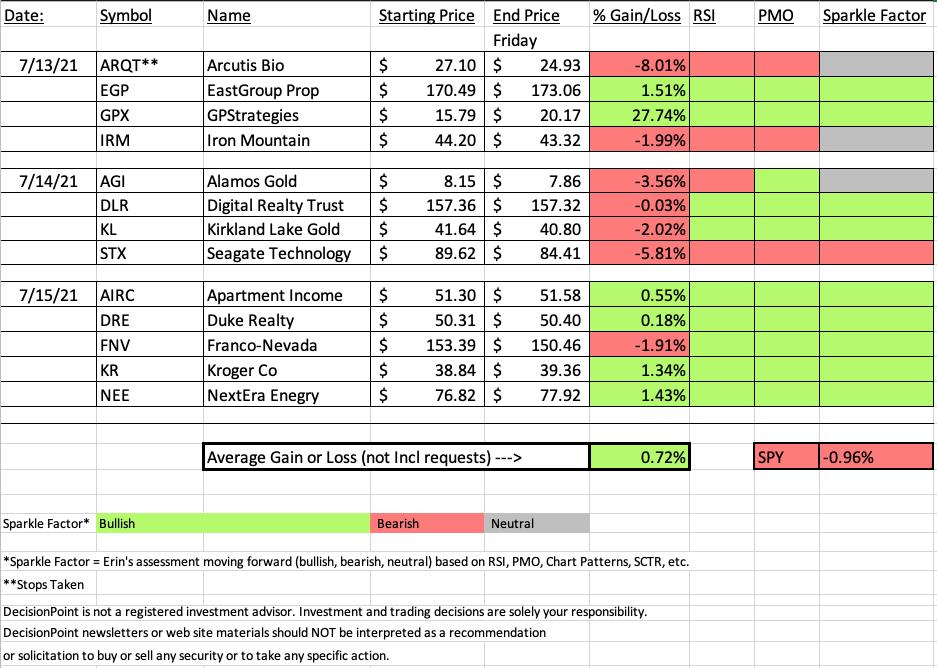

Interesting week for our "Diamonds in the Rough". A few shined up nicely while others remain pretty "rough". This week we had a "pop" on one the diamonds and a "drop" on another one.

The Darling GPX popped on Thursday over 26%! It has since begun to consolidate which suggests more upside to come. The Dud was biotech ARQT which barely triggered its 8% stop yesterday. It did recover somewhat; it's only down about 4% given today's rally.

Sadly the one diamond I bought this week, AGI, has a "Neutral" Sparkle Factor. I could see it going either way. I tightened up my stop and will hold into next week. As far as Gold Miners go, we got in a bit early but I still see them as ready to rally, but participation is dropping again so be careful. I still like KL, RGLD and FNV.

Technically, "Diamonds in the Rough" this week outperformed the SPY, but given GPX's outstanding move, we likely wouldn't have.

I didn't get a chance to do my "homework" in the Diamond Mine today as far as selecting the sector and industry group to watch next week, but I did hint at where I likely would be searching, Utilities.

New Diamond Mine registration link is available for next Friday below. Hope to see you all in the free DP Trading Room on Monday and in the Friday Diamond Mine. Be sure to check out the DP Newsletter that will go out later. I will be presenting a conference next week for Timing Research. I'll have the information and link to sign up. I'd appreciate any sign ups even if you can't go, it gets me invites to other events and new leads.

RECORDING LINK Friday (7/16):

Topic: DecisionPoint Diamond Mine (7/16/2021) LIVE Trading Room

Start Time : Jul 16, 2021 09:02 AM

Meeting Recording Link.

Access Passcode: July-16th

RECORDING Link Wednesday (7/14) Make-up Diamond Mine:

Topic: Make-up DecisionPoint Diamond Mine (7/14/2021) LIVE Trading Room

Start Time : Jul 14, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: July-14th

REGISTRATION FOR FRIDAY 7/23 Diamond Mine:

When: Jul 23, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (07/23/2021) LIVE Trading Room

Registration Link for 7/23.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room with Leslie Jouflas, CMT--RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Jul 12, 2021 08:41 AM

Meeting Recording Link.

Access Passcode: W72^WzSb

For best results, copy and paste the access code to avoid typos.

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

GPStrategies Corp. (GPX)

EARNINGS: 8/6/2021 (BMO)

GP Strategies Corp. provides training, e-Learning solutions, management consulting and engineering services. It operates through the following Geographic Segments: North America, EMEA and Emerging Markets (Latin America and Asia Pacific countries). It provides Workforce Transformation Services into three primary solution sets: Organizational Performance Solutions (OPS), Technical Performance Solutions (TPS) and Automotive Performance Solutions (APS). The company was founded in 1959 and is headquartered in Columbia, MD.

Below is the commentary and chart from Tuesday, 7/13:

"GPX is thinly traded and doesn't trade after hours. There's no reason you can't enter a thinly traded stock, you just have to keep tabs on it given market makers can easily push price wherever they like. Looking at volume on the chart, it does appear that volume overall has picked up in general. This was another double-bottom chart that I had to present. The upside target of the pattern would take price very close to overhead resistance. The RSI is now positive and the PMO just had a crossover BUY signal. The group has been performing well overall and GPX is beginning to outperform again. The stop is rather deep at 9.1% but it does get us just below support at that second bottom. The OBV is accelerating on the formation of this pattern."

Here is today's chart:

As noted in the opening, I do still like this to hold and possibly as a buy. The problem with buying in right now is that after that big pop, it isn't likely to see follow-through for a little while and there is also the possibility of a retracement back toward the breakout point.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Arcutis Biotherapeutics Inc. (ARQT)

EARNINGS: 8/3/2021 (AMC)

Arcutis Biotherapeutics, Inc. engages in the development and commercialization of treatments for dermatological diseases. Its pipeline consists of topical treatments for plaque psoriasis, atopic dermatitis, hand eczema, vitiligo, scalp psoriasis, alopecia areata, and seborrheic dermatitis. The company was founded by Bhaskar Chaudhuri and David W. Osborne in June 2016 and is headquartered in Westlake Village, CA.

Below is the commentary and chart from Tuesday, 7/13:

"ARQT is down -0.70% in after hours trading. Biotechs can be speculative and I am trying to avoid that type of stock. However, I couldn't resist this one given that large bullish double-bottom that is accompanied by a positive OBV divergence. Add to that the newly positive RSI and brand new PMO crossover BUY signal and you could have a winner here. The group itself is performing about as well as the SPX, but ARQT is outperforming both the group and the SPX. Price currently has to deal with overhead resistance at the 50/200-EMAs, but we are seeing a potential ST Trend Model BUY signal as the 5-EMA is nearing a positive crossover the 20-EMA. If you want the stop below the pattern, it is a big 12%, I decided to go with my default of 8%."

Below is today's chart:

The stop was just barely triggered yesterday, so I took the hit on the spreadsheet. However, it's not looking that bad after today's rally off support. The RSI is rising again and the PMO is flattening. There is a possible very short-term double-bottom forming. It's best viewed in the thumbnail.

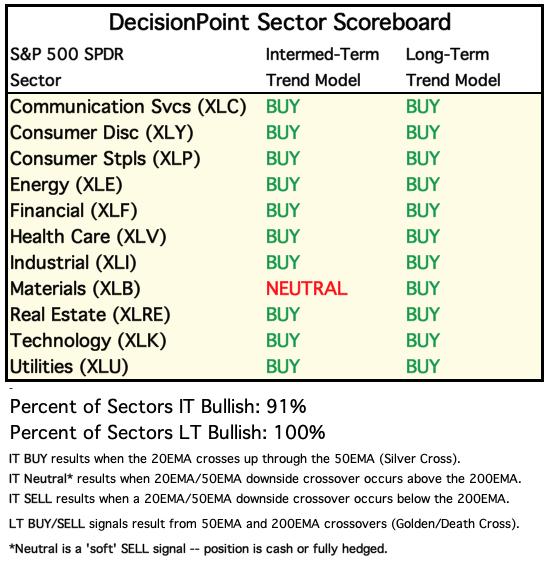

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

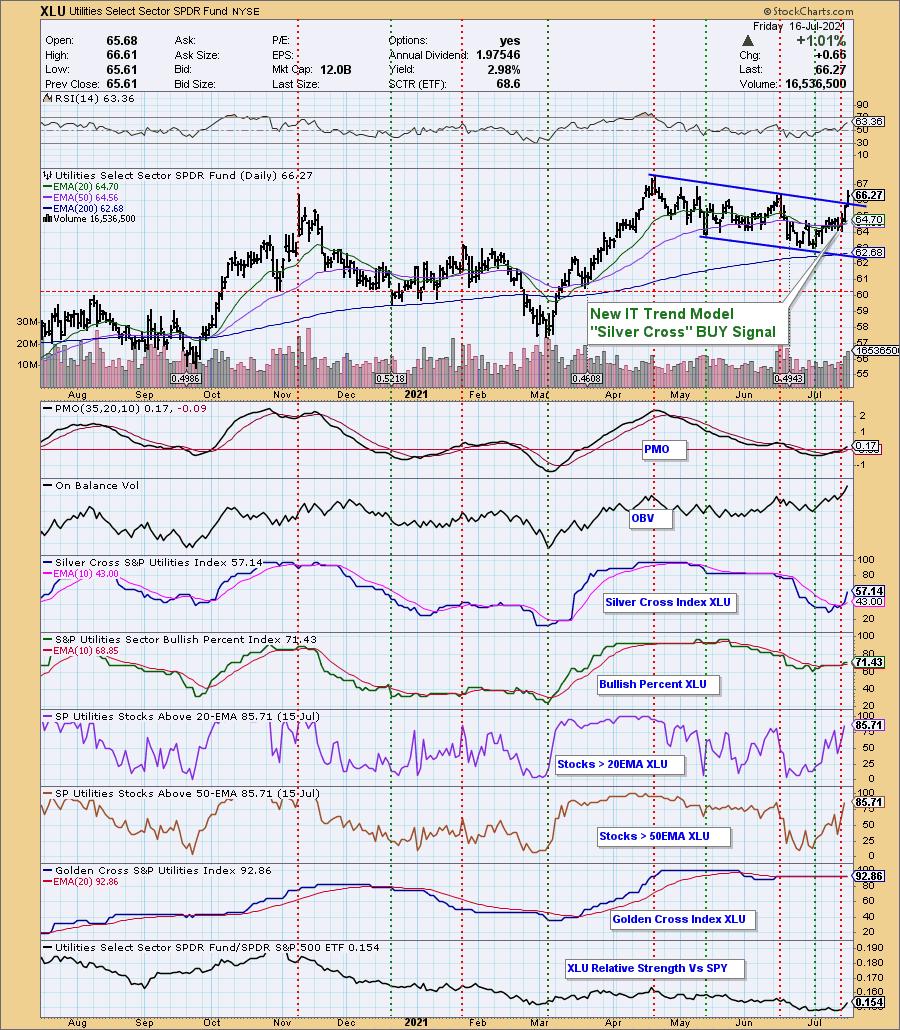

New IT Trend Model "Silver Cross" BUY signal arrived on XLU this week.

Click Here to view Carl's annotated Sector ChartList!

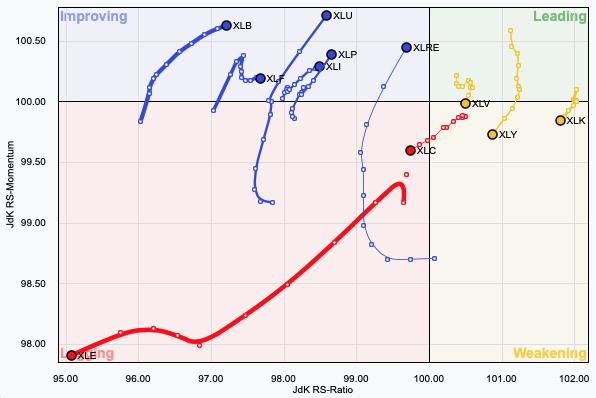

Short-term RRG:

Sector to Watch: Utilities (XLU)

It really was an easy choice this week. XLRE still looks good, but today's breakout on XLU sealed the deal. Participation continues to improve. The only issue is that we are seeing somewhat overbought readings on %Stocks > 20/50/200-EMAs.

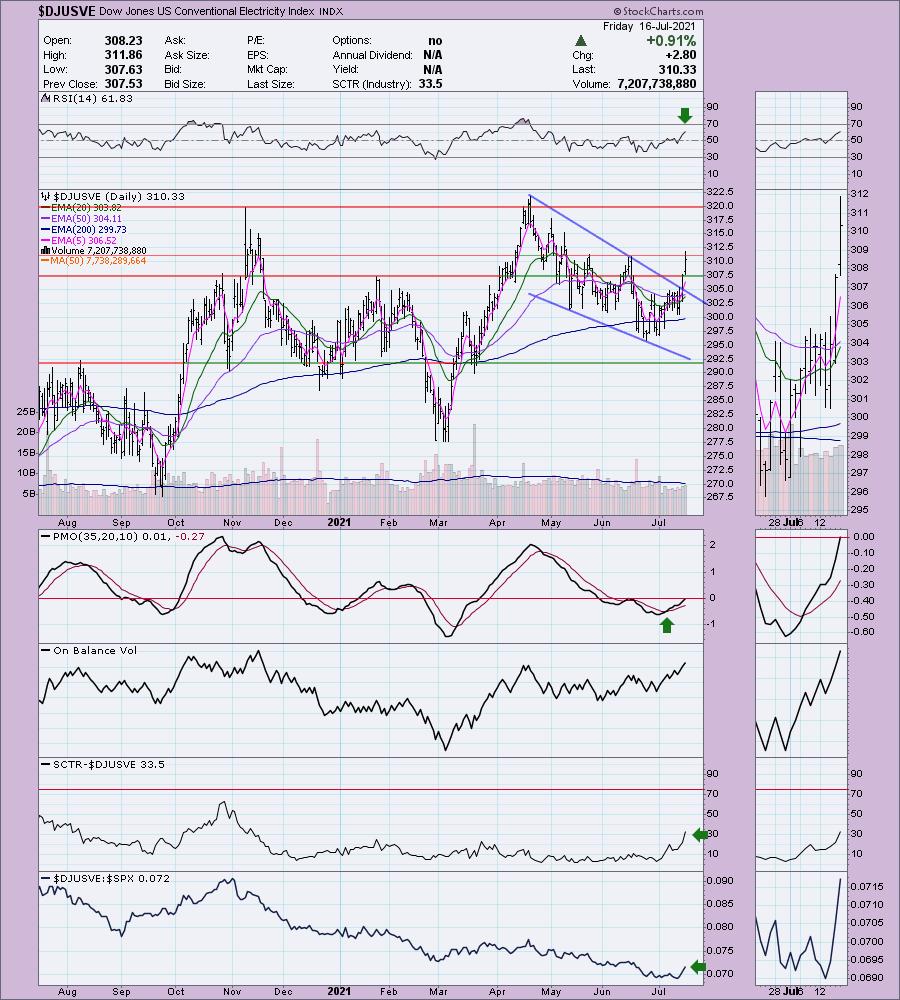

Industry Group to Watch: Conventional Electricity ($DJUSVE)

This chart looks similar to the sector chart only we have a breakout from a bullish falling wedge. The RSI is positive and not overbought. The PMO is on a BUY signal and just crossed above the zero line. The SCTR is improving and it is building relative strength against the SPX.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great holiday weekend & Happy Charting! Next Diamonds Report is Tuesday 7/20.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 50% invested right now and 50% is in 'cash', meaning in money markets and readily available to trade with. I didn't follow my advice and pare down my exposure this week to 30%. I was at 60% yesterday, but today after the Diamond Mine I went in and began to tighten stops and unload a few from sectors or groups that a languishing. Currently I'm at 40% exposure.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com