Reader request day! I have one faithful Diamonds reader who never misses out on putting in requests. Don't miss your opportunity to have me review your symbols! George, thank you for your faithful readership and excellent picks. I'm starting to consider you a silent Diamonds partner so I thought it was time to give you some credit. His two requests today are RNG and GDDY. I have two other requests (thanks, Jon and Paula!) and then a shorting opportunity that I found while doing today's live trading room that I'm hoping to get on tomorrow. Full disclosure, I did enter BYND at the end of today on its low using the 5-min bar chart below. I find the 5 and 15-minute charts to be valuable for timing entries. Here's what I looked at. Notice at the end of the day the PMO had a positive crossover and that was followed by the RSI moving above 50. While the RSI did fall after that, we can see that it is now back above net neutral (50).

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

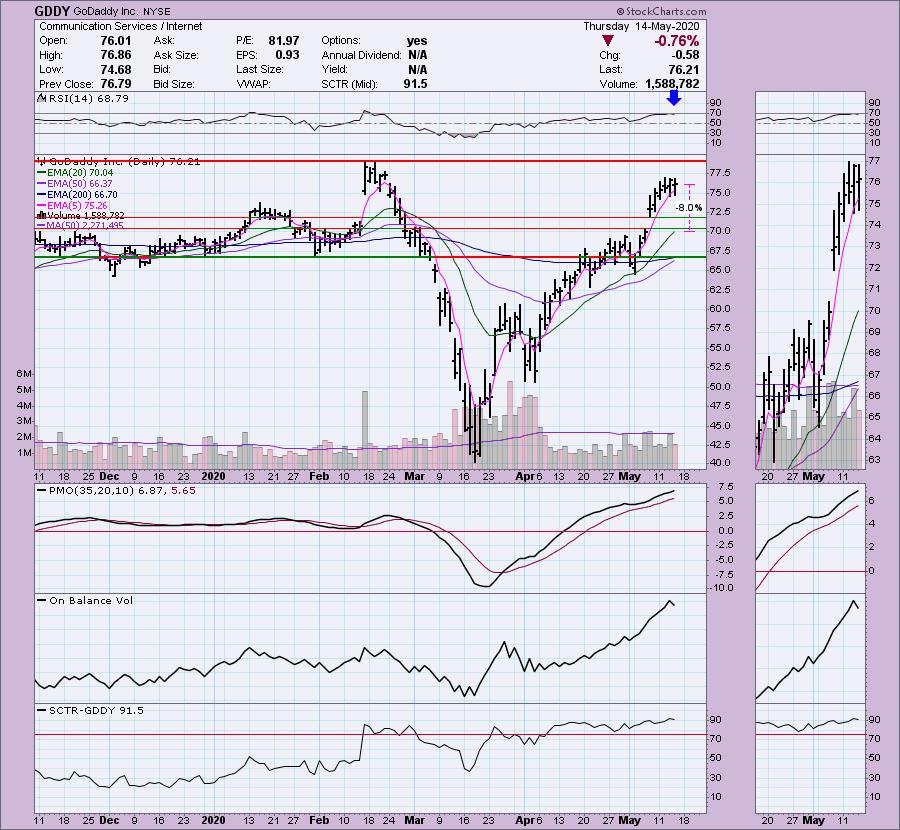

George: GoDaddy Inc (GDDY) - Earnings: 7/30/2020 (AMC)

GoDaddy, Inc. engages in the provision of domain name registration and web hosting services. It provides website building, hosting, and security tools.

GDDY is down slightly (-0.08%) in after hours trading. We are seeing a bit of rounded top on price, but the RSI is positive and not in overbought territory (+70). The PMO appears overbought, but we can see it has managed a reading of -10 at the bottom of the range. With the declining top, I might watchlist this one to see if I could get a better entry. I've marked the stop below the gap from early May. Typically when a gap is covered, price will continue in that direction. A lower price entry on this would allow that stop to be less than the 8% it currently is at.

Great weekly chart as far as the PMO and upside potential. My concern would be the declining tops trendline that we will want to see broken very soon.

Remember DecisionPoint Bundle Subscribers Get the

LIVE Trading Room for FREE ($49.95 Value)! Upgrade Today!

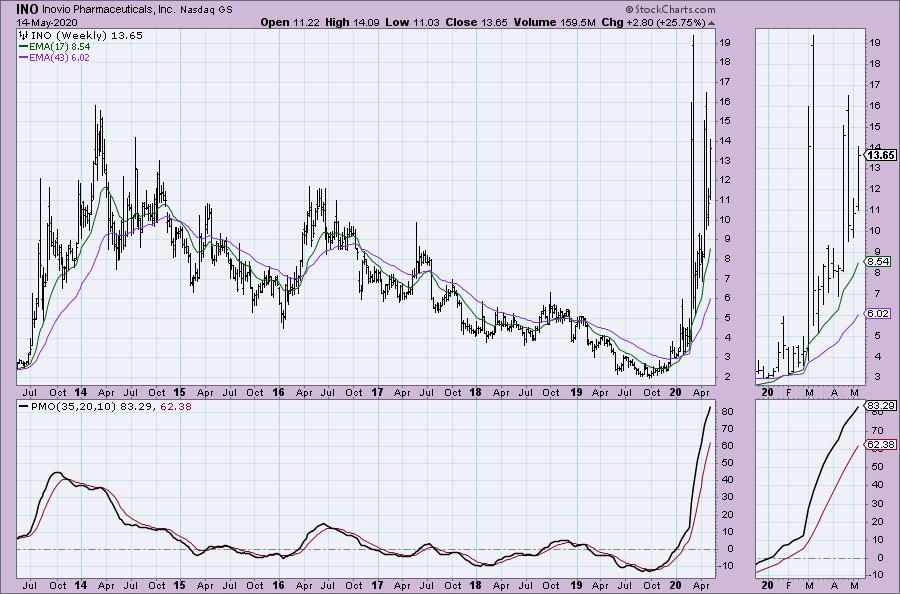

Jon: Inovio Pharmaceuticals Inc (INO) - Earnings: 8/6/2020 (AMC)

Inovio Pharmaceuticals, Inc. is a late-stage biotechnology company. It engages in the discovery, development, and commercialization of DNA-based immunotherapies and vaccines. The firm's drug candidates include SynCon immunotherapies which helps break the immune system's tolerance of cancerous cells; and CELLECTRA delivery system which facilitates optimized cellular uptake of the SynCon immunotherapies.

Early subscribers will likely remember this Diamond. I actually picked it before the March spike. Unfortunately I didn't get into it mainly because of the low price point. I mentioned this one in early March as a virus play. It had been linked as a potential coronavirus partner with the government. I think Jon has the right idea. It is making another run and the PMO is turning around to support that, as well as the positive RSI.

Nice weekly PMO, but it is unnerving to see the volatility on this low priced stock. Proceed with caution!

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

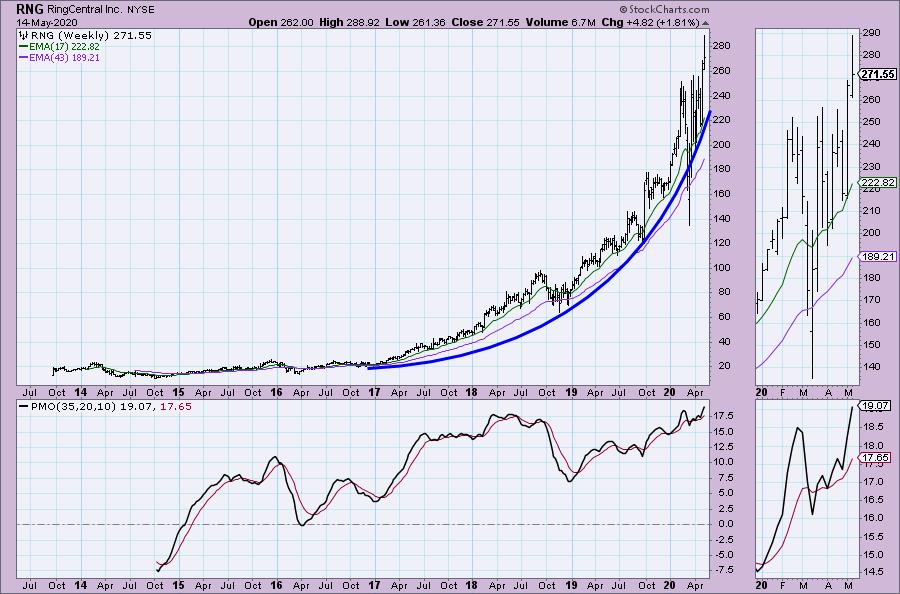

George: RingCentral Inc (RNG) - Earnings: 7/27/2020 (AMC)

RingCentral, Inc. engages in the provision of global enterprise cloud communications and collaboration solutions. The firms solutions provide a single user identity across multiple locations and devices, including smartphones, tablets, PCs and desk phones; and allow for communication across multiple modes, including high-definition voice, video, SMS, messaging and collaboration, conferencing, online meetings and fax. It sells its products under the RingCentral Professional, RingCentral Glip, and RingCentral Fax brands.

Today's pullback is offering us a much better entry than yesterday. It is currently up +0.17 in after hours trading. The PMO is decelerating, but that should be expected given today over 4% decline. It is clearing overbought conditions on the RSI which is helpful as well.

The weekly PMO is encouraging. I'm never a fan of a parabolic, definitely set a stop.

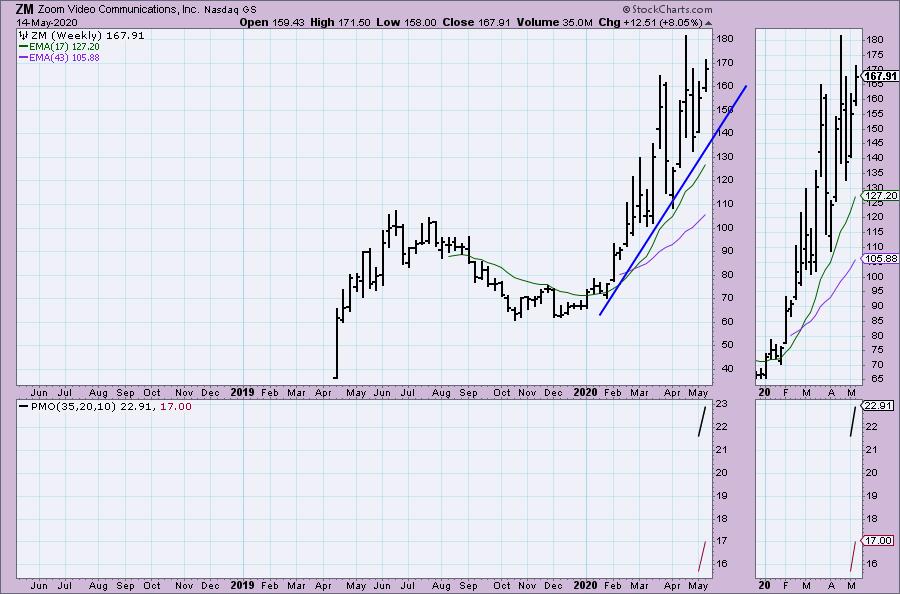

Paula: Zoom Video Communications Inc (ZM) - Earnings: 6/2/2020 (AMC)

Zoom Video Communications, Inc. engages in the provision of video-first communications platform. It connects people through frictionless video, voice, chat and content sharing, and enable face-to-face video experiences for thousands of people in a single meeting across disparate devices and locations. It focuses on customer and employee happiness, a video-first cloud architecture, recognized market leadership, viral demand, an efficient go-to-market strategy, and robust customer support.

I have to laugh at the last three words in the description of the company. I can tell you firsthand that customer support is far from robust right now with the demand. I'll not hold it against the chart which looks good right now. The RSI is above net neutral, the PMO has just triggered a BUY signal and you can set a reasonable stop just below support at the mid-April tops and the top of the gaps.

ZM isn't sporting a parabolic pattern which I definitely like. Not enough price data for the PMO to be helpful.

SHORT: Apache Corp (APA) - Earnings: 7/29/2020 (AMC)

Apache Corp. operates as an energy company, which engages in the exploration, development, and production of natural gas, crude oil, and natural gas liquids.

I hope to short this one despite it already seeing a nearly -3.5% decline today. The RSI has just gone negative below 50. The PMO has topped and the rising trend has been broken. The OBV is confirming the decline. Look in the thumbnail and you can see that volume has been increasing on this decline. The SCTR went from the 90's to 8.7 since the April top!

There is a bright spot on the weekly chart with the new PMO BUY signal, but I don't believe that will stick given the problems in the Oil industry right now.

Current Market Outlook:

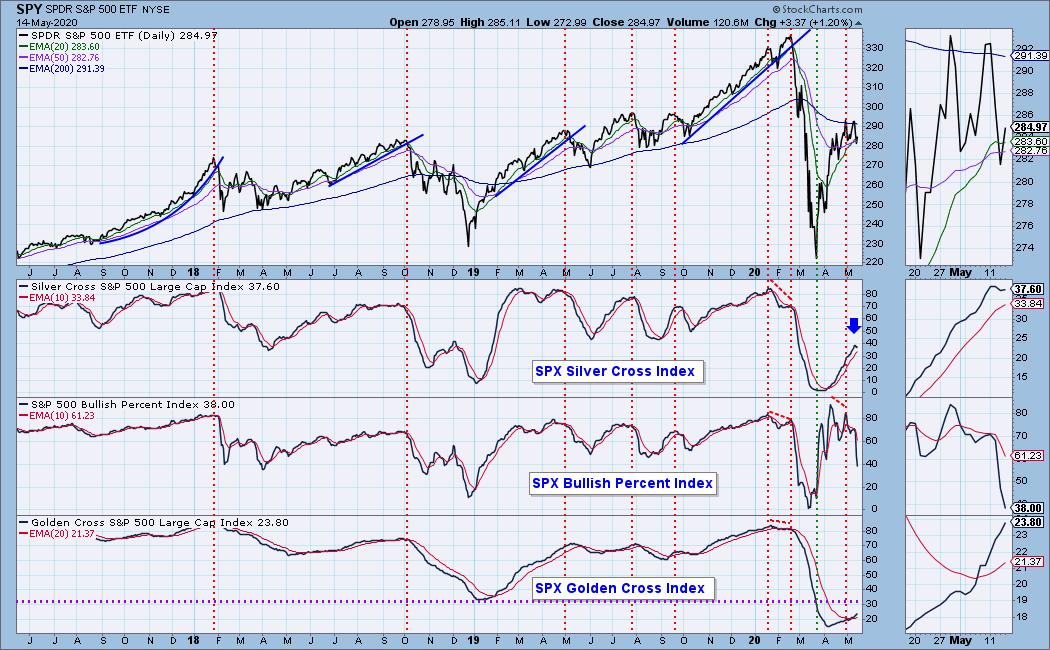

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 3

- Diamond Dog Scan Results: 563

- Diamond Bull/Bear Ratio: 0.01

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I don't own any of the stocks above but am considering opening one of the short positions. I'm currently 25% in cash. My trading timeframe has moved from intermediate-term to short-term and therefore I'm investing more.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!