I continue to be a fan of Industrials, although they are getting overbought. I found it interesting that I only had three Diamond PMO Scan results and all of them were Truckers. That compelled me to look at the Trucking Industry Group as well as the members within. While the three that were in the results were pretty good, I decided to look at all of the charts for the Group and find my five favorite. Of the three that hit my scan (JBHT, SNDR, WERN), I chose only SNDR, but feel free to check those other two charts out too. The OBV and today's candles on JBHT & WERN were not ideal.

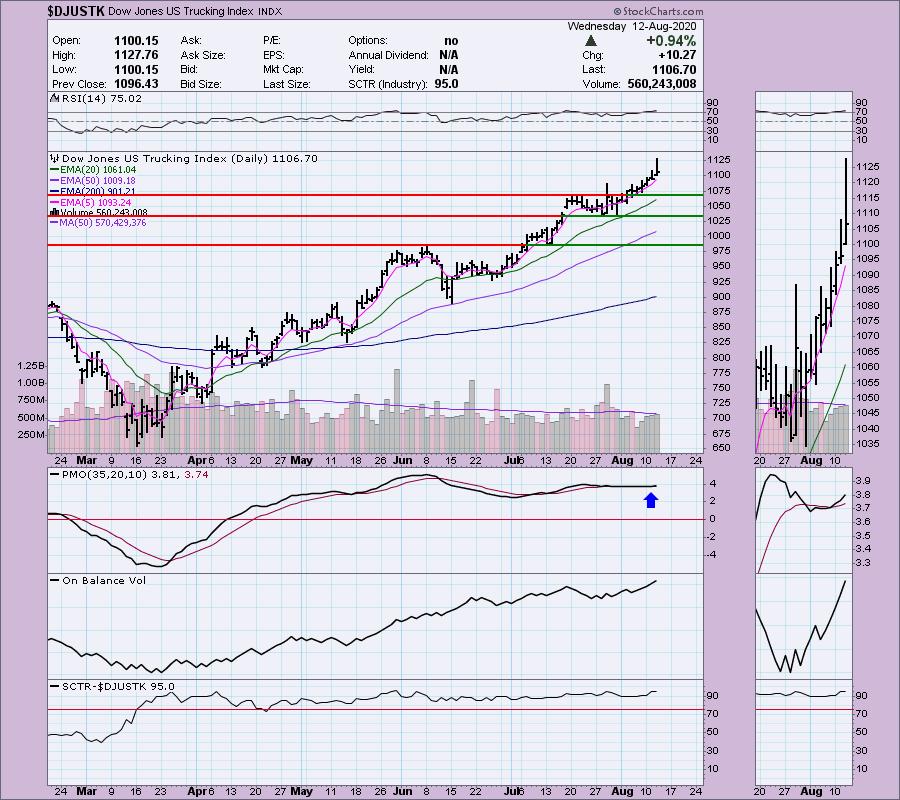

The Trucking Index has been on a steady rising trend since moving out of the March low. While the RSI and PMO are overbought, I like seeing the OBV confirming the move with rising bottoms. You can also see that the SCTR has been in the "hot zone" above 75 for some time.

** PRICES ARE GOING UP! **

You do NOT need to concern yourself if you're happy with what you have. Your current rate will stay the same as long as your subscription remains in good standing. You can also switch to an annual subscription at anytime where you pay for 10 months and get 12 months.

For our DP Diamond-only subscribers: You should consider our Bundle package. DP Alert Reports will be going up 33% to $40/mo so adding DP Alert later will be more expensive. Bundles currently are $50/mo or $500/yr. If you add DP Alert after August 16th, it will cost you an additional $40/mo or $400/yr for a Bundle total of $65/mo or $650/yr after August 16th!

To summarize, if you don't have the Bundle, subscribe now before it becomes very expensive!

For my Diamonds subscribers, there will be a new 1-hour trading room, "The DecisionPoint Diamond Mine" on Fridays beginning 8/21! It will be an opportunity for us to talk live, review current and past Diamonds for possible entries/exits/stops/targets and take your questions and symbol requests in this intimate trading room. But wait, there's more for Diamonds subscribers! I will be adding a Friday Diamonds Recap where I will look at the performance of that week's Diamonds and their prospects moving forward. Over the weekend we clean the slate and start over again.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Heartland Express Inc (HTLD) - Earnings: 10/28/2020 (BMO)

Heartland Express, Inc. is a holding company, which engages in the provision of short-to-medium haul truckload carrier services. It offers long haul truckload and regional truckload transportation.

This one isn't new to Diamonds, I presented it on March 18th and May 11th. We just had a breakout from a consolidation zone that has now formed a nice cup. We may be in need of a decline to give us the "handle" of this popular cup and handle formation. Price did close near the bottom of the range today, so watch this intraday to see if the handle is coming in or a better entry point. I think this one will surge. The RSI is now in positive territory. The PMO has just generated a BUY signal and we had a positive divergence with the OBV bottoms and price lows. The SCTR is mid-range and ready for improvement. I also like that you can set a reasonable stop just below major support.

Even if it only were to reach $22.75 resistance and turn back, that is still an 8%+ gain, but I am looking for a breakout there and targeting the 2017 top. The PMO has bottomed above its signal line which I always find especially bullish.

Old Dominion Freight Inc (ODFL) - Earnings: 10/22/2020 (BMO)

Old Dominion Freight Line, Inc. engages in the provision of less-than-truckload services. The company involves in the ground and air expedited transportation, and consumer household pickup and delivery. Its services include container drayage, truckload brokerage, supply chain consulting, and warehousing.

You can see that ODFL is and has been a better performer overall compared to HTLD given the steady rising trend. The PMO has turned up on this breakout above the July top. The RSI is positive, albeit a bit overbought. The OBV is confirming the up trend and the SCTR has remained in the hot zone for 6+ months.

The weekly PMO is overbought, but it continues to move steadily higher.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

SAIA Inc (SAIA) - Earnings: 10/28/2020 (BMO)

Saia, Inc. operates as a transportation holding company. The firm through its wholly-owned subsidiaries provides regional and interregional less-than-truckload (LTL) services through a single integrated organization. The firm also offers other value-added services, including non-asset truckload, expedited and logistics services across North America.

SAIA broke out today but did end up closing below the resistance level at the July top. It was still sizable gain on the day and I believe it will follow-through and continue rallying given the positive RSI, PMO bottom in oversold territory and strong SCTR. I have the stop lined up with the June top.

The weekly chart looks great. The weekly PMO is getting somewhat overbought, but we've seen much higher readings so it has room to run higher.

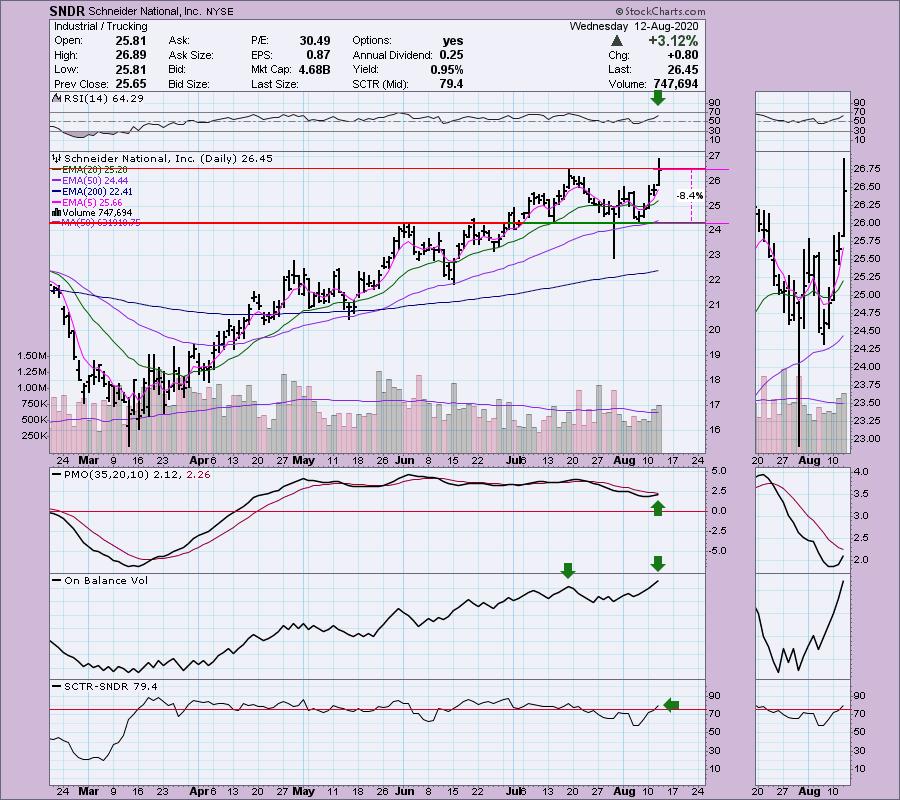

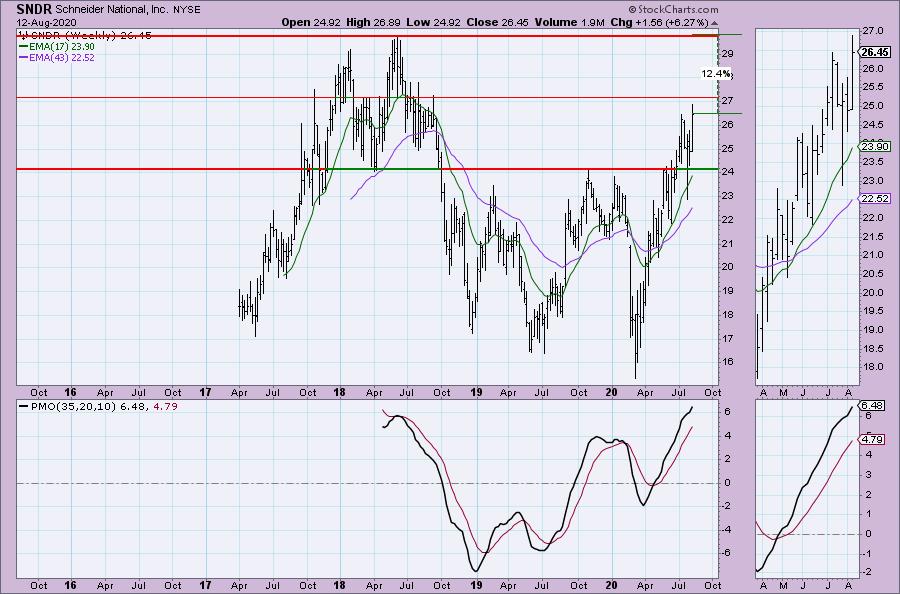

Schneider National Inc (SNDR) - Earnings: 10/29/2020 (BMO)

Schneider National Inc. provides transportation and logistics services. The firm's transportation solutions include van truckload, dedicated, regional, bulk, intermodal, brokerage, supply chain management, port logistics services and engineering and freight payment services. It operates through the following segments: Truckload, Intermodal and Logistics. The Truckload segment consists of freight transported and delivered with standard and specialty equipment by employed drivers in company trucks and by owner-operators. The Intermodal segment consists of door-to-door container on flat car service by a combination of rail and over-the-road transportation, in association with rail carrier partners. The Logistics segment consists of non-asset freight brokerage services, supply chain services and import/export services.

This is the stock that came from the Diamond PMO Scan today. I know it must be a pretty good chart because as I was clicking through the Truckers to write this article, I stopped on this chart and thought, "I need to add this one for today!" Then I realized it was already on my list. The RSI is positive, the PMO is readying for a crossover BUY signal and volume is coming in on this breakout. The SCTR has just now entered the "hot zone". I'd consider a stop around the early June top and matching lows from July /August.

Upside potential looks reachable. The weekly PMO is rising strongly. Since we don't have a lot of price data, it is hard to say whether the PMO is as overbought as it looks.

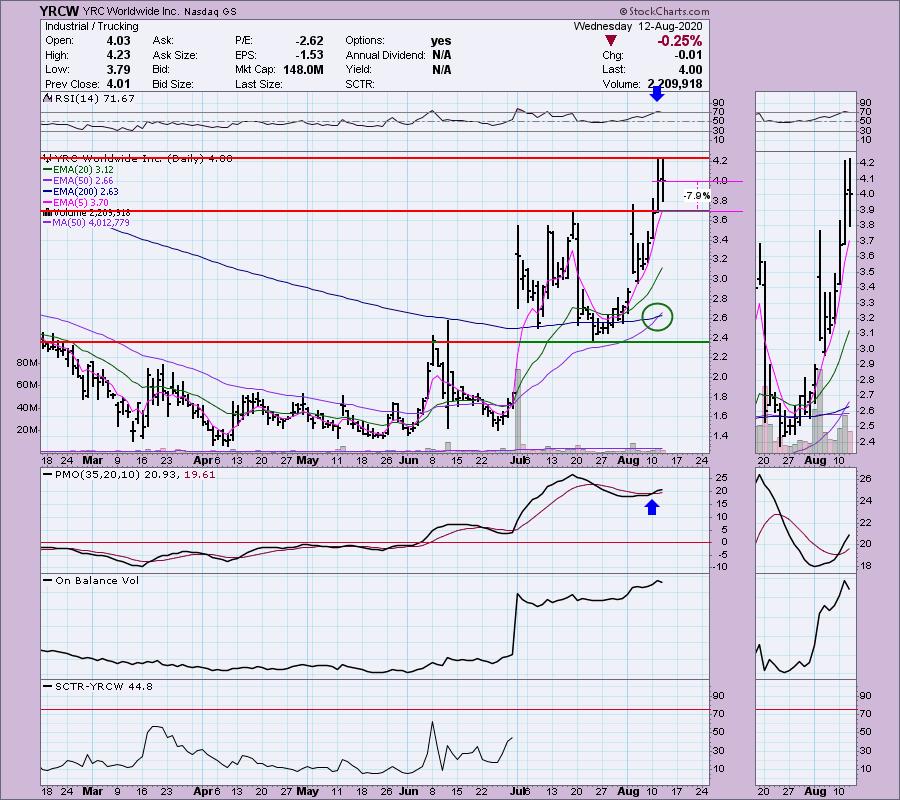

YRC Worldwide Inc (YRCW) - Earnings: 10/29/2020 (AMC)

YRC Worldwide, Inc. operates as a holding company, which through its subsidiaries engages in the provision of transportation services. It operates through the YRC Freight and Regional Transportation segments. The YRC Freight segment focuses on longer haul business opportunities with national, regional, and international services. The Regional Transportation segment comprises of transportation service providers, which focuses on business opportunities in the regional and next-day delivery markets.

This is my high risk trade for the day based on the major swings and low price point. This one you need to watch like a hawk if you get in and definitely position size accordingly. Currently it is down 0.13% in after hours trading, so we might find a better entry. I'd like to enter it around the stop area ideally, but I'm willing to get in if it decides to run back up. We just got a "golden cross" on YRCW which triggers a Long-Term Trend Model BUY signal. The RSI is overbought right now so again, you'll want to keep this one on a leash. The new PMO BUY signal and rising OBV are what make this one enticing. The SCTR is showing improvement now too. This is not for the feint of heart for sure.

The upside potential and very favorable PMO have me giving this one serious consideration for my own portfolio. Again, though, be careful here.

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 3

- Diamond Dog Scan Results: 3

- Diamond Bull/Bear Ratio: 1.00

Full Disclosure: I'm about 65% invested right now and 25% is in 'cash', meaning in money markets and readily available to trade with. I'm considering a few different positions (hard to resist bottom fish YRCW today, but I'll see what it looks like tomorrow), but honestly, I am feeling iffy about the market right now and don't want to be overexposed. As noted above all but two positions in my portfolio have been on trailing stops for 2 weeks and I am considering closing a few positions.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

ANNOUNCEMENT:

I have the information for my VIRTUAL presentation at The Money Show! My presentation will on August 19th at 1:20p EST! Click here for information on how to register to see me!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!