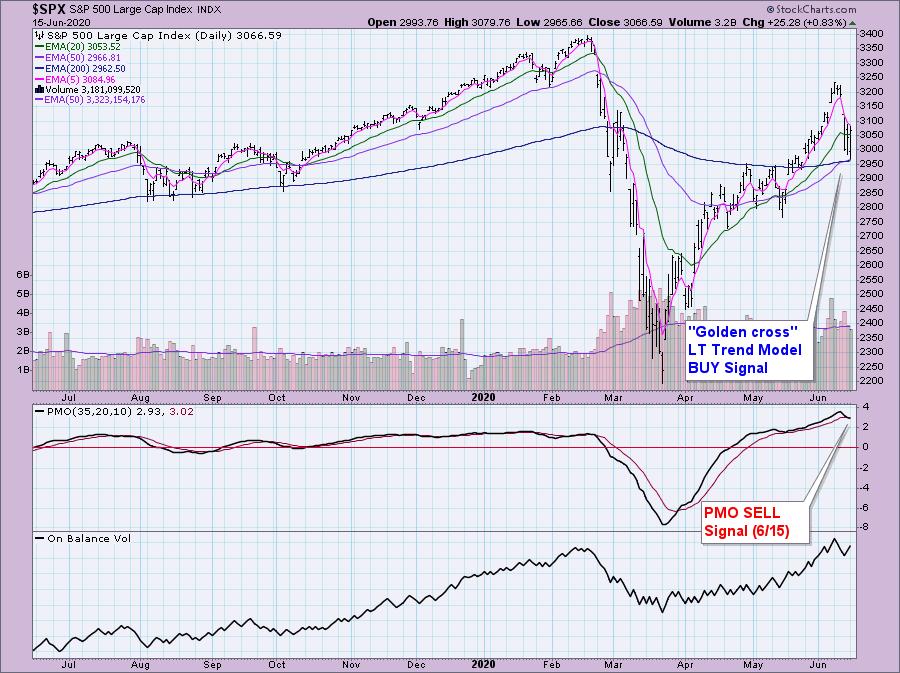

While the market and all of the sectors were higher, the scans really didn't produce much today. I found five stocks to present that have potential, but the market in general still worries me right now. I closed one position today and nearly closed two more, but decided to stick it out a bit longer on the others. I don't usually discuss the market in Diamonds reports, but I think it is necessary today. Below is the SPX chart. I want you to notice that despite a positive close today, the PMO triggered a SELL signal in overbought territory. This isn't the set up you want when you're investing. If the market fails, most stocks will go along for the roller coaster ride lower. Best case scenario is if the SPX finds support here which is entirely possible, though unlikely in my estimation.

** Announcements **

I will be traveling July 1 - July 15. I will be writing on the road, but broadcasting will be suspended during that time. It's going to be an adventurous road trip for me and my husband. We will be taking a train from Los Angeles to New Orleans, visiting family, checking out retirement areas and then renting a car and making our way back to California with various stops along the way. I'll be sure to post a picture or two and I'm sure I'll have funny stories to share along the way. It'll be interesting to see the various stages of the reopening of America.

A heads up to Bundle subscribers, the LIVE Trading Room will be going on hiatus as Mary Ellen will also be out of pocket in the upcoming month. We hope to reopen in late-July. Please direct questions to erin@decisionpoint.com.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Acacia Comm Inc (ACIA) - Earnings: 8/4/2020 (AMC)

Acacia Communications, Inc. is engaged in the development, manufacture, and sale of high-speed coherent optical interconnect products that are designed to transform communications networks through improvements in performance, capacity, and cost.

It appears that the PMO is going in for a BUY signal and the RSI has just moved above 50. Price itself has been traveling mostly sideways and currently it is in the center of a trading range. Good news is that setting a stop is pretty easy here. I would want it set around the 200-EMA.

Price has really had trouble breaking out in 2020. The good news is that when/if it does, the upside potential is great. Unfortunately the weekly PMO isn't suggesting that breakout just yet since it's barely decelerating.

Alarm.com Holdings Inc (ALRM) - Earnings: 8/6/2020 (AMC)

Alarm.com Holdings, Inc. engages in the provision of wireless and web-enabled security system technology. The company offers security, video monitoring, and energy management solutions. It operates through the Alarm.com and Other segments. The Alarm.com segment represents cloud-based platform for the connected home and related connected home solutions. The Other segment focuses on the research and development of home and commercial automation, as well as energy management products and services.

This one has a bullish flag formation that dominates the chart. It is somewhat overbought based on the PMO, but it just accelerated upward. The RSI is above net neutral (50). The OBV isn't telling us too much but overall it's in a rising trend that formed when the flagpole did.

Of all of the picks today, this one has the most favorable weekly chart. The PMO is rising strongly. I do note that overhead resistance could be difficult to climb over given it coincides with the 2018 high. However, if it does breakout, upside potential to the all-time high is about 20%.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Aurinia Pharma Inc (AUPH) - Earnings: 8/4/2020 (AMC)

Aurinia Pharmaceuticals, Inc. operates as a clinical stage biopharmaceutical company, which engages in the development of a therapeutic drug to treat autoimmune diseases.

This one had a great day, closing up over 5%. The PMO has now turned back up and the RSI has made it above net neutral for the first time since mid-May. There is a nice looking OBV positive divergence that does suggest this rally should get some legs. This is also the first time it has closed above the 20-EMA since it lost it as support in May.

The weekly PMO is not encouraging at all, so I would watch this one closely if you decide to give it a try. Upside potential to the next area of overhead resistance is a little over 16%.

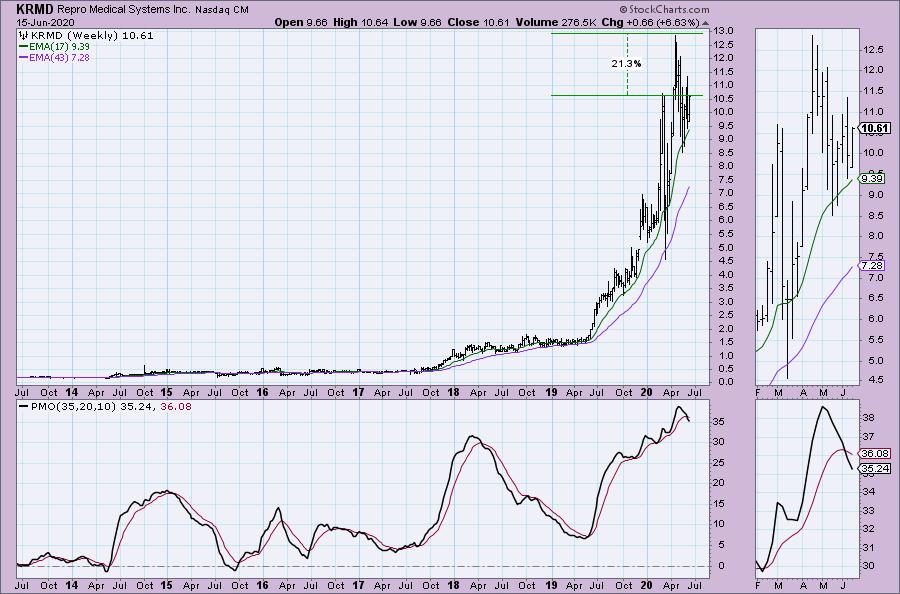

Repro Medical Systems Inc (KRMD) - Earnings: None Listed

Repro-Med Systems, Inc. engages in the design, manufacture, and market of proprietary medical devices. Its product portfolio includes FREEDOM60, FreedodmEdge syringe drivers, Precision Flow Rate Tubing, and HIgH-Flo Subcutaneous Safety Needle Sets.

This one is in the "needle" industry that could be finding new interest based on possible vaccines and immunizations. This one had a great day, but there is still more upside potential. The PMO has turned up and could be telling us the declining trend may successfully be broken this time around.

Another less than exciting weekly PMO. In this case the PMO just gave us a SELL signal. Upside potential is great, but the ugly PMO tells me we need to babysit this one closely in the short term.

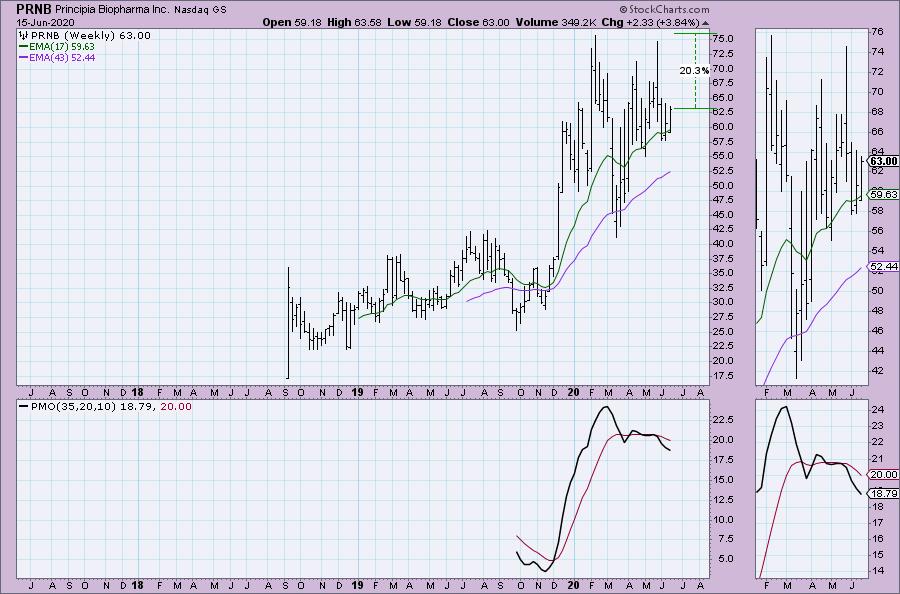

Principia Biopharma Inc (PRNB) - Earnings: 8/6/2020 (AMC)

Principia Biopharma, Inc. is a biopharmaceutical company, which engages in designing and developing oral therapies to patients with significant unmet medical needs in immunology and oncology. It operates through Tailored Covalency platform, which enables to develop small molecule inhibitors of enzymes and receptor ligands with potencies and selectivities that rival those of injectable biologics, yet maintain the convenience of a pill. Its product pipeline includes PRN1008, PRN2246, PRN1371, and immunoproteasome inhibitor.

We have a very large symmetrical triangle. These are continuation patterns, so the trend preceding this triangle is rising which suggests an upside breakout. The PMO has turned up today and the RSI just got above 50. We see rising bottoms on the OBV and that is positive.

At least the weekly PMO on PRNB is decelerating somewhat. There isn't that much PMO history here, so direction is more important than the reading. If price does breakout, upside potential could be 20%+.

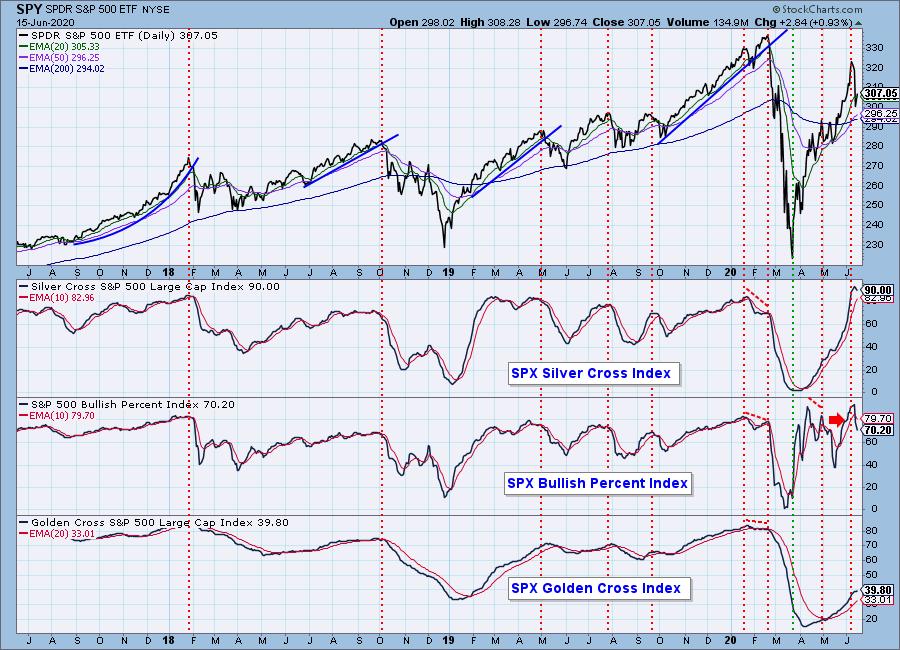

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 6

- Diamond Dog Scan Results: 126

- Diamond Bull/Bear Ratio: 0.05

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: Terrible day. I was stopped out of HD, but I'd made a tidy profit and had tightened the stop. Diamonds from Monday and Tuesday might be up for a relook as today's decimation could be offering better entries, Microsoft is high on that list. I am currently about 40% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!f