Reader Request Thursday is already here! Thank you to Olivia, Salvador, George, Alan, Jerry and Robert for your suggestions! A few readers have been sending questions about the viability of UNG moving higher based on the giant rally out of lows. I'll look at that chart at the bottom. I am so looking forward to tomorrow's Diamond Mine trading room at noon EST! If you haven't registered the information is below. I also sent out a registration link for the free DecisionPoint Trading Room on Mondays noon EST. Carl has agreed to join me on Monday for our first DecisionPoint Trading Room so you don't want to miss it. I will be sending out links to the recordings when they become available.

OPENING FRIDAY at Noon EST! The "DecisionPoint Diamond Mine" trading room!

"The DecisionPoint Diamond Mine" will be an opportunity for us to talk live, review current and past Diamonds for possible entries/exits/stops/targets and take your questions and symbol requests in this intimate trading room.

Register in advance for the "DecisionPoint Diamond Mine" Friday (8/21) 12:00p EST:

https://zoom.us/webinar/register/WN_71KbmIEzQqqEkXXhlwI68w

Password: diamonds

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Cameco Corp (CCJ) - Earnings: 11/6/2020 (BMO)

Cameco Corp. engages in the provision of uranium. The company operates through the following segments: Uranium and Fuel Services. The Uranium segment involves the exploration for, mining, milling, purchase and sale of uranium concentrate. The Fuel Services segment involves the refining, conversion and fabrication of uranium concentrate and the purchase and sale of conversion services.

Up 0.78% in after hours trading last I looked, CCJ just broke out of a consolidation zone between the 50/200-EMAs. It is heading right into overhead resistance at the May top, but I suspect given the bullish chart it should be able to beat it. The PMO is turning up just above the zero line and the RSI and SCTRs are rising. If I had to complain, it would be that the volume on today's big breakout was muted.

There are two areas of upside potential. I believe that it shouldn't have much problem reaching the $13 overhead resistance level and that is a gain of almost 18%. If it breaks out, we could be looking at a move to $16. I'd just want to reevaluate when it hits resistance at $13. The weekly PMO has turned up, although it is overbought.

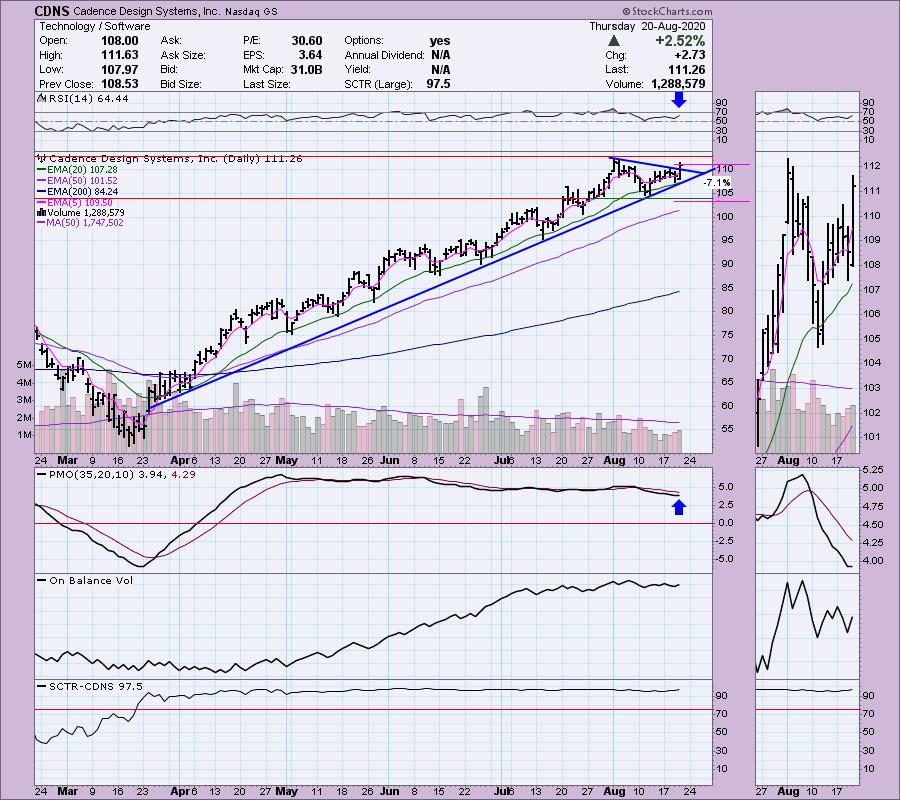

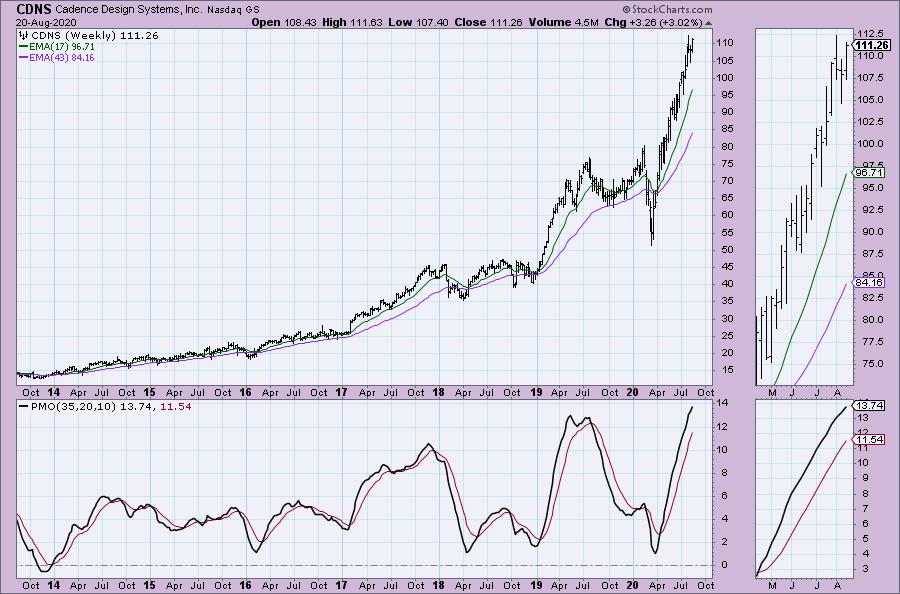

Cadence Design Systems Inc (CDNS) - Earnings: 10/19/2020 (AMC)

Cadence Design Systems, Inc. engages in the design and development of integrated circuits and electronic devices. Its products include electronic design automation, software, emulation hardware, and intellectual property, commonly referred to as verification IP, and design IP. The company was founded by Alberto Sangiovanni-Vincentelli, Gudmundur A. Hjartarson, K. Bobby Chao, and K. Charles Janac in June 1988 and is headquartered in San Jose, CA.

Really steady rising trend for this software stock. This is set up nicely. We got a breakout from a near-term symmetrical triangle. The PMO is turning up and OBV bottoms are rising. Hard to beat a SCTR of 97.5. The RSI is positive and best of all you don't have to set a very deep stop.

The PMO is overbought, but that is the only complaint I have here. It still looks very strong.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

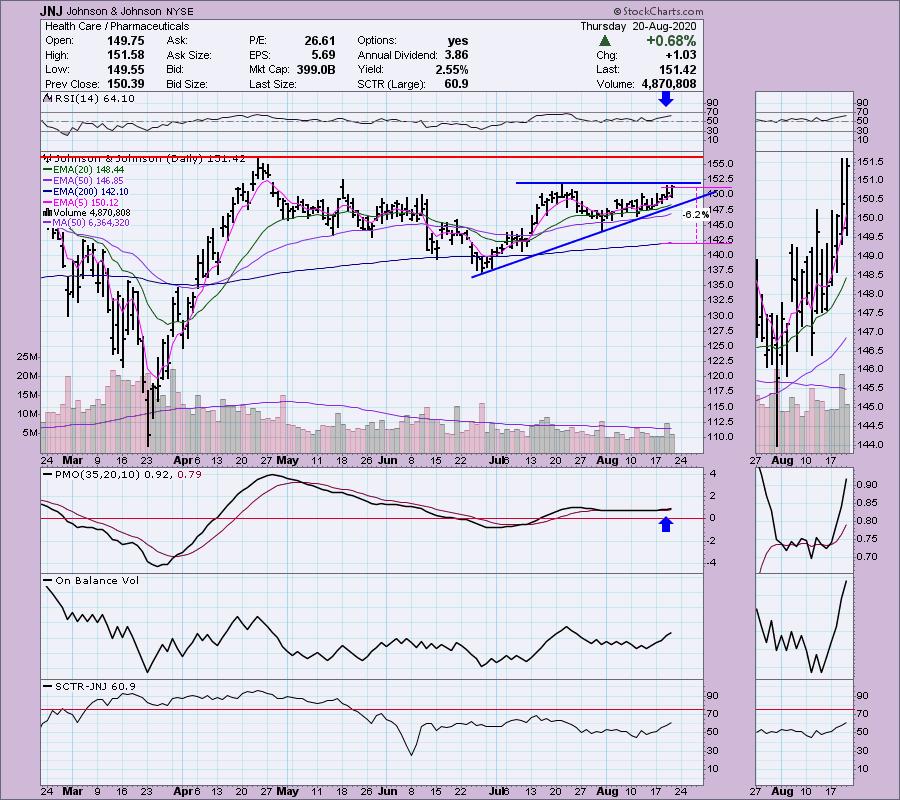

Johnson & Johnson (JNJ) - Earnings: 10/13/2020 (BMO)

Johnson & Johnson is a holding company, which engages in the research and development, manufacture and sale of products in the health care field. It operates through the following segments: Consumer, Pharmaceutical, and Medical Devices. The Consumer segment includes products used in the baby care, oral care, beauty, over-the-counter pharmaceutical, women's health, and wound care markets. The Pharmaceutical segment focuses on therapeutic areas such as immunology, infectious diseases ad vaccines, neuroscience, oncology, cardiovascular and metabolism, and pulmonary hypertension. The Medical Devices segment offers products used in the orthopedic, surgery, cardiovascular, diabetes care, and eye health fields. The company was founded by Robert Wood Johnson I, James Wood Johnson and Edward Mead Johnson Sr. in 1886 and is headquartered in New Brunswick, NJ.

Up 0.18% in after hours trading, JNJ is about to breakout from an ascending triangle formation. Overhead resistance is close at hand, but the PMO has made the turn after some twitching around and we are seeing heavy volume coming in. The RSI is positive and while the SCTR isn't in the "hot zone" above 75, it is rising.

Really like that new weekly PMO BUY signal.

Melco Resorts & Entertainment Ltd (MLCO) - Earnings: 5/14/2020 (BMO)

Melco Resorts & Entertainment Ltd. engages in the management, and development of casino gaming and entertainment resort facilities. It focuses on the operations of Mocha Clubs, Altira Macau, City of Dreams, Studio City, City of Dreams Manila and Cyprus Operations. It operates through the following geographical segments: Macau, the Philippines, and Cyprus. The company was founded by Yau Lung Ho on December 17, 2004 and is headquartered in Hong Kong.

Up 1.48% in after hours trading, MLCO has formed a bull flag. The PMO was topping in overbought territory but after today's rally turned it right back up. The RSI is positive and there is no need to set a very deep stop.

Very nice upside potential if it can reach 2019 highs. The weekly PMO is very positive as it has moved above the zero line and is not overbought.

US Natural Gas Fund (UNG) - Earnings: 8/31/2020 (AMC)

UNG holds near-month futures contracts in natural gas and swaps on natural gas.

Up 0.15% in after hours trading, UNG has been quite the darling since we brought it to your attention on July 24th. Many have asked me whether I believe UNG has more upside potential. My answer is yes. $14.50 will be the next 'checkpoint'. The double-bottom now looks like part of a larger 'cup and handle' that has just triggered. If it fulfills the pattern, it will indeed travel higher than $14.50. The pullback today took the RSI out of overbought territory. I'm okay with the overbought PMO and the OBV is confirming this upside move. I may add to my position given the stop area is manageable around the 20-EMA.

The weekly chart shows me a long-term bullish falling wedge. The pattern executed when price broke from the declining trendline. The pattern measurement would be done by taking the length of the backside and adding it to the breakout point. That would easily take us to and likely above overhead resistance at the 2016 low. So, yes I still like UNG.

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 21

- Diamond Dog Scan Results: 52

- Diamond Bull/Bear Ratio: 0.40

Full Disclosure: I'm about 60% invested right now and 40% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!