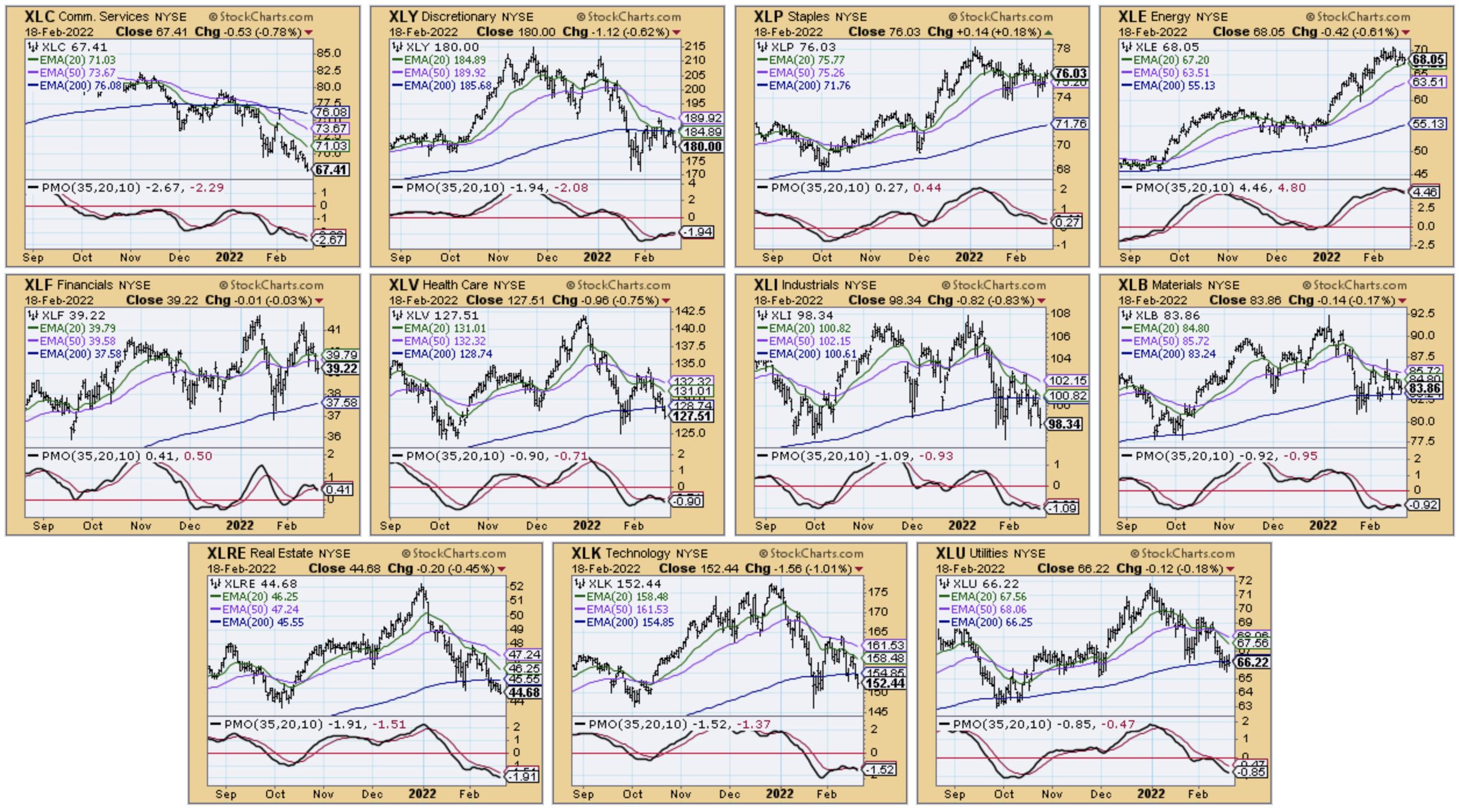

We recently took a stroll through the sector charts to find some strength.. anywhere... somewhere. Looking at the CandleGlance of the sectors, you'll note the problems with all of them with the exception of Consumer Staples (XLP).

XLE looks fairly healthy based on its trading above its 20-day EMA, but notice the overbought PMO turning over. I would look for a pause in that sector's rally. Price is already rounding off.

XLY has a PMO that is trending up, but it topped today and price hasn't been able to test the 50-day EMA.

XLF was doing well, but this week it is pulling back with price ending below the 50-day EMA and the PMO falling.

XLB has some promise. We know Gold and Gold Miners are in that sector and they have internal strength. Unfortunately, the PMO turned down. Price is also bounded by the 20/50-day EMAs.

Exposing yourself to the market is very risky business, particularly under bear market conditions. There are pockets of strength, but far fewer than before.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

MAJOR MARKET INDEXES

For Today:

For the Week:

SECTORS

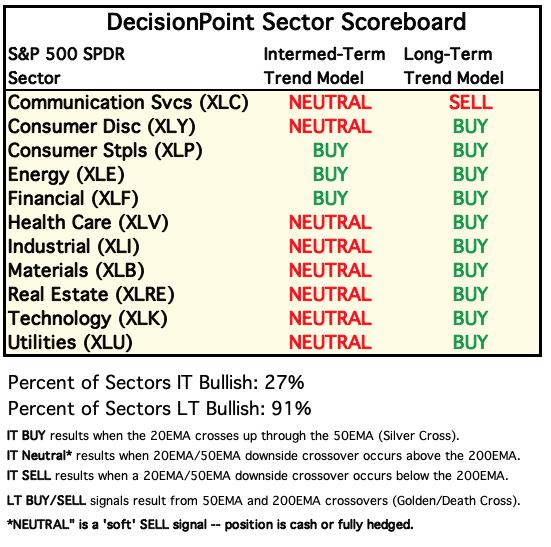

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

For Today:

For the Week:

Short-term (Daily) RRG: Short term, the strongest sectors on the RRG are XLF, XLB, XLI and XLP. All four are moving in the bullish northeast direction and none reside in Lagging. XLK entered Lagging today and while XLC, XLU and XLRE are at least traveling northward, they are still in Lagging. XLV has a bearish southwest heading and could enter Lagging very soon. XLE is mostly neutral. We know it is experiencing a pause that could result in a pullback. When it begins to move northeast, we would then want to nibble. XLY could enter Leading soon, but relative strength is already fading as it moves southeast now.

Intermediate-Term (Weekly) RRG: We determined the XLB, XLI, XLF, XLV and XLP looked the strongest on the short-term RRG with all traveling in the bullish northeast direction. Intermediate term, XLE and XLP look the strongest. The weakest are clearly XLK and XLY. XLU is neutral to bullish as it resides in Leading, but is swinging southward. XLRE is Leading, but it has a bearish southwest heading so we should be careful there. XLC looks somewhat enticing on the IT RRG given it has a bullish northeast heading and is in Improving. However, we do not favor bottom fishing in that sector.

RRG® charts show you the relative strength and momentum for a group of stocks. Stocks with strong relative strength and momentum appear in the green Leading quadrant. As relative momentum fades, they typically move into the yellow Weakening quadrant. If relative strength then fades, they move into the red Lagging quadrant. Finally, when momentum starts to pick up again, they shift into the blue Improving quadrant.

CLICK HERE for an animated version of the RRG chart.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

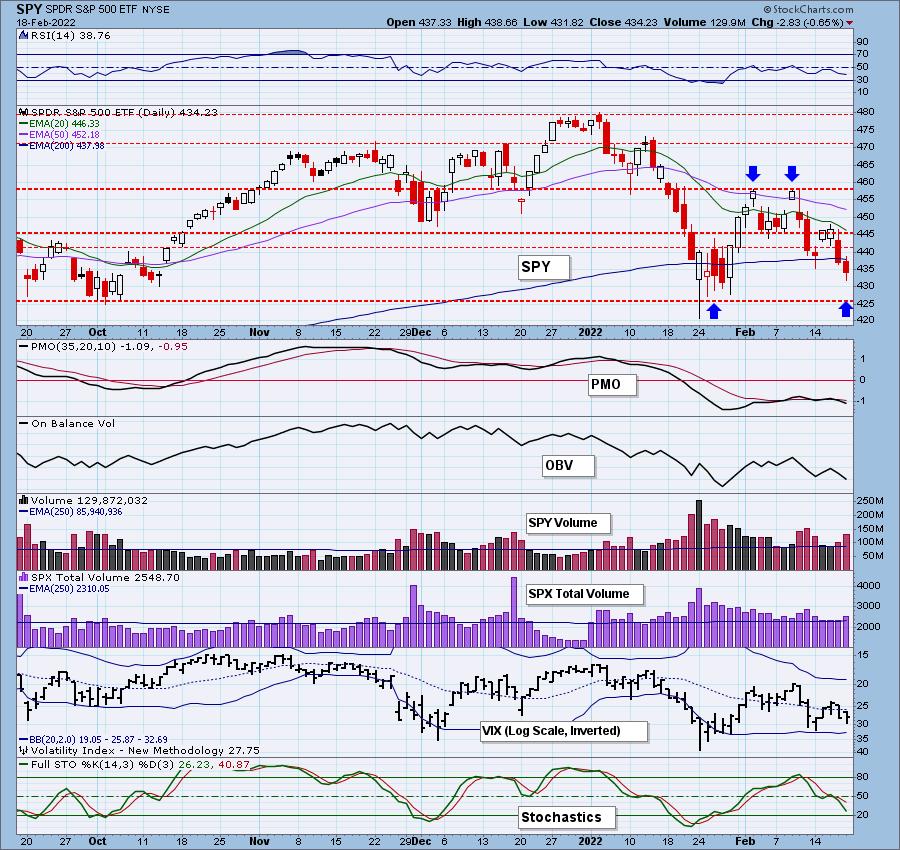

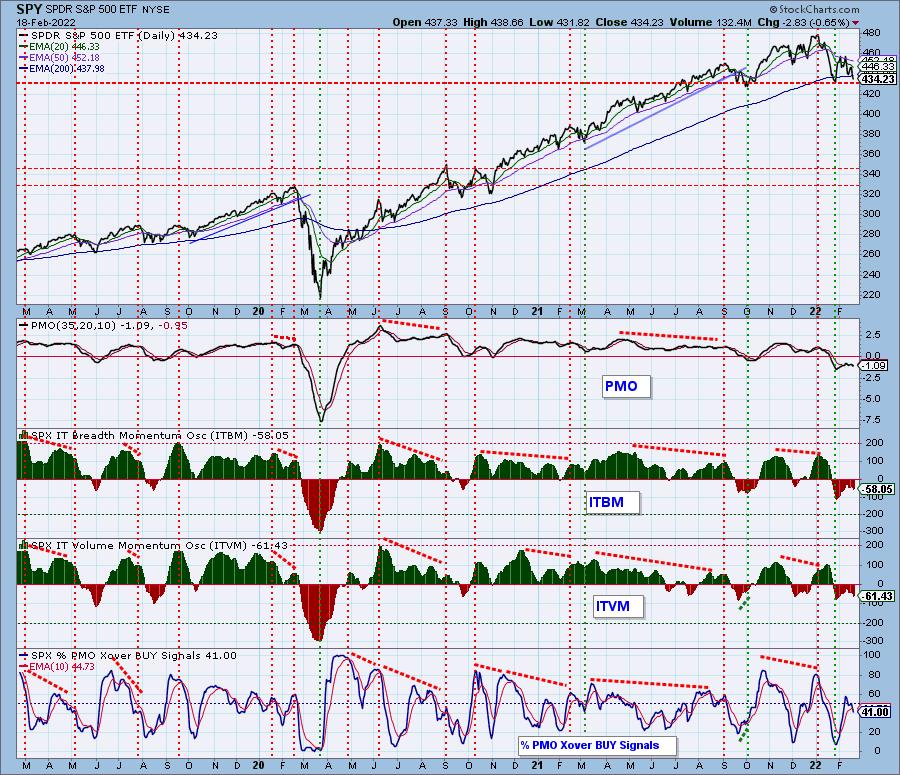

IT Trend Model: NEUTRAL as of 1/21/2022

LT Trend Model: BUY as of 6/8/2020

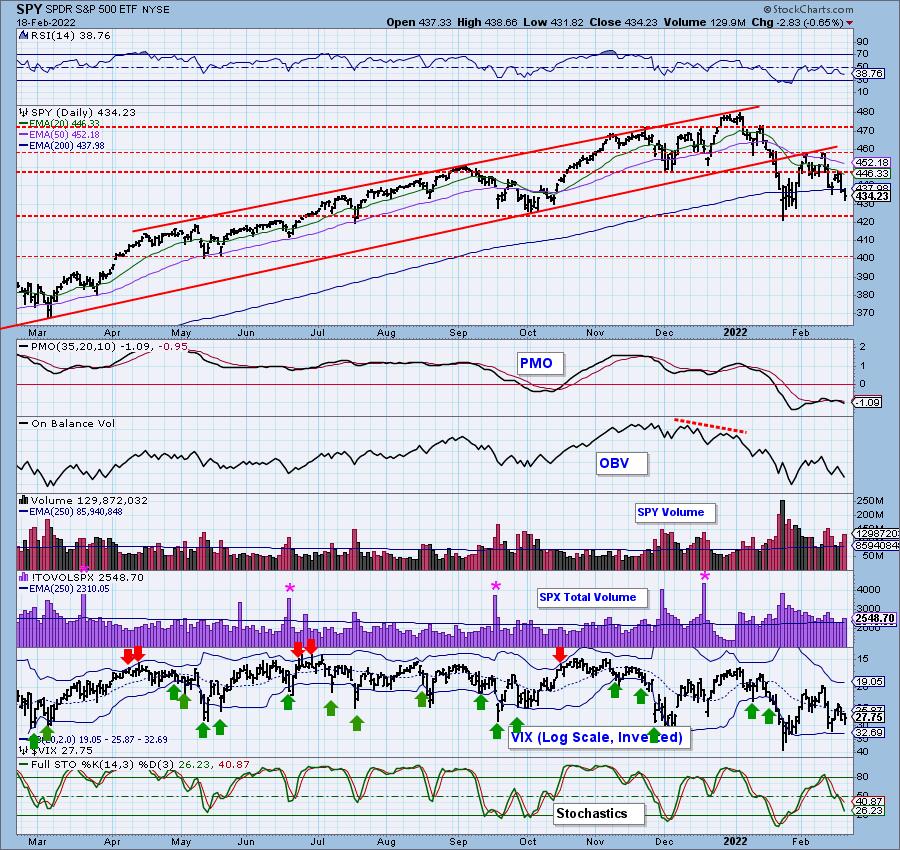

SPY Daily Chart: This week was options expiration, and we usually expect Thursday and Friday to be relatively quiet -- low volatility. This week those two days saw a price range of over 3%, not highly volatile, but we don't think low volatility applies either. At any rate, the market has approached the minimum downside expectation for the double top earlier this month. It's extremely early to call it, but if today's low holds on Tuesday, we could be looking at a bullish double-bottom forming.

The one-year daily chart looks particularly bearish given the breakdown of support at the 200-day EMA. More than likely we have a test of $420 level ahead. The RSI is negative, we had the SPY trigger a PMO SELL signal this week and Stochastics are negative, falling and not oversold.

Recording Link for Monday's (2/14) Free DP Trading Room:

Topic: DecisionPoint Trading Room

Start Time: Feb 14, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: Valentine#14

SPY Weekly Chart: The last time price penetrated the 43-week EMA, it at least closed higher on the week and above it. This week's OHLC bar looks particularly bearish with price closing beneath the 43-week EMA and finishing down for the week.

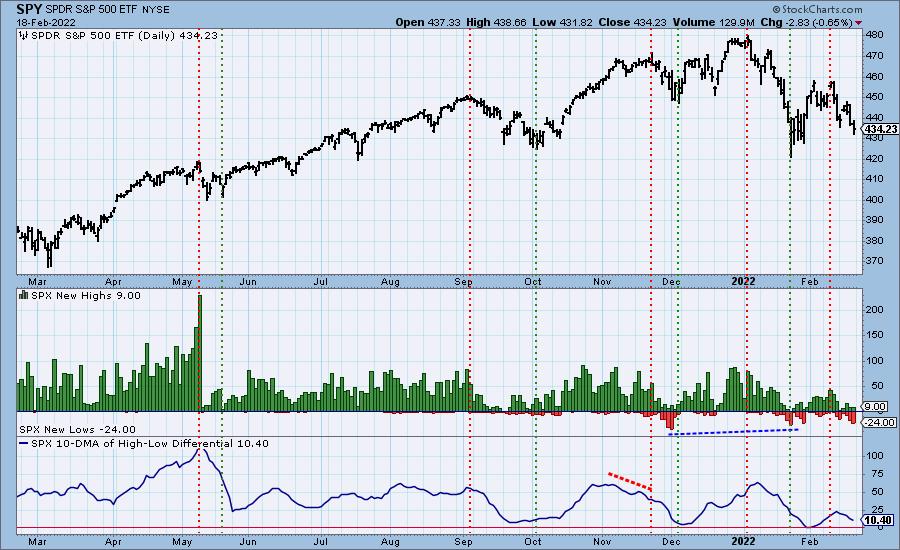

New 52-Week Highs/Lows: New Highs were fairly stable for the week. We do see an increase in New Lows on the week. The decline of the 10-DMA of the High-Low Differential is bearish. Seeing it top well-below its typical highs around 75. This is confirming the current short-term decline.

Climax Analysis: There were no climax readings today. We had three climaxes this week. Monday was a downside exhaustion climax. That led into higher prices and an upside initiation climax. We saw high prices on Wednesday. Thursday's sell-off generated a downside initiation climax which led into today's decline. This week they were right every time.

*A climax is a one-day event when market action generates very high readings in, primarily, breadth and volume indicators. We also include the VIX, watching for it to penetrate outside the Bollinger Band envelope. The vertical dotted lines mark climax days -- red for downside climaxes, and green for upside. Climaxes indicate either initiation or exhaustion.

Short-Term Market Indicators: The short-term market trend is DOWN and the condition is SOMEWHAT OVERSOLD.

Both the STOs contracted slightly on today's trading, but with no confirmation from %Stocks > 20-EMAs and %PMOs Rising (both are still declining), we wouldn't read too much into this.

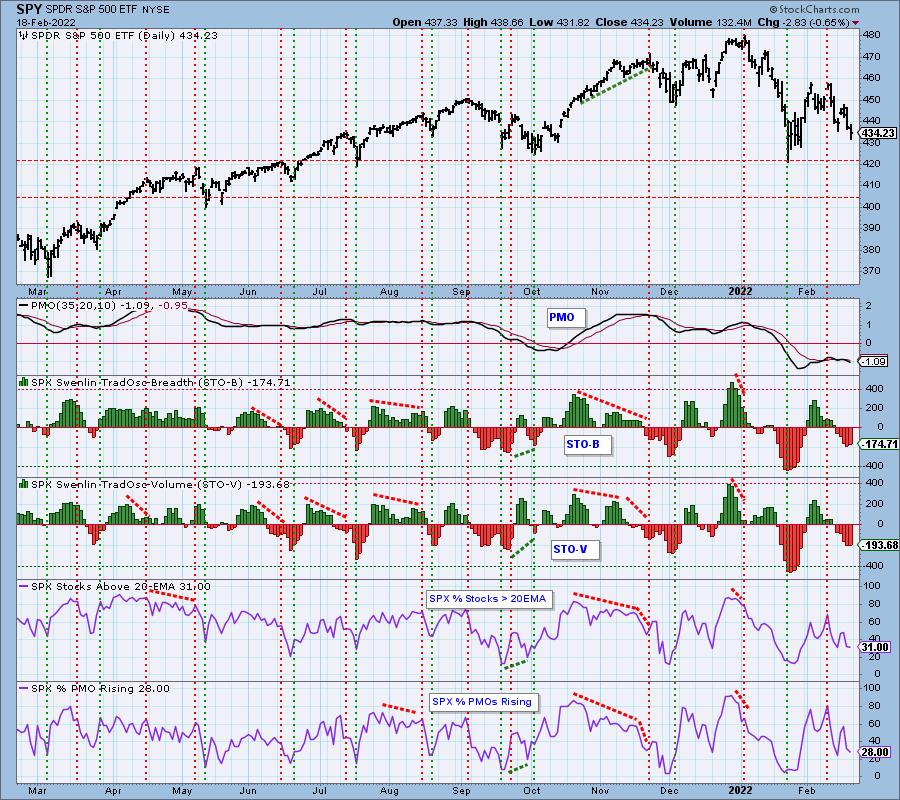

Intermediate-Term Market Indicators: The intermediate-term market trend is DOWN and the condition is SOMEWHAT OVERSOLD.

IT indicators are declining and while they are somewhat oversold, in the context of a bear market, not really oversold at all. %PMO BUY signals finished the week lower.

PARTICIPATION and BIAS Assessment: The following chart objectively shows the depth and trend of participation in two time frames.

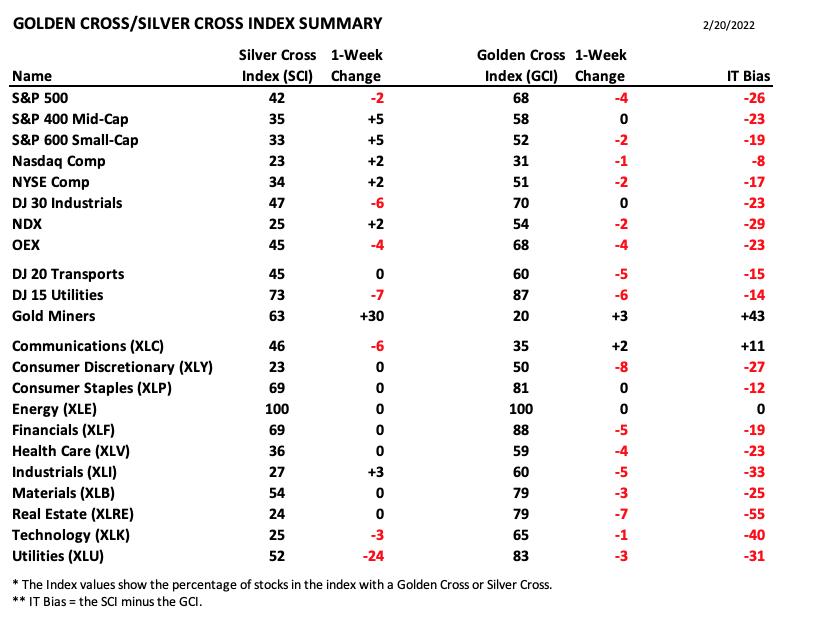

- Intermediate-Term - the Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA). The opposite of the Silver Cross is a "Dark Cross" -- those stocks are, at the very least, in a correction.

- Long-Term - the Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). The opposite of a Golden Cross is the "Death Cross" -- those stocks are in a bear market.

__

The following table summarizes participation for the major market indexes and sectors.

We have added 1-Week Change columns for each Index so that there is a dynamic aspect to the presentation. While the SCIs improved this week, the GCIs continued to deteriorate. Gold Miners had a good week, but Utilities were quite the opposite.

Yesterday's comments summarize the bias well. We do note that the SCI ticked up slightly today, but we didn't see any real improvement on this indicator this week. Participation is getting slimmer overall. %Stocks > 20/50/200-day EMAs are trending lower. We have to read the bias as bearish in all three timeframes.

CONCLUSION: It was a rocky week for the market that resulted in a -1.41% decline on the SPY and a PMO SELL signal. While the SCI and STOs did turn up today, participation in general is slimming and more importantly, lacking. IT indicators are bearish and there is a bearish bias in all three timeframes. There is some hope. If the market does turn back up quickly, this could turn into a bullish double-bottom. For now, expect more decline. Play defense... although, XLP, a very defensive sector and the only one with rising momentum, has only a few industry groups that are bullish and reversing. Finding profitable trades will be difficult even within that sector. The coast is not clear yet. Erin is only 8% exposed to the market.

Calendar: The U.S. markets will be closed on Monday for Presidents Day.

Free DP Trading Room will be held TUESDAY instead of Monday at Noon ET. Register HERE.

Tuesday: Case-Shiller Home Price Index & Consumer Confidence Index

Thursday: Jobless Claims & New Home Sales

Friday: Inflation Reports, Consumer Sentiment & Pending Home Sales

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

A beautiful short-term bullish reverse head and shoulders set up this week only to be thwarted by news of an upcoming executive order to look into regulating the crypto markets. That soured investors and the bullish reverse head and shoulders disintegrated. Indicators have moved negative and price dropped below the 20-day EMA. The short-term rising trend was also broken.

INTEREST RATES

Rates pulled back considerably toward the end of this week. This could be due to increased buying of Bonds as some investors take cover there.

10-YEAR T-BOND YIELD

Yields started the week off strong but fizzled out to finish the week. We didn't believe $TNX would test the 20-day EMA or even the bottom of the rising trend channel. It is beginning to. We believe yields will rebound, but if we see a flight to Bonds, yields will fall further.

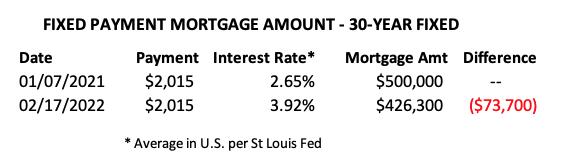

MORTGAGE INTEREST RATES (30-Yr)**

**We watch the 30-Year Fixed Mortgage Interest Rate, because, for the most part, people buy homes based upon the maximum monthly payment they can afford. As rates rise, a fixed monthly payment will carry a smaller mortgage amount. (See table.) As buying power shrinks, real estate prices will fall, and homeowners will increasingly find that they are upside down with their mortgage.

Looking at the chart since December, the word "soaring" comes to mind, and buyers are really getting squeezed.

DOLLAR (UUP)

IT Trend Model: BUY as of 6/22/2021

LT Trend Model: BUY as of 8/19/2021

UUP Daily Chart: The dollar finished the week lower but did show signs of life today. The RSI is now positive and the PMO is very close to a crossover BUY signal in oversold territory. Stochastics are also rising. It appears a very short-term double-bottom is setting up that could see price move to its nemesis resistance level at $26.

There is a large bearish rising wedge and our thought had been that since it topped well-below the top of the pattern that a breakdown was ahead. That's not panning out.

UUP Weekly Chart: The weekly chart is somewhat mixed. The weekly PMO is nearing a negative crossover, but the weekly RSI remains positive. Look for more sideways movement out of UUP.

GOLD

IT Trend Model: BUY as of 12/29/2021

LT Trend Model: BUY as of 1/12/2022

GOLD Daily Chart: Gold rallied strongly this week and topped it off with a big gap up above overhead resistance. GLD was down slightly. The concern is we are looking at a possible island reversal in the making. This is what happened in November. Gold is pesky so it wouldn't completely surprise us if we see a gap down, but indicators are very bullish. The RSI is not overbought, Stochastics are rising above 80 and the PMO is rising strongly. Maybe we see a pause.

GOLD Weekly Chart: The weekly chart shows us the significance of this week's breakout move. The symmetrical triangle has now been confirmed to the upside. It is a continuation pattern so we should expect to see the rally continue. The weekly RSI is positive and rising and the weekly PMO bottomed above its signal line and is rising again.

GOLD MINERS Golden and Silver Cross Indexes: Gold Miners hit the brakes today after breaking above overhead resistance yesterday. We see some deterioration in %Stocks > 20/50-day EMAs, but the percentages are much higher than the SCI so the bias is still bullish on GDX. Stochastics are oscillating above 80. The PMO is rising strongly and the RSI has avoided overbought territory.

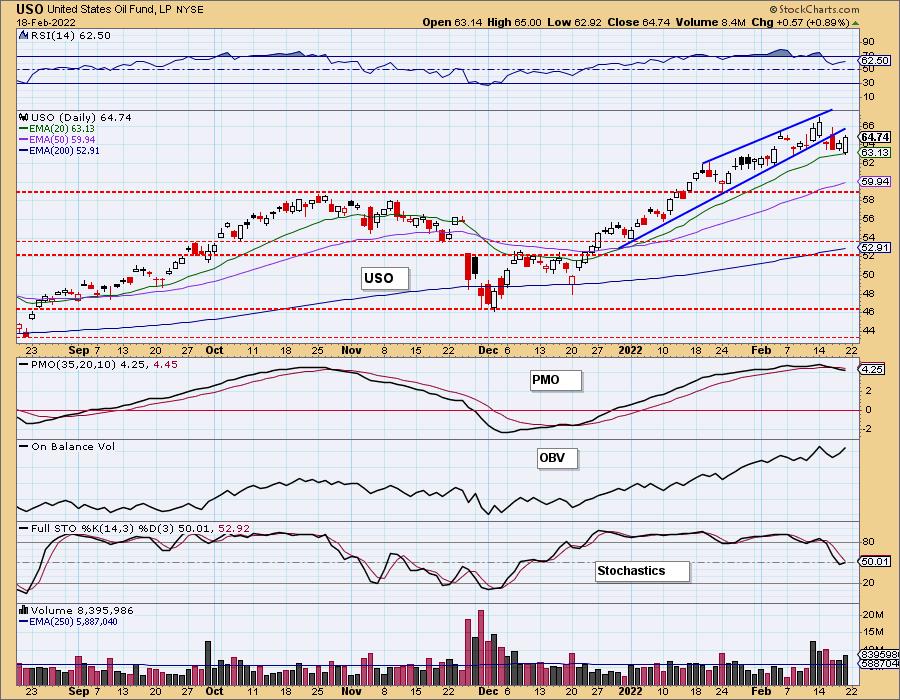

CRUDE OIL (USO)

IT Trend Model: BUY as of 1/3/2022

LT Trend Model: BUY as of 3/9/2021

USO Daily Chart: Nice bullish engulfing candlestick today as price held the 20-day EMA. This week price did lose the rising trend. It is likely we will see a cooling off period for Crude Oil prices. We aren't thinking big decline, more of a consolidation or trickle lower to possibly test the 50-day EMA. Watch your Energy positions to determine whether they are in for a pullback or consolidation.

We favor consolidation here because the RSI is still positive and the PMO is actually decelerating its decline already. Stochastics also ticked higher and moved into positive territory above net neutral (50).

USO/$WTIC Weekly Chart: The weekly RSI is overbought and it is falling. This is more evidence that we will see a pause continue in the Oil rally. A big breakdown doesn't seem likely given the rising weekly PMO.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 1/5/2022

LT Trend Model: SELLas of 1/19/2022

TLT Daily Chart: TLT reversed to finish the week as yields dropped. The daily charts are looking slightly more bullish. The PMO has turned back up and Stochastics are rising again.

At issue is the very strong overhead resistance ahead at the 20-day EMA and the April/May highs.

TLT Weekly Chart: The weekly chart shows a confirmed double-top pattern. The minimum downside target of that pattern would be right around support at the 2021 low and late 2019 lows. The weekly RSI is negative and the weekly PMO just moved into negative territory. We could see higher prices in the short term, but longer term we would expect $130 to be tested.

Good Luck & Good Trading! Have an excellent three day weekend!

Carl & Erin Swenlin

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.