I will tell you that I had difficulty making selections for "diamonds in the rough". The market was up quite a bit and therefore many of the scan results came in with hefty gains on the day. My scans look for new momentum on stocks and today I had many PMOs that did 180's to the upside on huge 10%+ gains. While winners may keep on winning, I prefer to give you Diamonds that don't require a pullback for entry. Most of the stocks I looked at had RSIs above 70 (overbought) and I had to discard them as well.

A few observations: Banks, Oil Production, Oil Exploration and Pipelines were big winners today. I debated adding IEO and IEZ to today's Diamonds. Many of the Bank stocks that I reviewed were overbought on big rallies today, but that is an area you may want to watch for a pullback and then entry. Last Thursday I discussed that the last time we had stimulus, the Banks did very well. Tomorrow I will be scouring for a Bank should we see a pullback.

Don't forget this is a regular week so I will be doing Reader Requests tomorrow. I only pick four so don't be upset if I don't get to yours. Bring it to the Diamond Mine on Friday and I promise to look at them.

Today's "Diamonds in the Rough" are: ANAB, HAL, HCKT, LNG and WMT.

Diamond Mine Information:

Diamond Mine Information:

Here is today's (12/30/2020) recording link. Access Passcode: b2(K+8jF

Register in advance for the next "DecisionPoint Diamond Mine" trading room!

Here is the registration link for FRIDAY, 1/8/2021. Registration & Entry Password: winter

Please do not share these links! They are for Diamonds subscribers ONLY!

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 1/4/2021 free trading room? Here is a link to the recording. Access Code: &z=1pfp2

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

AnaptysBio, Inc. (ANAB)

EARNINGS: 3/1/2021 (AMC)

AnaptysBio, Inc. is a clinical stage biotechnology company, which engages in developing antibody product candidates focused on unmet medical needs in inflammation. Its products pipeline include ANB020, ANB019, and checkpoint receptor agonist antibodies. The company was founded by Andrew B. Cubitt, William J. Boyle and Nicholas B. Lydon in November 2005 and is headquartered in San Diego, CA.

ANAB is already up +3.64% in after hours trading and I nearly included this one yesterday! When it came in again, I decided it must be time. The PMO is nearing an oversold crossover BUY signal. The RSI has just moved into positive territory. I didn't annotate it, but there is a clear break in the declining trend right now. The 5-EMA just crossed above the 20-EMA for a ST Trend Model BUY signal. I set the stop at the 200-EMA.

The weekly PMO has bottomed above the signal line and the RSI has turned up to remain in positive territory. Upside potential is good if it can breakout above the 2020 high. Even if it goes just to the 2020 high, that would be a 30%+ gain.

Halliburton Co. (HAL)

EARNINGS: 1/19/2021 (BMO)

Halliburton Co. engages in the provision of services and products to the energy industry related to the exploration, development, and production of oil and natural gas. It operates through the following segments: Completion and Production, and Drilling and Evaluation. The Completion and Production segment delivers cementing, stimulation, intervention, pressure control, specialty chemicals, artificial lift, and completion services. The Drilling and Evaluation segment provides field and reservoir modeling, drilling, evaluation, and wellbore placement solutions that enable customers to model, measure, and optimize their well construction activities. The company was founded by Erle P. Halliburton in 1919 and is headquartered in Houston, TX.

HAL is unchanged in after hours trading. I was surprised I haven't suggested this as a Diamond previously. It looks good today with a positive RSI and a PMO that has just turned up. Yesterday's breakout didn't hold, but today it did. The SCTR is very positive. The OBV isn't great but we do see heavy accumulation over the last two days. The stop is rather deep. To get below support at $18, that was far too deep for me. I've aligned it with the 20-EMA.

The weekly PMO and RSI are very positive, although getting overbought. I've marked upside potential to the 2019/2020 top, but it could certainly travel higher.

Hackett Group, Inc. (HCKT)

EARNINGS: 2/16/2021 (AMC)

The Hackett Group, Inc. is an intellectual property-based strategic consultancy and enterprise company, which engages in the provision of business and technology consulting services. The firm offers services include benchmarking, executive advisory, business transformation, enterprise performance management, training and advisory to global business services. It also produces digital transformation including robotic process automation and enterprise cloud application implementation. The company was founded by Ted A. Fernandez and David N. Dungan in 1991 and is headquartered in Miami, FL.

HCKT is unchanged in after hours trading. This one was the result of a scan that looks for 5/20-EMA positive crossovers. Remember that is a ST Trend Model BUY signal for DecisionPoint. The PMO has been gently moving higher and is now about ready to give us the crossover BUY signal. The RSI is positive again and price has broken out. The OBV isn't moving much, but its last few bottoms are even and not on the decline. The stop level is fairly tight and matches both the 200-EMA and December support.

The weekly chart is positive with a weekly PMO that is accelerating higher and what looks like a flag formation out of the September low. This week's price action is resolving the flag upward as expected. The weekly OBV bottoms are rising nicely and actually show a positive divergence.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Cheniere Energy, Inc. (LNG)

EARNINGS: 2/22/2021 (BMO)

Cheniere Energy, Inc. engages in liquefied natural gas (LNG) related businesses. It owns and operates LNG terminals, and develops, constructs, and operates liquefaction projects near Corpus Christi, Texas, and at the Sabine Pass LNG terminal. The company was founded by Charif Souki in 1983 and is headquartered in Houston, TX.

LNG is down -0.93% in after hours trading, so a better entry will be available which will alleviate the deep 10.5% stop level. It may not help the recap spreadsheet on Friday, but I like it moving well past today. The PMO has turned up on today's successful breakout above the December top. The RSI is positive and not overbought. OBV bottoms are rising while price bottoms are flat.

The weekly chart is very positive with a PMO that is rising and not that overbought. The RSI is positive and not yet overbought.

Walmart Inc. (WMT)

EARNINGS: 2/18/2021 (BMO)

Walmart, Inc. engages in retail and wholesale business. The Company offers an assortment of merchandise and services at everyday low prices. It operates through the following business segments: Walmart U.S., Walmart International, and Sam's Club. The Walmart U.S. segment operates as a merchandiser of consumer products, operating under the Walmart, Wal-Mart, and Walmart Neighborhood Market brands, as well as walmart.com and other eCommerce brands. The Walmart International segment manages supercenters, supermarkets, hypermarkets, warehouse clubs, and cash & carry outside of the United States. The Sam's Club segment comprises membership-only warehouse clubs and samsclubs.com. The company was founded by Samuel Moore Walton and James Lawrence Walton in 1945 and is headquartered in Bentonville, AR.

WMT is up +0.29% in after hours trading. I covered Walmart in April 8th Diamonds Report (up 20.4% since). I really like the breakout and the nearing ST Trend Model BUY signal as the 5-EMA jets toward the 20-EMA. The PMO has turned up and is headed for an oversold crossover BUY signal. The RSI just hit positive territory again. One big positive is that you can set a tighter stop. I have marked -7.2% as a stop level, but you could easily halve that and stop just below the December low.

I had hoped that the weekly chart would show a rising PMO, but alas, no. It is however beginning to decelerate and the RSI is positive.

Full Disclosure: I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with. I'm considering adding positions again. Read the DP Alert for my reasons why.

Current Market Outlook:

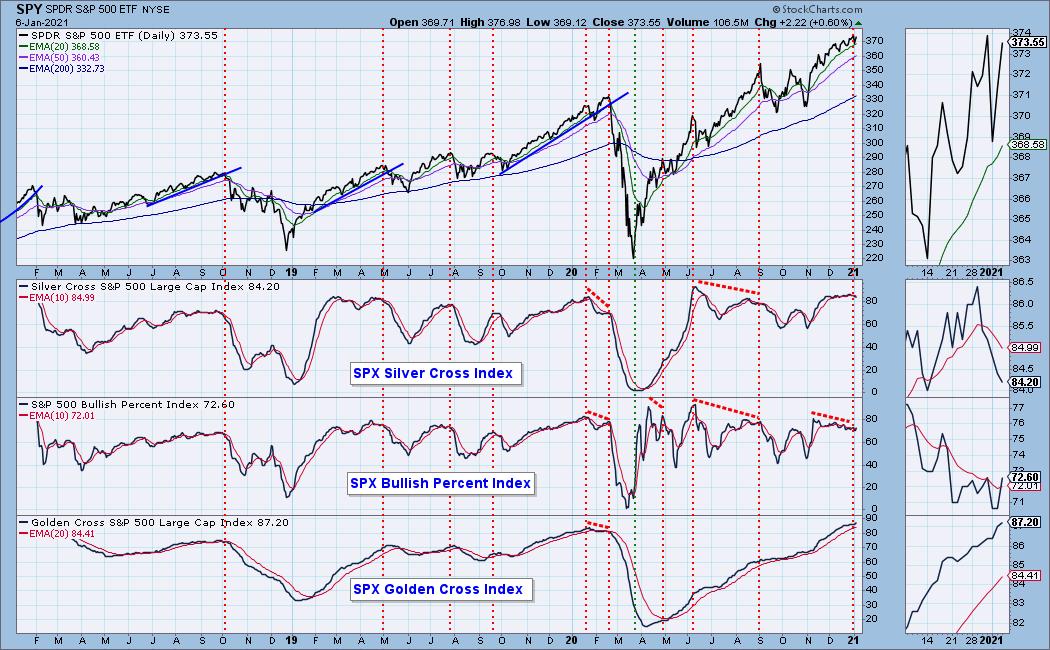

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 4

- Diamond Dog Scan Results: 3

- Diamond Bull/Bear Ratio: 1.33

I'm in the process of trying to plot the Diamond Index, but with time at a premium, it is on the back burner.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!