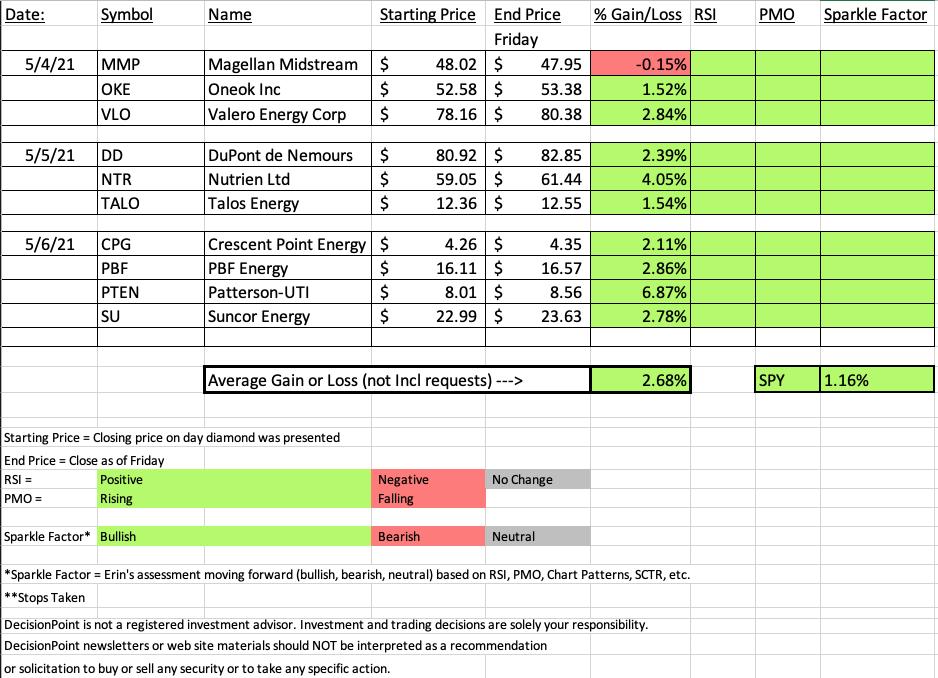

Over the last two weeks I have been presenting the majority of "diamonds in the rough" from the Energy and Materials sectors. They didn't do much last week, but this week these stocks have been outperforming in a major way.

This week we only had one "diamond in the rough" finish the week at a loss, but it was only a lost of -0.15%. It happens to be one of the diamonds I bought last week and I'm just fine with it. The chart is still very strong.

The big winner this week was yesterday's pick of Patternson-UTI (PTEN). The chart still looks fantastic as do all of the charts this week. You'll notice that every one of this week's stocks have Sparkle Factors that are green. The indicators on all of the picks this week are still positive as well.

It's time to register for next week's Diamond Mine! You can do it right now using this link.

Diamond Mine Information:

RECORDING LINK:

Topic: DecisionPoint Diamond Mine (5/7/2021) LIVE Trading Room

Start Time : May 7, 2021 08:59 AM

Meeting Recording Link.

Access Passcode: May/7/2021

REGISTRATION:

When: May 14, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (5/14/2021) LIVE Trading Room

Register in advance for this webinar at this link.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Free DecisionPoint Trading Room on Mondays, Noon ET

*Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!*

=======================================

BELOW is a link to Monday's recording:

Topic: DecisionPoint Trading Room

Start Time : Apr 19, 2021 09:00 AM

Free Trading Room Recording

Access Passcode: April/19

For best results, copy and paste the access code to avoid typos.

Darling:

Patterson-UTI Energy, Inc. (PTEN)

EARNINGS: 7/29/2021 (BMO)

Patterson-UTI Energy, Inc. engages in the provision of drilling and pressure pumping services, directional drilling, rental equipment and technology. It operates through the following segments: Contract Drilling Services, Pressure Pumping Services, and Directional Drilling Services. The Contract Drilling Services segment markets its services to major and independent oil and natural gas operators. The Pressure Pumping Services segment provides pressure pumping services to oil and natural gas operators primarily in Texas and the Appalachian Basin. The Directional Drilling Services segment offers downhole performance motors and equipment to provide services including directional drilling, downhole performance motors, motor rentals, directional surveying, measurement-while-drilling, and wireline steering tools, in most major onshore oil and natural gas basins. The company was founded by Cloyce A. Talbott and A. Glenn Patterson in 1978 and is headquartered in Houston, TX.

Below is the commentary and chart from Thursday (5/6):

"PTEN is up +0.50% in after hours trading. The RSI is positive and not overbought. Not only is the PMO on a BUY signal, we just had an IT Trend Model "Silver Cross" BUY signal when the 20-EMA crossed above the 50-EMA. The SCTR is very healthy and it has been a steady out-performer over the past week. The stop is set just below support at the early April tops."

Here is today's chart:

Today's breakout move was the reason this one ended up as the big winner. The chart still looks fantastic and there may be an opportunity to pick this one up on a pullback next week. The RSI is getting overbought, but based on history, it can stay that way. Also, today's big rally also pushed the RSI toward overbought. When/if we see some digestion of this move, that will get the RSI out of overbought territory.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Magellan Midstream Partners, LP (MMP)

EARNINGS: 7/29/2021 (BMO)

Magellan Midstream Partners LP engages in the transportation, storage and distribution of petroleum products. It operates through the following segments: Refined Products, Crude Oil, and Marine Storage. The Refined Products segment consists of common carrier refined products pipeline system, independent terminals, and its ammonia pipeline system. The Crude Oil segment comprises of crude oil pipelines, splitter and storage facilities which are used for contract storage. The Marine Storage segment includes marine terminals located along coastal waterways. The company was founded in August 2000 and is headquartered in Tulsa, OK.

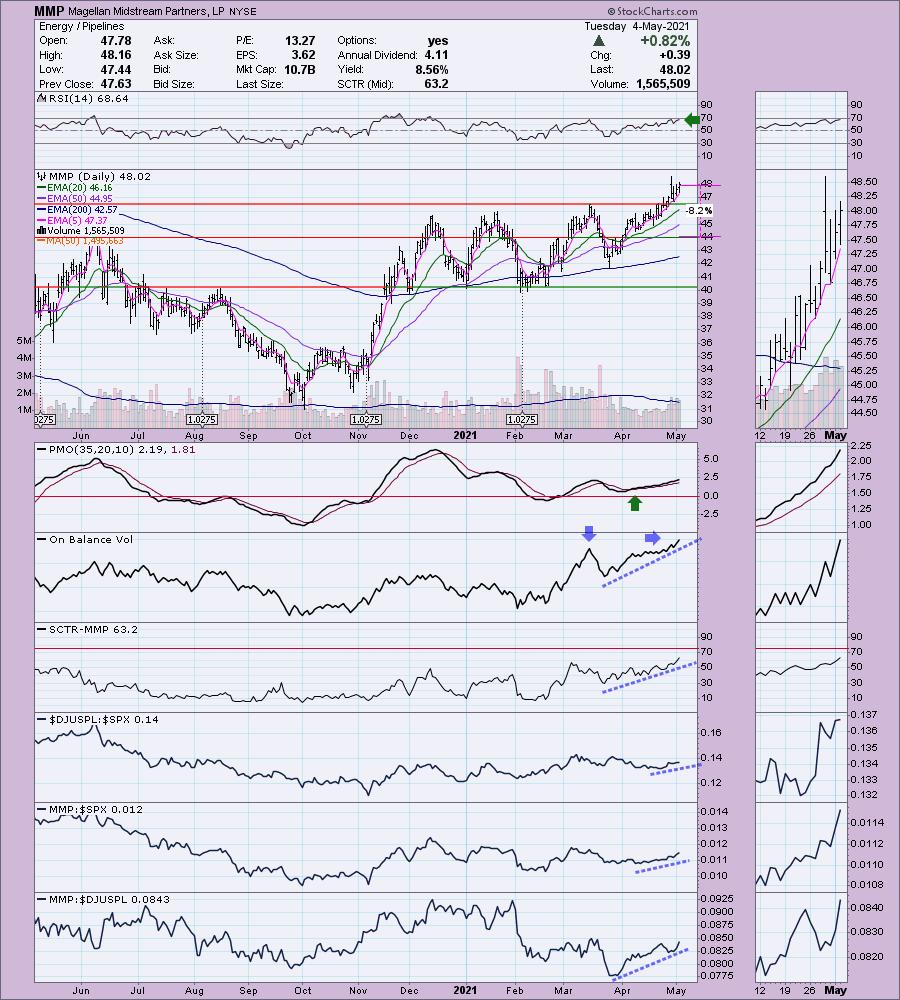

Below is the commentary and chart from Tuesday (5/4):

"MMP is unchanged in after hours trading. This one has been a winner since late March. As Mary Ellen McGonagle often says, "Winners keep on winning". The RSI is positive and not yet overbought. The PMO is on an oversold BUY signal and is rising gently, leaving it plenty of room to rise before getting overbought. The OBV is confirming this recent breakout by breaking out itself. The SCTR is continuing to improve and performance is excellent against the SPX and its industry group which also began to outperform at the end of March. This is clearly a strong performer in this industry group. The stop level is manageable at about 8% or $44."

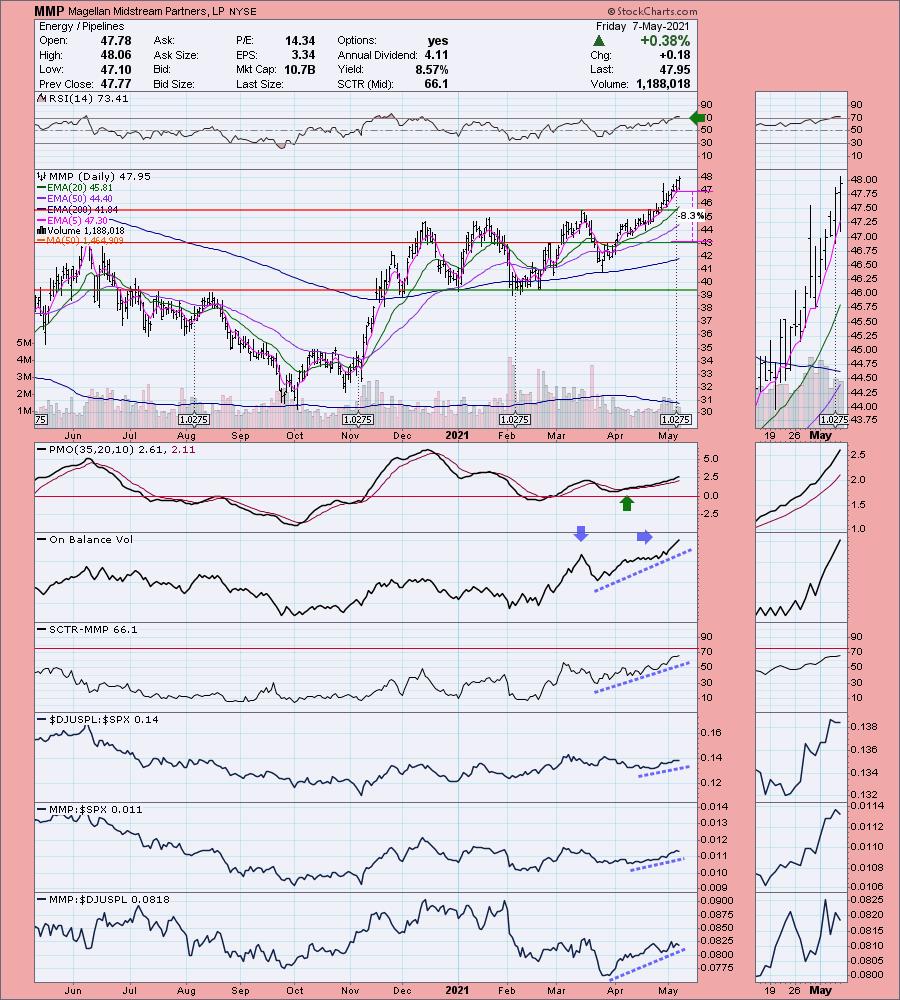

Below is today's chart:

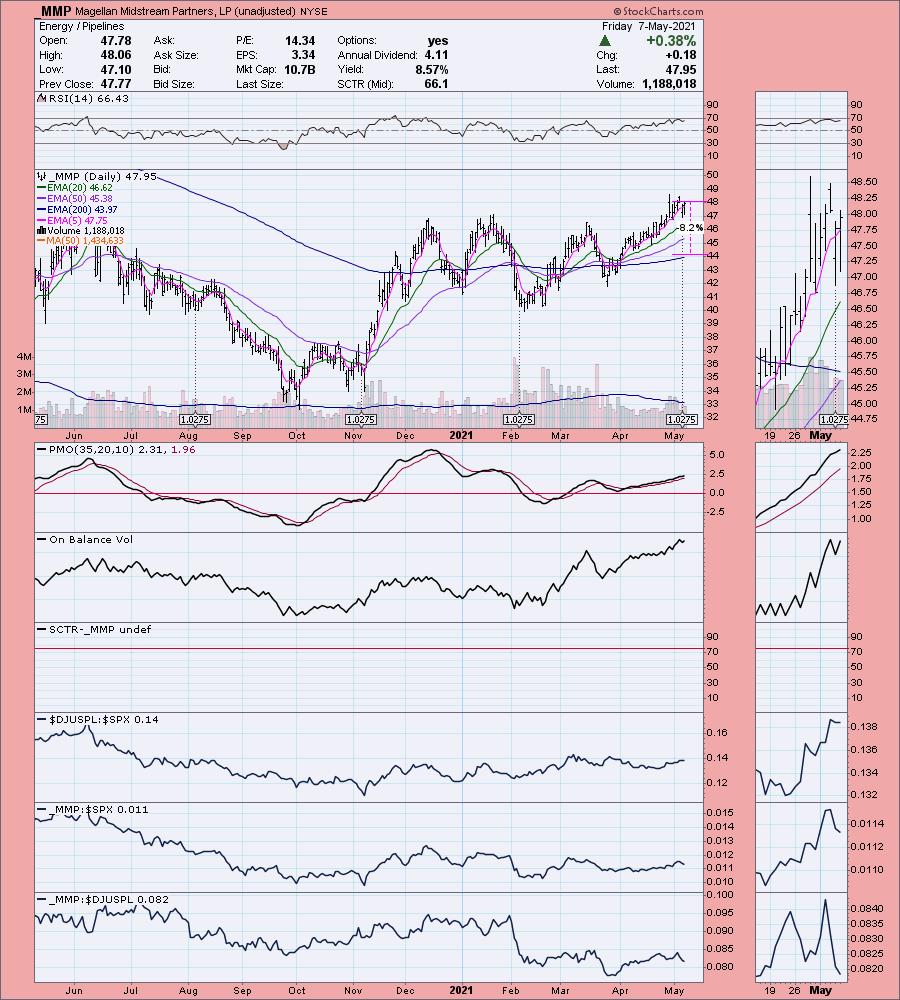

Full disclosure, I do own this one. I bought it using the 5-min candlestick and though it is currently down on the week, my position is in the green. I hate to even put the "red" color around this one as I think it still looks great. It is on a steady rising trend (not parabolic). The RSI is on the overbought side right now, but okay with that for now; mainly, because the PMO is rising nicely and isn't overbought. Also, it may seem weird that the closing price on Tuesday is below today's. You'll note that MMP had distributions so it changed the price point for the beginning of the position. I've included an unadjusted version of this chart below the first so that you can see it is lower than when I presented it.

THIS WEEK's Sector Performance:

Click Here to view Carl's annotated Sector ChartList!

CONCLUSION:

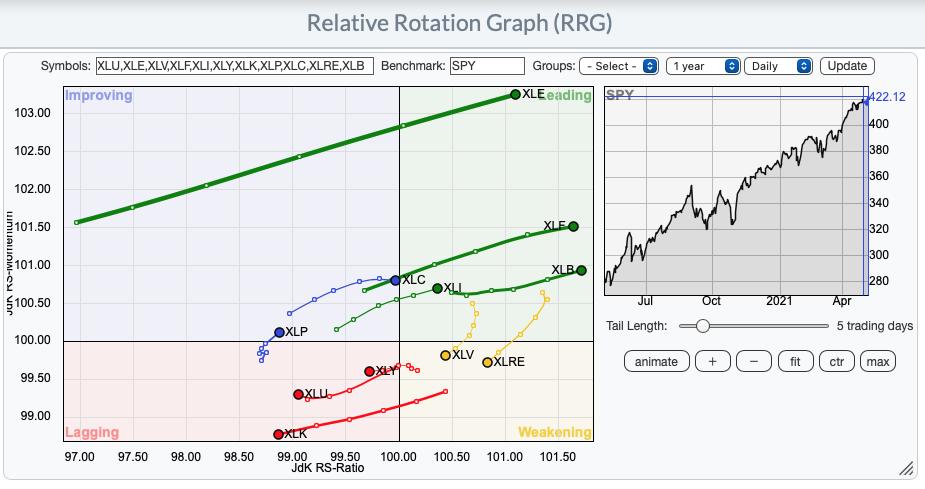

There are four winning sectors based on the RRG and for those who attended the Diamond Mine this morning, it shouldn't be a surprise that the four sectors we reviewed as a possible sector to watch are the winners on the RRG: XLE, XLF, XLB and XLI.

Short-term RRG:

Sector to Watch: Energy (XLE)

Although getting overbought based on the RSI and participation (%Stocks > 20/50/200-EMAs), I really like the PMO configuration as well as the rising Silver Cross Index (SCI). Volume is confirming with the rising OBV.

Industry Group to Watch: Exploration & Production ($DJUSOS)

There are plenty of similarities to the sector chart above. Price has hit overhead resistance, but it did have a higher close than the previous top's closing price so that is a breakout to me. We touched on a few stocks in this area: TPL, OVV and DVN. The "diamonds in the rough" from this industry group over the past week: CPG, PBF, TALO and VLO (I own VLO). "Diamonds in the rough" over the past month from this industry group: LPI and OXY.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 75% invested right now and 25% is in 'cash', meaning in money markets and readily available to trade with. I own MMP and VLO which were mentioned in this report.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)