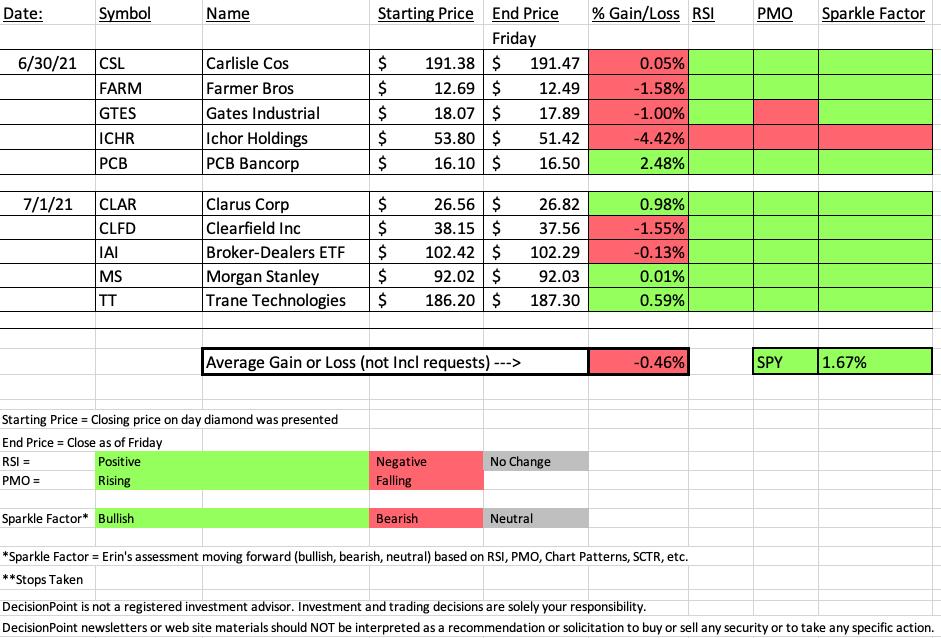

It was a tricky week because five picks had only two days to mature and the other five had only one day to mature. The charts still look pretty good, but as far as the spreadsheet goes, it was mixed.

Thank you again for allowing me to work on the road and get your picks to you rather late. Next week will be more of the same, but I hope to publish sooner than I did on Wednesday and Thursday. On top of everything, our website underwent some changes and it caused our mail and publishing system to choke. Everything is back to normal as far as the website.

The biggest winner this week was PCB Bancorp (PCB). The biggest loser was Ichor Holdings (ICHR). I was surprised by the loser this week as it is a Semiconductor and they have continued to enjoy relative strength. However, the chart turned south and I no longer like it.

** WORKING VACATION - June 28th to July 9th **

It's that time of year again! Last year it was a road trip to Alabama and back, this year it is a road trip to Utah and back! We hit Las Vegas and Zion. We are now in Spanish Fork, and then onto Bryce Canyon, back to the Grand Canyon, Bull Head City and finally back home. I'll include my travel diary and pictures just like last year for Diamonds readers!

I plan on writing, but trading rooms will be postponed until I return home. Blog articles may be delayed depending on WIFI service and/or our travel for the day. You'll miss two Diamond Mines (I'll make them up in the coming weeks).

NEXT WEEK'S SCHEDULE: Tuesday, Wednesday, Thursday with a Recap on Friday.

Diamond Mine Information:

Diamond Mine Information:

RECORDING LINK Wednesday (6/23):

Topic: BONUS DecisionPoint Diamond Mine Wednesday (6/23)

Start Time : Jun 23, 2021 09:01 AM

6/23 Diamond Mine Recording Link.

Access Passcode: June-23rd

RECORDING LINK (Friday 6/18):

Topic: DecisionPoint Diamond Mine (06/18/2021) LIVE Trading Room

Start Time : Jun 18, 2021 08:59 AM

6/18 Diamond Mine Recording Link.

Access Passcode: June-18th

REGISTRATION FOR FRIDAY Diamond Mine:

When: Jun 25, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (6/25) LIVE Trading Room

Register in advance for FRIDAY's webinar HERE

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Jun 14, 2021 09:00 AM

Free DP Trading Room Recording LINK.

Access Passcode: June/14th

For best results, copy and paste the access code to avoid typos.

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

PCB Bancorp (PCB)

EARNINGS: 7/22/2021 (AMC)

PCB Bancorp operates as the bank holding company for Pacific City Bank that provides various banking products and services to individuals, and small and middle market businesses in Southern California. The firm offers demand, savings, money market, and time deposits, as well as certificates of deposit; and remote deposit capture, courier deposit services, positive pay services, zero balance accounts, and sweep accounts. It also provides real estate loans, commercial and industrial loans, automobile secured loans, unsecured lines of credit, term loans, and personal loans for various business customers, including manufacturing, wholesale and retail trade, hospitality, etc. In addition, the company offers automated teller machines, debit cards, direct deposits, and cashier's checks, as well as treasury management, wire transfer, and automated clearing house services, cash management services, and online, mobile, telephone, mail, and personal appointment banking services. The company was founded on July 9, 2007 and is headquartered in Los Angeles, CA.

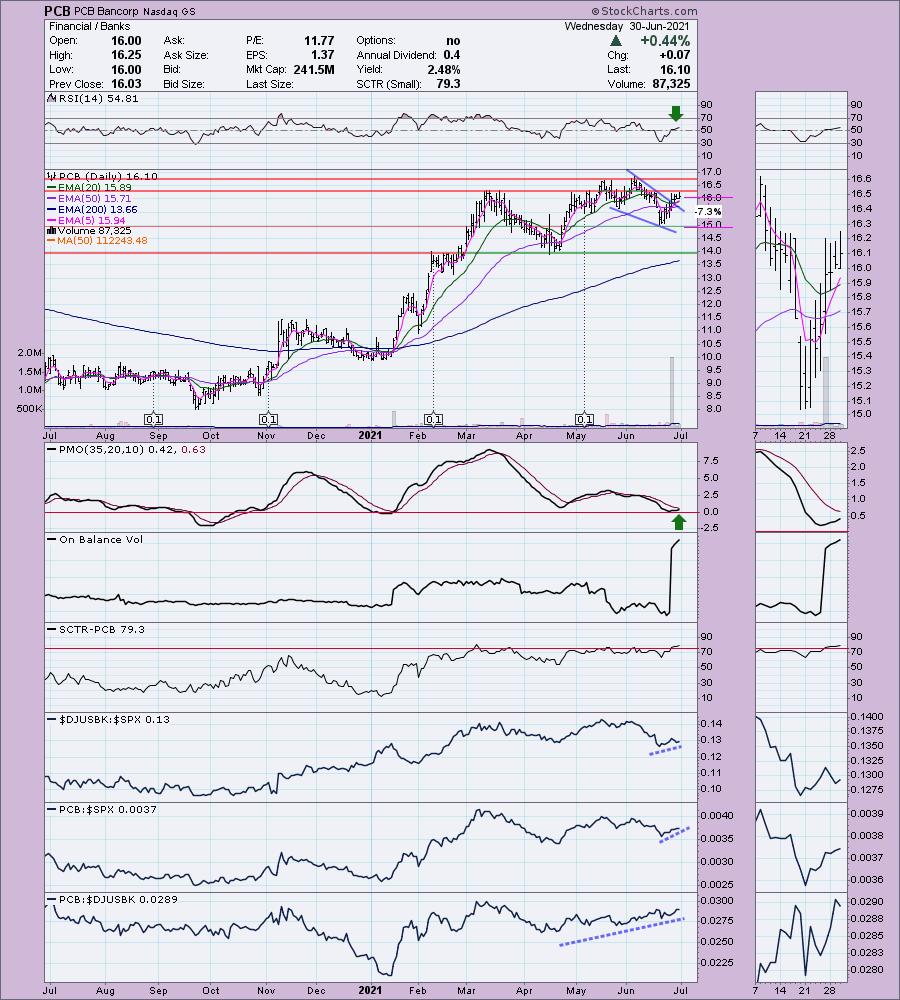

Below is the commentary and chart from 6/30:

"PCB was unchanged in after hours trading. I noticed three Banks came through the Diamond PMO Scan and I liked this one best. I'm still suspect of the group, but it is slowly beginning to outperform. Price broke out from a bullish falling wedge; it is just stuck below overhead resistance right now at the March high. There was a huge influx of volume on strong earnings estimates moving forward. The RSI is positive and the PMO is nearing a crossover BUY signal. The 5-EMA just crossed above the 20-EMA for a ST Trend Model BUY signal. The SCTR just entered the "hot zone" above 75. This is a solid out-performer within the industry group and it is beginning to outperform the SPX. You can set a stop just above 7%."

Here is today's chart:

One of the reasons this one was the "Darling" of the week was due to today's +2.17% rally, but we'll take it! The chart continues to look good with today's breakout taking price above resistance at the March top. It stopped today just under resistance at the $17. The indicators still look good, so I would expect a breakout here.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Ichor Holdings, Ltd. (ICHR)

EARNINGS: 8/3/2021 (AMC)

Ichor Holdings Ltd. engages in designing, engineering, and manufacturing fluid delivery subsystems for semiconductor capital equipment. It offers gas and chemical delivery systems, which are key elements of the process tools used in the manufacturing of semiconductor devices. The firm also manufactures precision machined components, weldments, and proprietary products for use in fluid delivery systems for direct sales to its customers. The company was founded in 1999 and is headquartered in Fremont, CA.

Below is the commentary and chart from 6/30:

"ICHR was unchanged in after hours trading. It is currently forming a bullish double-bottom pattern. The RSI is positive and the PMO just reached positive territory and is on its way toward a crossover BUY signal. Price is holding above the major moving averages and today the 5-EMA crossed above the 20-EMA. The SCTR has been healthy for some time. The group is doing well and ICHR is beginning to outperform both the group and SPX."

Below is today's chart:

This "Diamond in the Rough" turned south today, ruining its performance, bringing the RSI in negative territory and turning the PMO back down. The thin 5.9% stop nearly triggered today. I've annotated a bearish descending triangle based on today's decline. It sure looked like a bullish double-bottom on Wednesday. The SCTR is still healthy, but the chart really isn't anymore. Again, I'm surprised as Semiconductors have been outperforming, although looking in the thumbnail, we see that this week their performance slipped which didn't help ICHR.

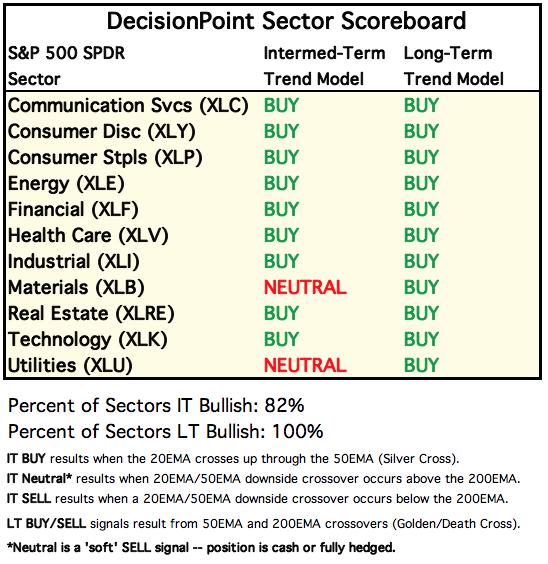

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

CONCLUSION:

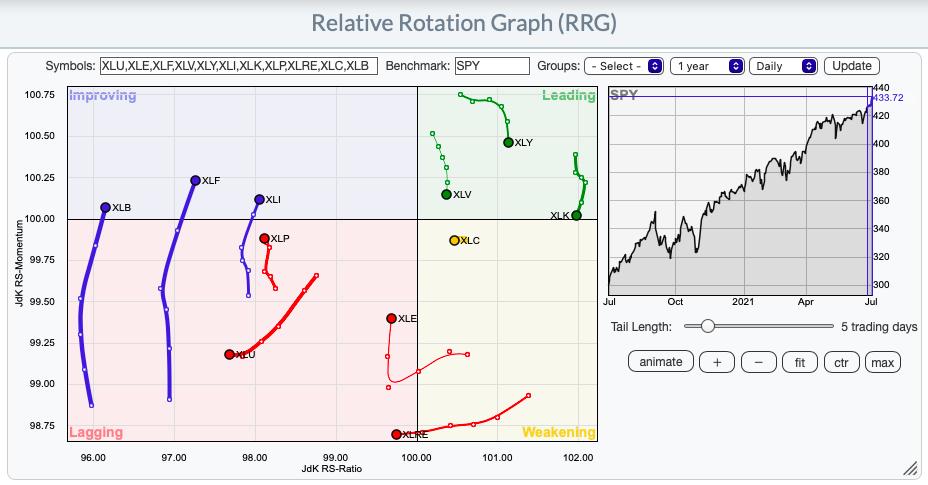

I used the RRG today to help me select the "Sector to Watch" next week. I still like Discretionary (XLY), but I'm not thrilled that it is headed downward on the RRG. Materials (XLB) hasn't gelled yet and Financial (XLF) don't have participation yet. Healthcare (XLV) popped this week and does deserve the 'runner up' award, but I like to find brand new momentum. That led me to Industrials (XLI) this week. It looks strong on the daily RRG as well.

Short-term RRG:

Sector to Watch: Industrials (XLI)

Yesterday and today, XLI broke out above the 20-EMA. The RSI just entered positive territory. The PMO has only begun to turn up (new momentum) and participation is improving and is not overbought. It hasn't been performing well against the SPX, but with new momentum, I believe that will change next week.

Industry Group to Watch: Business Support Services ($DJUSIV)

This is the best performer in the sector. Today saw an excellent breakout. Runner ups would be Railroads and Delivery Services, although Diversified Industrials are looking pretty good too.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great holiday weekend & Happy Charting! Next Diamonds Report is Tuesday 7/6.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 50% invested right now and 50% is in 'cash', meaning in money markets and readily available to trade with. I'm planning to book some profits this week and reduce my exposure to 30%.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com