The market is pulling back. It is time to start considering "Diamonds in the Rough" as watch list candidates. The short-term market trend is working against us right now. Any positions you open should be accompanied by a hard stop or watched very closely each day. I continue to go into my portfolio and adjust or add stops to any positions I have "mental" stops on.

Oil and gas prices are on the rise, so I believe that the Energy sector will continue to outperform. I've covered this sector for the last two weeks, so if you look at back issues of DP Diamonds reports you can take look. The sector charts for all other sectors, including Consumer Staples are looking bearish so be careful out there!

You'll notice that the "Stocks to consider" list is getting shorter and shorter. My scans are producing very few results and I am picky :-)

Today's "Diamonds in the Rough" are: AVDL, SHYF and THS.

Stocks/ETFs to Consider (no order): MRNS, SNDX and RYAM.

Diamond Mine REGISTRATION Information:

Diamond Mine REGISTRATION Information:

When: May 14, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (5/14/2021) LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar, including the password. SAVE IT! Zoom doesn't always send out the reminders.

=======================================================================

Diamond Mine RECORDING Link:

Topic: DecisionPoint Diamond Mine (5/14/2021) LIVE Trading Room

Date: May 10, 2021 08:59 AM Pacific Time (US and Canada)

Meeting Recording HERE.

Access Passcode: ih7j1e!V

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Free DP Trading Room RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : May 10, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: May-10th

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Avadel Pharmaceuticals plc (AVDL)

EARNINGS: 8/9/2021 (BMO)

Avadel Pharmaceuticals Plc engages in the development and commercialization of pharmaceutical products. Its products include Bloxiverz, Vazculep, Nouress, and Akovaz. It focuses on approval of FT218, a formulation of sodium oxybate designed to treat excessive daytime sleepiness and cataplexy in adults with narcolepsy. The company was founded on December 1, 2015 and is headquartered in Dublin, Ireland.

AVDL is unchanged in after hours trading. I noticed a handful of Pharmaceuticals in my scan results. I like the potential on this chart. The RSI is positive and the PMO just triggered an oversold crossover BUY signal. This is a volatile stock and low priced, so remember to position size appropriately to minimize risk. Price has broken out of its declining trend and for the fourth day in a row price has closed above the 20-EMA. Notice that today there is a ST Trend Model BUY signal (generated when the 5-EMA crosses above the 20-EMA). The group and AVDL are outperforming. The stop is rather deep, I set it below the 200-EMA and summer 2020 lows.

The weekly PMO is on a SELL signal, but it is beginning to decelerate. We can see that price is coming off long-term support at mid-2020 lows and 2016/2017 lows. The OBV in the long term is confirming.

The Shyft Group, Inc. (SHYF)

EARNINGS: 8/5/2021 (BMO)

The Shyft Group, Inc. engages in vehicle manufacturing and assembly for the commercial and retail vehicle industries as well as for the emergency response and recreational vehicle markets. It operates through the Fleet Vehicles and Services, and Specialty Vehicles segments. The Fleet Vehicles and Services segment manufactures commercial vehicles used in the e-commerce/last mile/parcel delivery, beverage and grocery delivery, mobile retail, and trades and construction industries. The Specialty Vehicles segment deals with engineering and manufacturing diesel motor home chassis; provision of specialty vehicles and other commercial vehicles; and distribution of related aftermarket parts and accessories. The company was founded by William F. Foster, George Sztykiel, Gerald Geary, and John Knox on September 18, 1975 and is headquartered in Novi, MI.

SHYF is unchanged in after hours trading. Yesterday price broke out from a bullish falling wedge. Today it did pullback but stayed above the declining trendline that forms the top of the wedge. Today there was a new ST Trend Model BUY signal as the 5-EMA crossed above the 20-EMA. The PMO turned up right on the zero line and is headed for an oversold BUY signal. The RSI remains in positive territory. It is a top performer in its industry group and is outperforming the SPX. The SCTR just reentered the "hot zone" above 75. The stop is set just below the late March bottom.

The weekly RSI is positive and we have a positive divergence between rising OBV bottoms and falling price bottoms. The PMO isn't looking good although it could be starting to decelerate somewhat.

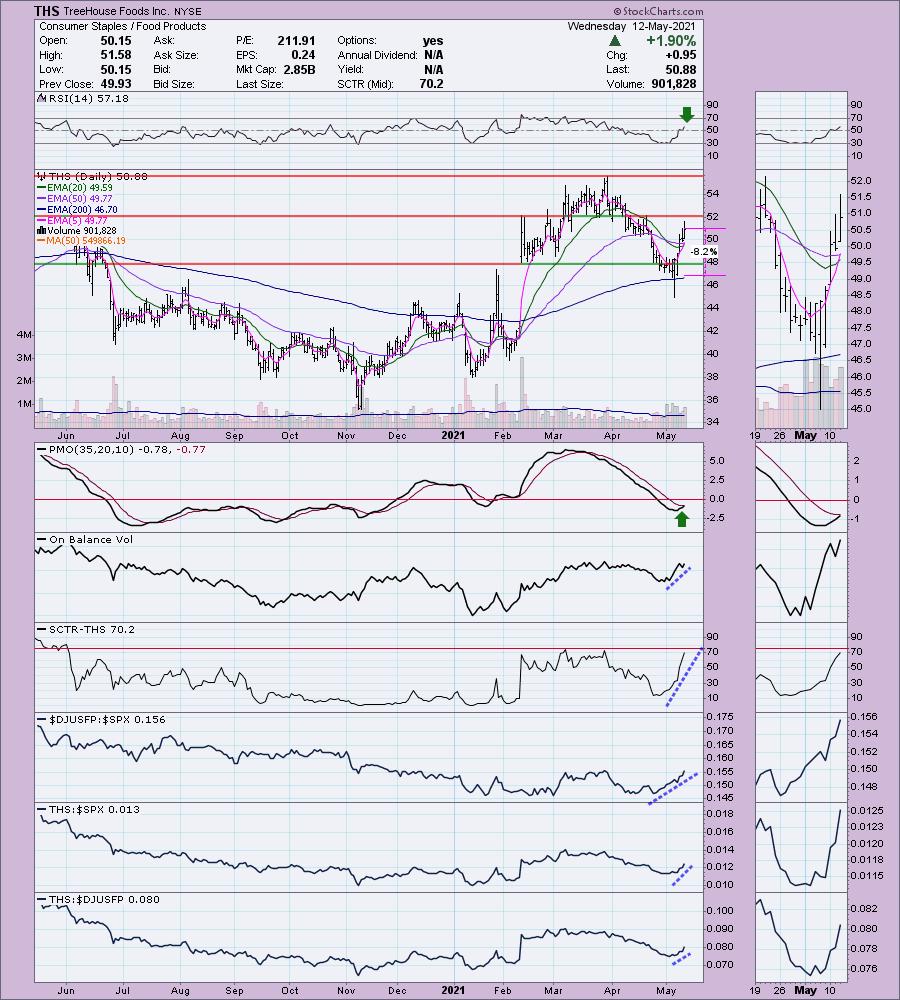

TreeHouse Foods Inc. (THS)

EARNINGS: 8/5/2021 (BMO)

TreeHouse Foods, Inc. is a manufacturer and distributor of private label packaged foods and beverages in North America. Its product portfolio includes snacking, beverages, and meal preparation products, available in shelf stable, refrigerated, frozen, and fresh formats. The firm operates through the following segments: Meal Preparation and Snacking & Beverages. The Meal Preparation segment sells aseptic cheese & pudding; baking and mix powders; hot cereals; jams, preserves, and jellies; liquid and powdered non-dairy creamer; macaroni and cheese; mayonnaise; Mexican, barbeque, and other sauces; pasta; pickles and related products; powdered soups and gravies; refrigerated and shelf stable dressings and sauces; refrigerated dough; single serve hot beverages; skillet dinners; and table and flavored syrups. The Snacking & Beverages segment sells bars; broths; candy; cookies; crackers; in-store bakery products; pita chips; powdered drinks; pretzels; ready-to-drink coffee; retail griddle waffles, pancakes, and French toast; specialty teas; and sweeteners. The company was founded on January 25, 2005 and is headquartered in Oak Brook, IL.

THS is unchanged in after hours trading. I covered this one back on March 17th 2020. It was up over 32% by May 2020, but as you can see, it began to decline. The stop was finally hit on the November 2020 low. It's setting up nicely right now. Consumer Staples normally sees some love during market declines, except during extended corrections or bear market declines. Price broke out above the 20/50-EMAs and today triggered a ST Trend Model BUY signal. The RSI has just moved into positive territory and the PMO is likely to generate a crossover BUY signal tomorrow. It's performing very well and the SCTR is racing higher. The stop is set around the 200-EMA.

The weekly PMO is definitely turning up and the RSI is positive. I like seeing the bounce off the 43-week EMA and this week off the 17-week EMA. The one issue I have is that overhead resistance is arriving soon. However, if it can vault that resistance level, price could make its way back up to the next resistance level which is around $68.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

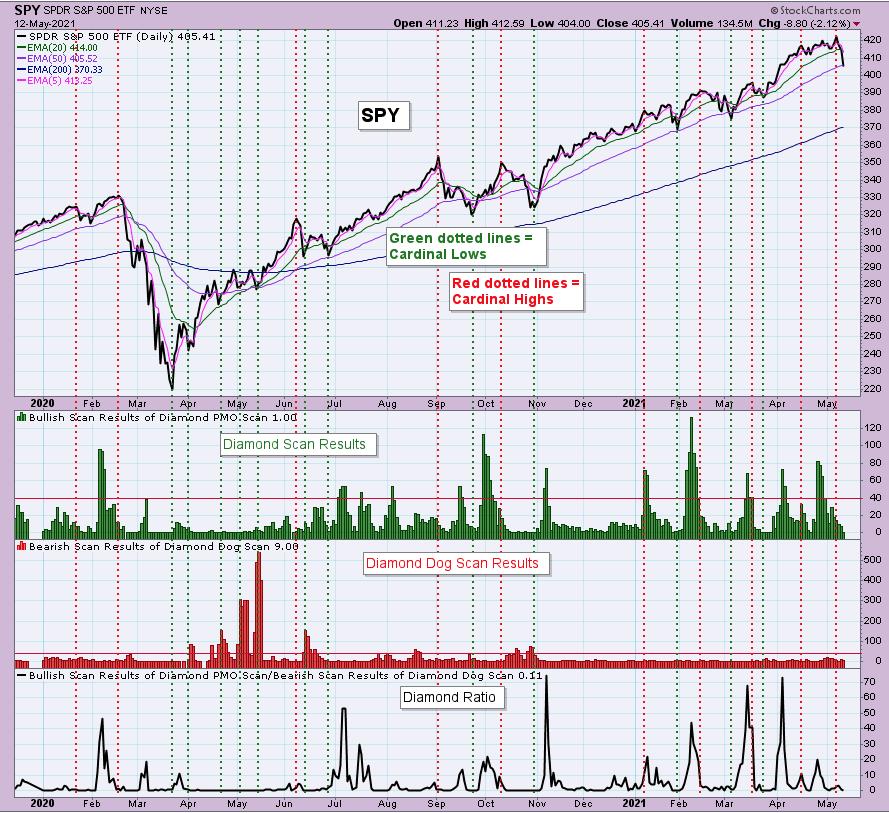

Diamond Index:

The Diamond Index chart looks at the number of scan results from my bullish Diamond PMO Scan and the number of scan results from the inverse Diamond Dog Scan. The Diamond Ratio divides the bullish results by the bearish results.

I only have data going back to October 2019 so I won't make any sweeping conclusions about the Diamond Index chart. I have marked cardinal tops with red dotted vertical lines and cardinal price bottoms with green dotted vertical lines. I believe that when the Diamond Dog results spike, it usually comes at a price bottom, or marks a strong continuation of the rising trend.

Unfortunately, the Diamond PMO Scan result numbers aren't providing much insight. The Diamond Ratio has promise, but again I don't see a clear correlation to the market tops/bottoms right now. I need to study and manipulate the data some more. Keep you posted!

Full Disclosure: I'm about 65% invested and 35% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!