I absolutely adore analyzing reader requests! Our readers excel on their choices nearly every time. I have a few "runners" and a couple of big names in the mix today that I think you'll find interesting. I do like many of these charts. Of note today, I had 79 results on the Diamond DOG Scan. I don't have enough data to tell me what this is about, but the last time we had very high numbers was 4/3 and 4/4, the short-term low. I've heard Dow futures are up, so maybe that will hold true again.

Now, for the hard lesson learned. I let everyone know yesterday that I had put a limit order in on RiteAid (RAD). I always type in when earnings are going to be reported and for some reason I got so enamored of the possibilities on RAD (greed) that I didn't refer back to the earnings date. One lesson that I thought I had learned from Tom Bowley was to never hold into earnings. Well, you shouldn't buy into them either <insert eye roll>. The chart is below. Of course my limit was reached right on the open. (Another lesson - no overnight orders, even limit orders in a bear market). Now I need to determine when to get out, likely I will be up early tomorrow watching how RAD digests today's giant move lower with the hope to get out while the getting is good. I think it only fair that I admit to my mistakes. Not all of these work out and I don't pretend otherwise. However, in this particular case, I did let everyone know I had a limit order and felt I needed to talk about it up front.

I was able to get into CPB and BIIB today and thankfully they worked out much better!

Live Trading Room - Tuesdays/Thursdays

I'm teaming up with Mary Ellen McGonagle (MEMInvestmentResearch.com) to do regular "LIVE Trading Room" sessions for FREE at 11:00a EST. We've had excellent reviews on our new LIVE Trading Rooms so far and plan on continuing them Tuesdays/Thursdays 11:00a EST. The link will be sent out the day before the event, so watch your email and tell your colleagues to sign up for our free email list on DecisionPoint.com to be notified!

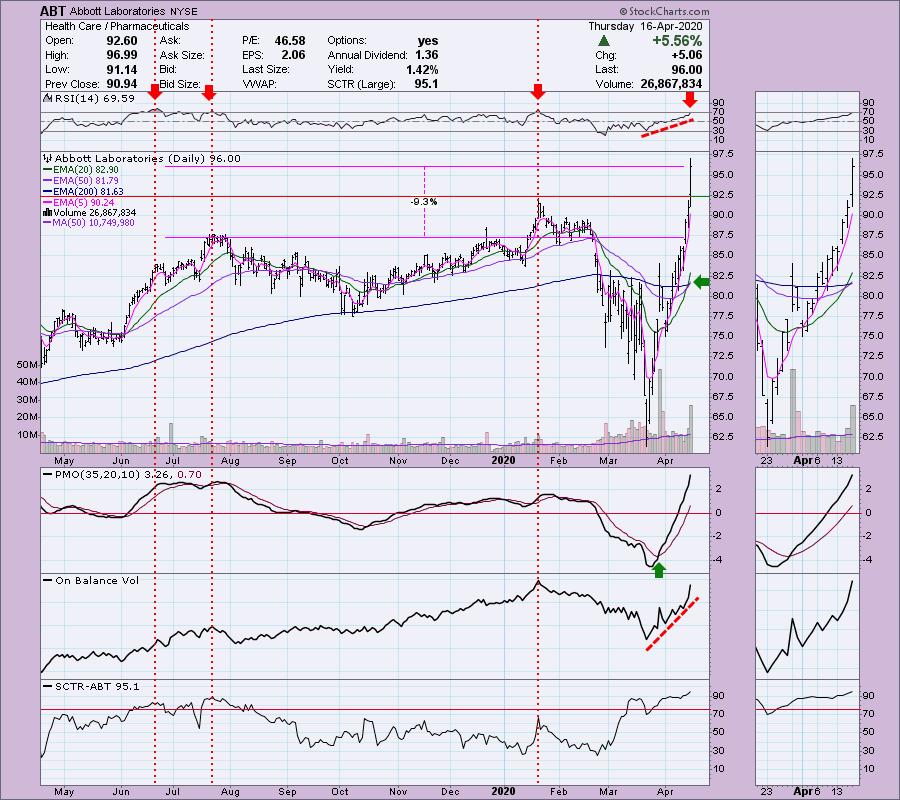

Abbott Laboratories (ABT) - Earnings: 4/16/2020 (BMO)

Mary Ellen and I talked about this one this morning in the Trading Room. It's a runner, but as Mary Ellen said, many times strong stocks will continue to run. A proper stop can help. We are seeing a Silver Cross (20/50-EMA positive crossover) and a Golden Cross (50/200-EMA positive crossover). The rally is nearly vertical and in my estimation ready for a pullback. Notice how this stock behaves when the RSI hits overbought territory. The PMO is also overbought-ish (highly technical term). It appears very overbought, but we can see a negative reading of -4, that says we can get a move to +4. This one should see a pullback. It reported earnings today which could account for the high volume interest. I'd look for some profit taking to occur. An excellent point of entry would be $92.50, right on support.

ABT has only just made it back into its rising trend. The 17/43-week EMAs have turned up and we are set for a new PMO BUY signal after the close tomorrow.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Catasys Inc (CATS) - Earnings: 5/7/2020 (AMC)

I like the pullback today, but with price closing near the lows, we might see more pullback before rally. This is in the Health Care Providers industry group. This group has been showing excellent relative strength and CATS is one of the leaders. We have a recent Silver Cross and Golden Cross. The RSI is overbought and an overbought RSI typically precedes a downturn. This is an excellent stock, but might need to see it pullback before entering.

Price is up over 20% this week. Not something I'd want to chase. The weekly PMO is ready to trigger a BUY signal after the close tomorrow (weekly signals aren't final until the close of the last trading day of the week). I really like this one, but I would want to wait on a pullback.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dropbox Inc (DBX) - Earnings: 5/7/2020 (AMC)

Mary Ellen made a great point in today's Trading Room session. She is finding areas of Technology to be 'defensive' not 'aggressive' which goes against the textbook definition of Technology as being a highly aggressive sector. She specifically talked about the Software industry. Dropbox is struggling against overhead resistance at the January and March tops. The good news is that it isn't overbought and we are seeing a new Silver Cross. It does seem poised to move higher. The PMO is rising and the RSI is rising but not overbought. There is a reverse divergence with the OBV. Despite lower lows on the OBV, price has been able to rise anyway. This one strikes me as a "momentum sleeper".

The upside target on this one is wonderful and a PMO bottom above the signal line is almost always a good sign.

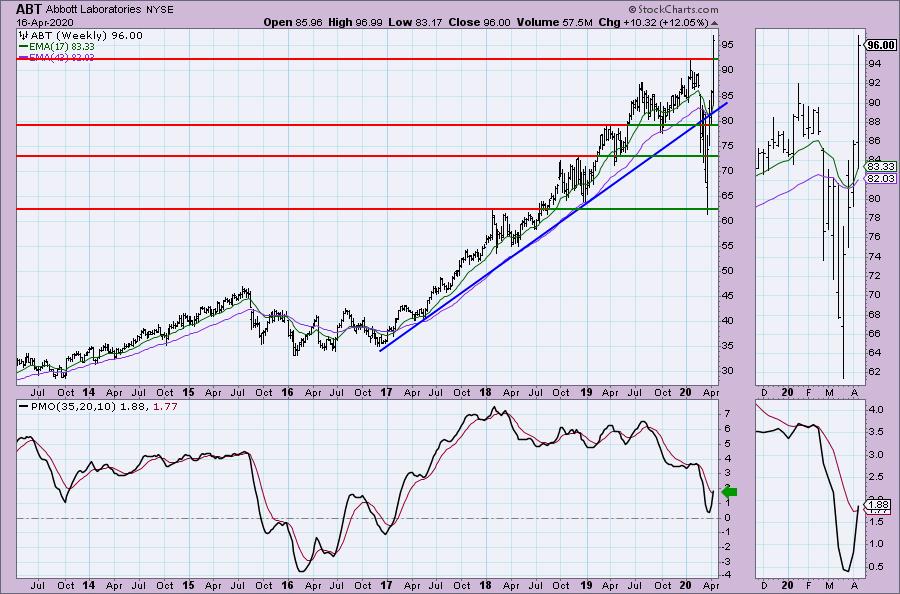

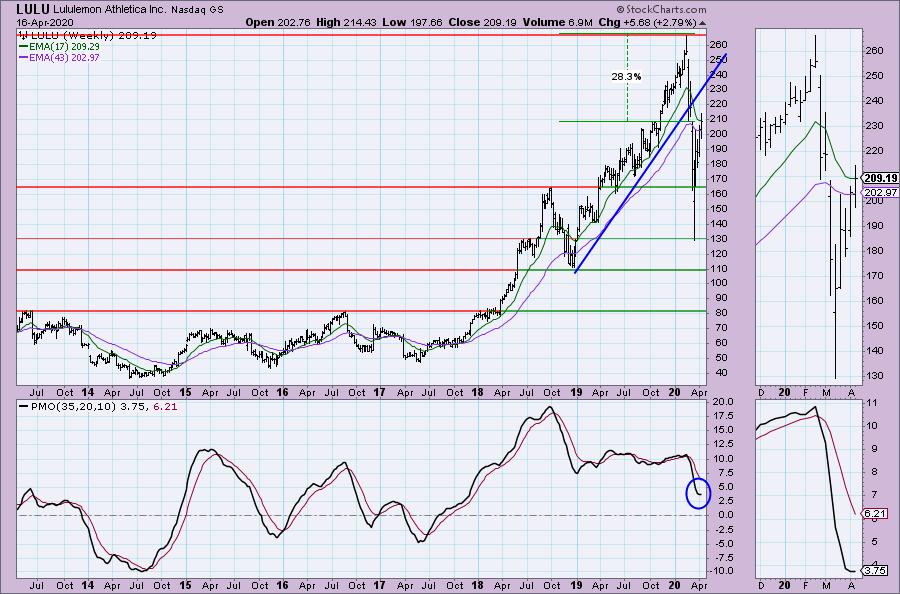

Lululemon Athletica Inc (LULU) - Earnings: 6/10/2020 (AMC)

We could be looking at the execution of a bull flag and that would mean a rally that should challenge all-time highs. The PMO has just reached positive territory and today's high broke above resistance at the October top and flag pole top. The RSI is rising but isn't overbought. The OBV broke out along with this price breakout and that confirms the breakout. The SCTR is well into the "hot zone" above 75. With this week's break above the 50/200-EMAs, it avoided a Death Cross which I also find very bullish.

The weekly chart is okay. The rising trend was broken on the crash and it hasn't recaptured it just yet. The PMO is turning up which suggests it should be able to move back into the intermediate-term rising trend.

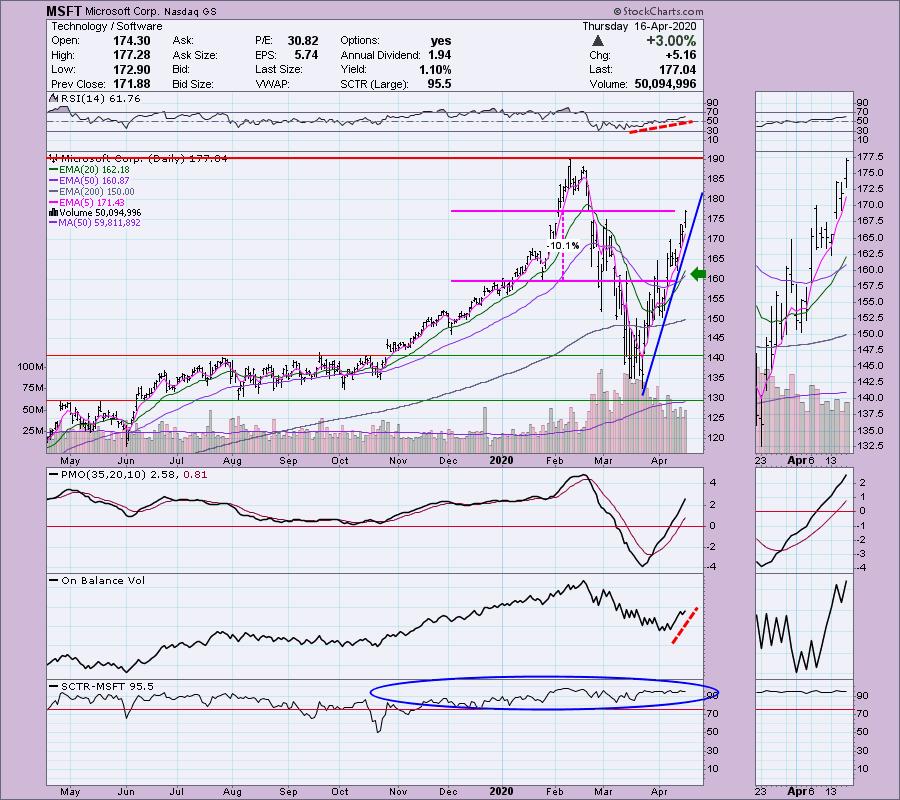

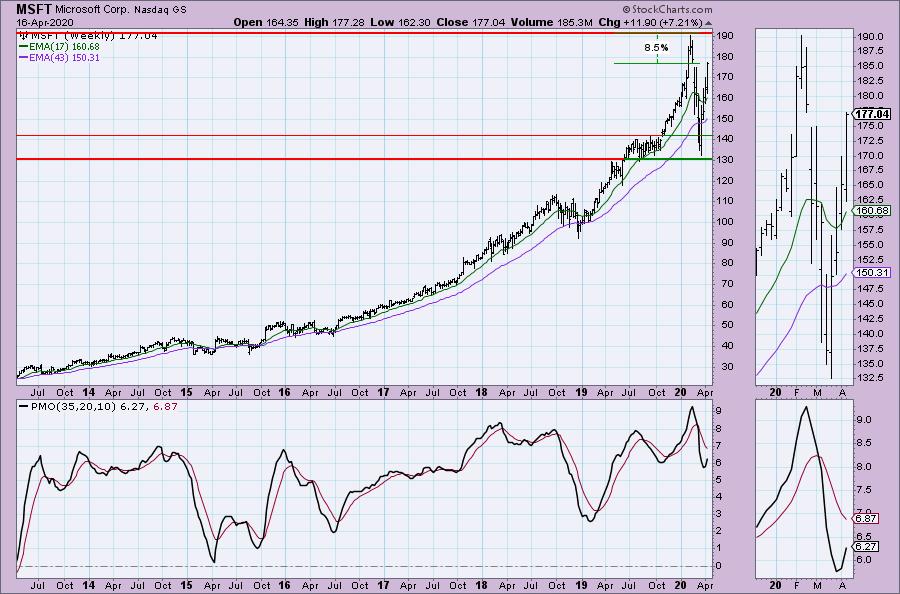

Microsoft Corp (MSFT) - Earnings: 4/29/2020 (AMC)

I really like the Microsoft chart. We just got a Silver Cross and price has formed a nice rising trend, albeit steep, but not parabolic. I would set a stop along the 20-EMA around $162.50. I've annotated a 10% stop which aligns with the January low. The RSI isn't overbought and neither is the PMO. OBV is confirming the move. I like this chart.

The upside target is the all-time high, but I suspect it will ride higher given the very nice hook on the PMO

Before I finish, I just want to reiterate that Diamonds are not a stock-picking service, not at $25/mo! I'm not a CFP and therefore cannot make recommendations. I want you to see what I'm seeing. I want to narrow your focus on what I'm looking at. And truth be told, 95% of my investments literally come from the Diamonds or the Trading Room. I can highly recommend Mary Ellen McGonagle's service (MEMInvestmentResearch.com) if you want to watch a model portfolio in action with buy and sell notifications.

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 3

- Diamond Dog Scan Results: 79

- Diamond Bull/Bear Ratio: 0.04

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I do not own any of the stocks above but will be looking for possible entry into MSFT or LULU (thanks for the tips, readers!) I'm currently 50% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!