Today's midday reversal helped some and hurt others. As I was looking at charts for "Diamonds in the Rough" I noticed that all of the defensive plays had big filled black candlesticks. They were soaring in the morning, but when the market reversed, they took back the majority of the gains and closed below their open. On the other hand, sectors like Financials (XLF) below were able to recover from big losses. The most profitable sectors today were the growth areas like Technology and Consumer Discretionary while defensive sectors like XLP reversed and suffered big losses on today's reversal.

While XLF did recover it was still down well over 1%. This is what helped trigger today's IT Trend Model "Dark Cross" Neutral signal. Remember that a "Silver Cross" is a positive 20/50-day EMA crossover; a "Dark Cross" is the opposite. Not only do we see a breakdown below support and the 200-day EMA intraday, I see a possible double-top formation. Price will need to close below $37 to confirm the pattern. The PMO is declining and just hit negative territory. The RSI is negative and continuing lower (not oversold yet). The SCI was beginning to rise this month, but on the sell-off dropped below its signal line in a hurry. Participation of stocks > 20/50/200-day EMAs continue lower with very bearish readings of 9%, 19% and 60% respectively. I'm reminded of the "now or never" phrase. XLF needs a big bounce here to avoid executing the double-top pattern. If price does confirm the pattern, the minimum downside target is at support at $32.50. Ouch.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

MAJOR MARKET INDEXES

SECTORS

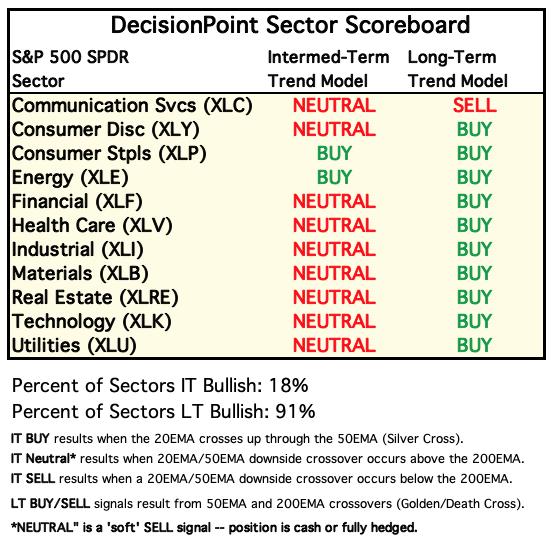

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

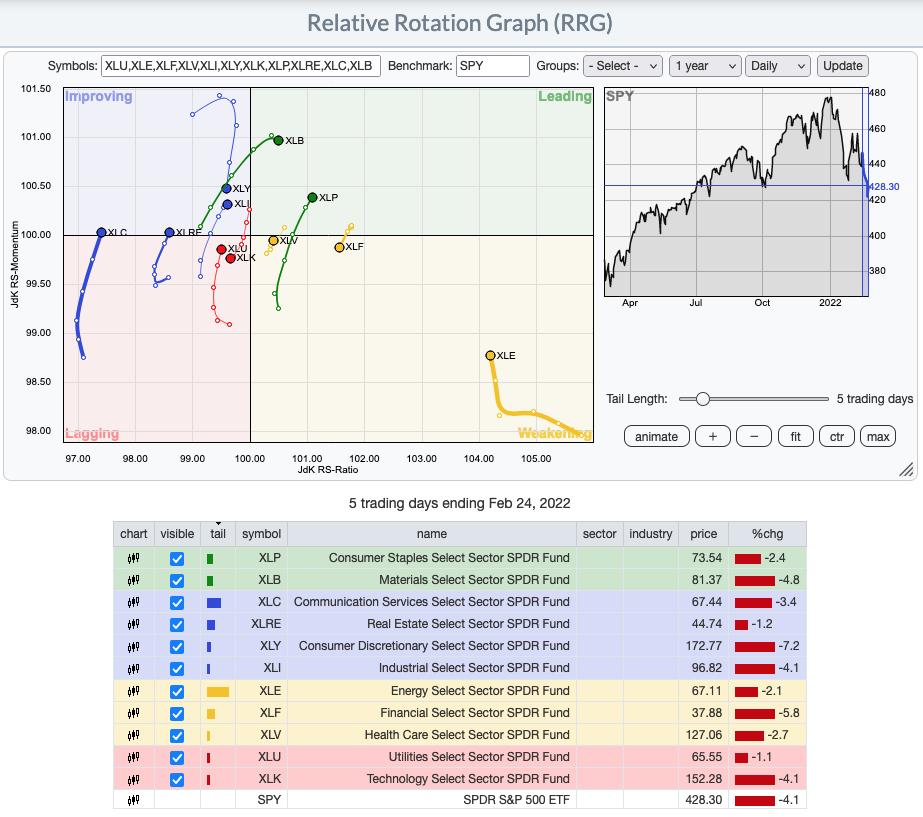

RRG® Chart: There are four sectors that look the most bullish on the RRG. XLC, XLI and XLRE have bullish northeast headings in Improving. I like XLE as well. It is the biggest outperformer overall based on its distance from the center point of the RRG (the SPY). It now has a more bullish northward heading.

XLB is in Leading, but I don't like that it is beginning to hook around toward Weakening. It's still outperforming, but be careful here.

XLK, XLY and XLF look bearish. They are all traveling bearishly southwest. XLK certainly is most bearish given it resides in Lagging as well.

XLU is showing improvement and should hit Improving soon, but it is very close to the center which tells me even if it starts improving, it is still staying close to the benchmark SPY which is very weak.

RRG® charts show you the relative strength and momentum for a group of stocks. Stocks with strong relative strength and momentum appear in the green Leading quadrant. As relative momentum fades, they typically move into the yellow Weakening quadrant. If relative strength then fades, they move into the red Lagging quadrant. Finally, when momentum starts to pick up again, they shift into the blue Improving quadrant.

CLICK HERE for an animated version of the RRG chart.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

IT Trend Model: NEUTRAL as of 1/21/2022

LT Trend Model: BUY as of 6/8/2020

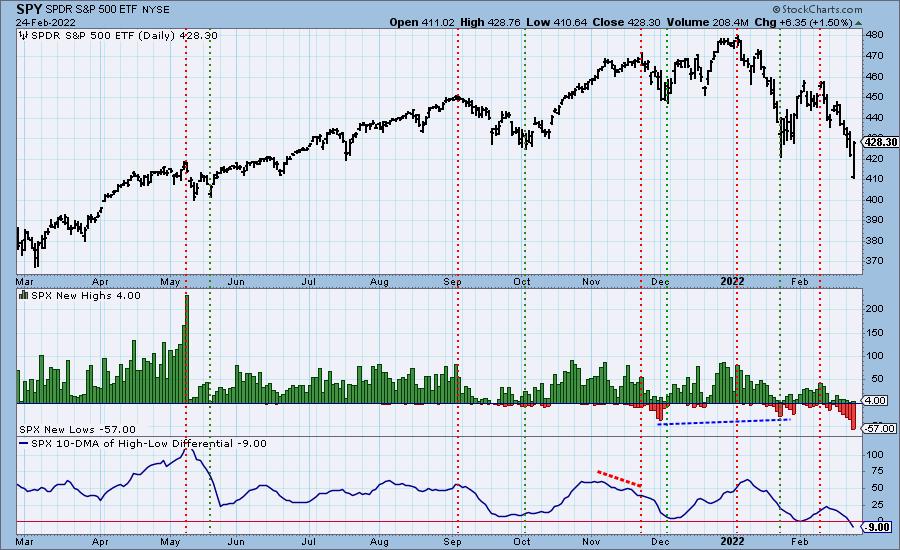

SPY Daily Chart: We finished higher today, but did not break out of the steep declining trend. Now that we have a positive close, we could start to consider the possibility of a double-bottom, but I won't call it until I at least see a higher low. Total Volume was climactic, but we didn't receive any other signs of a climax day. It could be due to the giant swing in price.

The VIX punctured the lower Bollinger Band on the inverted scale by a large margin, but by the finish of the day it had closed above the Band. I like this look. Typically we will see an upside reversal after a puncture like this.

Tuesday's Free Trading Room Recording:

Topic: DecisionPoint Trading Room

Start Time: Feb 22, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: Feb#22nd

S&P 500 New 52-Week Highs/Lows: New Lows expanded in a big way today. Remember they log New Highs and New Lows during the day. If they hit it anytime during the day, it is counted in the totals. At one point the market was down over 2% so I'm not surprised we have this expansion on a 1.5% rally day.

Climax* Analysis: As noted earlier, no climax today. There was very high SPX Total Volume, but there were no other climactic readings. This high volume is a reflection of strong selling pressure early in the day, followed by strong buying pressure when the market reversed. Certainly no climax in either direction. The previous two downside exhaustion climaxes finally resolved with a positive close.

*A climax is a one-day event when market action generates very high readings in, primarily, breadth and volume indicators. We also include the VIX, watching for it to penetrate outside the Bollinger Band envelope. The vertical dotted lines mark climax days -- red for downside climaxes, and green for upside. Climaxes indicate either initiation or exhaustion.

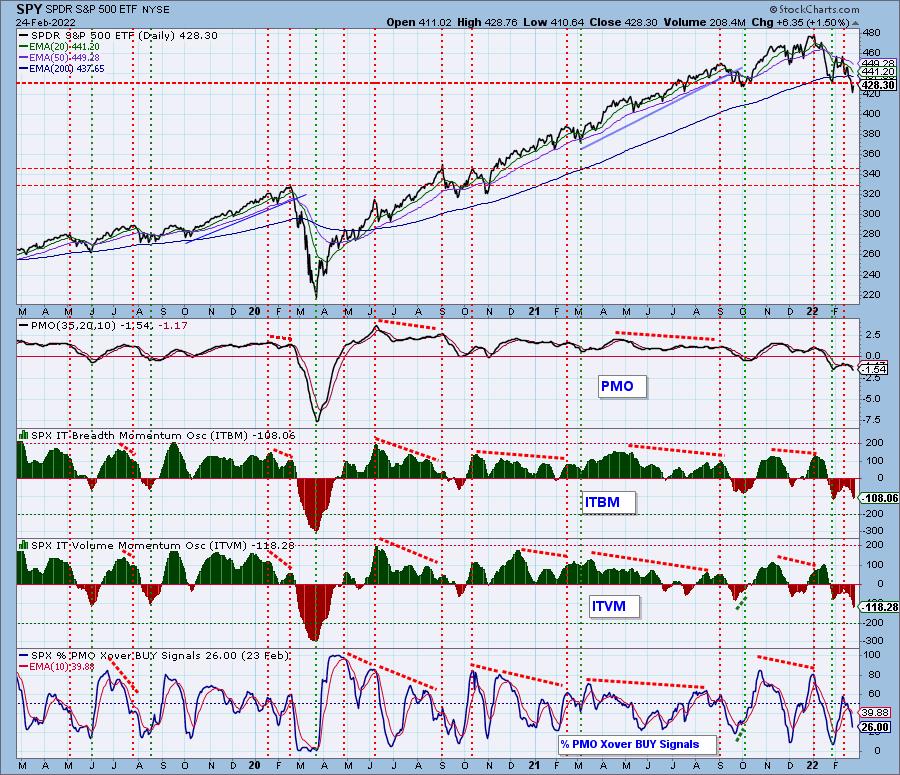

Short-Term Market Indicators: The short-term market trend is DOWN and the condition is OVERSOLD.

ST indicators are now oversold, but we did see lower readings on the January low. Participation has faded and is now in oversold territory. This is setting up nice conditions for a bear market rally.

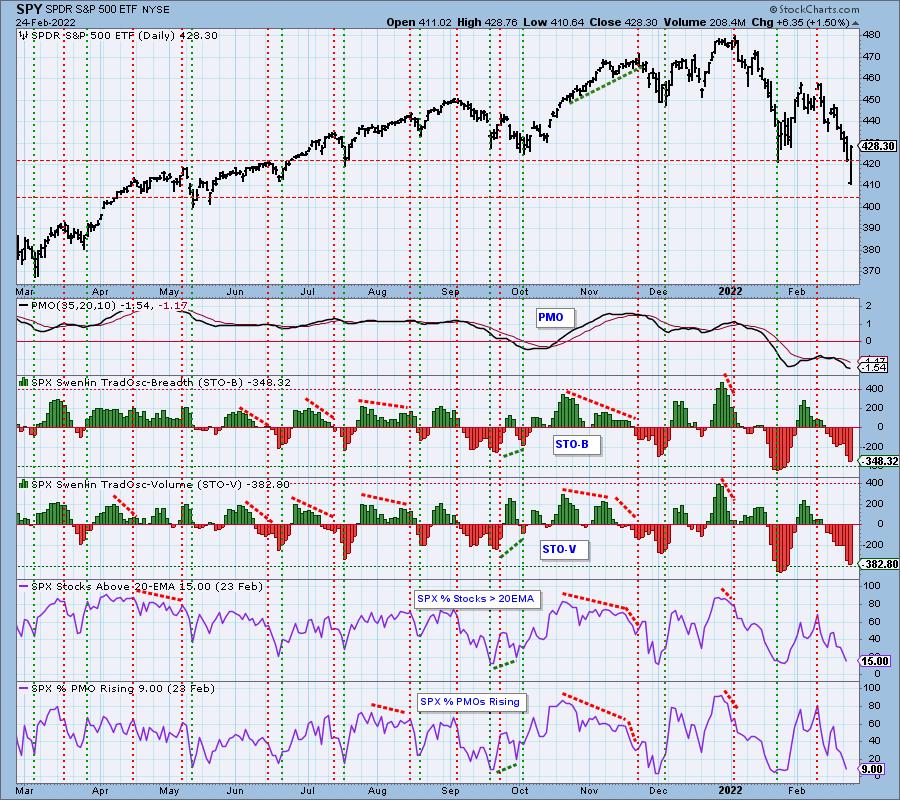

Intermediate-Term Market Indicators: The intermediate-term market trend is DOWN and the condition is OVERSOLD.

In the grand scheme, the ITBM/ITVM are oversold right now, just not as oversold as they were at the 2020 bear market low. The ground is still fertile for a bear market rally given they are oversold, but I would like to see %PMO BUY signals move further into oversold territory.

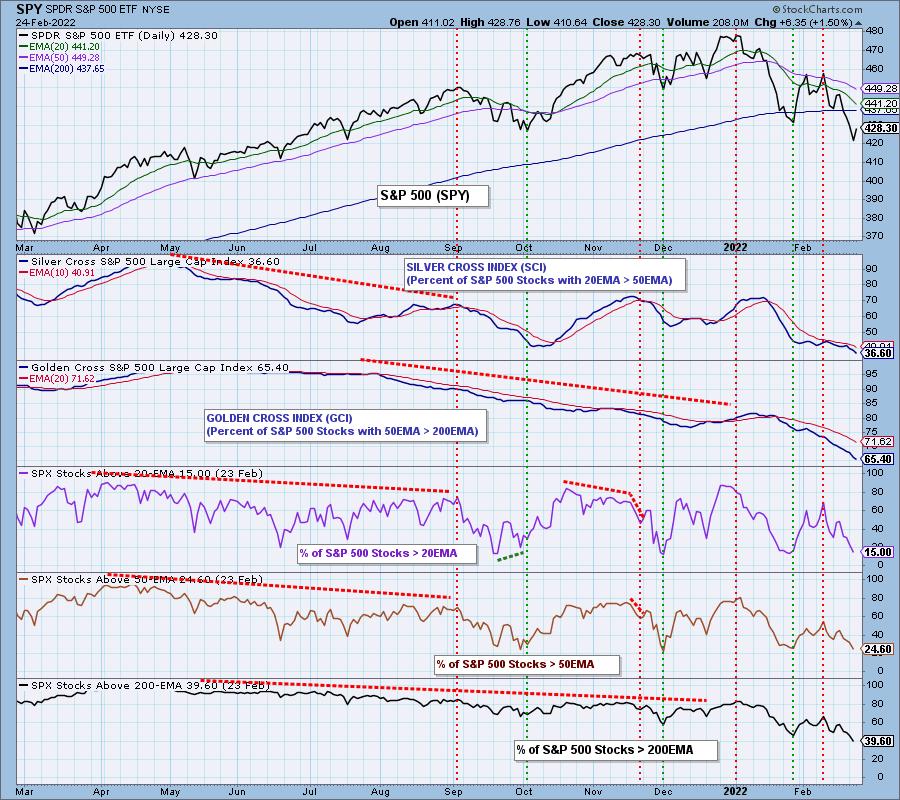

PARTICIPATION and BIAS Assessment: The following chart objectively shows the depth and trend of participation in two time frames.

- Intermediate-Term - the Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA). The opposite of the Silver Cross is a "Dark Cross" -- those stocks are, at the very least, in a correction.

- Long-Term - the Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). The opposite of a Golden Cross is the "Death Cross" -- those stocks are in a bear market.

The market bias is easy to determine in all three timeframes. Readings below 70% are somewhat bearish, but readings below 50% are very bearish. Given the SCI/GCI are both falling and %Stocks > 20/50/200-day EMAs are still falling, the bias is firmly bearish across the board. However, participation is getting oversold and that could mean a bear market rally.

CONCLUSION: I've used the term "bear market rally" a few times in this blog. A bear market rally conforms with bear market rules. Bear market rules tell us that oversold territory is "thin ice" and not solid. If this rule holds, a short rally like we had at the end of January will likely be all we will get. If the rule doesn't hold and we see a rally well above 460 on the SPY (4600 on the SPX), then we may've escaped a full scale bear market. Indicators are oversold, but still in decline and haven't confirmed today's rally yet.

If we're lucky, a bear market rally is on its way; however, with the Russian invasion of Ukraine combined with all the economic instability, we may only get a few up days before the bottom falls out again. I think you can begin stalking some of the stocks on your watch lists, but know that you'll need to trade in a very short-term timeframe to protect yourself. I would also use hard stops.

I have 8% exposure to the market.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

I am still optimistic that Bitcoin is bottoming here. The RSI and Stochastics are showing some positive movement. Today's intraday low nearly tapped support at $32,500 before reversing. I'll feel more confident when the PMO finally bottoms and has a positive crossover.

INTEREST RATES

The flight to Bonds is likely the culprit of falling yields today. If we see a market rally, a flight from Bonds could be seen and that would see higher yields.

10-YEAR T-BOND YIELD

The intraday low on $TNX punctured the rising trendline, the 20-day EMA and support at the January high. However, it rebounded nicely and closed above all three with ease. The RSI and Stochastics are positive, but the PMO crossover SELL signal still has me somewhat concerned. However, it does seem it will whipsaw back into a BUY signal soon.

DOLLAR (UUP)

IT Trend Model: BUY as of 6/22/2021

LT Trend Model: BUY as of 8/19/2021

UUP Daily Chart: Huge rally in the Dollar today, but it did finish with a bearish filled black candlestick. This candlestick could also form a reverse island. The indicators look good, but price has now tested the top of the bearish rising wedge which suggests to me we will see that reverse island and a test of the bottom of the wedge. Stochastics seem to be confirming this line of thinking. Price popped today, but Stochastics decelerated.

GOLD

IT Trend Model: BUY as of 12/29/2021

LT Trend Model: BUY as of 1/12/2022

GLD Daily Chart: Gold was having a fabulous morning, but it is a defensive area of the market and as I explained in the opening, the defensive sectors got killed on today's SPY reversal. We have a giant bearish engulfing candlestick on GLD. Stochastics and the RSI turned down; however, both remain in positive territory above net neutral (50). The RSI was getting overbought so this decline relieved those conditions. The PMO is still rising and price did hold above important support.

(Full disclosure: I own GLD)

GOLD Daily Chart: $GOLD closed higher today, an interesting disparity between the ETF and the metal itself. I'm not sure what to make of it, but it probably isn't a good thing. $GOLD's RSI is overbought and continuing to rise. Stochastics did top but remain above 80 indicating so there is internal strength. The PMO as on GLD, looks very bullish and isn't really that overbought yet. Still I never like "Pinocchio" bars (a phrase coined by Martin Pring for OHLC bars like today's) because as the name implies, it is lying to you.

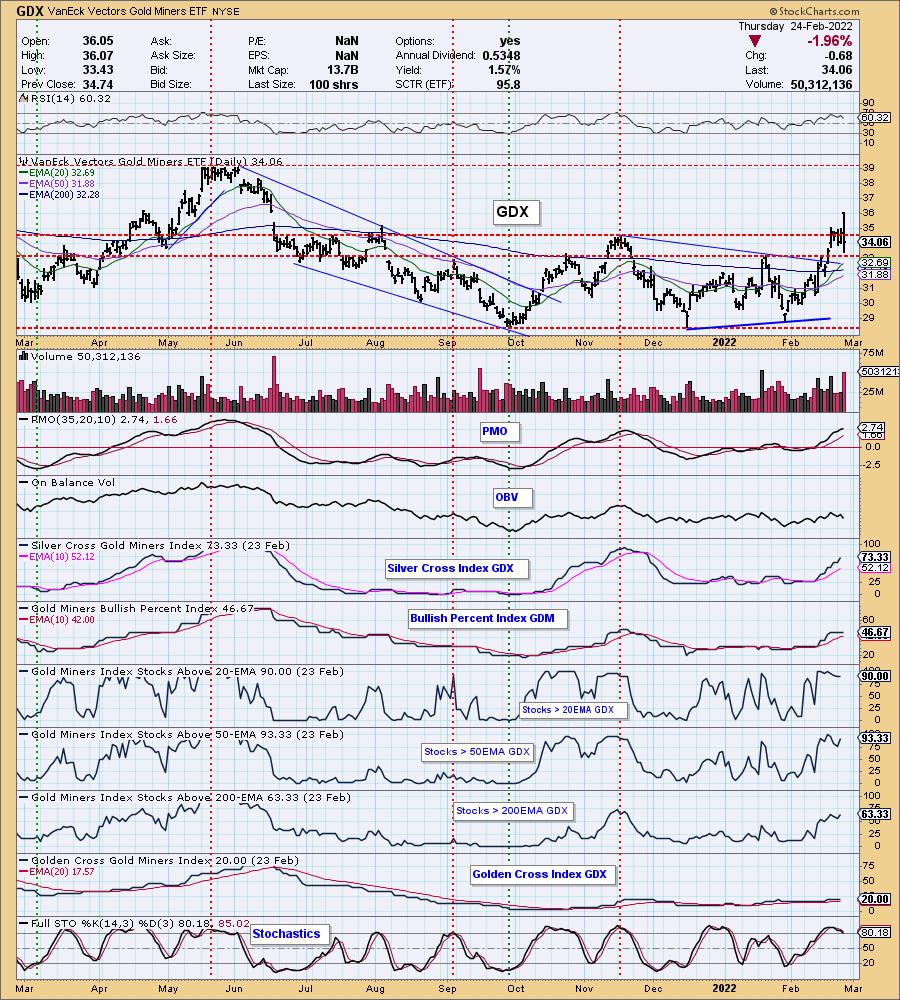

GOLD MINERS Golden and Silver Cross Indexes: GDX was flying but as Gold prices declined and defensive areas of the market got hit, Gold Miners were a casualty. This is another failed breakout. Still, I like the positive RSI, rising PMO, rising SCI and the strong participation of stocks > 20/50/200-day EMAs. Stochastics are little worrisome, but the other indicators are still bullish.

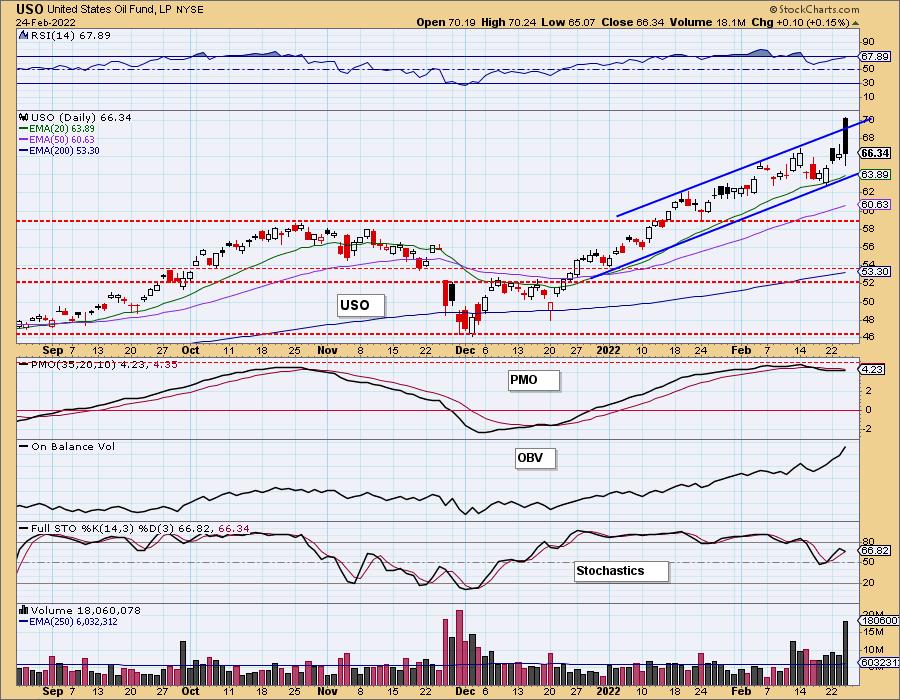

CRUDE OIL (USO)

IT Trend Model: BUY as of 1/3/2022

LT Trend Model: BUY as of 3/9/2021

USO Daily Chart: Giant bearish black filled candlestick today. The upside breakout from an already bullish rising trend channel was likely due to Russia/Ukraine invasion. I'm not exactly sure why we saw such a pullback, but overall the chart looks pretty healthy. The PMO is beginning to rise again and the RSI is positive. I'm not liking the top on Stochastics, but that is likely due to today's close being so much lower than the open.

BONDS (TLT)

IT Trend Model: NEUTRALas of 1/5/2022

LT Trend Model: SELL as of 1/19/2022

TLT Daily Chart: A defensive investment vehicle with a filled black candlestick--not a surprise. I think near term Bonds have some merit, but if I'm right about a possible bear market rally, Bonds aren't going to be as popular. The black candlestick tells us that. As soon as the market began to get healthy today, people sold off so price failed to overcome resistance. The PMO which is nearing a crossover BUY signal is topping below the signal line already. Stochastics are topping in negative territory. While the RSI is technically rising, it is still firmly in negative territory below net neutral (50).

Good Luck & Good Trading!

Erin Swenlin

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.