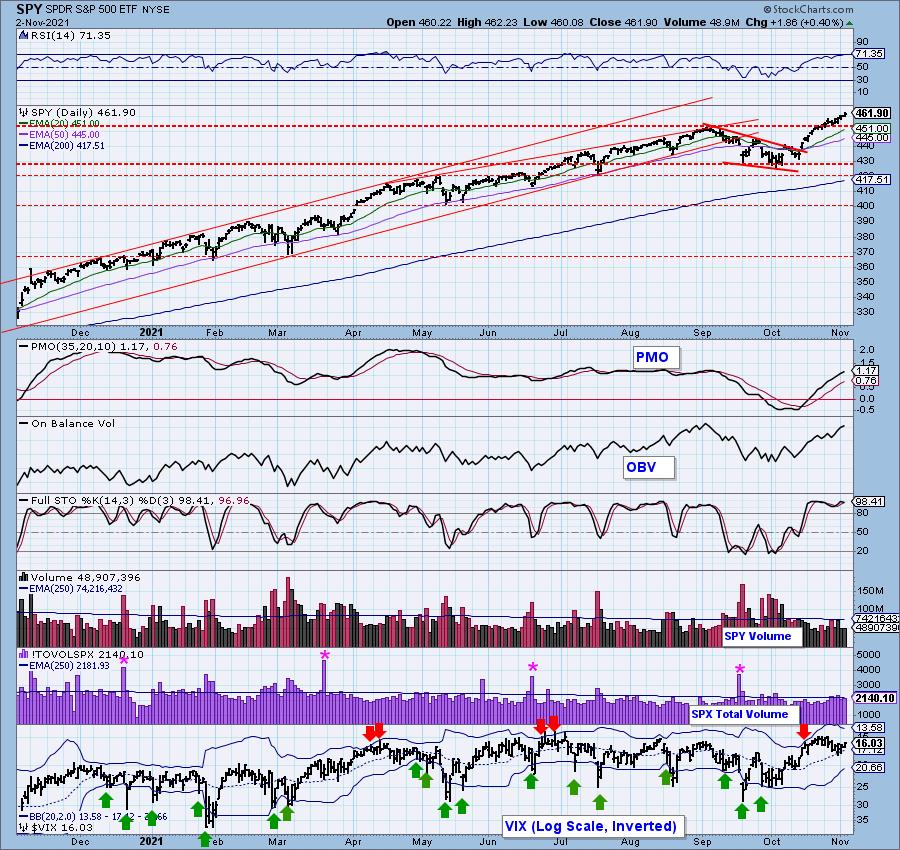

IT Trend Model: BUY as of 10/18/2021

LT Trend Model: BUY as of 6/8/2020

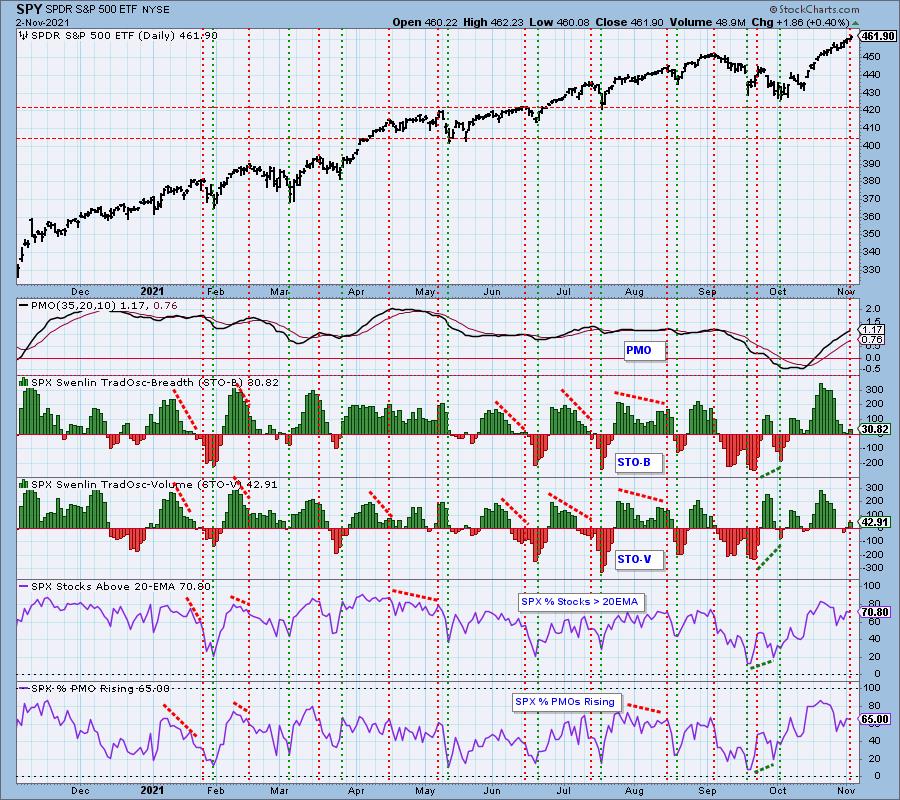

SPY Daily Chart: The SPY continues to set new all-time highs, but price is now getting overbought given the RSI is now reading above 70. The PMO is rising nicely and although it appears overbought, the typical range for the SPY's PMO is -2 to +2. It has room to move higher.

Total Volume expanded but is still slightly below the annual average. Stochastics are firmly above 80 and oscillating which is bullish.

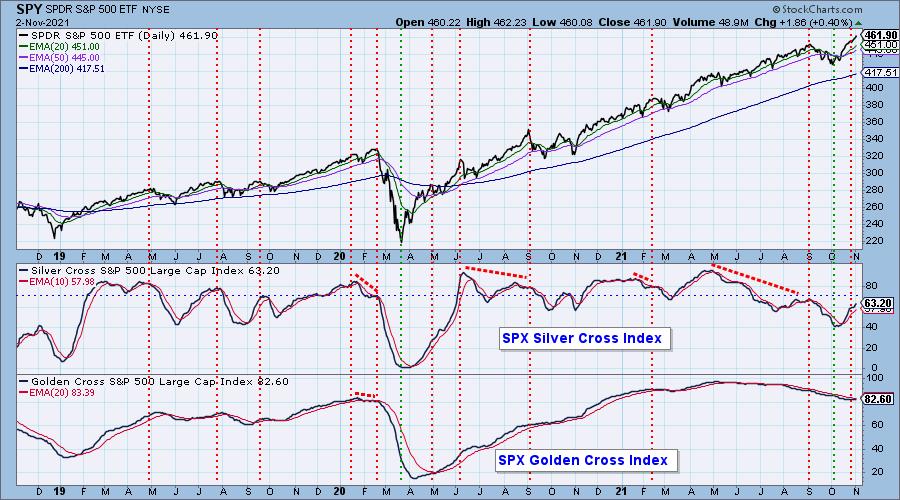

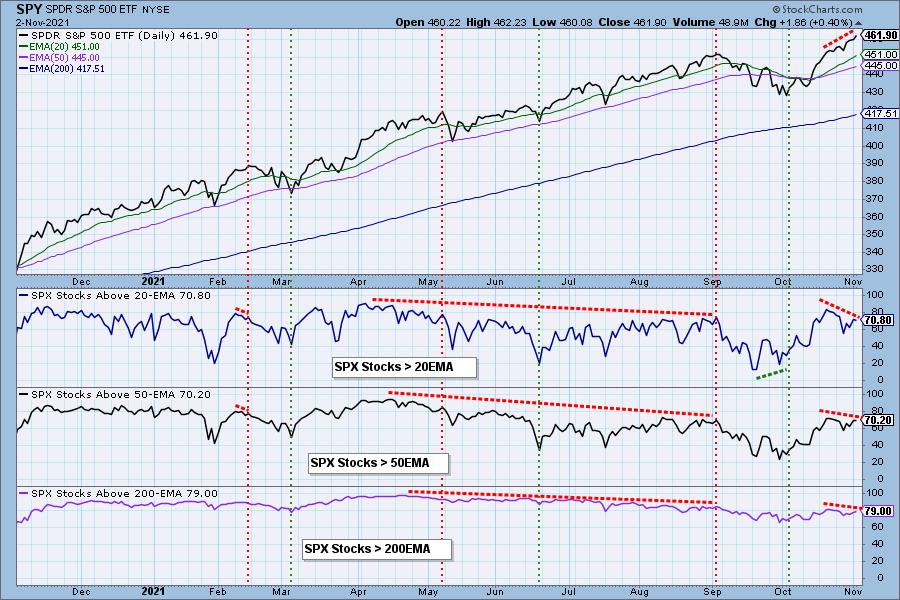

Participation: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

The SCI is continuing to rise which is bullish and with a reading of 63% it is bullish and not at all overbought. The GCI is flat, but sure looks ready to move higher again.

Negative divergences on participation are concerning. I also don't like that %Stocks > 20/50-EMAs topped today.

Climax Analysis: No climax today. The VIX is oscillating above its EMA on the inverted scale which is bullish in the very short term.

Short-Term Market Indicators: The short-term market trend is UP and the condition is NEUTRAL.

I'm very pleased to see the STOs rising again. When they rise, price usually does too.

Intermediate-Term Market Indicators: The intermediate-term rising market trend is UP and the condition is OVERBOUGHT.

Both of these indicators are overbought, but they are still rising. They've certainly seen higher readings. Of concern is the declining PMO BUY signals within the SPX.

Bias Assessment: It occurred to us that one of the ways we can measure market bias is to compare the SCI to the percent of stocks above their 20/50-EMAs. When the percentages are lower than the SCI, the market bias is bearish and if they are higher, it is bullish. Any "mechanical" signal requires additional analysis to confirm the numbers.

We have a slight bullish bias in the short term given both the %Stocks > 20/50-EMAs are reading higher than the SCI. Intermediate-term bias is bullish given the SCI is rising and above 60% and the long-term bias is bullish given the GCI reading is around 82%.

CONCLUSION: STOs are rising which leads me to believe the SPY will too. Participation is iffy given the negative divergences, but the readings are at a healthy level. The FOMC meeting comments will be released tomorrow. We do need to be prepared for an adverse reaction depending on the tightening measures disclosed. Given price is very overbought, a cooling period is warranted and the Fed could provide the refrigeration.

I'm 80% exposed to the market.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

Bitcoin has formed a bull flag and broke out of it today. The RSI is positive and while the PMO is on a SELL signal, it appears to be flattening again. Stochastics are rising and have reached above net neutral (50). The minimum upside target of the pattern is <drum roll> $92,000.

INTEREST RATES

Yields are trending low in all time frames.

10-YEAR T-BOND YIELD

The 10-year yield is faltering but layers of support are available. More than likely those levels will be tested given the declining PMO. The RSI is neutral and not providing any hints.

DOLLAR (UUP)

IT Trend Model: BUY as of 6/22/2021

LT Trend Model: BUY as of 8/19/2021

UUP Daily Chart: Yesterday's comments still apply:

"The Dollar is moving mostly sideways. The bearish rising wedge is still the dominate pattern. The PMO and RSI aren't providing many clues, but we do note that Stochastics are rising out of negative territory. Might be time for UUP to test the top of the wedge again."

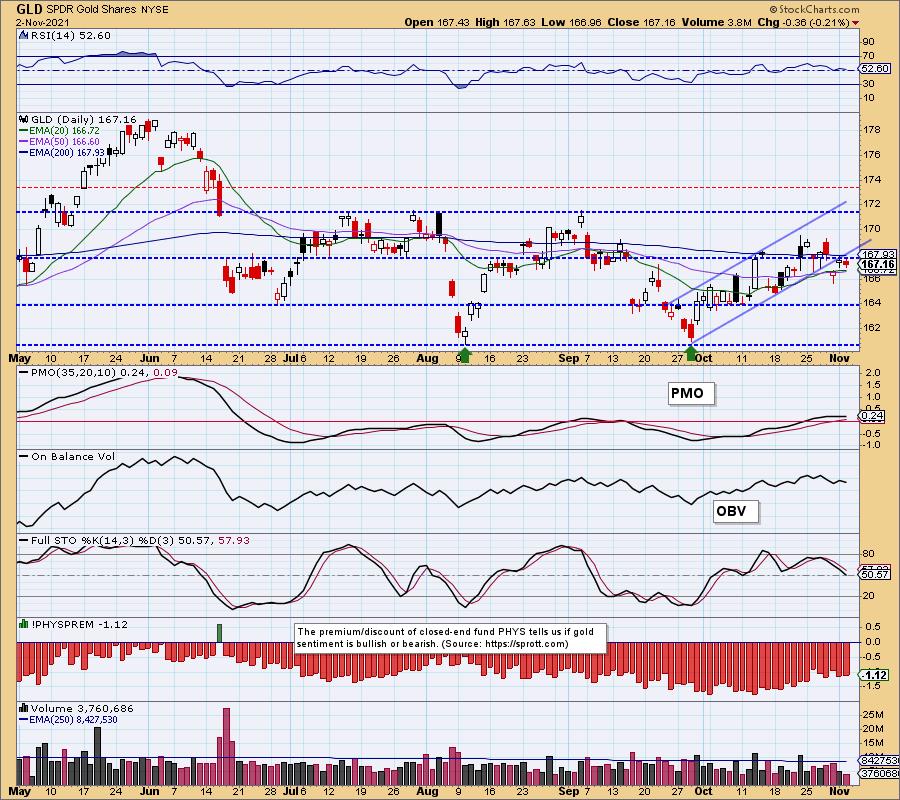

GOLD

IT Trend Model: NEUTRAL as of 6/24/2021

LT Trend Model: SELL as of 8/9/2021

GLD Daily Chart: Gold continues to bounce around below the rising trend. The recent Silver Cross BUY signal is now in peril. Stochastics are pointing lower but the PMO and RSI are sideways and neutral.

(Full disclosure: I own GLD as a long-term buy and hold position.)

GOLD Daily Chart: Gold is holding loosely to its rising trend. I expect price will continue to twitch around the EMAs, but Stochastics do have me concerned.

GOLD MINERS Golden and Silver Cross Indexes: Gold Miners pulled back after testing the 200-EMA. The PMO is still declining and now the RSI has hit negative territory. A PMO SELL signal is on tap. Given the 63% SCI and more than half of Miners having price > 20/50-EMAs, I am looking for support to hold at the August low, but that PMO is rather ominous.

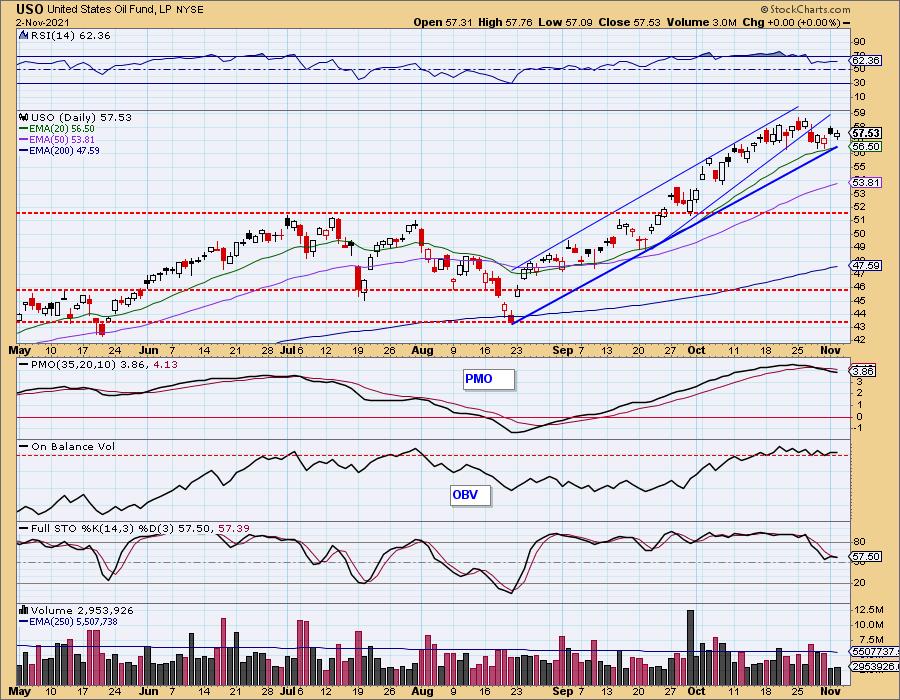

CRUDE OIL (USO)

IT Trend Model: BUY as of 9/7/2021

LT Trend Model: BUY as of 3/9/2021

USO Daily Chart: USO is consolidating on top of the 20-EMA. Stochastics halted their decline in positive territory, but are starting to trend lower again.

The bounce off the 20-EMA suggests higher prices, but what we may see is sideways consolidation as the supply and demand issues on fuel and energy become more clear.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 10/1/2021

LT Trend Model: SELL as of 10/21/2021

TLT Daily Chart: TLT pulled back to strong support at the 20/50/200-EMAs as well as the June price top and August low. The table is set for price to continue higher given the rising PMO, positive RSI and Stochastics oscillating above 80. We will see what the Fed serves up tomorrow.

Technical Analysis is a windsock, not a crystal ball.

-- Erin Swenlin

(c) Copyright 2021 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.