The U.S. Dollar Index ETF (UUP) daily 50-day EMA crossed up through the 200-day EMA (Golden Cross), generating an LT Trend Model BUY Signal. Notice that the 20-day EMA and 50-day EMA are the same, so it is virtually guaranteed that there will be a Silver Cross on Monday. The fact that these crossovers are so close together emphasizes the narrow range price has been in recently, but it doesn't add weight to the signals.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

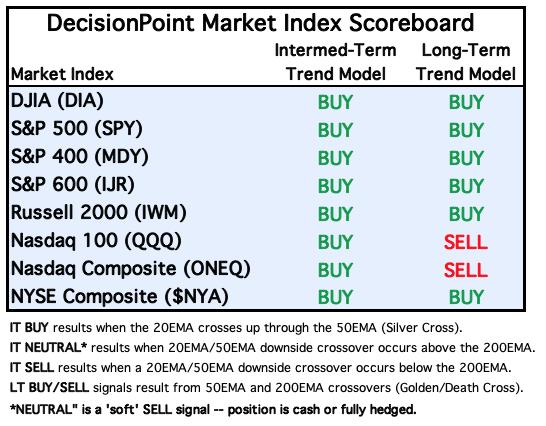

MAJOR MARKET INDEXES

For Today:

For the Week:

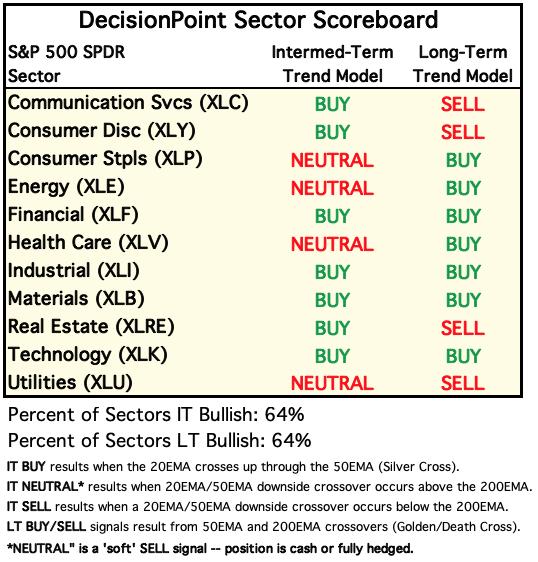

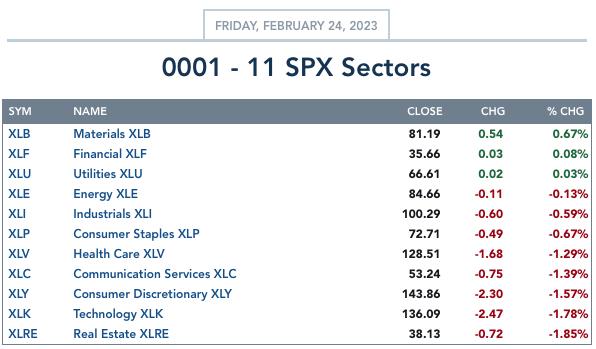

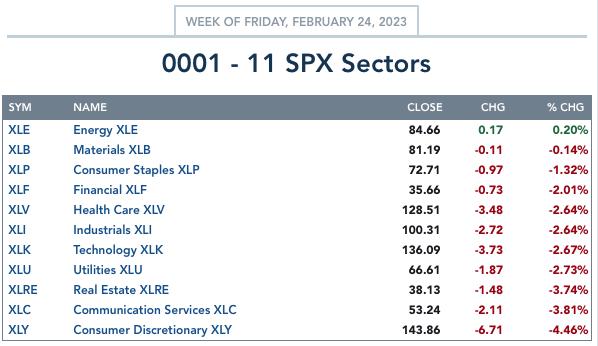

SECTORS

Each S&P 500 Index component stock is assigned to one of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

For Today:

For the Week:

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

IT Trend Model: BUY as of 1/12/2023

LT Trend Model: BUY as of 2/9/2023

SPY Daily Chart: Today SPY broke down through the rising trend line that defines the current cyclical bull market, putting the bull in question. A decisive break would be down 3% to 385, so we need some time to see if the decline will continue. Price snapped back to the line by the close, forming a bullish hollow red candlestick, so the break is minuscule.

Indicators suggest this decline isn't over with. The RSI topped in negative territory below net neutral (50). The PMO is in decline on a SELL signal and the OBV shows a negative divergence with price tops. Internal weakness is visible given the VIX is oscillating below its moving average on the inverted scale and Stochastics are below 20.

Here is the latest episode from 2/13 - no recording due to the holiday on 2/20:

SPY Weekly Chart: Just as the market broke out to reach the bull market 20% measurement out of the October low, the market has retreated. Price is still above the bear market declining trend, but it could be back within as soon as next week. It appears we experienced a bear market rally rather than the beginning of a new bull market.

SPY Monthly Chart: There are only two February trading days next week, so we will cover monthly charts in this issue. Last month we were encouraged by the breakout from the declining tops trendline. As we noted above price is almost back in that declining trend. The monthly RSI is still positive, but the monthly PMO is still in decline. This appears to have been a longer-term bull trap.

New 52-Week Highs/Lows: New Lows are finally expanding, but they still are very modest considering the decline out of this month's high. The 10-DMA of the High-Low Differential is in decline, confirming the market's downturn.

Climax Analysis: There were climax readings on two of the four eligible indicators today. That's a little weak, but we're happy to call this a downside exhaustion climax.

*A climax is a one-day event when market action generates very high readings in, primarily, breadth and volume indicators. We also include the VIX, watching for it to penetrate outside the Bollinger Band envelope. The vertical dotted lines mark climax days -- red for downside climaxes, and green for upside. Climaxes are at their core exhaustion events; however, at price pivots they may be initiating a change of trend.

Short-Term Market Indicators: The short-term market trend is DOWN and the condition is OVERSOLD.

All of our short-term indicators are oversold. Looking at readings before the October low, we know all of these can move even lower. With only 12% of stocks showing positive momentum, it's going to be hard to find a good investment.

Intermediate-Term Market Indicators: The intermediate-term market trend is DOWN and the condition is NEUTRAL.

We changed the intermediate-term market trend to "Down" due to the break of the bull market rising trendline. %PMO Crossover BUY signals is now oversold, but it should get even more oversold given only 12% have rising momentum. There are still 4% holding buy signals that are vulnerable to a crossover SELL signal. Again we point you to the October low. None of these indicators are remotely as oversold as they were in October.

_______

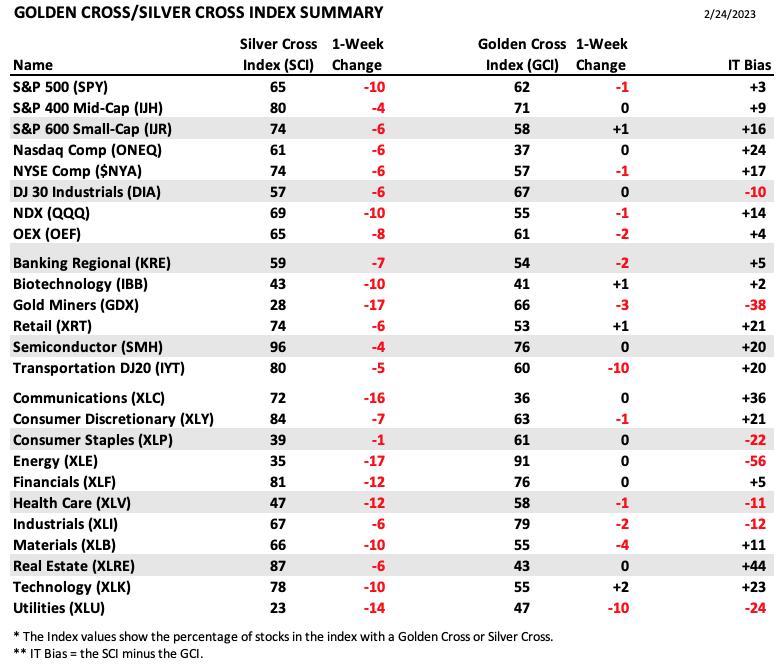

PARTICIPATION and BIAS Assessment: The following table objectively shows the depth and trend of participation in two time frames.

- Intermediate-Term - the Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA). The opposite of the Silver Cross is a "Dark Cross" -- those stocks are, at the very least, in a correction.

- Long-Term - the Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). The opposite of a Golden Cross is the "Death Cross" -- those stocks are in a bear market.

The following table summarizes participation for the major market indexes and sectors. The 1-Week Change columns inject a dynamic aspect to the presentation. There are three groups: Major Market Indexes, Miscellaneous Sectors, and the eleven S&P 500 Sectors.

NEW INDUSTRY GROUPS ADDED! We have begun collecting SCI and GCI data for four new sectors: Biotechnology (IBB), Regional Banking (KRE), Retail (XRT), and Semiconductor (SMH).

Real Estate (XLRE) holds the highest positive IT Bias. With a Silver Cross Index that is much higher than its Golden Cross Index, it lands in this top spot. However, we can see deterioration of that bias as the Silver Cross Index lost ground this week.

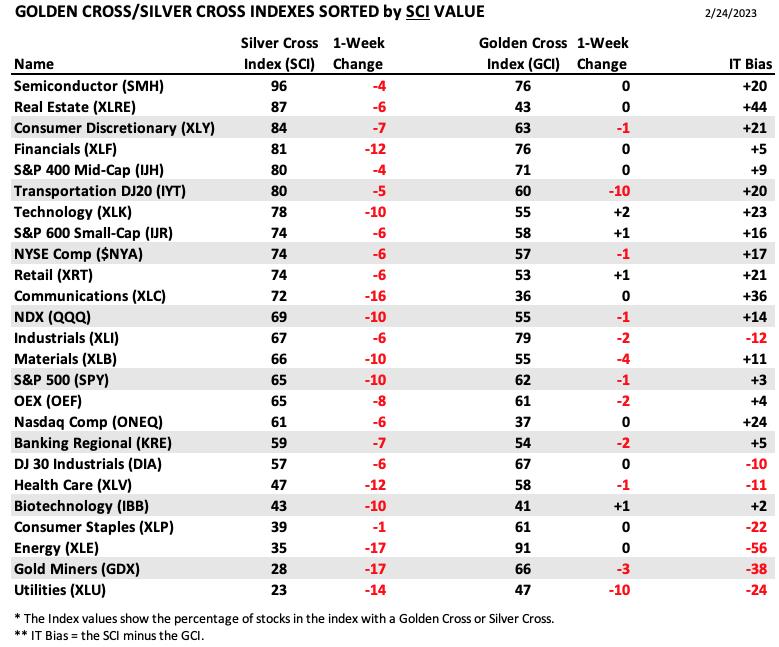

This table is sorted by SCI values. This gives a clear picture of strongest to weakest index/sector in terms of intermediate-term participation.

Semis still hold the top spot on the Silver Cross Index, but we can see that is deteriorating. The worst SCI goes to Utilities (XLU) which not only hold the last place reading on the SCI, the SCI and GCI are getting worse quickly.

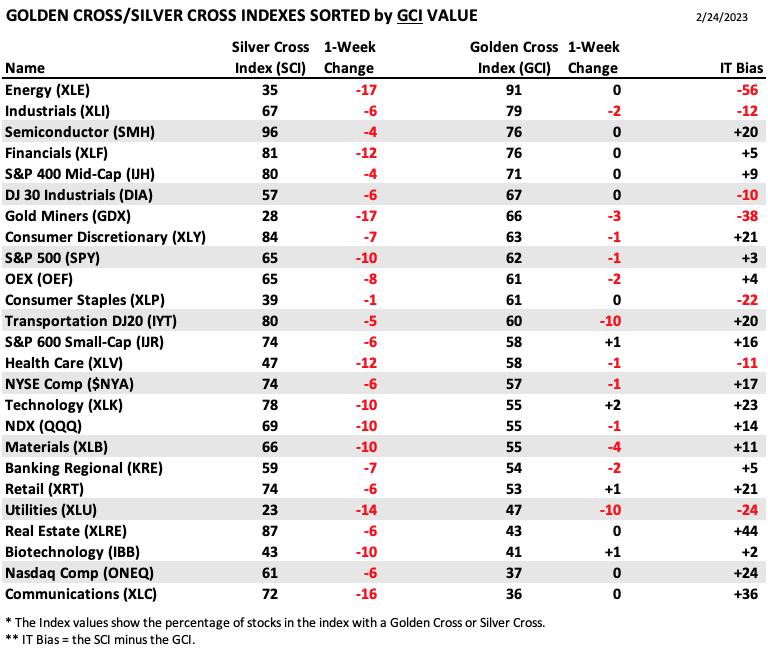

This table is sorted by GCI values. This gives a clear picture of strongest to weakest index/sector in terms of long-term participation.

Energy holds first place on the Golden Cross Index table. Unfortunately it is a sector that is losing internal strength as far as the Silver Cross Index. Therefore we should expect that GCI value to begin falling soon. At the bottom is Comm Services (XLC). This sector was beat down and while it led the October bull market rally, it has faded quickly. Note the loss of 16% on the SCI.

The following chart objectively shows the depth and trend of participation in three time frames.

The market bias is BEARISH.

The short-term bias is BEARISH.

The intermediate-term bias is BEARISH.

The long-term bias is BEARISH.

The market bias is clearly bearish all around. There is a slim percentage of stocks with price above both their 20/50-day EMAs. A percentage that is much lower than the Silver Cross Index. The SCI was already bearish and looks more bearish as it declines quickly. This week the Golden Cross Index topped.

CONCLUSION: The decline continues as investors begin waking up to the idea a recession is likely and rates will stay high. The technicals are languishing. The bias is bearish. There is a glimmer of hope in today's downside exhaustion climax, but all other indicators are negative; and, remember how the last exhaustion climax worked out...it didn't. When bullish signals don't result in rallies and bearish signals always result in downside, we have to start playing by bear market rules. Currently every sector has a declining PMO, leaving us on the hunt using a magnifying glass to find strength. We would prepare for more market decay. We may have reached the 20% bull market benchmark, but once hit, it was the kiss of death. Hindsight being 20/20, this was a bear market rally not a new bull market. Prepare for more downside.

Erin is 22% exposed.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

Bitcoin's rally is over, but it has reached a level where we could see a reversal. It is about to test the bottom of a bearish rising wedge, but is sitting on support at the September top. Given the slumping indicators, we don't expect this support level to hold, but if it is going to reverse, this is the place it should.

This chart shows where some of the support/resistance lines come from.

INTEREST RATES

Rates rallied this month forming a second bottom to help us identify bullish double-bottoms. Shorter-term rates have confirmed their patterns, we are just waiting on longer-term rates to follow suit.

The Yield Curve Chart from StockCharts.com shows us the inversions taking place. The red line should move higher from left to right. Inversions are occurring where it moves downward.

10-YEAR T-BOND YIELD

$TNX confirmed its bullish double-bottom pattern with a breakout above the confirmation line at the December high. Since then it has mainly paused, but given strongly positive indicators, we would look for the 10-year yield to continue rising.

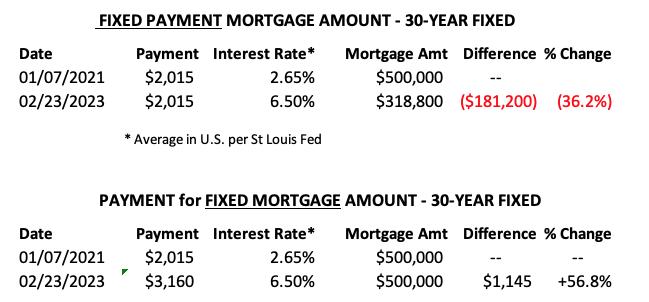

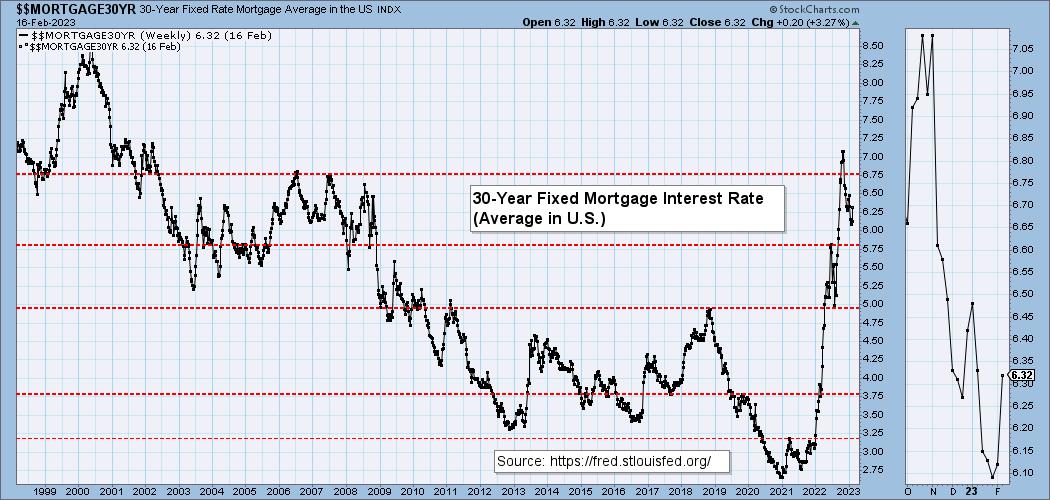

MORTGAGE INTEREST RATES (30-Yr)**

**We watch the 30-Year Fixed Mortgage Interest Rate, because, for the most part, people buy homes based upon the maximum monthly payment they can afford. As rates rise, a fixed monthly payment will carry a smaller mortgage amount. As buying power has been shrinking, home prices have come under pressure.

--

This week the 30-Year Fixed Rate rose from 6.32 to 6.50.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 11/14/2022

LT Trend Model: BUY as of 2/24/2023

UUP Daily Chart: As noted in the opening, UUP saw a Golden Cross and a Silver Cross today. The indicators look healthy, although we note that the RSI is in overbought territory. We annotated where price would need to travel in order to form a rising trend channel. It is not official until price actually tops. If it tops next week, we'll have a new bearish rising wedge to deal with.

UUP Weekly Chart: The weekly PMO has now turned up bullishly and the weekly RSI is in positive territory. This chart looks very bullish and suggests the Dollar has more upside potential.

UUP Monthly Chart: The monthly chart has changed greatly. It's hard to tell, but this month's candlestick was a giant bullish engulfing. It suggests more upside to come. The monthly RSI had been in decline, but is now rising in positive territory. The monthly PMO is the most impressive. It made an about face and is now headed back up. Expect the Dollar to continue to gain strength.

GOLD

IT Trend Model: BUY as of 11/14/2022

LT Trend Model: BUY as of 1/5/2023

GOLD Daily Chart: GLD has lost level after level of support this month. It is now at its last line of defense before facing a treacherous journey lower to the October high. Indicators are firmly negative. Stochastics are reading a meager 3.67 and are still moving lower.

The reverse correlation with the Dollar is nearly perfect; this means if the Dollar is up +1%, Gold will be down -1%. We see that Gold strength against the Dollar is weakening so in the example above, Gold could fall further than the inverse of the Dollar. All of this spells trouble for Gold.

GOLD Weekly Chart: The weekly PMO has topped bearishly. The weekly RSI should hit negative territory next week. This support level isn't really that strong. It's primary 'touch' on the line is August top.. we don't see too many others. We don't expect support to hold. More than likely we will see the long-term rising bottoms trendline tested.

GOLD Monthly Chart: The monthly chart is basically the inverse of the Dollar's. Not surprising given their near perfect reverse correlation. Gold formed a big bearish engulfing candlestick and the monthly PMO was yanked downward, forming a top beneath the signal line which is especially bearish. If we are fortunate, this is an addition to the handle on the bullish cup with handle pattern and not a collapse.

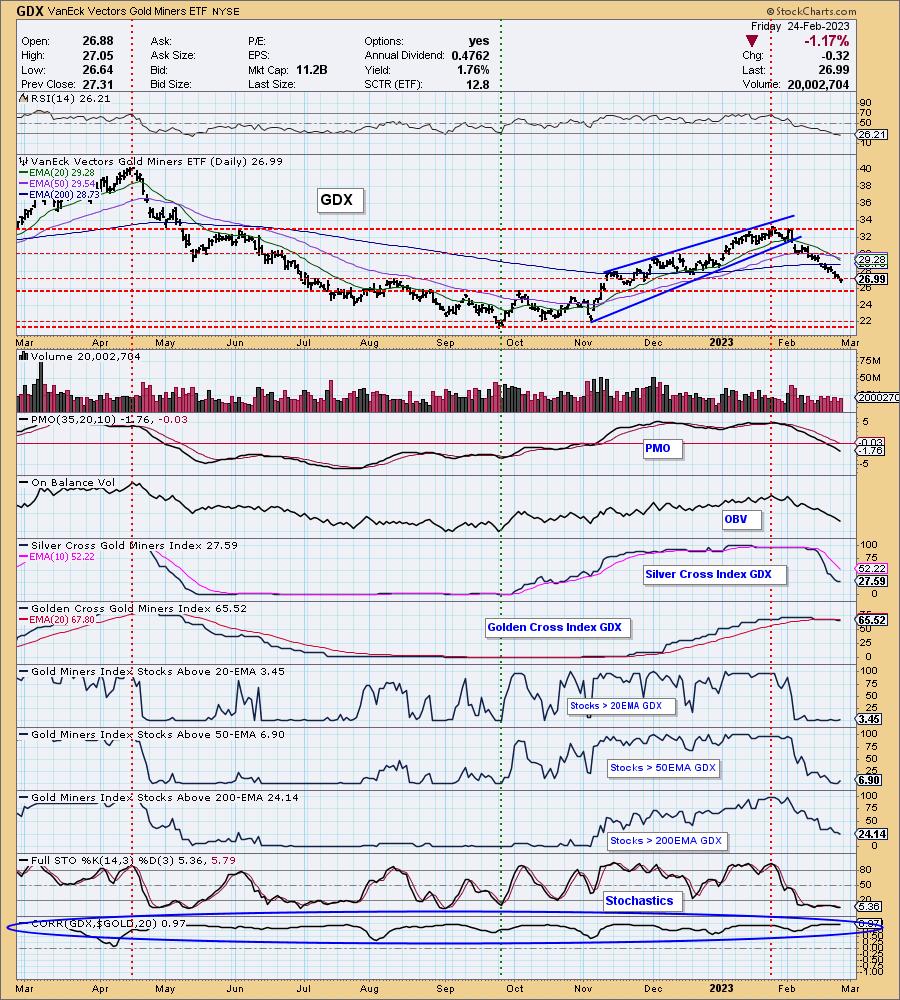

GOLD MINERS Golden and Silver Cross Indexes: In this morning's Diamond Mine trading room for Diamonds subscribers only, Erin added a correlation line to the Gold Miners chart to see how it fares against Gold. Not surprisingly you'll see in the last indicator window that Gold Miners hold a strong positive correlation. This means Gold Miners are particularly vulnerable to swings in Gold. Given our dreary outlook for Gold, GDX should continue to slide. Participation already is flashing more downside, the correlation to Gold just adds insult to injury.

CRUDE OIL (USO)

IT Trend Model: SELL as of 2/2/2023

LT Trend Model: SELL as of 12/6/2022

USO Daily Chart: Crude Oil is range-bound and to be honest, frustrating. It looked very bearish on this last top given it couldn't reach overhead resistance at the January highs. Now it is rebounding before hitting the support line at the January/February lows which is bullish. Stochastics are rising again along with the RSI. The PMO has turned up. We likely have a short bounce to look forward to on Monday given the bullish engulfing candlestick.

USO/$WTIC Weekly Chart: Price is drifting away from the long-term rising trendline. At the same time the weekly PMO is attempting a crossover BUY signal. We see more sideways movement ahead.

WTIC Monthly Chart: The monthly chart of $WTIC shows that support at the confirmation line of a large double-bottom pattern is being tested. The double-bottom pretty much fulfilled its upside target on the 2022 high. Given the struggle at support, the now negative monthly RSI and the monthly PMO SELL signal in overbought territory, we have to look for lower prices eventually.

BONDS (TLT)

IT Trend Model: SELLas of 2/21/2023

LT Trend Model: SELL as of 1/19/2022

TLT Daily Chart: TLT made a valiant effort this week to rally off support and the rising bottoms trendline. Today price fell erasing the small gains acquired Wednesday and Thursday. The RSI and PMO are very negative, but Stochastics are hinting that support may actually hold given they have begun to rise.

TLT Weekly Chart: We have a bearish double-top chart pattern and price is just about to test the confirmation line at the December low. The weekly RSI is very negative. The weekly PMO doesn't look that bad considering the bearish price action. However, look at the double-bottom on the 20-year yield. We believe that TLT will test lows at 90 and not rebound here.

TLT Monthly Chart: The monthly PMO is in decline and the monthly RSI topped in negative territory. Support at the late 2016 low was lost again. All TLT charts are bearish and the yield charts are bullish. We would look for Bonds to continue to fade.

Have a nice weekend! Good Luck & Good Trading!

Erin Swenlin And Carl Swenlin

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.