Reader requests were fascinating as usual and I can't wait to share some of these great charts! What I found very interesting is that these all come from different sectors. The market continues to nauseate as the up and downs are so volatile it feels like we are pulling Gs each day. If you read today's DP Alert (when I publish it in a few hours), you'll see that this is likely not the end of it. Fear is rampant and investors are in a frenzy to take advantage of the rallies and quickly reap profits before the next down leg. Let's look at a few stocks that are beckoning the short-term trader and could be pockets of strength when market volatility lets up for the intermediate-term investor.

Ball Corp (BLL) - Earnings: 4/30/2020 (BMO)

This was a reader request yesterday and it came up in today's Diamond Scan. I would've presented this one even had it not been requested. There is a lovely bullish cup and handle pattern and it has executed with the breakout from the short-term declining trend. The PMO is turning up, although it is on the overbought side. The SCTR has just entered the "hot zone" above 75. Although the OBV tops are falling, I note that volume itself is around its 250-EMA and speaks less to a 'frenzy' situation of buying and selling.

I like the weekly chart. The PMO recently generated a BUY signal and despite the damage caused by the broad market sell-off, Ball has managed to retain that BUY signal. It is far from overbought. I annotated the cup, but I think you could easily annotate a bull flag as well.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

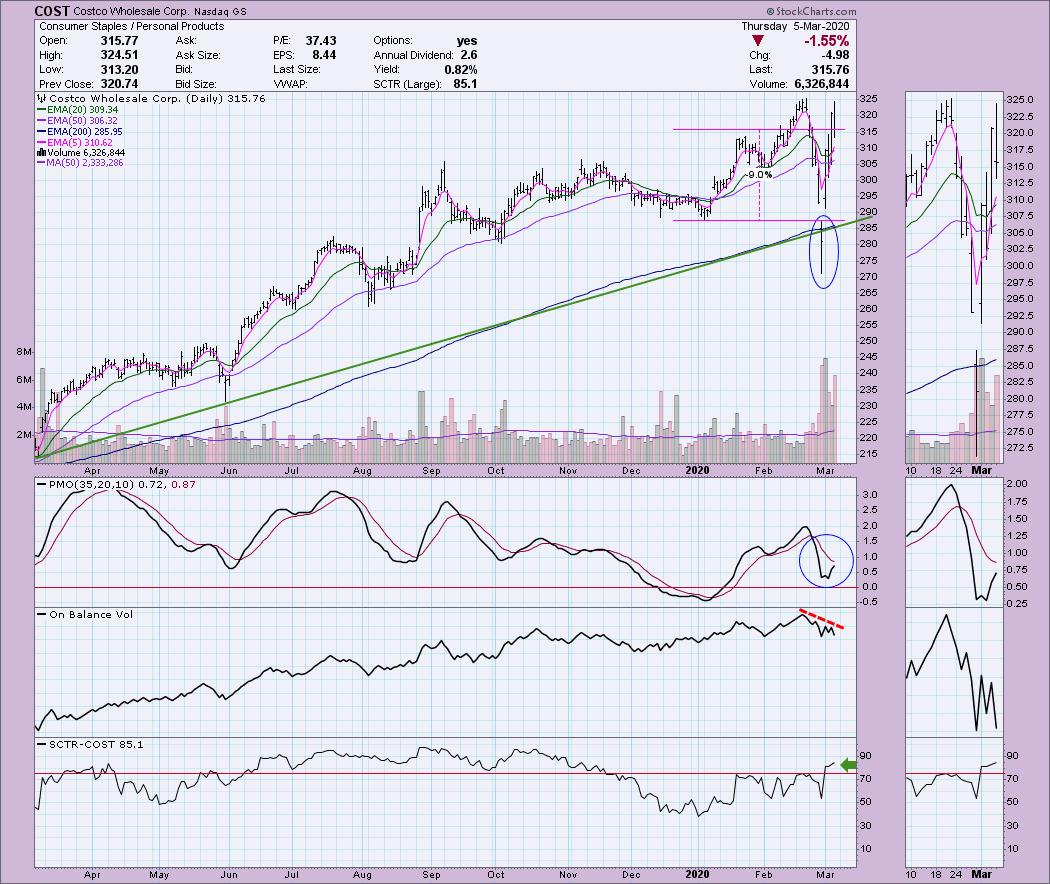

Costco Wholesale Corp (COST) - Earnings: 3/5/2020 (AMC)

This one was getting a lot of coverage on the business news channel I was watching today. It is hard to bet against a company that is having a run up in sales due to the virus. It is still susceptible to market fluctuations as seen by today's 1.5% drop. I'd like a more positive OBV, but the SCTR and PMO are bullish.

The PMO failed to get a BUY signal and turned lower. It is ticking back up currently and if it can turn it around, it really isn't all that overbought. Overhead resistance at all-time highs will likely be difficult to pass if market volatility doesn't subside.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

3M Co (MMM) - Earnings: 4/28/2020 (BMO)

Another newsworthy stock today. Vice-President Pence visited their headquarters today to discuss the shortage of medical masks. The government is ready to boost their production but in the meantime VP Pence suggested people not buy these unless they are sick, so as to preserve them for medical staff. MMM is at a low for the year and is consolidating in a trading range. The PMO has turned up and it is beginning to outperform based on the high SCTR ranking. $155 is the next big hurdle. I'd like to see it jump that before I'd enter. The nice thing is you can set a tight stop if you want to give it a try.

It isn't easy to visualize, but this is a falling wedge, not a declining trend channel. The expected resolution of the pattern would be to the upside. The PMO isn't encouraging yet.

Science Applications International Corp (SAIC) - Earnings: 3/26/2020 (AMC)

I like the set-up on this astute reader request. The PMO is trying to turn back up in oversold territory and the positive divergence with the OBV is quite impressive. This one may have taken a beating in the short-term, but selling volume wasn't nearly as high as buying volume. This is a bullish "V" bottom pattern. I'd like to see the $88 level surpassed. That would put price above the 20-EMA and clear longer-term overhead resistance.

The PMO is in the process of logging a SELL signal. It won't be final until after trading tomorrow, so we could see it fix itself. On the weekly chart, the $90 range looks more compelling as overhead resistance.

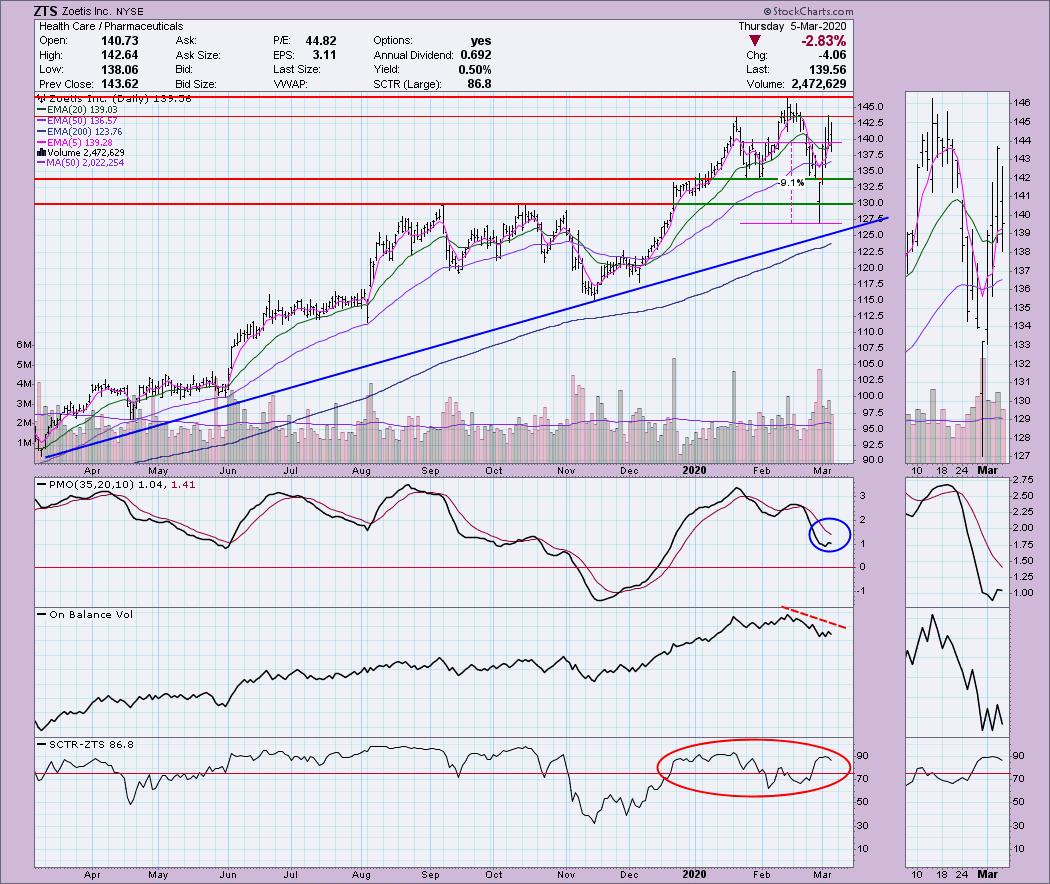

Zoetis Inc (ZTS) - Earnings: 4/30/2020 (BMO)

Interesting chart. The PMO, while it did turn down today, has been rising. Another OBV configuration I'm not thrilled with but the SCTR shows strength. This technically is another "V" bottom that could result in a breakout and continuation above the all-time high. I like pharmas in general right now and this one seems to be in a nice rising trend. Volatility is killing it right now just like the rest of the market.

We saw a double-bottom execute and nearly hit its upside target. Had the market not crashed, I believe this one was headed higher to test all-time highs. With the drop back to the confirmation line of that previous pattern and a rally following, this is enticing. Not only that, but the PMO is on a BUY signal and is not overbought.

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 18

- Diamond Dog Scan Results: 2

- Diamond Bull/Bear Ratio: 9.00

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I do not own any of the stocks above, but am considering a few small positions. I'm currently 60% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas on May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!