This morning I was on "Your Daily Five" on StockChartsTV and discussed the resurgence of the Health Care sector and provided a Diamond in the Rough that I'll share along with another Health Care stock. I became enamored enough during my presentation of that Diamond in the Rough to follow-up and buy it today. You'll have to determine if you want to try it out too. When I ran the DP Diamond PMO Scan today I noticed that many of the results came from Home Construction and Building Materials industry groups so I am going to look at the Home Construction ETF (ITB) and one Home Builder and one Building Materials company.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

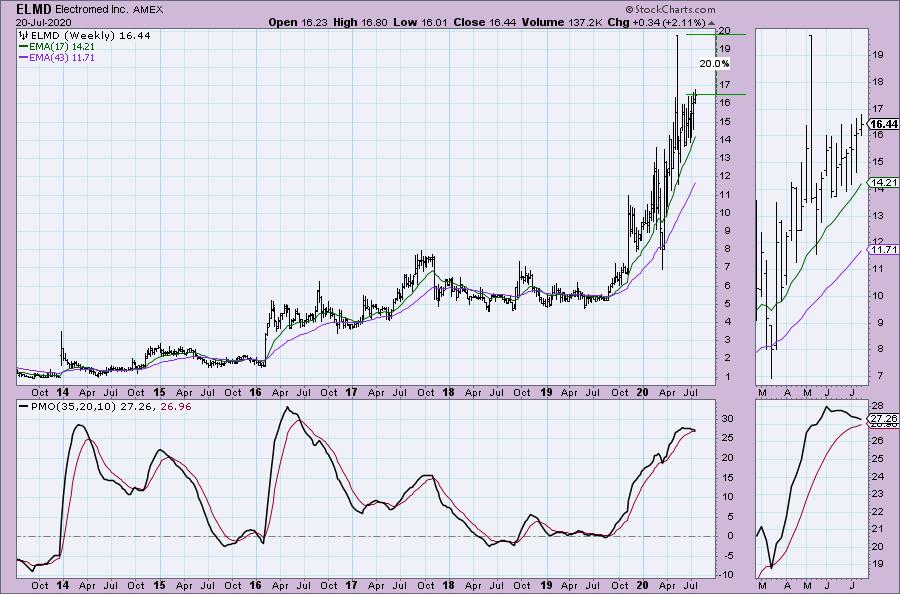

Electromed Inc (ELMD) - Earnings: 8/25/2020 (AMC)

Electromed, Inc. engages in the development, manufacture, marketing, and sale of medical equipment. It offers smartvest, and airways clearance system to patients with compromised pulmonary function. It focuses on building market awareness, and acceptance of its products and services with physicians, clinicians, patients, and third-party payers.

This is the stock that I presented in "Your Daily Five" this morning and that I bought shortly thereafter. Turned out to be a good pick up. This one has a brand new PMO BUY signal. The OBV isn't configured optimally, but at least we are back to having rising bottoms in the short term. The risk here is that it will make its way back down to test the bottom of the rising trend. However, with the RSI positive and that PMO BUY signal, I'm looking for a breakout.

It's a 20% gain if it can go back to the 2nd quarter high. The PMO is not optimum for intermediate-term investment.

iRhythm Technologies Inc (IRTC) - Earnings: 7/29/2020 (AMC)

iRhythm Technologies, Inc. engages in the development of monitoring and diagnostic solutions for detection of cardiac arrhythmias. It offers Zio XT, is a wearable patch-based biosensor, continuously records and stores ECG data from every patient heartbeat for up to 14 consecutive days; and Zio AT, also provides ECG data but also provides physicians with actionable notifications during the wear period.

This is the other Health Care stock that I liked from the Diamond PMO Scan. We have a bullish falling wedge. The OBV is confirming the uptrend. The RSI is positive and the PMO is only hundredths of a point away from a BUY signal. The stop level is rather deep so see if you can time an entry that will make that less hairy.

The weekly PMO is trending lower right now, but I have to say that I like the upside potential and the possible bullish flag formation that would suggest a breakout.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

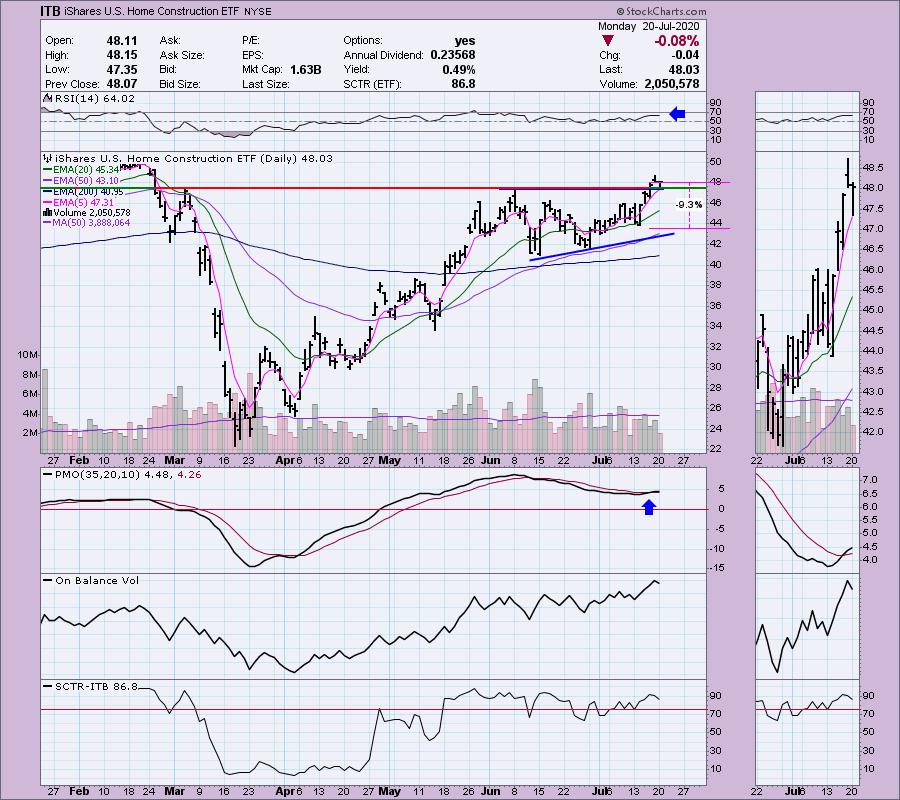

iShares U.S. Home Construction ETF (ITB) - Earnings: N/A

ITB tracks a market-cap-weighted index of companies involved in the production and sale of materials used in home construction.

ITB last I checked was up 0.73% in after hours trading. The chart for Home Builders is quite bullish. We have a PMO BUY signal and a positive RSI. The OBV is confirming the rising trend. The SCTR is in the "hot zone" above 75. The bullish ascending triangle resolved upward on Thursday. Today it pulled back somewhat but did manage to close near the top of its range. This was a nice pullback to a breakout point that should result in a bounce higher. The 50-EMA has provided support, but that would require a rather large stop. If it fell back and breached the 20-EMA, I wouldn't want it if I owned it.

Upside potential is limited right now, but given the very positive PMO and positive daily chart above, I suspect it will breakout to new all-time highs.

Meritage Homes Corp (MTH) - Earnings: 7/22/2020 (AMC)

Meritage Homes Corp. is a holding company, which engages in the development and sale of residential properties. It operates through two segments: Homebuilding and Financial Services. The Homebuilding segment acquires constructs and markets single-detached houses. The Financial Services segment includes the operations of the company's subsidiary, Carefree Title.

MTH has been in a confirmed rising trend since the end of June. The SCTR is in the "hot zone" above 75. The RSI is positive and the PMO is working its way toward a crossover BUY signal. I'd set my stop around the 20-EMA. The risk here is a pullback to the bottom of the rising trend channel.

Notice the very strong support that is right between $77 and $80. That would be a deep decline. However we have a rising weekly PMO and a possible bull flag in the thumbnail.

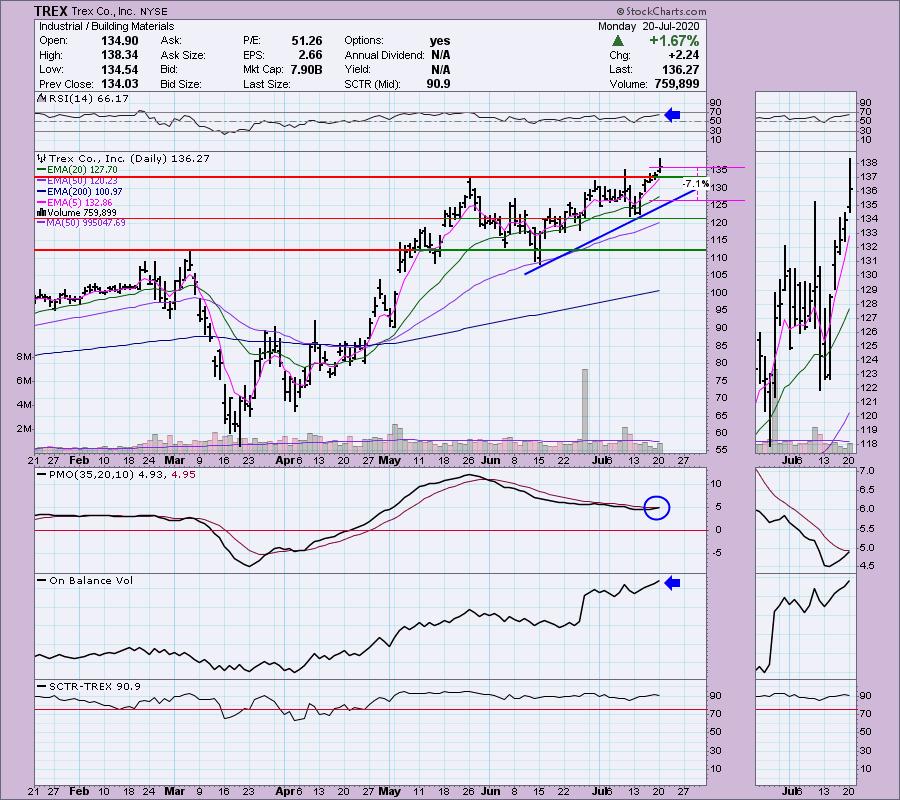

Trex Co Inc (TREX) - Earnings: 8/3/2020 (AMC)

Trex Co., Inc. engages in the manufacture of wood-alternative decking and railing. Its products include deck framing and drainage, outdoor lighting, furniture, pergola and outdoor kitchens, fencing, collections, and accessory hardware. It operates through the following segments Trex Residential Products and Trex Commercial Products.

I like TREX on this breakout today. The PMO is about to give us a BUY signal and the RSI is positive. Notice that the OBV made a new high along with price on this breakout. The SCTR has been very healthy.

It's making new highs and the weekly PMO suggests it will make more.

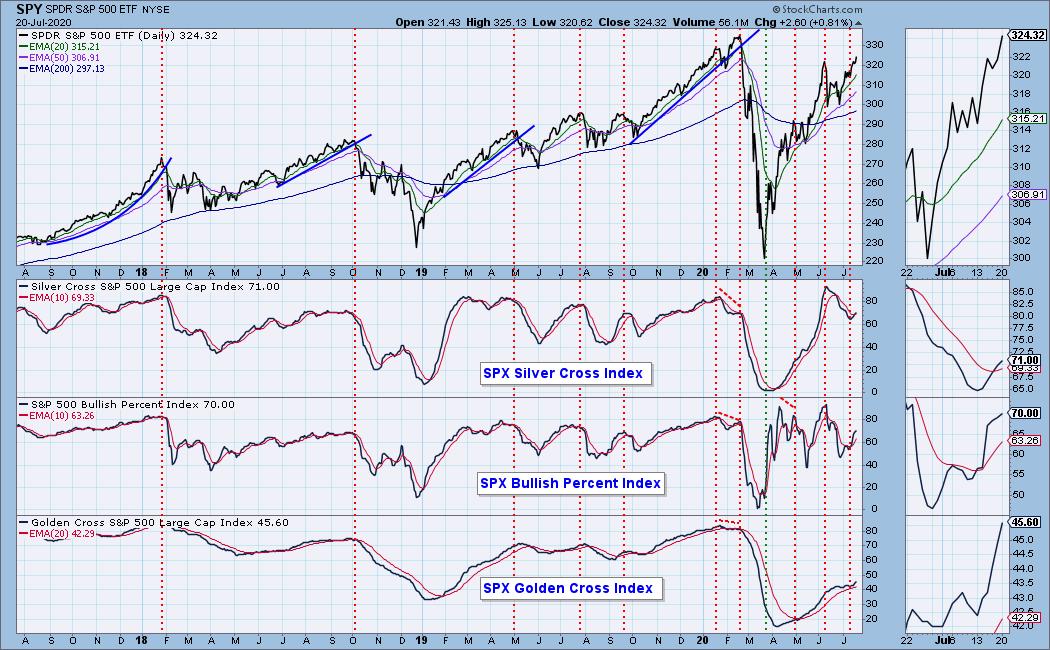

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 25

- Diamond Dog Scan Results: 4

- Diamond Bull/Bear Ratio: 6.25

Full Disclosure: I purchased ELMD this morning, along with IFF which I talked about last week. I'm about 65% invested right now. 35% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!