Today the Diamond PMO Scan really came through with some great results that I think you'll find interesting. Additionally, I wanted to update you on US Natural Gas (UNG). I know many of you have been enjoying the ride, but it is starting to look rather bearish right now. I've added a tight trailing stop to my position in case it bounces off support. I've had many subscribers write to me and tell me just that one pick has paid over and over for the annual subscription to Diamonds, so I want to make sure you have an alert that it is beginning to turn. Note the rounded top on price. The PMO has turned over in very overbought territory and is headed for a crossover SELL signal. The RSI is falling fast, though it isn't negative yet. Volume has been pouring in as people begin to take profits. The SCTR completely spiraled lower. We're about ready to hit strong support at $13 which is about 3% less than the closing price.

Diamond Mine Information:

Diamond Mine Information:

Recording from 8/28 is at this link. The password to view the recording is: $LeoDog24

Register in advance for the "DecisionPoint Diamond Mine" Friday (9/4) 12:00p EST:

Here is this week's registration link. Password: dpdmine

Please do not share links! They are for Diamonds subscribers ONLY!

Click here to register in advance for the recurring free DecisionPoint Trading Room (Next one is 9/14)! Did you miss the 8/31 trading room? Here is a link to the recording (password: V#^P89Yv).

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

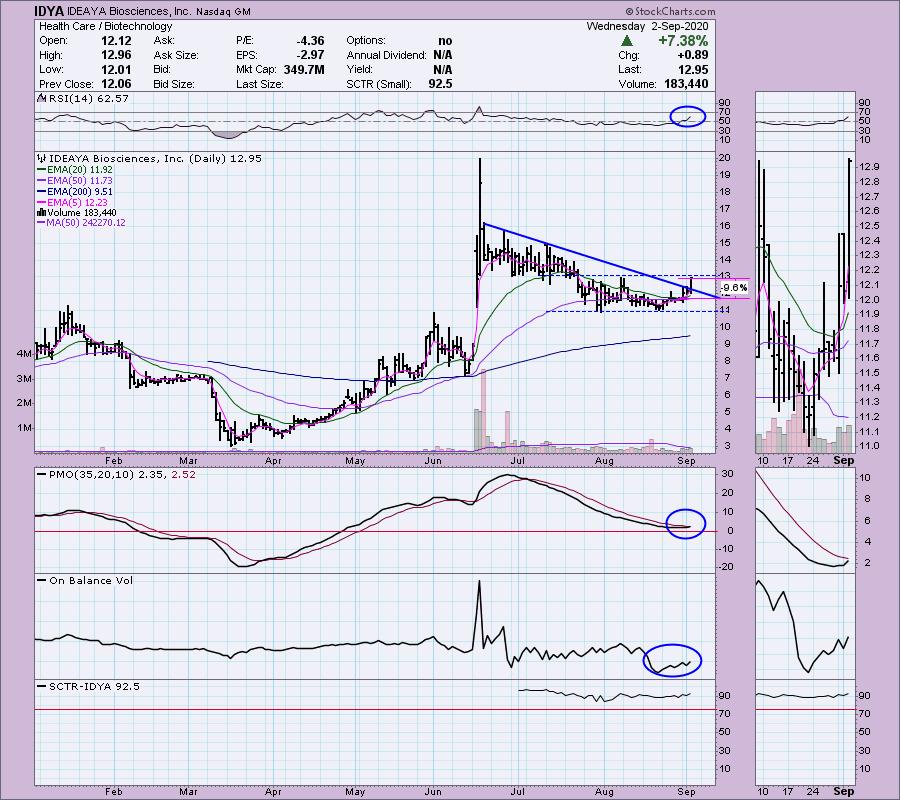

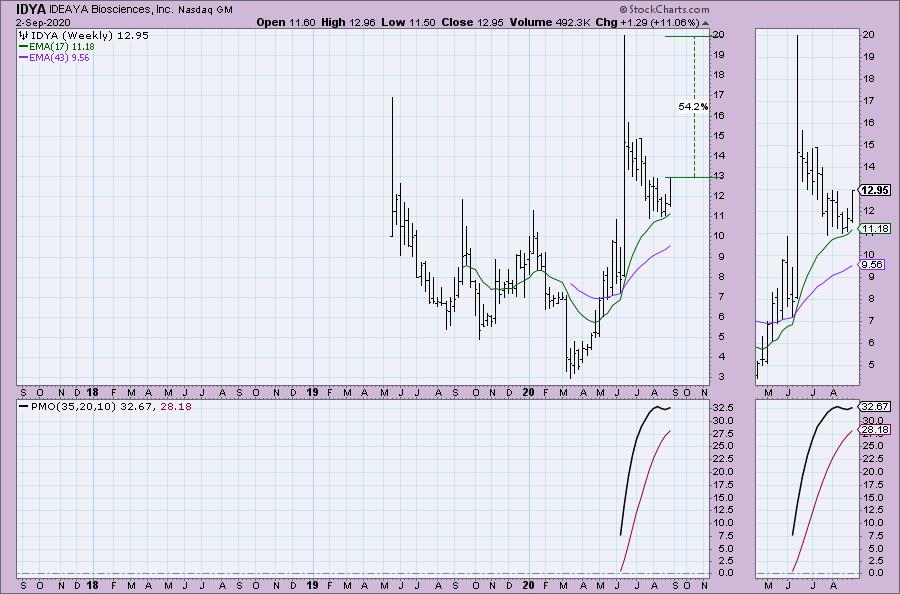

IDEAYA Biosciences Inc (IDYA)

EARNINGS: 11/12/2020 (BMO)

IDEAYA Biosciences, Inc. engages in the research and development of oncology-focused precision medicine. The firm focuses on targeted therapeutics for patients selected using molecular diagnostics. Its product candidate, IDE196, is a protein kinase C inhibitor for genetically-defined cancers having GNAQ or GNA11 gene mutations. The company was founded by Yujiro S. Hata and Jeffrey Hager in June 2015 and is headquartered in South San Francisco, CA.

This is an interesting trade but does require the understanding that the stock is quite liquid (low volume) and volatile, so you need to be ready for swings that might be uncomfortable for intermediate-term investors and short-term traders alike. The charts are very interesting. On the daily chart you can see the indicators are going the right way. I especially like the PMO reversal and nearing crossover BUY signal. The OBV is confirming the move and it is in the top 8% of small-cap stocks based on the SCTR.

If we can just get back to the June top, that would be an over 50% gain. I'm not saying I expect it to get there, but it could be a nice ride higher if it attempts to. The PMO has reversed direction and is moving higher already.

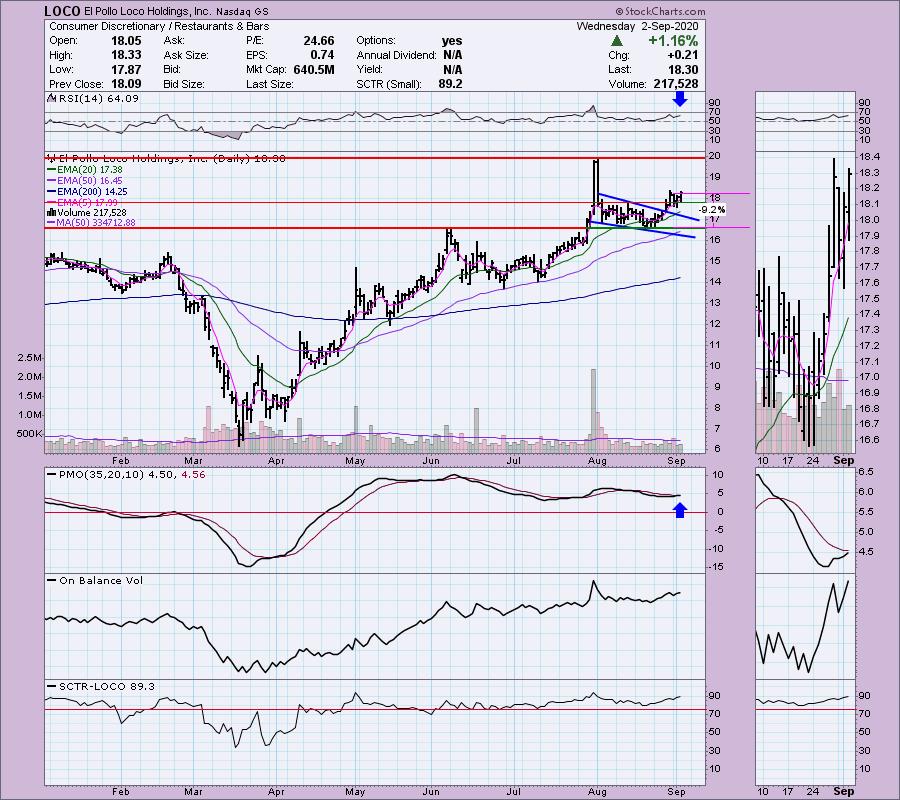

El Pollo Loco Holdings Inc (LOCO)

EARNINGS: 10/29/2020 (AMC)

El Pollo Loco Holdings, Inc. engages in the ownership and management of restaurant chains. It specializes in fire-grilling citrus-marinated chicken and operates in the limited service restaurant (LSR) segment. The restaurant industry is divided into two segments: Full Service and Limited Service. The Full service segment is comprised of the casual dining, mid-scale, and fine dining sub-segments. The Limited service segment is comprised of the QSR and fast casual sub-segments. It develops, franchises, licenses and operates quick-service restaurants under the name El Pollo Loco. The company was founded in 1975 and is headquartered in Costa Mesa, CA.

LOCO has been coming in on my scan results for a few days now. The PMO was acting funky so I opted not to include it. However, now the PMO is looks ready for a positive crossover and the RSI is positive. We had a breakout from a short-term bullish falling wedge and since it has mostly consolidated. It would require an over 9% stop to hit strong support. The SCTR is in the "hot zone" so I do expect some follow-on to this rally.

We're trading at 2020 highs right now, but if we can get the breakout above $20, there's plenty of upside potential.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Repligen Corp (RGEN)

EARNINGS: 10/29/2020 (BMO)

Repligen Corp. provides advanced bioprocessing technologies and solutions used in the process of manufacturing biologic drugs. The firm serves through the following product lines: Chromatography; Filtration; and OEM Products (Proteins). The Chromatography product line includes a number of products used in the downstream purification and quality control of biological drugs. The Filtration products offer a number of advantages to manufacturers of biologic drugs at volumes that span from pilot studies to clinical and commercial-scale production. The OEM products are represented by Protein A affinity ligands, which are a critical component of Protein A chromatography resins used in downstream purification, and cell culture growth factor products. The company was founded by Alexander G. Rich and Paul R. Schimmel in May 1981 and is headquartered in Waltham, MA.

RGEN was a Diamond on 7/23 and I currently own it. It is currently down 0.68% in after hours trading so there could be a better entry point sometime tomorrow. It appears we have another entry point now as the RSI remains positive and the PMO is beginning to turn up on the breakout from the symmetrical triangle. Those are continuation patterns so we should expect that upside breakout. I like the volume coming in right now as the OBV pushes higher to challenge its previous top, just as price is ready to challenge that price top. The stop level is reasonable to hit that first area of strong support.

The weekly PMO is very bullish and not particularly overbought.

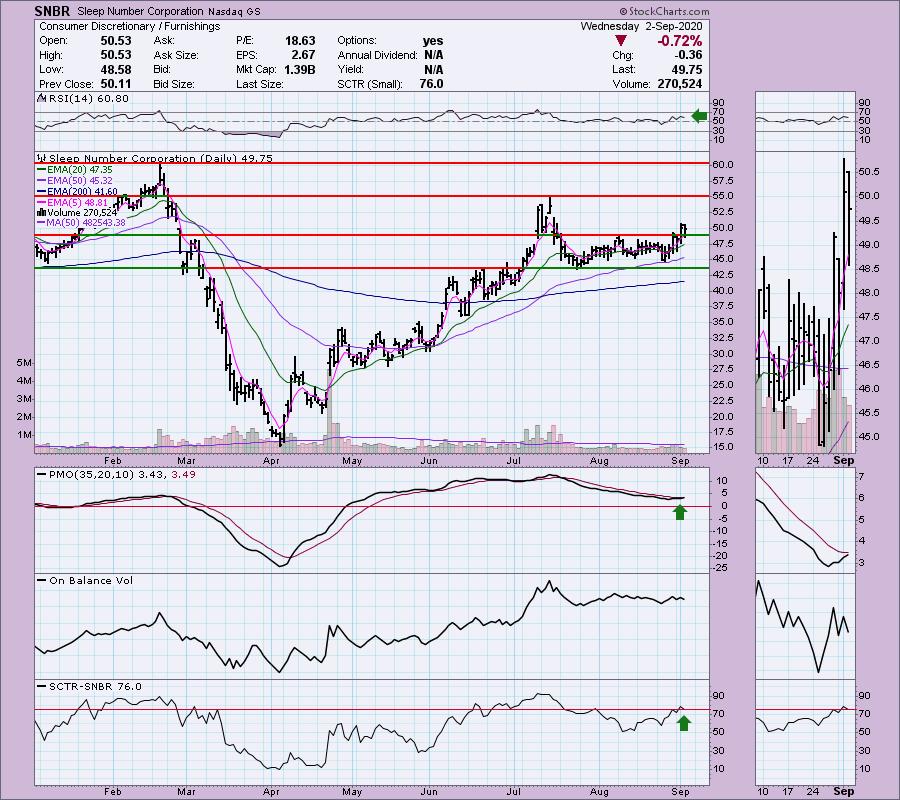

Sleep Number Corporation (SNBR)

EARNINGS: 10/14/2020 (AMC)

Sleep Number Corp. designs, manufactures, markets, and distributes beds, proprietary beds, and other sleep-related accessory products. It offers beds under the brand name Sleep Number. The company was founded by Robert Walker and JoAnn Walker in 1987 and is headquartered in Minneapolis, MN.

SNBR has been in a trading range for over a month and we finally got a nice breakout yesterday. Today it pulled back slightly but held onto new support. The PMO is about to give us a BUY signal and the RSI is in positive territory. I would've liked a better looking OBV on this breakout, but in the short-term the bottoms are rising with price. The SCTR just entered the "hot zone" above 75.

The weekly PMO is rising albeit overbought, but I like it. Upside potential would be a 23% gain if it managed to recapture the 2020 high.

Zebra Technologies Corp (ZBRA)

EARNINGS:

2U, Inc. engages in the provision of education technology for nonprofit colleges and universities. It operates through the following segments: Graduate Program and Alternative Credential. The Graduate Program segment provides technology and services to nonprofit colleges and universities to enable the online delivery of degree programs. The Alternative Credential segment provides premium online short courses and technical, skills-based boot camps through relationships with nonprofit colleges and universities. The company was founded by Christopher J. Paucek on April 2, 2008 and is headquartered in Lanham, MD.

Down slightly (-0.05%) in after hours trading, ZBRA had a gorgeous breakout today coming in shortly after a positive OBV divergence (rising OBV bottoms v falling price bottoms). The RSI is positive and the PMO is curling up for a crossover BUY signal. Hard to beat a SCTR that has been in the "hot zone" four+ months.

I like that the weekly PMO is accelerating upward and isn't overbought yet.

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 9

- Diamond Dog Scan Results: 13

- Diamond Bull/Bear Ratio: 0.69

Full Disclosure: I'm about 65% invested right now and 35% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!