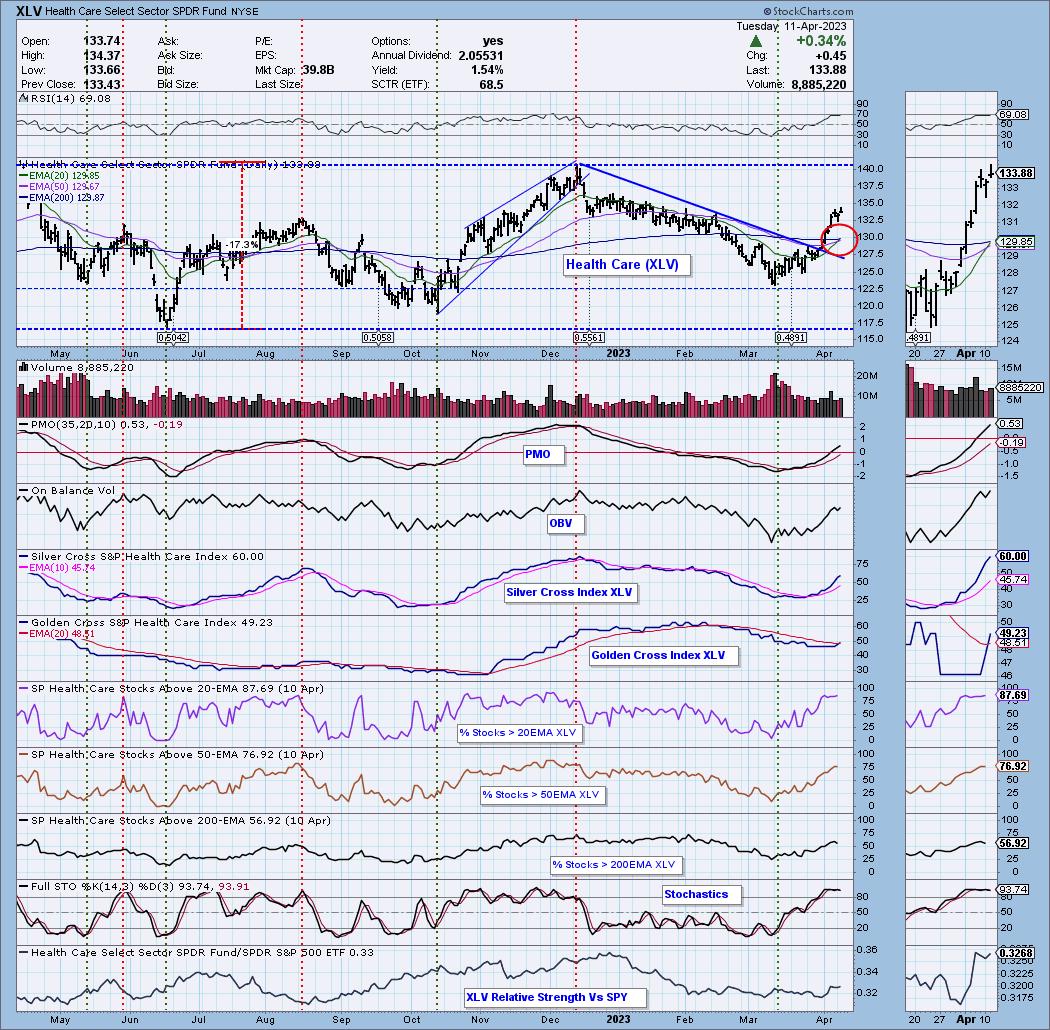

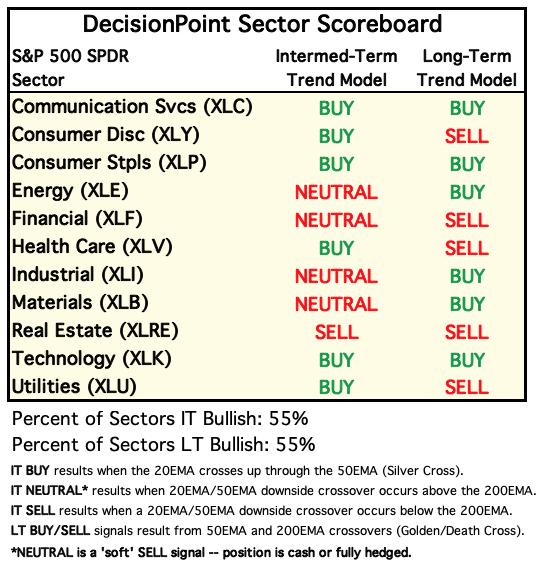

Today the Health Care ETF (XLV) 20-day EMA crossed up through the 50-day EMA (Silver Cross), generating an IT Trend Model BUY Signal. As has similarly been the case for other recent signals, this is the sixth 20/50-day EMA crossover in a year, and it has occurred near the top of the one-year trading range. Also, it is obvious that XLV is on the verge of delivering the sixth 50/200EMA crossover signal in a year, this time a Golden Cross BUY Signal. These may prove to be profitable signals, but beware of another reversal when it gets close to the 2023 top.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

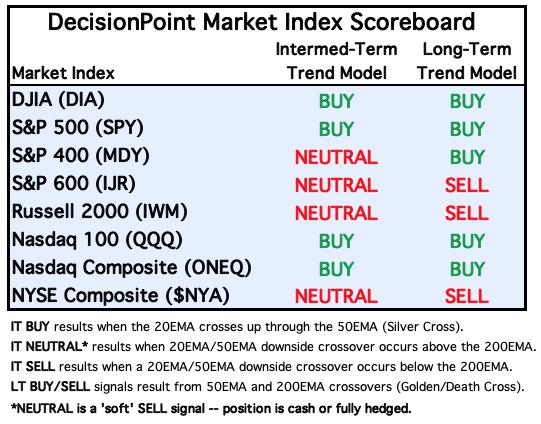

MAJOR MARKET INDEXES

SECTORS

Each S&P 500 Index component stock is assigned to one of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

IT Trend Model: BUY as of 3/30/2023

LT Trend Model: BUY as of 3/29/2023

SPY Daily Chart: The market finished nearly unchanged on the day. A bearish filled black candlestick was formed as price closed below the open, but technically higher than the previous close. This could be a pause, but we have a strong feeling that price will revert back to support at 405.00.

We still see a possible bull flag with the current rally confirming the pattern. The RSI is positive and not overbought. The PMO is still rising albeit flattening. The OBV is confirming the rising trend. Stochastics are comfortably above 80 with the VIX staying above its moving average on the inverted scale. We still see some internal strength, but notice how the relative strength line of the SPY to RSP is falling. This tells us that large-cap stocks are beginning to bow out. It will be up to 'cats and dogs' of the SPX to keep it moving higher.

Here is the latest recording:

S&P 500 New 52-Week Highs/Lows: New Highs are expanding as they should. We don't see weakness in breadth given there were no New Lows.

Climax* Analysis: There was only one climax reading today -- NYSE UP/DOWN Volume Ratio. That is not nearly enough to declare a climax day, and SPX Total Volume was only 79% of the one-year daily average. Still, if it had been a climax day it would've been an exhaustion which matches the bearish filled black candlestick.

*A climax is a one-day event when market action generates very high readings in, primarily, breadth and volume indicators. We also include the VIX, watching for it to penetrate outside the Bollinger Band envelope. The vertical dotted lines mark climax days -- red for downside climaxes, and green for upside. Climaxes are at their core exhaustion events; however, at price pivots they may be initiating a change of trend.

Short-Term Market Indicators: The short-term market trend is UP and the condition is NEUTRAL.

Some good news to report! The STO-B turned back up today. It wasn't by much, but it was up nonetheless. The STO-V is declining so the chart isn't fully bullish. We see that participation is expanding as we would expect on a rally.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is OVERBOUGHT.

The ITBM is definitely overbought with the ITVM not far behind. %PMO Crossover BUY Signals bottomed above the signal line, but with the same amount of rising PMOs as BUY signals, it won't continue rising. Of course, if we see more stocks get rising PMOs tomorrow, it would offer an opportunity for this indicator to rise.

PARTICIPATION and BIAS Assessment: The following chart objectively shows the depth and trend of participation in two time frames.

- Intermediate-Term - the Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA). The opposite of the Silver Cross is a "Dark Cross" -- those stocks are, at the very least, in a correction.

- Long-Term - the Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). The opposite of a Golden Cross is the "Death Cross" -- those stocks are in a bear market.

The market bias is BULLISH in all three timeframes:

We have over 50% of stocks above their 20/50/200-day EMAs. Those percentages are all greater than the Silver Cross Index and Golden Cross Index percentages which implies they will likely continue moving higher.

CONCLUSION: All indicators are bullish except the STO-V as it is declining. Price is holding above support and it should if all of these bullish indicators are correct. We do expect a hiccup tomorrow given today's bearish engulfing candlestick. Don't get us wrong, we are troubled by forgetful investors who are moving past this bank crisis and who believe the Fed will lower rates even though they have a strong conviction to raise them. There are problems that are being ignored. Currently the market bias is favorable so we don't see a need pare exposure. Keeping stops at current levels should provide protection.

Erin is 26% long, 2% short.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

With the continuation of yesterday's breakout, yesterday's comments still apply:

"Bitcoin is finally breaking out above long-term overhead resistance at 29,000. Indicators suggest this rally could get legs. The RSI is positive, rising and not overbought. The PMO has turned up and is close to moving back into a BUY Signal. Stochastics are rising after bottoming above net neutral (50). Technicals favor Bitcoin."

INTEREST RATES

After declining last week, yields reversed on Thursday and continue higher. Most have reached support zones and given the rallies, we expect more upside.

The Yield Curve Chart from StockCharts.com shows us the inversions taking place. The red line should move higher from left to right. Inversions are occurring where it moves downward.

10-YEAR T-BOND YIELD

$TNX continued its rally above support. Indicators are attempting to firm up. The PMO has flattened but isn't really rising. The RSI is in negative territory, but it is rising now. Stochastics are very positive. They reversed yesterday and continued to rise vertically. We expect $TNX to test 3.7%.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 3/28/2023

LT Trend Model: BUY as of 2/24/2023

UUP Daily Chart: UUP saw a "death cross" of the 50/200-day EMAs. Price would have had to get above the 200-day EMA to avoid the signal. The pullback at this resistance level tells us the Dollar is in a holding pattern. Indicators had been improving, but the PMO has already turned back down. Stochastics are still rising so we do believe 27.50 will hold as support.

GOLD

IT Trend Model: BUY as of 3/7/2023

LT Trend Model: BUY as of 1/5/2023

GLD Daily Chart: Gold showed strength today as it rose more than the Dollar was down. While the RSI is positive, the PMO has flattened and Stochastics have turned down. Additionally we have a bearish rising wedge. We expect a breakdown, but if the Dollar is going to continue meandering sideways, Gold may be able to prevent a breakdown below the 50-day EMA.

GOLD Daily Chart: Gold discounts have pared back considerably since March. This means that investors are more bullish than previously. In general, when discounts are low or we see premiums, it often leads to decline.

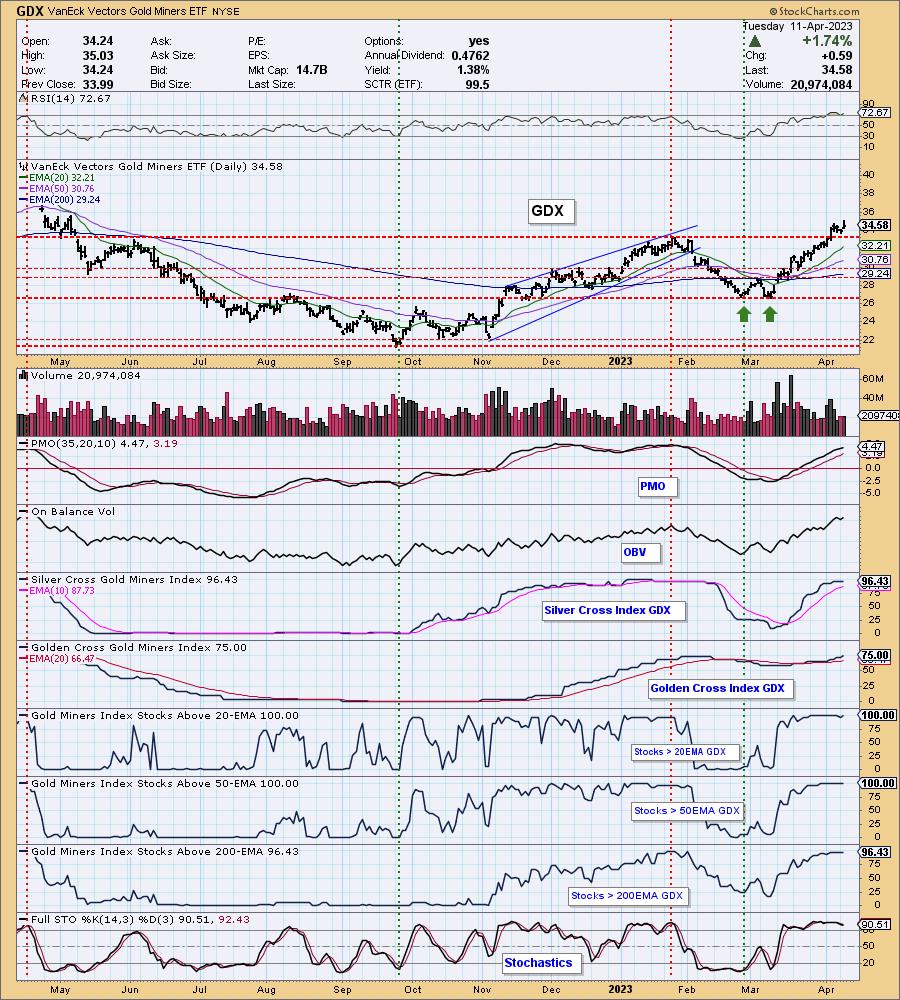

GOLD MINERS Golden and Silver Cross Indexes: Gold Miners aren't ready to stop yet and given the strong participation, internal strength is excellent--basically about as good as you can get given 100% are above both their 20/50-day EMAs. We are expecting some consolidation on support which would offer latecomers a possible entry.

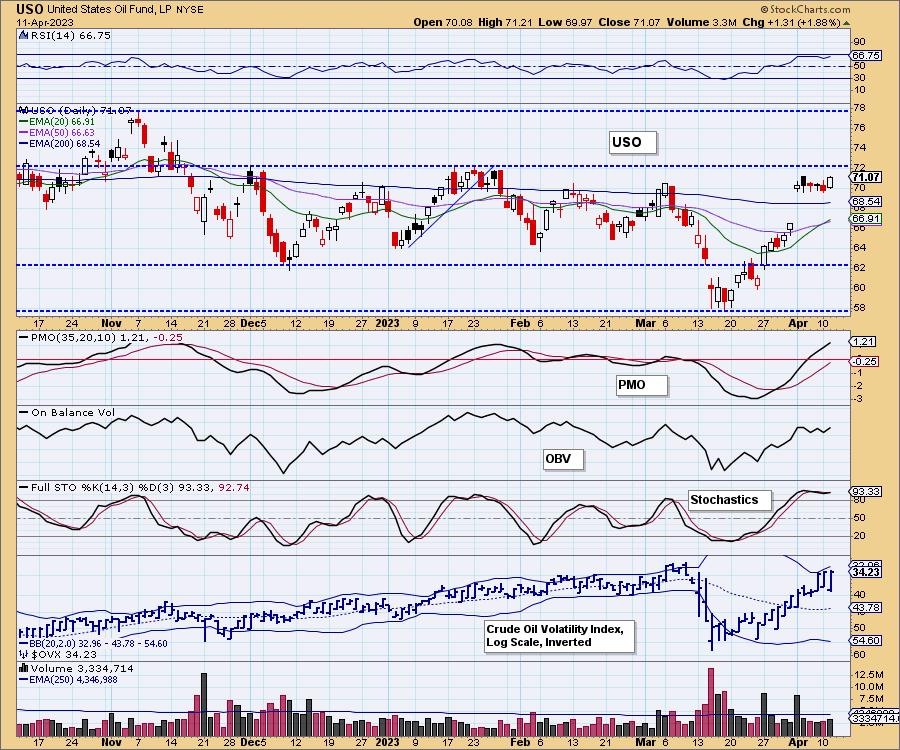

CRUDE OIL (USO)

IT Trend Model: BUY as of 4/10/2023

LT Trend Model: SELL as of 12/6/2022

USO Daily Chart: Crude rallied strongly today, but we are don't like this congested "island" that has formed. If price was going to break out above resistance, we believe it would've done so by now given the strength of the indicators. Stops are a must on any Energy positions. USO is quite vulnerable to a decline, even a possible gap down.

We had seen the rally off the March low as likely to reach the price levels we are currently at and then retreat, keeping the trading range intact. The gap up may have been a red herring.

BONDS (TLT)

IT Trend Model: BUY as of 3/17/2023

LT Trend Model: SELL as of 1/19/2022

TLT Daily Chart: The 20-year yield stumbled, offering TLT an opportunity to rally modestly. It made lower lows and a lower high so our bearish opinion on Bonds hasn't changed. Stochastics have dropped below 80. They usually give us early warning.

We have a trading zone and price is at the top of it. A decline here seems likely given it is declining off the top of the range.

Good Luck & Good Trading!

Erin Swenlin and Carl Swenlin

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.