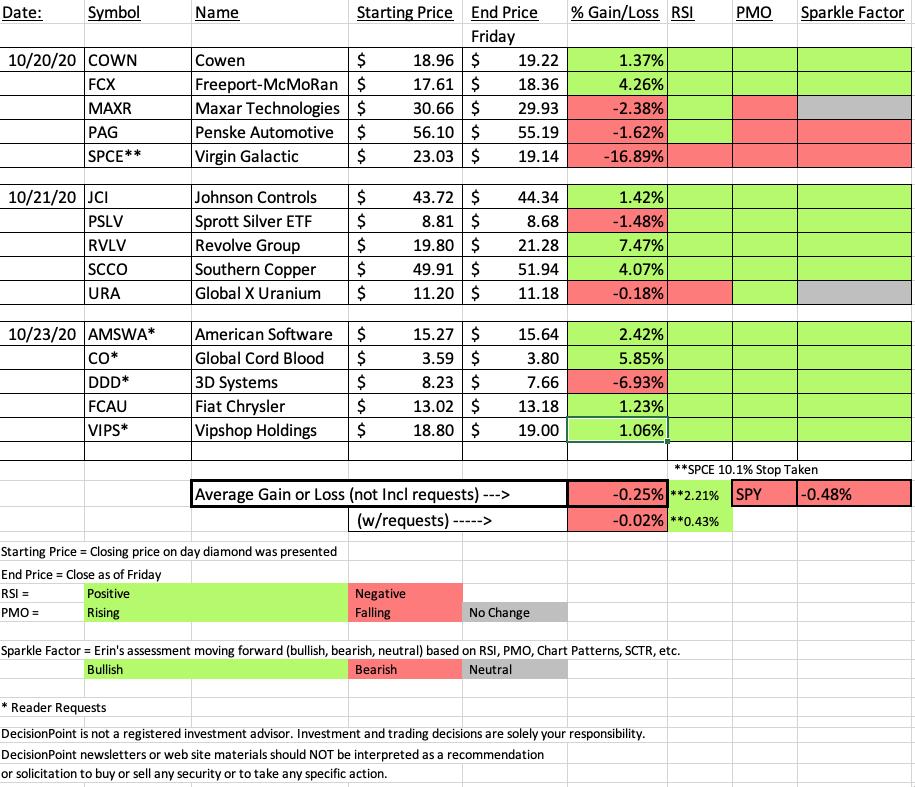

This week's Diamonds in the Rough performed quite well. Our big winner finished the week +7.47% and the two runners-up were up +4.26% and +4.07%; not bad on a week where the SPY was down -0.48%. One thing I would like to take into consideration from here on out are stops. I mark stop "areas" but always have an exact percentage placed on the chart. So far I haven't had a stop trigger like this. For the Recap, I believe that stop losses should be considered. To that end, today's spreadsheet will include the average without using the stop on Virgin Galactic (SPCE), as well as the average with the stop. It would've been a banner week (+2.21%) if we account for the stop being hit.

I'll be doing a relook at Virgin Galactic (SPCE), this week's lump of coal and a relook at Revolve Group (RVLV), this week's sparkling Diamond.

Be sure and register right now for next Friday's Diamond Mine. I didn't have the link in the free version of the Diamonds Report yesterday and some didn't realize they needed to go to the official paid version of the Diamond Report to get active links. You can always go back to an old report for the registration links for that week, but save yourself some time and register now. Remember it is a free perk for Diamonds subscribers.

Diamond Mine Information:

Diamond Mine Information:

Recording from Today's (10/23/2020) is at this link. Access Passcode: 3F36ts=$

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (10/23/2020) 12:00p ET:

Here is the registration link for Friday, 10/30/2020. Password: diamond

Please do not share these links! They are for Diamonds subscribers ONLY!

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

It's FREE!

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 10/19 trading room? Here is a link to the recording (password: Au6B.X*1).

For best results, copy and paste the password to avoid typos.

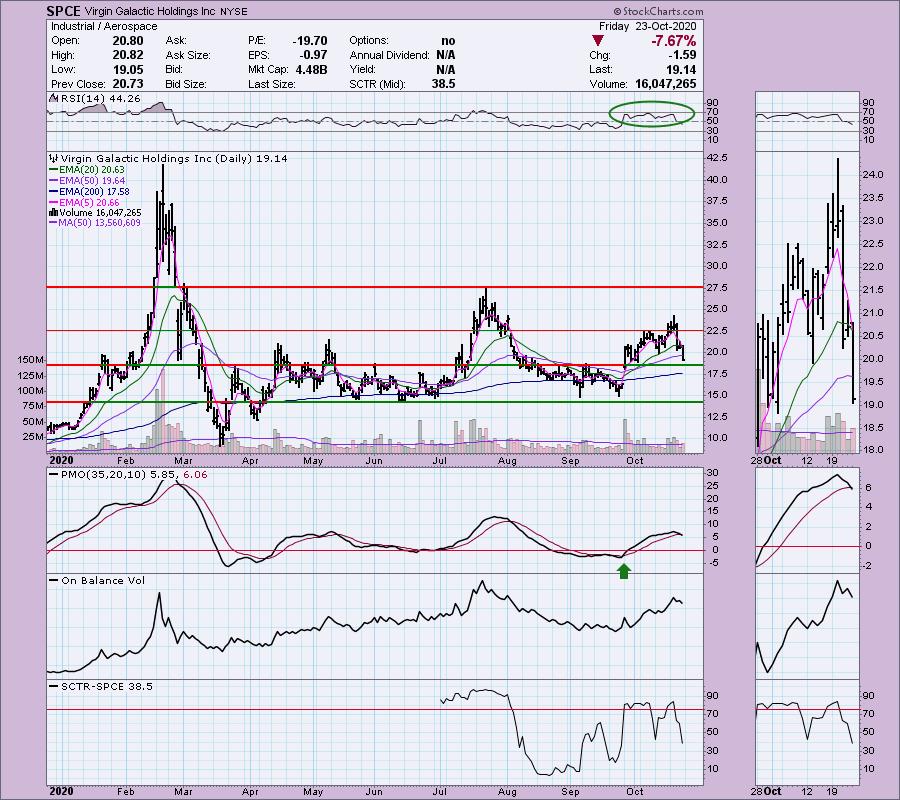

Virgin Galactic Holdings Inc (SPCE)

EARNINGS: 11/5/2020 (AMC)

Virgin Galactic Holdings, Inc. engages in the manufacture of advanced air and space vehicles, and provision of spaceflight services for private individuals and researchers. It designs spaceships which can fly anyone to space safely without the need for expertise or exhaustive time consuming training. The company was founded on May 5, 2017 and is headquartered in Las Cruces, NM.

This one was supposed to take us to the moon but instead, took us on a journey to the center of the earth. Below is the chart as it looked on Tuesday when I presented it. You can see the positive traits and in all honesty, I don't see anything negative on Tuesday's chart.

Now let's look at it today. The very next day it was down well over 11% which tripped the stop set above of 10.1%. This has definitely turned into a lump of coal. It is nearing support, but it took out the 20/50-EMAs like a hot knife through butter. I would look for a drop to major support below $15.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

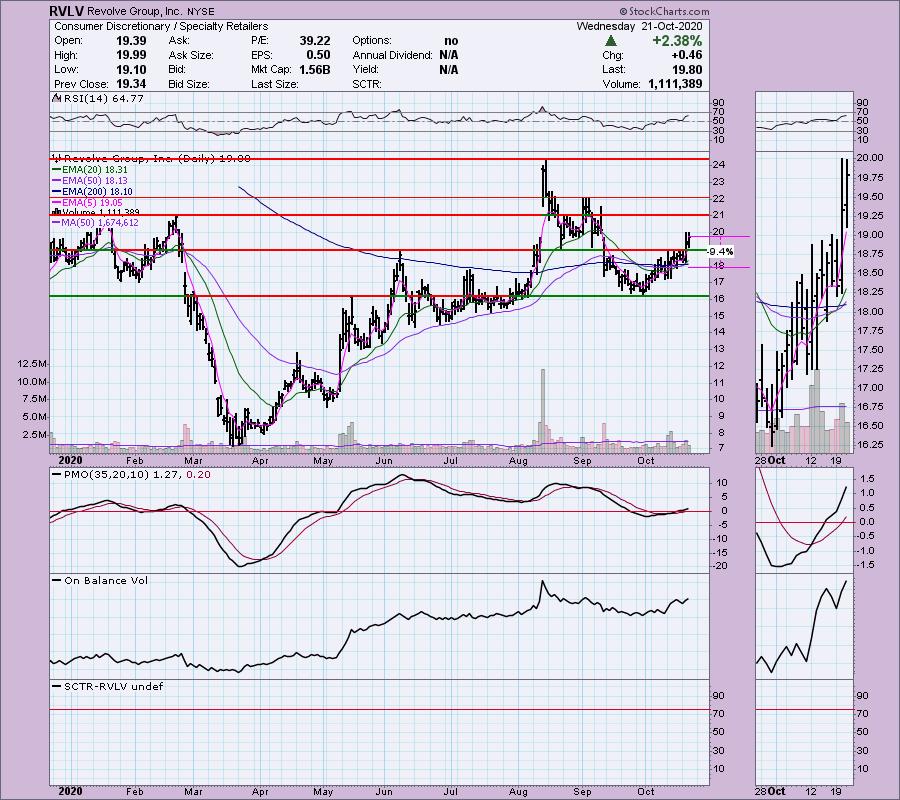

Revolve Group, Inc. (RVLV)

EARNINGS: 11/5/2020 (AMC)

Revolve Group, Inc. engages in the retail of next-generation fashion for millenial consumers. It operates through the following segments: Revolve and Forward. The Revolve segment offers assortment of apparel and footwear, accessories and beauty products from emerging, established and owned brands. The Forward segment provides luxury products. The company was founded by Michael Mente and Mike Karanikolas in 2003 and is headquartered in Cerritos, CA.

I liked the set-up on this. My concern had been a cup and handle possibility, but as I noted then, the positives outweighed that.

RVLV has only gotten better with age. It broke above resistance at the pre-bear market highs. The PMO rising nicely and is far from overbought. The only issue right now is the overbought RSI. RVLV has had serious damage done on overbought RSI pullbacks. So set your stop accordingly.

THIS WEEK's Sector Performance:

CONCLUSION:

Sector to Watch: Communications Services (XLC)

Industry Group to Watch: Internet ($DJUSNS)

I've added links to the charts for XLC above and the Internet industry group chart. You can see support under the surface and some room to go higher

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Have a Great Weekend! Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I own Disney (DIS) on the spreadsheet. I'm about 45% invested right now and 55% is in 'cash', meaning in money markets and readily available to trade with. I have no interest in adding positions right now.

Technical Analysis is a windsock, not a crystal ball.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!