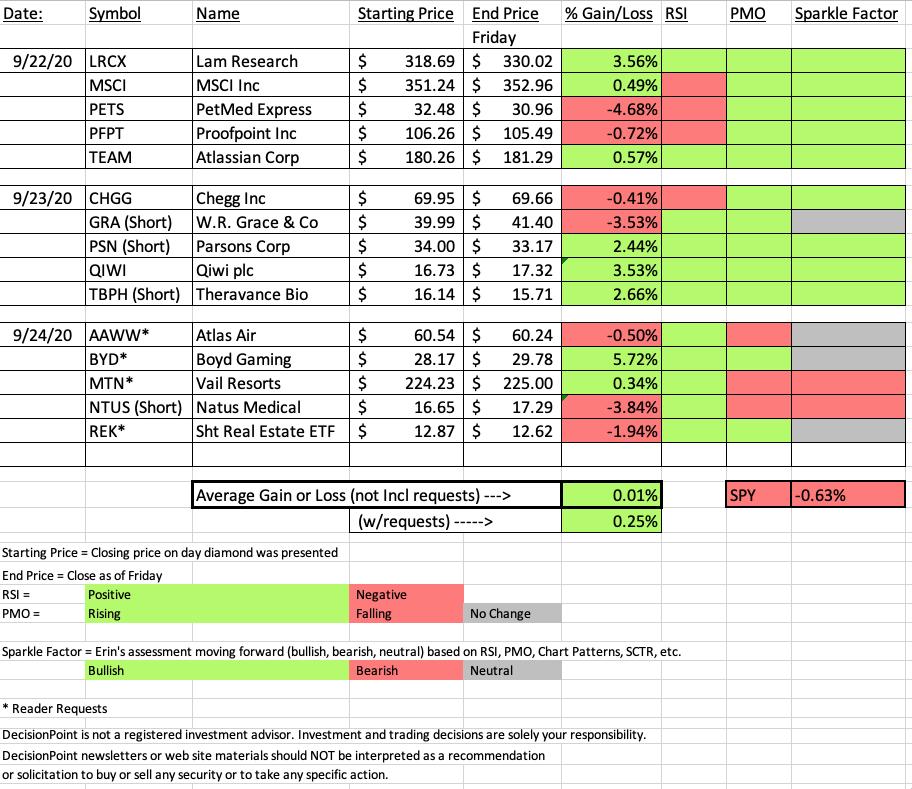

I really enjoyed this morning's Diamond Mine trading room! Lots to discuss and look at, I always seem to run out of time! The spreadsheet is looking better than it did this morning. I managed to scrape by with a +0.01% gain on the week, but with subscriber requests, together we saw a +0.25% gain! With the SPX down -0.63% on the week, I beat that benchmark by +0.64% and with your help, we beat it +0.88%.

My top performer this week was Lam Research (LRCX) with +3.56% gain so we will look at that. My worst performer was PetMed Express (PETS) at -4.68%. I had a feeling when I listed PETS after a 6%+ gain on the day, that I could get caught in a pullback. I still like PETS so that is a good chart to look at. There were only two stocks (MTN*, NTUS (short)) that received a negative "Sparkle Factor" and four (GRA (short), AAWW*, BYD* and REK*) have a "neutral" Sparkle Factor. Overall, it was a good week! "*" denotes reader requests.

Diamond Mine Information:

Diamond Mine Information:

Recording from Today (9/25/2020) is at this link. Access Passcode: w+*x#H00

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (10/2/2020) 12:00p ET:

Here is this week's registration link. Password: bull-bear

Please do not share these links! They are for Diamonds subscribers ONLY!

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Register for the Free Trading Room at this link or click above. Our next session is on 9/14/2020!

Lam Research Corp. (LRCX)

EARNINGS: 10/21/2020 (AMC)

Lam Research Corp. engages in manufacturing and servicing of wafer processing semiconductor manufacturing equipment. It operates through the following geographical segments: the United States, China, Europe, Japan, Korea, Southeast Asia, and Taiwan. It offers thin film deposition, plasma etch, photoresist strip, and wafer cleaning. The company was founded by David Lam on January 21, 1980 and is headquartered in Fremont, CA.

Currently LRCX is down slightly (-0.08%) in after hours trading. The RSI moved into positive territory today and the PMO executed a new crossover BUY signal. Overhead resistance is close, but I do like the indicators here. You could tighten the stop level to just below the original gap.

No improvement on the weekly chart, although it does have a positive RSI.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

PetMed Express, Inc. (PETS)

EARNINGS: 10/19/2020 (BMO)

PetMed Express, Inc. engages in the provision of markets prescription and non-prescription pet medications, health products and supplies for dogs and cats. Its non-prescription medications include flea and tick control products, bone and joint care products, vitamins, treats, nutritional supplements, hygiene products, and supplies. The prescription medications include heartworm preventatives, arthritis, thyroid, diabetes and pain medications, heart/blood pressure, and other specialty medications, as well as generic substitutes. The firm markets its products through national television, online and direct mail or print advertising campaigns. The company was founded in January 1996 and is headquartered in Delray Beach, FL.

I still like PETS despite it being the biggest loser this week. As I noted when I presented it, I had a feeling I'd get dinged on it in the recap because it had just had a 6%+ move that day and it was due for a pullback. Well, pullback it did in a big way. It technically triggered the stop. The RSI is negative, but rising and the PMO is beginning to rise again. I would set a new stop just below the September lows or even wait and see if it needs to test that support level. If it rallies and did not need to test support, that is a very bullish sign. I still like the positive divergence on the OBV.

The weekly PMO is pretty ugly, but the RSI is about ready to pop back into positive territory. You can see how important this support level is as it matches the 2017/2018 lows. If it can get a continuation on today's rally, I don't see why it couldn't move back to July top.

THIS WEEK's Sector Performance:

CONCLUSION:

Sector to Watch: Consumer Discretionary (XLY)

Industry Group to Watch: Restaurants & Bars ($DJUSRU)

With discussion of Florida opening restaurants and bars to 100% capacity and many other states lessening restrictions, this could be an interesting industry group next week. My two stock selections going into next week are GrubHub (GRUB) and Darden Restaurants (DRI). I did want to mention that in the Diamond Mine one of the viewers suggested I look at BioTelemetry Inc (BEAT). It is definitely "diamond in the rough" material!

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Have a Great Weekend! Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I do not own any of the stocks on the spreadsheet. I'm about 40% invested right now and 60% is in 'cash', meaning in money markets and readily available to trade with. The market is still soft, I'd rather hold off and not add new positions.

Technical Analysis is a windsock, not a crystal ball.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!