Great Diamond Mine Trading Room today! The majority of this week's "Diamonds in the Rough" are off to a good start and most should continue to outperform. If not for a large loss on Copper and a small-cap Pharma, it would've been an almost perfect week. I'll discuss our big winner and big loser below.

I'm going to keep it short today. My daughters are here for a belated Mother's Day. It's rare to get them together now that they are out on their own.

It's time to register for next week's Diamond Mine! You can do it right now using this registration link.

** IMPORTANT NEW ZOOM SECURITY **

This week I will be setting up Zoom recordings so that you'll need to get our approval to view the recordings. I will be watching my email so you shouldn't experience any delays. I know this is an inconvenience for all of us. Hopefully I won't need to do this in the future, but currently we have a security issue that requires vigilance.

Diamond Mine Information:

RECORDING LINK:

Topic: DecisionPoint Diamond Mine (5/14/2021) LIVE Trading Room

Date: May 14, 2021 09:00 AM Pacific Time (US and Canada)

Meeting Recording LINK **

**APPROVAL is required to view the recordings. DecisionPoint will get an email from Zoom with your request to view and we will immediately approve you. You may want to go ahead and request approval as soon as possible in case there is a delay. We apologize for this security limitation. Hopefully we can turn this off soon.

Access Passcode: May-14-21

REGISTRATION:

When: May 21, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (5/21/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

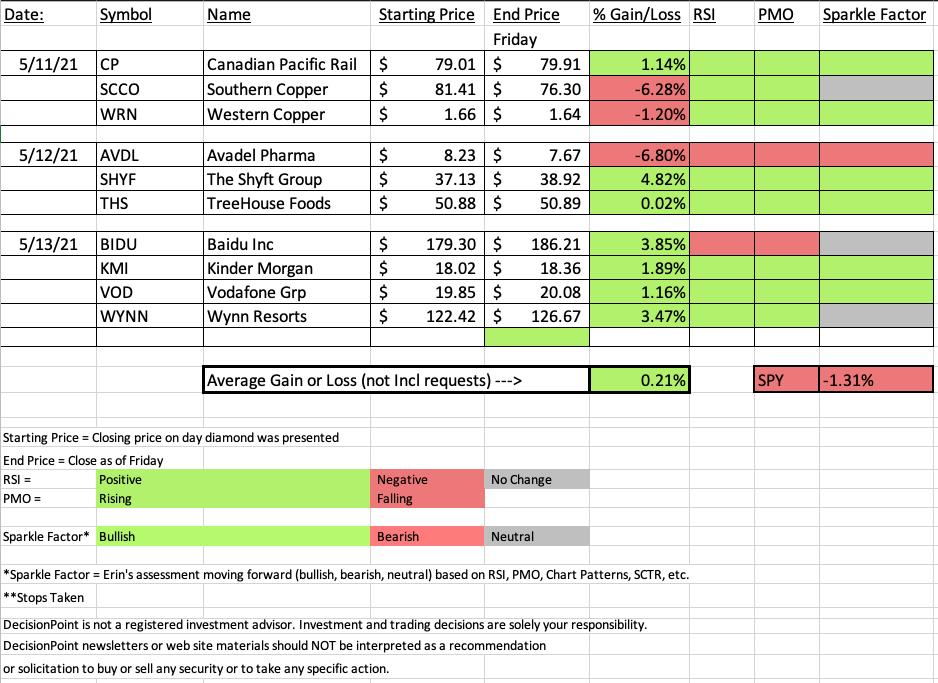

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Free DecisionPoint Trading Room on Mondays, Noon ET

*Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!*

=======================================

BELOW is a link to Monday's recording:

Topic: DecisionPoint Trading Room

Start Time : May 10, 2021 09:00 AM

Free Trading Room Recording LINK.

Access Passcode: May-10th

For best results, copy and paste the access code to avoid typos.

Darling:

The Shyft Group, Inc. (SHYF)

EARNINGS: 8/5/2021 (BMO)

The Shyft Group, Inc. engages in vehicle manufacturing and assembly for the commercial and retail vehicle industries as well as for the emergency response and recreational vehicle markets. It operates through the Fleet Vehicles and Services, and Specialty Vehicles segments. The Fleet Vehicles and Services segment manufactures commercial vehicles used in the e-commerce/last mile/parcel delivery, beverage and grocery delivery, mobile retail, and trades and construction industries. The Specialty Vehicles segment deals with engineering and manufacturing diesel motor home chassis; provision of specialty vehicles and other commercial vehicles; and distribution of related aftermarket parts and accessories. The company was founded by William F. Foster, George Sztykiel, Gerald Geary, and John Knox on September 18, 1975 and is headquartered in Novi, MI.

Below is the chart and commentary from 5/12:

"SHYF is unchanged in after hours trading. Yesterday price broke out from a bullish falling wedge. Today it did pullback but stayed above the declining trendline that forms the top of the wedge. Today there was a new ST Trend Model BUY signal as the 5-EMA crossed above the 20-EMA. The PMO turned up right on the zero line and is headed for an oversold BUY signal. The RSI remains in positive territory. It is a top performer in its industry group and is outperforming the SPX. The SCTR just reentered the "hot zone" above 75. The stop is set just below the late March bottom."

Here is today's chart:

This chart just keeps getting better and better. We now have a decisive (3%+) breakout from the bullish falling wedge. The PMO has now given us a crossover BUY signal. The RSI is positive and not overbought. The SCTR is in the "hot zone" above 75. I think the stop level is good where it is.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Avadel Pharmaceuticals plc (AVDL)

EARNINGS: 8/9/2021 (BMO)

Avadel Pharmaceuticals Plc engages in the development and commercialization of pharmaceutical products. Its products include Bloxiverz, Vazculep, Nouress, and Akovaz. It focuses on approval of FT218, a formulation of sodium oxybate designed to treat excessive daytime sleepiness and cataplexy in adults with narcolepsy. The company was founded on December 1, 2015 and is headquartered in Dublin, Ireland.

Below is the commentary and chart from 5/12:

"AVDL is unchanged in after hours trading. I noticed a handful of Pharmaceuticals in my scan results. I like the potential on this chart. The RSI is positive and the PMO just triggered an oversold crossover BUY signal. This is a volatile stock and low priced, so remember to position size appropriately to minimize risk. Price has broken out of its declining trend and for the fourth day in a row price has closed above the 20-EMA. Notice that today there is a ST Trend Model BUY signal (generated when the 5-EMA crosses above the 20-EMA). The group and AVDL are outperforming. The stop is rather deep, I set it below the 200-EMA and summer 2020 lows."

Below is today's chart:

When I look at the chart from Wednesday, the only bearish element that I can find would be that price closed below the 50-EMA, but at the same time it held above the 20-EMA and we were just about to get a positive 5/20-EMA crossover. This one simply didn't follow-through as it should have despite all of the bullish characteristics on the chart.

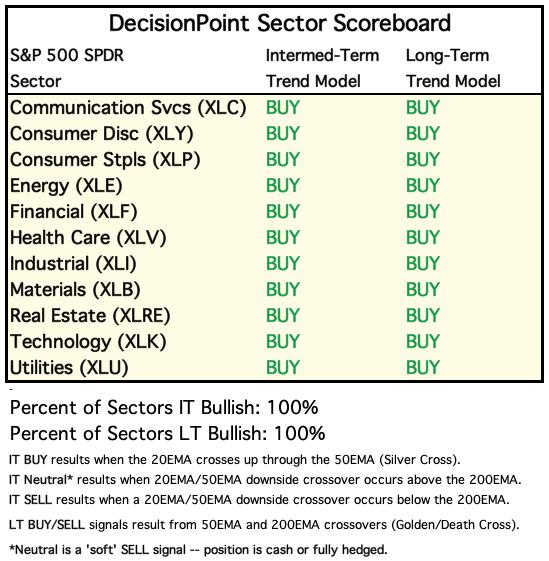

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

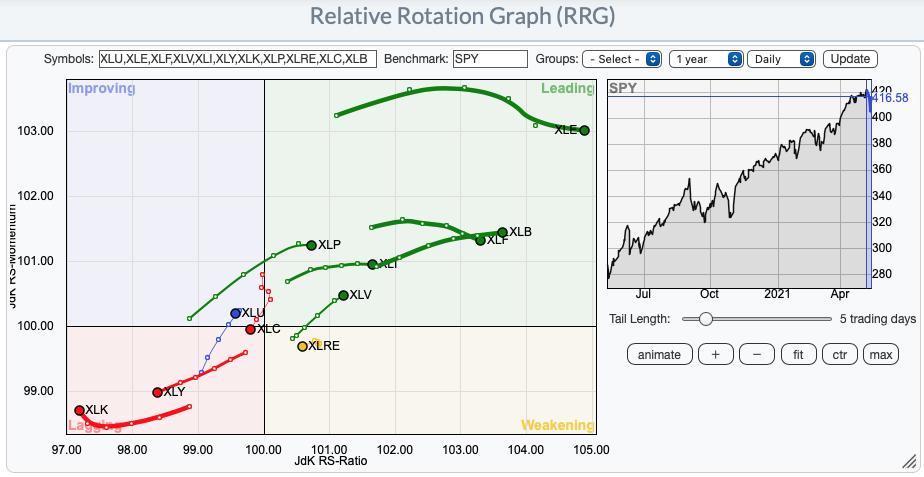

CONCLUSION:

We have more sectors in the "Leading" category. XLU looks interesting to me given it is "Improving" and moving toward Leading. However, in this morning's Diamond Mine I decided to go with the Financial Sector ETF (XLF) based on its sector chart.

Short-term RRG:

Sector to Watch: Financial (XLF)

The PMO and rebound off the 20-EMA is what eventually sold me on this sector. The PMO has bottomed above the signal line and is not overbought. The RSI is positive. Participation is overbought right now, but notice that XLF can hold onto overbought conditions for quite some time.

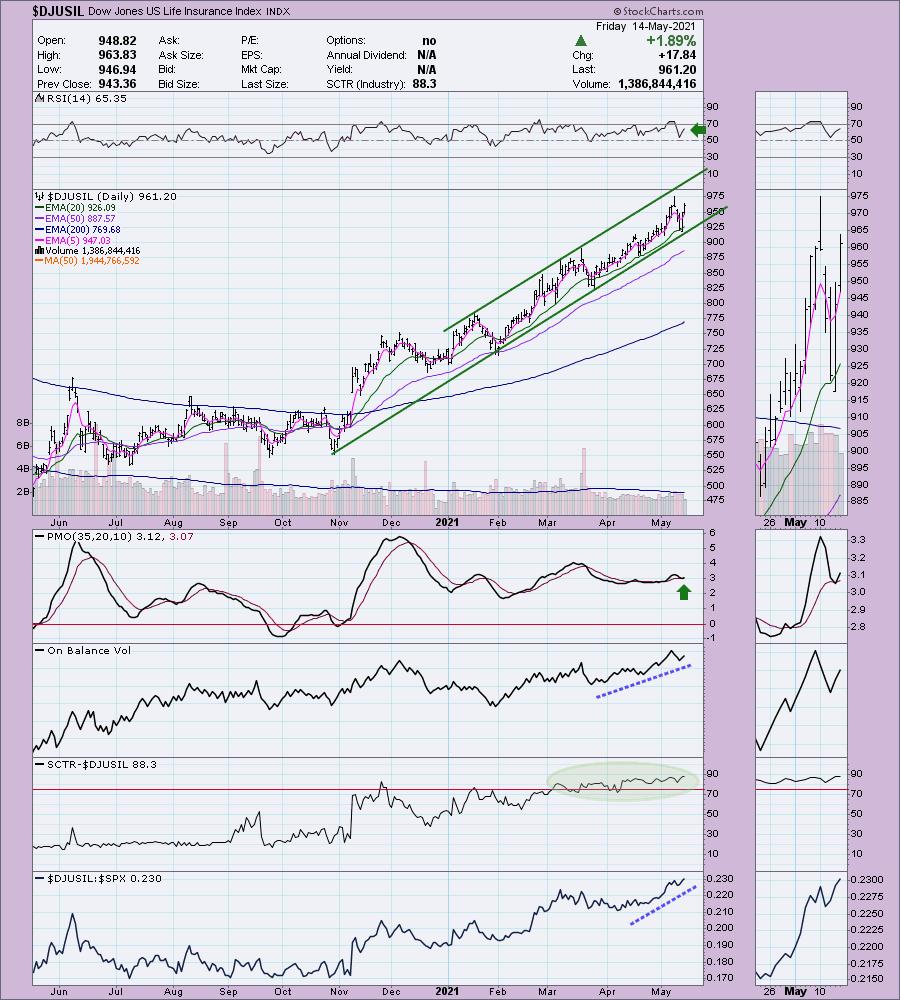

Industry Group to Watch: Life Insurance ($DJUSIL)

I like the positive RSI and PMO turning back up. Neither are overbought. This group is outperforming the SPX by a mile and the SCTR is positive.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 75% invested right now and 25% is in 'cash', meaning in money markets and readily available to trade with. I own MMP and VLO which were mentioned in this report.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)