The rally in the market this week put the wind at our backs this week. Another great example of why it is best to trade in a market with a bullish bias. To learn more about "bias" read the DP Alert. In the DP Alert, I wrote yesterday that I won't ignore the strong bullish bias in the market. Today's strong rally tells me there is more upside to be had and these charts all still look bullish except one.

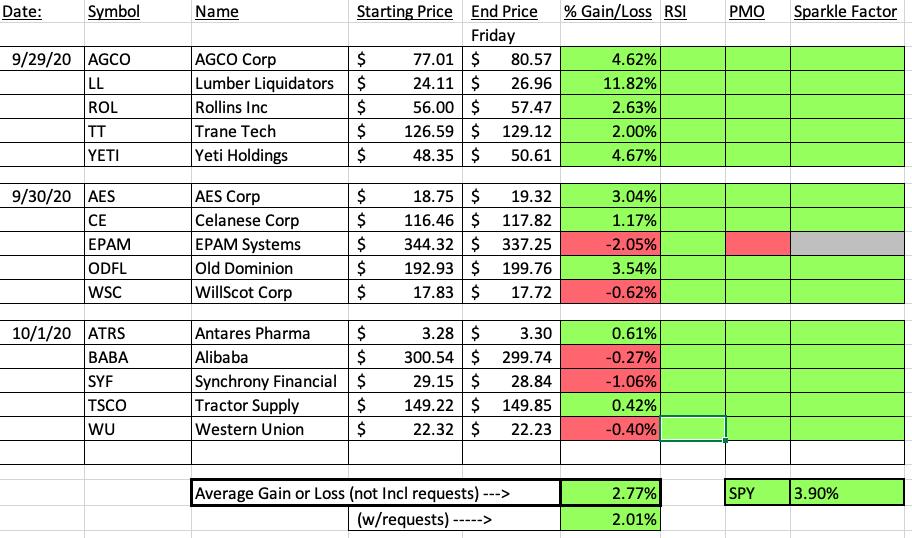

Reviewing the spreadsheet, Lumber Liquidators (LL) was the clear winner this week. I'll look at that chart and discuss its prospects moving forward. The biggest loser was EPAM Systems (EPAM) at just over a 2% loss. I have to say that I still am only "Neutral" going forward on EPAM.

I'm unhappy that we didn't outperform the SPY this week, but certainly many of the Diamonds did perform better so I'll take that.

Diamond Mine Information:

Diamond Mine Information:

Recording from Today's (10/9/2020) is at this link. Access Passcode: .6O2G.E!

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (10/9/2020) 12:00p ET:

Here is the registration link for Friday, 10/16/2020. Password: outlook

Please do not share these links! They are for Diamonds subscribers ONLY!

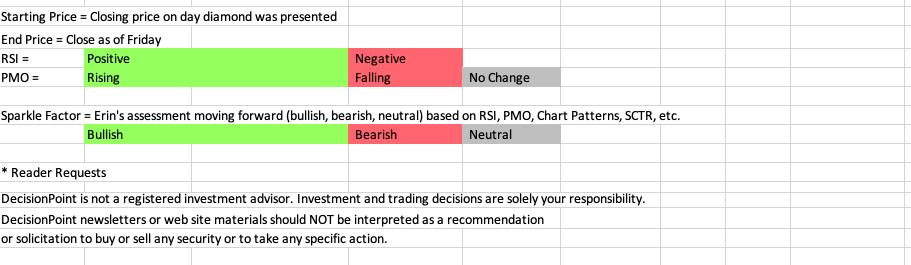

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

It's FREE!

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 10/5 trading room? Here is a link to the recording (password: J942MF*c).

For best results, copy and paste the password to avoid typos.

Lumber Liquidators Holdings, Inc. (LL)

EARNINGS: 11/4/2020 (BMO)

Lumber Liquidators Holdings, Inc. operates as a multi channel specialty retailer of hardwood flooring and hardwood flooring enhancements and accessories in the United States. The firm offers exotic and domestic hardwood species, engineered hardwood, laminate, vinyl plank, bamboo and cork direct to the consumer. It also provides flooring enhancements and accessories, including moldings, noise reducing underlay, adhesives and flooring tools. The company was founded by Thomas David Sullivan in 1993 and is headquartered in Richmond, VA.

Our big winner of the week and I can finally say that I own it. Seems that my best performers are not the ones I pick. This one had such a beautiful chart pattern and indicators, it should've performed well and it did. Remember that Old Dominion (ODFL) and Western Union (WU) also had very similar chart set-ups. Full disclosure I own both of those too. Nothing to complain about except an overbought RSI, although it's not at overbought extremes, so I'm looking for a test of $30.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

EPAM Systems, Inc. (EPAM)

EARNINGS: 11/5/2020 (BMO)

EPAM Systems, Inc. engages in the provision of software product development and digital platform engineering services. It operates through the following segments: North America, Europe, and Russia. The company was founded by Leonid Lozner and Arkadiy Dobkin in 1993 and is headquartered in Newtown, PA.

This one actually looks okay despite being the biggest loser which is why I vote neutral going forward. There is a negative divergence with the OBV now. We have declining tops on the OBV from the September high while price tops are rising. The breakout didn't hold up either. The PMO is now turned down below its signal line. The RSI is still positive and the very short-term rising bottoms trendline is intact which is why I can't be completely bearish on EPAM.

THIS WEEK's Sector Performance:

CONCLUSION:

Sector to Watch: Technology (XLK)

Industry Group to Watch: Electronic Equipment ($DJUSAI) and Semiconductors ($DJUSSC)

The market seems ready to rally to new all-time highs and I would be looking in the Technology space this week. If you look at a chart of both of those industry groups, you'll see new breakouts. If the market truly is firing on all cylinders, we should probably got into a more aggressive sector like Technology.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Have a Great Weekend! Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I do not own any of the stocks on the spreadsheet. I'm about 40% invested right now and 60% is in 'cash', meaning in money markets and readily available to trade with. The market is still soft, I'd rather hold off and not add new positions.

Technical Analysis is a windsock, not a crystal ball.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!