Today the Russell 2000 ETF (IWM) 20-day EMA crossed up through the 50-day EMA (Silver Cross), generating an IT Trend Model BUY Signal. Like many other market indexes, IWM is rallying off a double bottom. It should be noted that IWM has exceeded its minimum upside target. Also, today's candlestick (not shown) is a shooting star, which is short-term bearish. The rally may need a chance to cool, but the Price Momentum Oscillator (PMO) is very encouraging as it reaches toward a Crossover BUY Signal.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

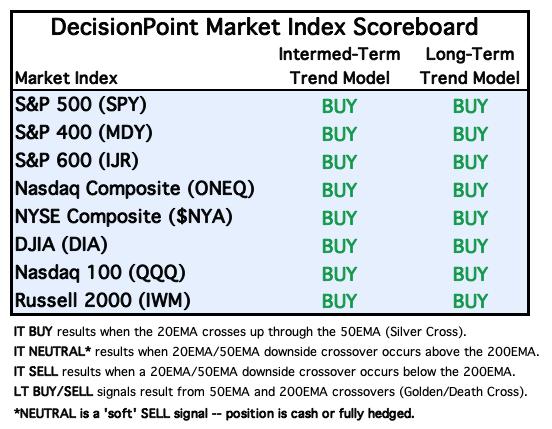

MAJOR MARKET INDEXES

For Today:

For the Week:

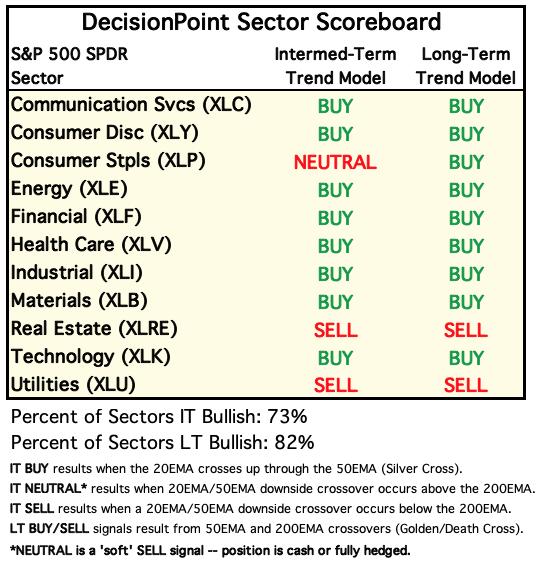

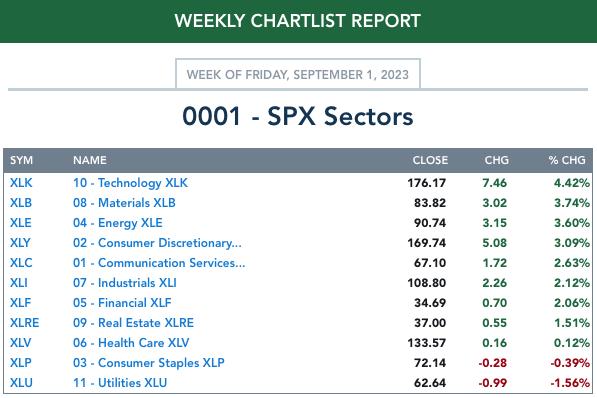

SECTORS

Each S&P 500 Index component stock is assigned to one of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

For Today:

For the Week:

CLICK HERE for Carl's annotated Market Index, Sector, and Industry Group charts.

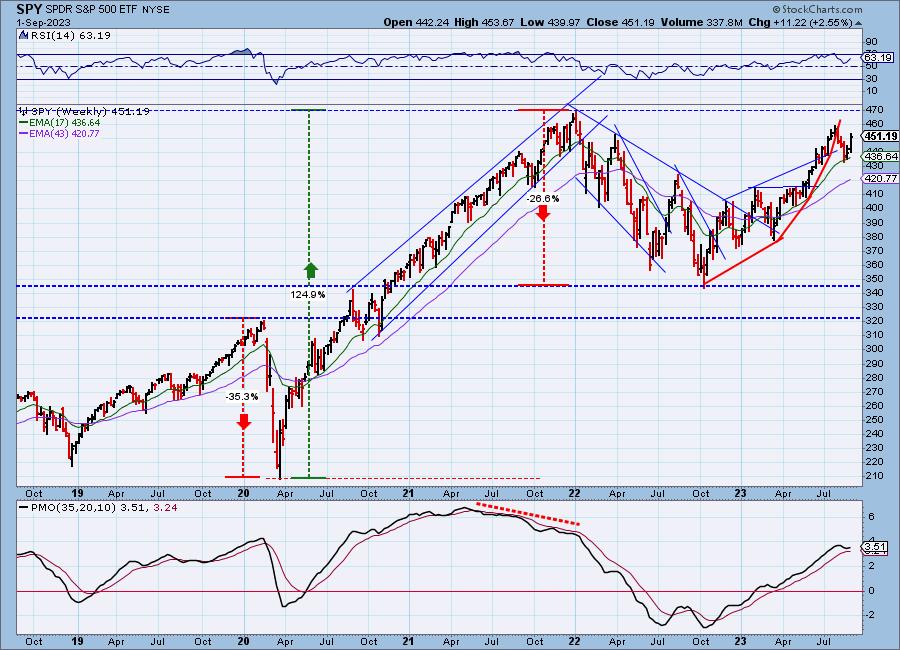

THE MARKET (S&P 500)

IT Trend Model: BUY as of 3/30/2023

LT Trend Model: BUY as of 3/29/2023

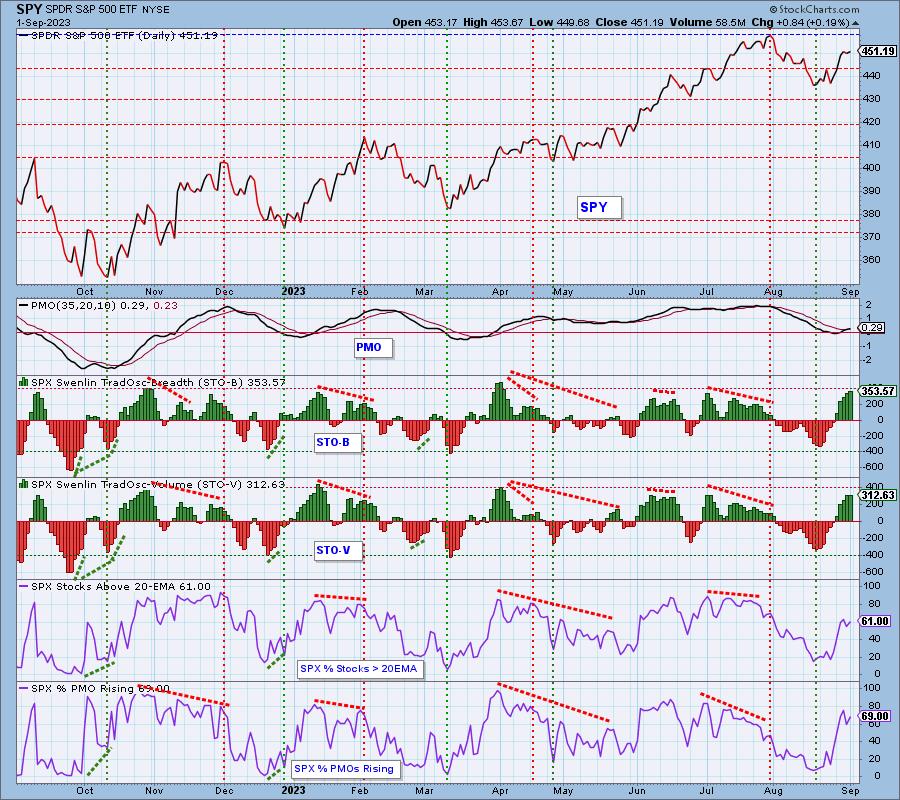

SPY Daily Chart: The market managed a positive close, but didn't finish above the open. That price activity caused a bearish filled black candlestick to emerge. The PMO is on a BUY Signal and the RSI is positive which is good, but this candlestick does imply lower prices will arrive on Monday.

The VIX continues to puncture the upper Bollinger Band on the inverted scale which does suggest a decline over the next day or two. Sentiment may be getting a little too bullish as far as the VIX goes. Stochastics stayed above 80 so internal strength is visible.

SPY Weekly Chart: This week the SPY jumped considerably and that has caused the weekly PMO to surge above the signal line. This is bullish for the intermediate term.

SPY Monthly Chart: The monthly PMO is nearing a Crossover BUY Signal. Any follow-through on this month's rally will bring that BUY Signal to fruition. This is bullish for the long term.

New 52-Week Highs/Lows: New Highs expanded on the rally as expected, but we saw a number of New Lows too which does suggest weakness is seeping in. The 10-DMA of the High-Low Differential is rising and is in positive territory which is bullish for the intermediate to long terms.

Climax Analysis: There were no climax readings today. We saw two climaxes this week. The first was an upside initiation climax that did see follow-through. The bearish upside exhaustion climax didn't see follow-through. When price doesn't comply with bearish signals, it's positive for the market in general.

*A climax is a one-day event when market action generates very high readings in, primarily, breadth and volume indicators. We also include the VIX, watching for it to penetrate outside the Bollinger Band envelope. The vertical dotted lines mark climax days -- red for downside climaxes, and green for upside. Climaxes are at their core exhaustion events; however, at price pivots they may be initiating a change of trend.

Short-Term Market Indicators: The short-term market trend is UP and the condition is OVERBOUGHT.

The Swenlin Trading Oscillators (STOs) are bullish and rising but have become overbought this week. They didn't rise as enthusiastically as before and could suggest a pause in the rally. Participation expanded nicely today but didn't recapture the highs this week. Neither %Stocks > 20EMA nor %PMOs Rising are overbought and both can accommodate more upside. While STOs are overbought, we have seen higher readings previously so a continuation rally is certainly possible.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is NEUTRAL.

All of our IT indicators are in neutral territory. All are rising suggesting we will see higher prices in the intermediate term. %PMO Cover BUY Signals is at 43% but should expand further given we have 69% showing rising PMOs.

_______

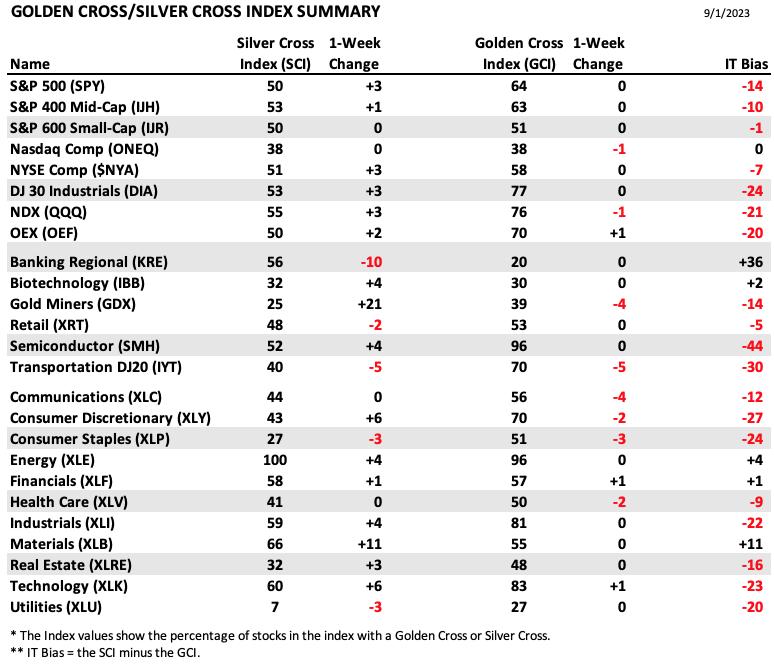

PARTICIPATION: The following tables summarize participation for the major market indexes and sectors. The 1-Week Change columns inject a dynamic aspect to the presentation. There are three groups: Major Market Indexes, Miscellaneous Industry Groups, and the 11 S&P 500 Sectors.

The strongest IT Bias goes to Regional Banks (KRE). This is not a positive situation given the SCI lost the most percentage points on KRE. With another round of Bank problems ahead, we would avoid this industry group.

The most negative IT Bias belongs to Semiconductors (SMH). We aren't worried about this given the strength of the GCI. With SMH leading the prior decline, the SCI was brought down far enough to cause this negative IT Bias. SMH is seeing new improvement to the SCI.

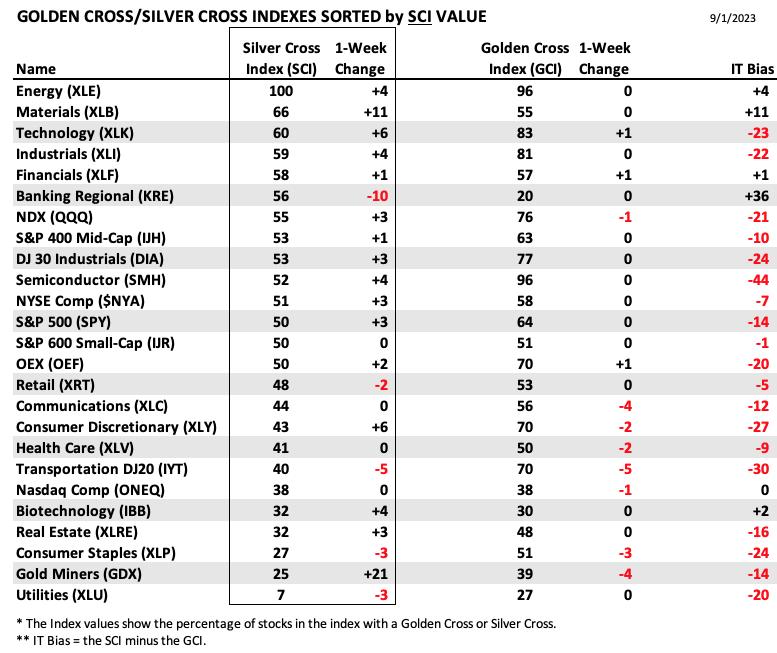

This table is sorted by SCI values. This gives a clear picture of strongest to weakest index/sector in terms of intermediate-term participation.

Energy (XLE) is clicking on all cylinders and shows every stock with a 20-day EMA above the 50-day EMA. The SCI improved to 100% this week. Energy will likely continue to dominate.

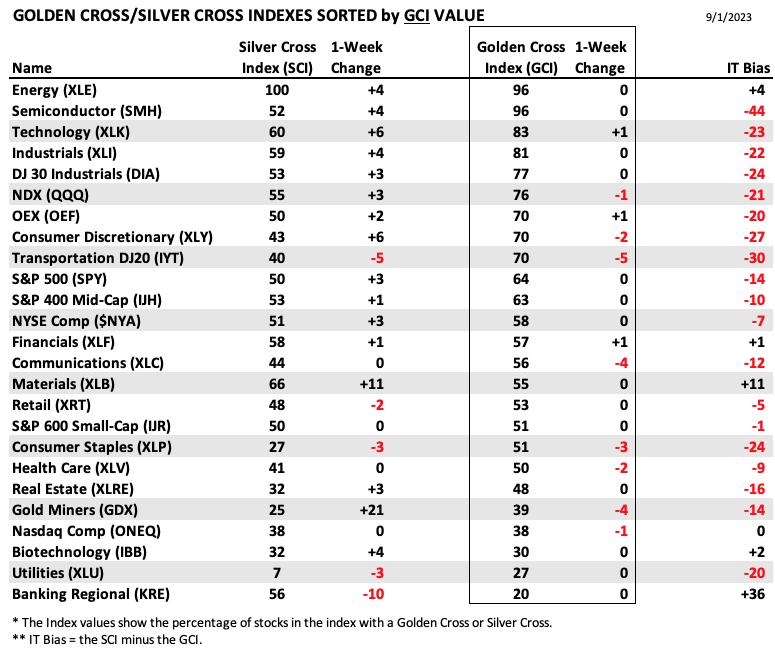

This table is sorted by GCI values. This gives a clear picture of strongest to weakest index/sector in terms of long-term participation.

The highest GCI percentages belong to the strong Energy (XLE) sector and Semiconductors (SMH). Internal strength abounds for both and with this strong foundation, we should expect higher prices. At issue is that there isn't really anywhere for these to go but down, so we should be mindful as we manage positions in these areas.

Regional Banks (KRE) hold the lowest reading on the GCI and based on the loss of percentage points on the SCI, we expect the GCI to begin moving downward soon.

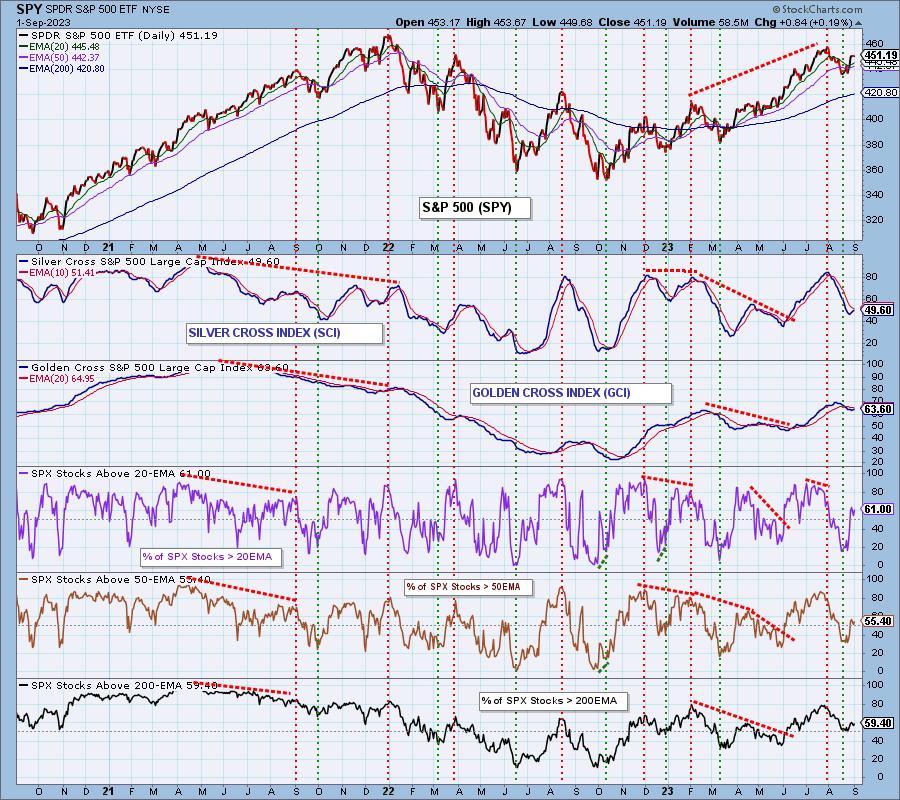

PARTICIPATION: The following chart objectively shows the depth and trend of participation in two time frames.

- Intermediate-Term - the Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA). The opposite of the Silver Cross is a "Dark Cross" -- those stocks are, at the very least, in a correction.

- Long-Term - the Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). The opposite of a Golden Cross is the "Death Cross" -- those stocks are in a bear market.

The short-term market bias is BULLISH.

The intermediate-term market bias is NEUTRAL.

The long-term market bias is BEARISH.

This week the Silver Cross Index began rising again and now is headed toward a Bullish Shift. Given we have far more stocks above their 20/50-day EMAs versus the SCI, we should see it have that Bullish Shift across the signal line. Until we see the Shift we are leaving the intermediate-term bias as Neutral.

%Stocks > 20/50/200EMAs are reading above our 50% bullish threshold which leaves our short-term bias as Bullish. We do not have the GCI higher than %Stocks > 50/200EMAs so we are leaving the long-term bias as Bearish.

BIAS Assessment: The following table expresses the current BIAS of various price indexes based upon the relationship of the Silver Cross Index to its 10-day EMA (intermediate-term), and of the Golden Cross Index to its 20-day EMA (long-term). When the Index is above the EMA it is bullish, and it is bearish when the Index is below the EMA. The BIAS does not imply that any particular action should be taken. It is information to be used in the decision process.

Today the S&P 400 Mid-Cap (MDY) long-term BIAS changed to bearish, and the Nasdaq 100 (QQQ) intermediate-term BIAS changed to bearish. This does hint that all isn't completely well within the market.

_______________

CONCLUSION: The SPY rallied more than 2.5% this week pushing the Silver Cross Index back up on increasing participation. Short-term indicators are overbought right now and today's filled black candlestick does imply a pause or possibly a short decline to digest this strong rally to start next week. This could bring STOs out of overbought territory. Overall the bias remains bullish in the short term and it is improving in the intermediate term. At this point, we expect a pause or short decline next week, followed by a resumption of the rally. Stops should be placed in case a pause turns into a more strenuous decline.

Erin is 50% long, 0% short.

Calendar: The U.S. markets will be closed Monday for Labor Day.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

Bitcoin had a rocky week after a favorable ruling for Grayscale Bitcoin Trust (GBTC) Bitcoin pushed prices outside the recent trading range. The move did not hold and Bitcoin headed back into the range. This has caused the PMO to top beneath the signal line which is especially bearish. Stochastics topped in negative territory. Bitcoin should hold this trading range barring any news noise, but it is very vulnerable to a breakdown based on Stochastics and the PMO.

This chart is to show where some of the support/resistance lines come from. A drop out of the current trading range would be significant given the strength of this current support level.

INTEREST RATES

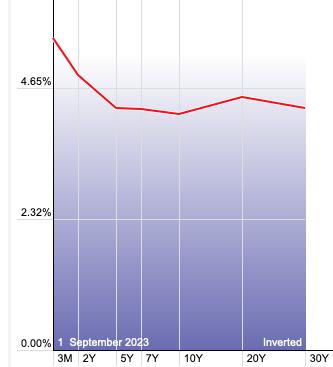

Yields spent the majority of the week moving lower but finished on a high note today. This pullback may be setting up another move higher for yields.

The Yield Curve Chart from StockCharts.com shows us the inversions taking place. The red line should move higher from left to right. Inversions are occurring where it moves downward.

10-YEAR T-BOND YIELD

$TNX hit support and soared higher to finish the week. The RSI has moved back into positive territory, but we don't see any improvement for the PMO and Stochastics. The declining trend is also still intact. We expect yields to rise once again, but indicators will need to improve to protect this level of support.

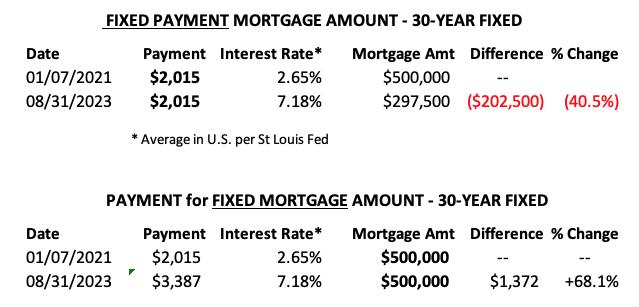

MORTGAGE INTEREST RATES (30-Yr)**

**We watch the 30-Year Fixed Mortgage Interest Rate, because, for the most part, people buy homes based upon the maximum monthly payment they can afford. As rates rise, a fixed monthly payment will carry a smaller mortgage amount. As buying power has been shrinking, home prices have come under pressure.

--

This week the 30-Year Fixed Rate changed from 7.23 to 7.18.

BONDS (TLT)

IT Trend Model: SELL as of 5/16/2023

LT Trend Model: SELL as of 1/19/2022

TLT Daily Chart: TLT was holding onto a rising trend, but today's drop compromised it. This still looks like a constructive bottoming formation, but both Stochastics and the PMO have topped already with the RSI now in negative territory. We are expecting yields to rise once again and leave TLT out in the cold.

TLT Weekly Chart: In spite of a rally this week, the weekly PMO is still declining. The weekly RSI is in negative territory. This looked like a good place for Bonds to begin rallying, but rising yields are not cooperating.

TLT Monthly Chart: The monthly PMO is accelerating lower with the monthly RSI in deeply negative territory. Over we see the bias in all three timeframes as bearish for TLT.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 7/13/2023

LT Trend Model: BUY as of 5/25/2023

UUP Daily Chart: The Dollar pulled back to start the week, but immediately reversed course. Today it printed a giant bullish engulfing candlestick. The PMO has surged (bottomed) above its signal line which is especially bullish. We should expect the Dollar to continue its rally higher.

UUP Weekly Chart: This was an excellent place for UUP to pullback and rebound given the strength of support. Weekly indicators are very favorable so we should look for the Dollar to rise higher.

UUP Monthly Chart: The monthly PMO has surged above the signal line and the weekly RSI is positive. The monthly chart also suggests the Dollar will continue to rally.

GOLD

IT Trend Model: NEUTRAL as of 8/2/2023

LT Trend Model: BUY as of 1/5/2023

GOLD Daily Chart: In spite of a strong Dollar, Gold is plugging along and holding a short-term rising trend. GLD did form a bearish engulfing candlestick so we should expect a decline on Tuesday. Stochastics topped so that is inline with that supposition. However, the PMO is rising and the RSI is positive so ultimately we do expect the rising trend to hold strong.

There is a nice double bottom formation, but we need to see the longer-term declining trend broken. Normally we would be less optimistic given the bullish outlook on the Dollar, but you can see that the correlation between Gold and the Dollar is near zero. They have decoupled from each other so a rising Dollar won't necessarily be a problem for Gold.

GOLD Weekly Chart: The weekly RSI moved into positive territory, but the weekly PMO is still declining. This support level did hold and we have already pointed out the bullish double bottom so we are cautiously optimistic in the intermediate term as well as the short term.

GOLD Monthly Chart: Gold is poised to rally further based on monthly indicators. Discounts have ultimately pared back so investors are feeling more bullish about Gold.

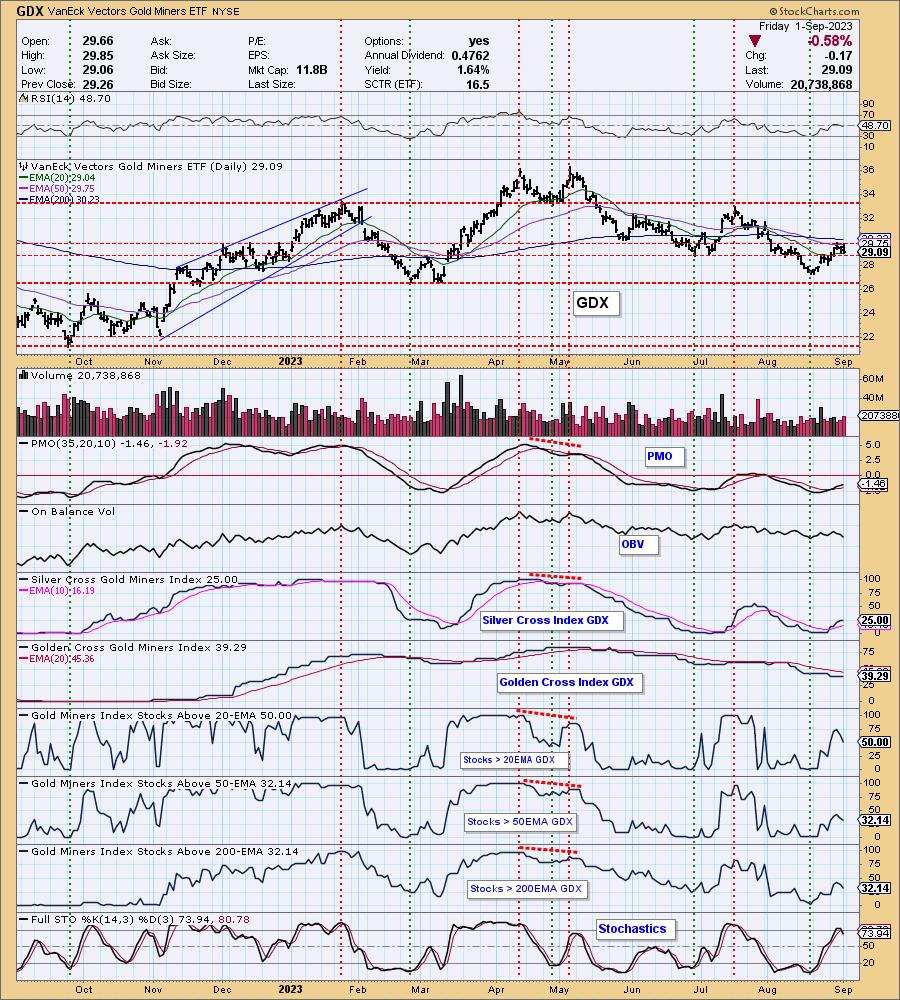

GOLD MINERS Golden and Silver Cross Indexes: Gold looks healthier, but a decline in the market could pose problems for GDX. We've been bullish on GDX, but we need to be aware that internal strength is dissipating somewhat given shrinking readings on %Stocks > 20/50EMAs. Those indicators remain in rising trends, but further deterioration would have us bearish on the group. For now we are cautiously optimistic given the rising PMO and Silver Cross Index.

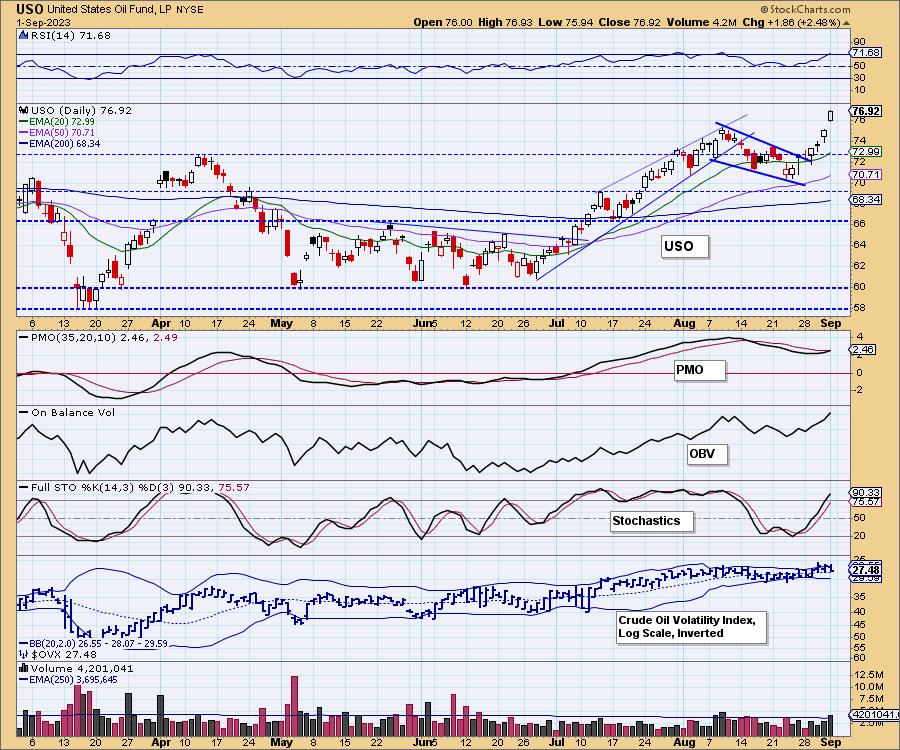

CRUDE OIL (USO)

IT Trend Model: BUY as of 7/12/2023

LT Trend Model: BUY as of 8/3/2023

USO Daily Chart: Crude Oil took off this week and it doesn't appear interested in backing off. The RSI is now in overbought territory, but we know based on late July and early August that it isn't necessarily a problem for USO. The PMO looks very bullish as it nears a Crossover BUY Signal. Stochastics are back above 80. Look for Crude to rally even higher from here.

USO/$WTIC Weekly Chart: We haven't annotated it, but you can see a bull flag that led into this week's breakout. The minimum upside target of the pattern would take price to overhead resistance at the Q2 high.

WTIC Monthly Chart: The monthly PMO is still declining, but it is beginning to decelerate. It was a steep decline for Crude out of the 2022 high and that put major downside pressure on the monthly PMO. This bounce off support is credible and we expect the monthly PMO will turn back up soon.

Good Luck & Good Trading!

Erin Swenlin and Carl Swenlin

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.