First off, I hope you all set stops and targets. If you aren't setting both (even in a spreadsheet or price alert instead of "hard" stops/targets), you should as a practice. Right now, I'd say with volatility and an unusual market environment, it is a necessity. I went in today and readjusted my stops AND my targets. When the market begins to act "toppy", it is a good idea to tighten your range between stop and target. I methodically went through all of my portfolio holdings and meticulously looked at each chart, determined a closer stop and set price alerts when I reach overhead resistance levels. When you are alerted to a price target being hit or exceeded, it is reminder to go reevaluate the chart and determine if you'd want to buy the stock 'right now' if you weren't already holding the position. If the chart looks good, I ride it. If it is neutral or weakening, I will sell part or all of my position. You'll find in upcoming Diamonds Reports that I will have tighter stops and targets listed. Remember, a target is not only where I want to see this stock go, it can be a more modest upside target to trigger a relook.

As a reminder, I'm taking your symbol requests for Thursday's report. Email them to me at erin@decisionpoint.com.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Calavo Growers Inc (CVGW) - Earnings: 6/8/2020 (AMC)

Calavo Growers, Inc. engages in marketing and distribution of avocados, prepared avocados, and other perishable foods. It operates through the following segments: Fresh Products, Calavo Foods, and Renaissance Food Group. The Fresh Products segment grades, sizes, packs, cools, and ripens avocados for delivery to the customers. The Calavo Foods segment procures and processes avocados into wide variety of guacamole products; and distributes the processed products to the customers. The Renaissance Food Group segment produces, markets, and distributes nationally a portfolio of healthy fresh packaged food products for consumers via the retail channel.

I love avocados and apparently this company is the purveyor of everything avocado! Today CVGW broke out, but ultimately closed near its low. I have this one listed with a short leash stop about halfway down into the double-bottom formation. The reason I like this one is that double-bottom formation, so if it collapses and doesn't execute, I'm not going to want to hold onto it. However, despite a -2.25% drop today, the PMO is still rising and triggered a BUY signal. I've annotated the gap from March. I believe that will be a very difficult area of resistance. It has failed there before.

The weekly PMO has turned up. A larger double-bottom is visible on the weekly chart. I have a target set at the top of the gap that I noted on the daily chart. That alone would give me a 22% gain, but I would set a price alert at about $66 just so I could watch what price does at the beginning of gap resistance.

Remember DecisionPoint Bundle Subscribers Get the

LIVE Trading Room for FREE ($49 Value)! Upgrade Today!

Encompass Health Corp (EHC) - Earnings: 7/27/2020 (AMC)

Encompass Health Corp. engages in providing post-acute healthcare services. It operates through the following segments: Inpatient Rehabilitation and Home Health & Hospice. The Inpatient Rehabilitation segment operates inpatient rehabilitation hospitals that provides rehabilitative treatment and care to patients who are recovering from stroke and other neurological disorders, cardiac & pulmonary conditions, brain & spinal cord injuries, complex orthopedic conditions and amputations. The Home Health and Hospice segment provides Medicare-certified home nursing, specialized home care and in-home services.

Yesterday EHC busted out of its intermediate-term declining trend and had a strong follow-on rally today. Price popped up above resistance, but did end up settling just below. The PMO has generated a crossover BUY signal and volume is clearly coming in on the breakout. It had a big 3% move today so it may be in need of a pullback. It would then need to make another go at resistance. Given the RSI and positive PMO, I am looking for it to breakout.

The weekly PMO is about ready to log a new IT BUY signal. I set the target at the all-time high, but you may want to give it a relook as it approaches $80.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

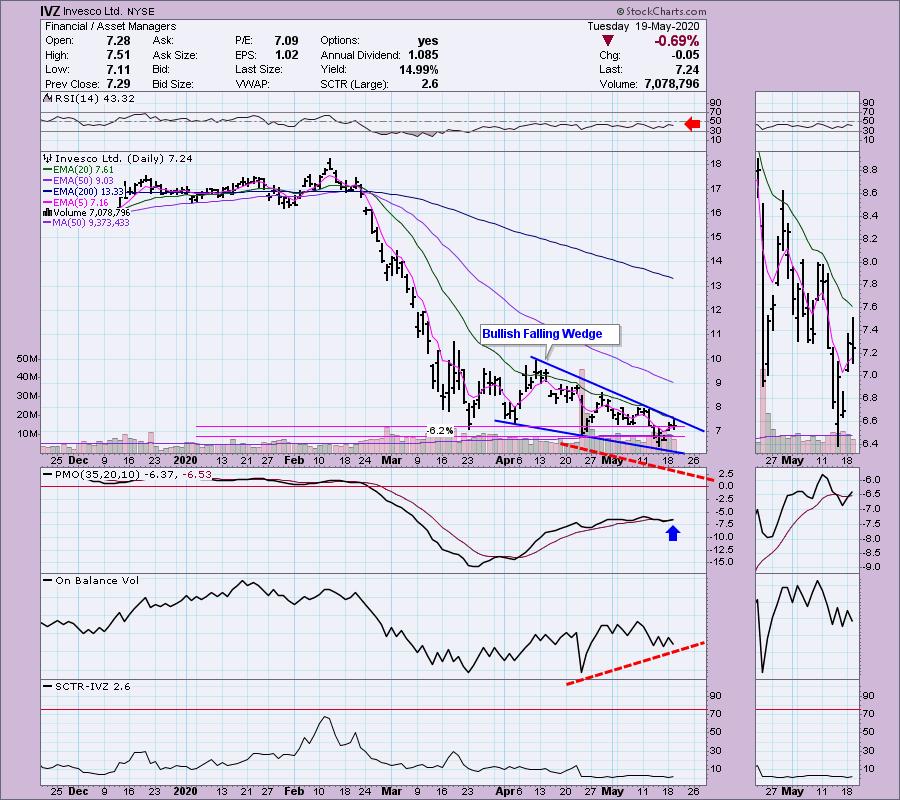

Invesco Ltd (IVZ) - Earnings: 7/23/2020 (BMO)

Invesco Ltd. engages in the investment management business. Its product includes mutual funds, unit trusts, exchange-traded funds, closed-end funds, and retirement plans.

This is for the bottom fishers out there. Currently IVZ is up +1.14% in after hours trading, so maybe others are seeing the possibilities on this chart. We don't have the breakout yet, but this is a bullish falling wedge and the expectation is an upside breakout. The PMO triggered a BUY signal today. The RSI is still below 50, so this may not be ripe until we see the breakout from the wedge. There is a very nice OBV positive divergence that does suggest that breakout will arrive. I do have a 'short leash' stop at the April low, but I'd wait for that breakout. There's plenty of upside potential, so it would be worth the wait.

Not a great weekly chart, but bottom fishing will generally lead to a chart like this. If we get that breakout, I have an upside target at the $10 mark for a relook, but I would hope to be able to ride it back to $14.

NetGear Inc (NTGR) - Earnings: 7/22/2020 (AMC)

NETGEAR, Inc. engages in the provision of Internet connected products to consumers, businesses, and service providers. It operates through the following segments: Connected Home, and Small & Medium Business. The Connected Home segment focuses on consumers and consists of high-performance, dependable and easy-to-use WiFi Internet networking solutions such as WiFi mesh systems, routers, 4G/5G mobile products, smart devices such as Meural digital canvasses, and services offering consumers a range of parental controls and cyber security for their home networks. The Small & Medium Business segment focuses on small and medium-sized businesses and consists of business networking, wireless LAN, storage, and security solutions that bring enterprise-class functionality to small and medium-sized businesses at an affordable price.

Yesterday NTGR executed a bullish ascending triangle. The expectation of the pattern is a move the height of the back end. That would easily take NTGR to its December top. The PMO triggered a BUY signal and has managed to decompress out of very overbought territory even while price lows were rising. That a reverse divergence that equals internal strength. The RSI has landed above the 50 reading. The OBV is confirming the move and the SCTR is almost in the "hot zone" above 75. I set a stop just below $23. Basically I would watch to see if the rising trend that forms the bottom of triangle holds. If it doesn't, I wouldn't be interested.

I have a target for a 'relook' at the 2018 low as that appears to be the next area of overhead resistance to worry about. I suspect if it reaches that point it will continue higher, but I'd want to make sure the technicals are still strong when it hits just above $28.50.

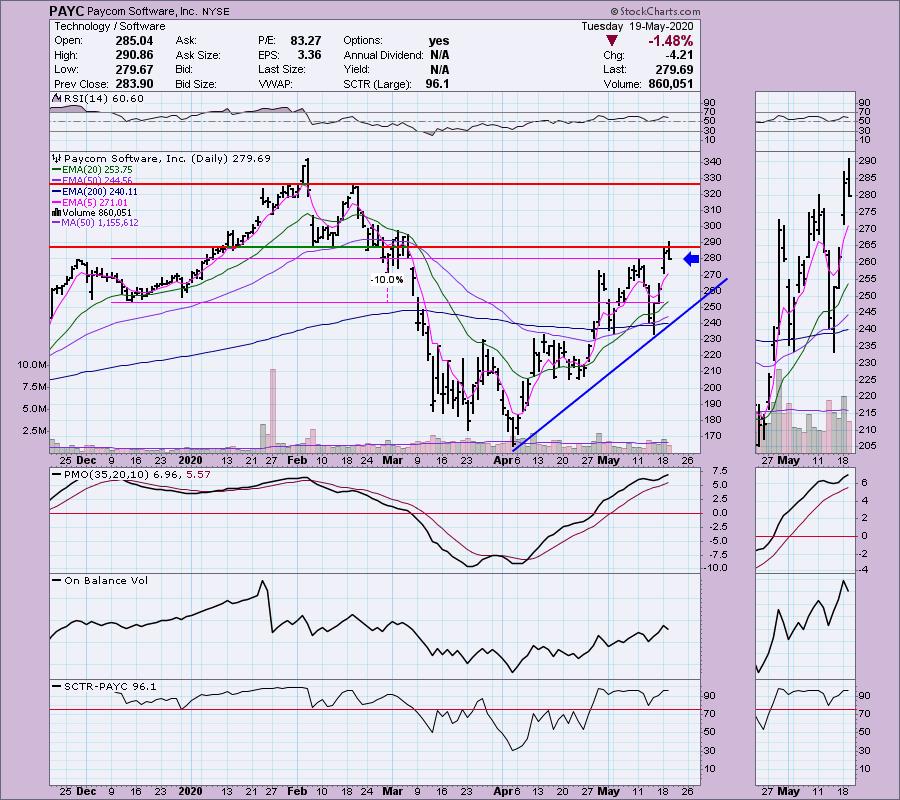

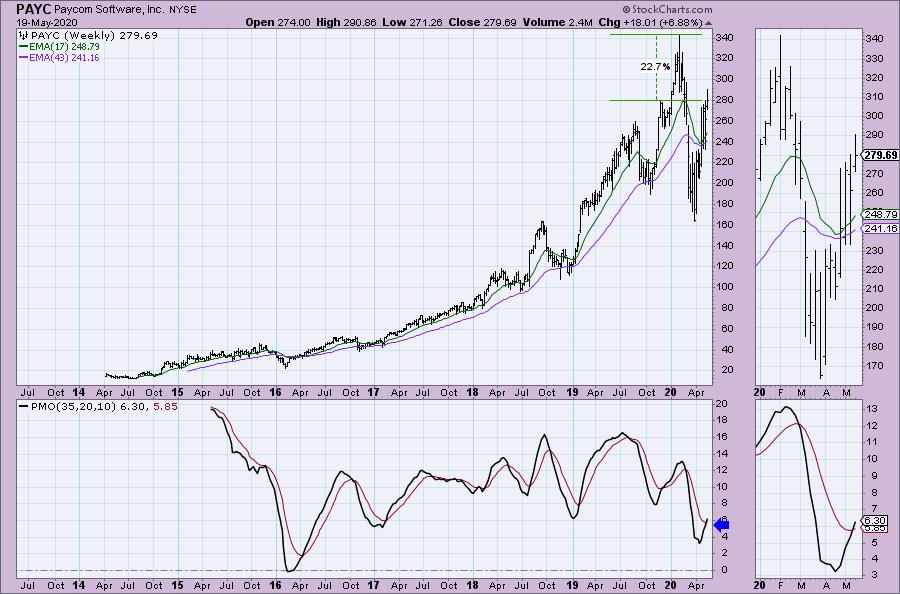

Paycom Software Inc (PAYC) - Earnings: 5/19/2020 (BMO)

The Home Depot, Inc. engages in the sale of building materials and home improvement products. Its products include building materials, home improvement products, lawn and garden products, and decor products. It offers home improvement installation services,and tool and equipment rental.

PAYC is down -1.7% in after hours trading, so you may want to hold off on this one as it could be pulling back to the rising bottoms trendline. The technicals look good though so I'm not looking for it to pull back that far. The PMO has formed a bottom above the signal line which I find especially bullish. Despite the pullback at overhead resistance, the RSI remains above 50.

If PAYC doesn't tank, we should see that new IT PMO crossover BUY signal logged after trading on Friday when the signal goes "final". My upside target would be all-time highs.

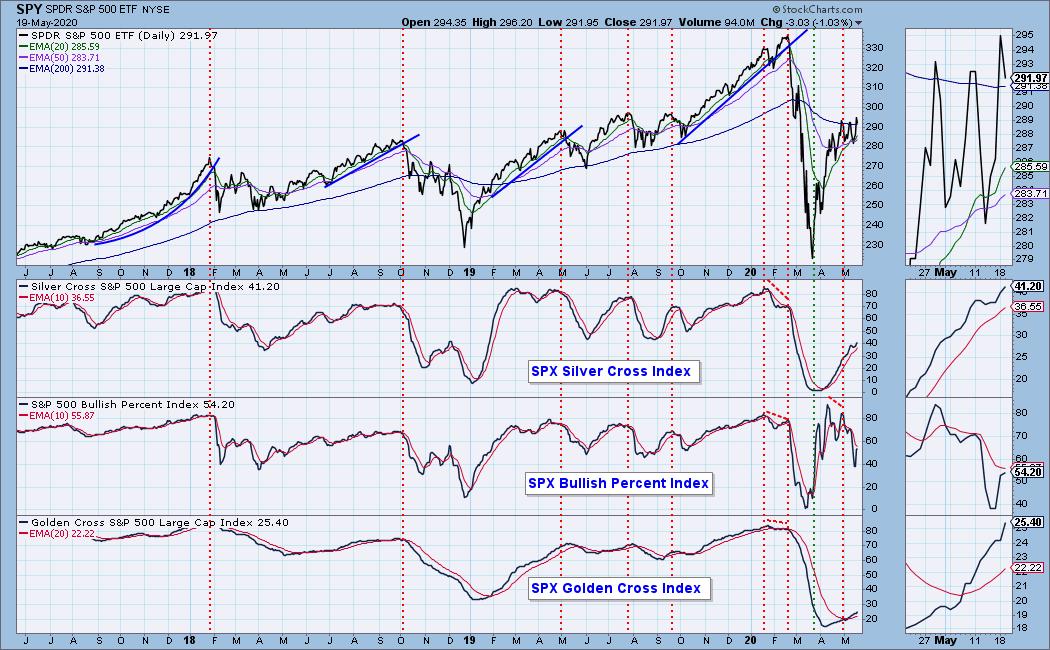

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 6

- Diamond Dog Scan Results: 6

- Diamond Bull/Bear Ratio: 1.00

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I entered BHC and HD today from yesterday's Diamonds. I'm currently 22% cash. My trading timeframe has moved from intermediate-term to short-term and therefore I'm investing more.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!