I discussed yesterday that Biotechs were beginning to look good but I hadn't found a stock I liked. Well, today I found a stock I like! I am still a fan of Renewable Energy and I found a somewhat newly listed stock in this area that deserves a look.

Software took a small step back, but it beginning to take another step forward, building on its already strong relative strength. I had an interesting one come up on my list that I will share.

Thank you for all who attended today's make-up Diamond Mine trading room (since I didn't hit the record button last Friday). I think it went pretty well. We had a lot of time to look at different symbols.

Today's "Diamonds in the Rough" are: BOX, IBB, NVTA and SHLS.

Stocks to Review ** (no order): BIIB, ILMN, CTEC, TAN, RGEN, REGN and WRAP.

** The "Stocks to Review" are stocks that were on my short list for the day.

RECORDING LINK Friday (7/23):

Topic: DecisionPoint Diamond Mine (07/23/2021) LIVE Trading Room

Start Time : Jul 23, 2021 09:00 AM

Recording link for 7/23 Diamond Mine is HERE.

Access Passcode: July/23rd

THERE WAS NO RECORDING FOR FRIDAY (7/30), I forgot to hit record.

RECORDING LINK FOR Wednesday 8/4 Bonus Diamond Mine:

Topic: DecisionPoint Make-Up Diamond Mine (8/4/2021) LIVE Trading Room

Start Time : Aug 4, 2021 09:00 AM

Meeting Recording Link HERE.

Access Passcode: August/4

REGISTRATION FOR FRIDAY 8/6 Diamond Mine:

When: Aug 6, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (8/6/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Tom Bowley joined Erin in the DP Trading Room August 2nd!

Free DP Trading Room (8/2) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Aug 2, 2021 08:41 AM

Meeting Recording Link HERE.

Access Passcode: August/2nd

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

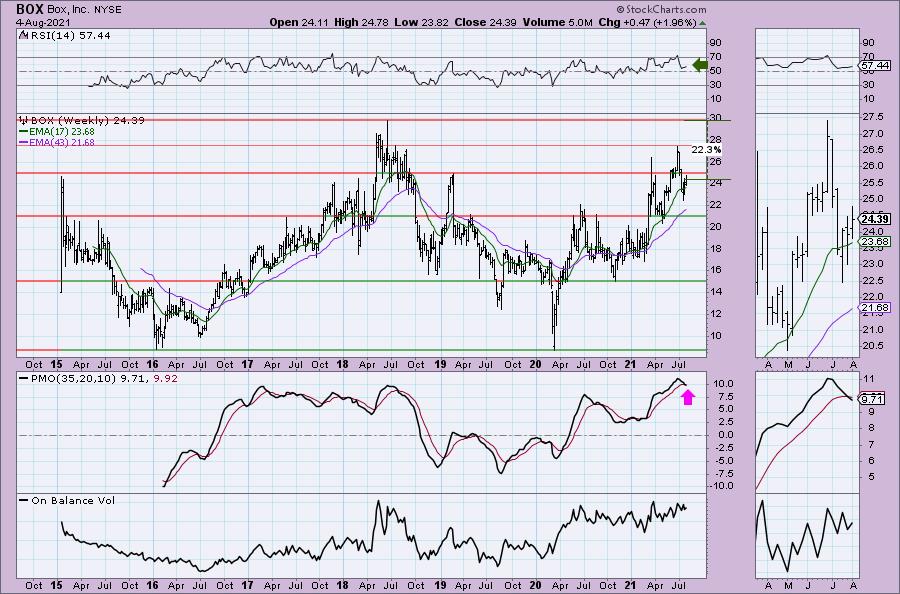

Box, Inc. (BOX)

EARNINGS: 8/25/2021 (AMC)

Box, Inc. engages in the provision of enterprise content platform that enables organizations to securely manage enterprise content while allowing easy, secure access and sharing of this content from anywhere, on any device. Its products include cloud content management, IT and admin controls, box governance, box zones, box relay, box shuttle, box keysafe and automations. The company was founded by Aaron Levie, Dylan Smith, Jeff Queisser and Sam Ghods in 2005 and is headquartered in Redwood City, CA.

BOX is down -0.78% in after hours trading which suggests we could see a good entry tomorrow. I do notice a bearish engulfing candle today based on the OHLC bar which does tell me there is a likely down day ahead for BOX. That's fine, as noted earlier it could mean a good entry although a negative ahead on Friday's recap. I decided to add it today mainly based on the strength in the group and BOX's new relative strength against the group and the SPX. It has broken above resistance at the June lows. The 20-EMA avoided a negative crossover the 50-EMA. The RSI is back in positive territory and the PMO just gave us a crossover BUY signal. The SCTR is strong. The stop was easy, set it at the July low.

The weekly PMO isn't favorable, but we do have a positive weekly RSI and rising bottoms on the weekly OBV. If we get a return to the 2018 highs, that would be a 22%+ gain.

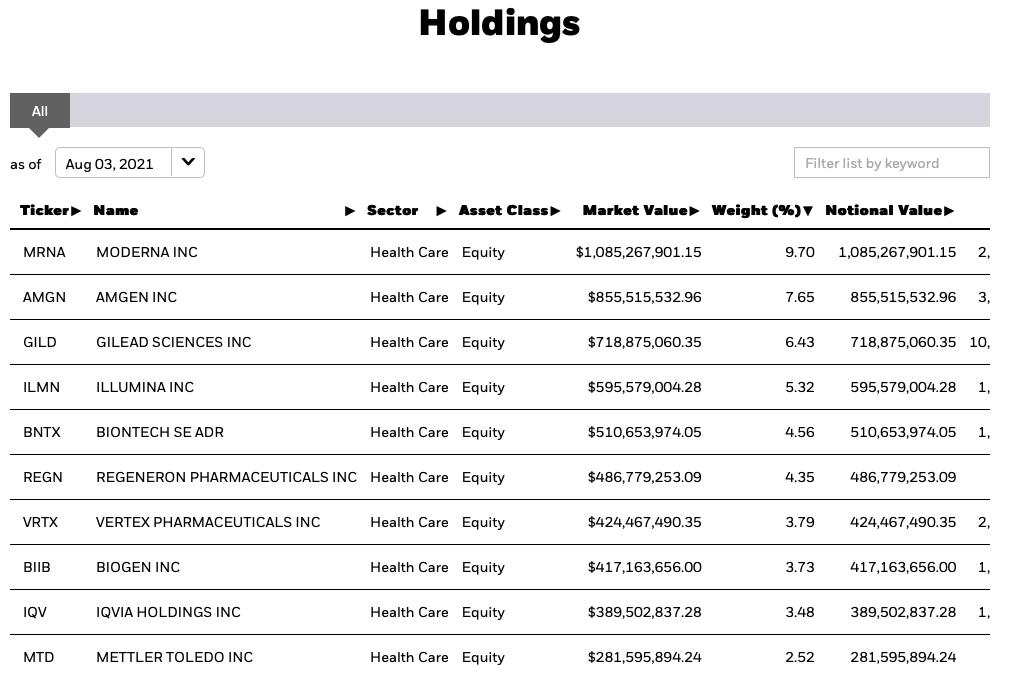

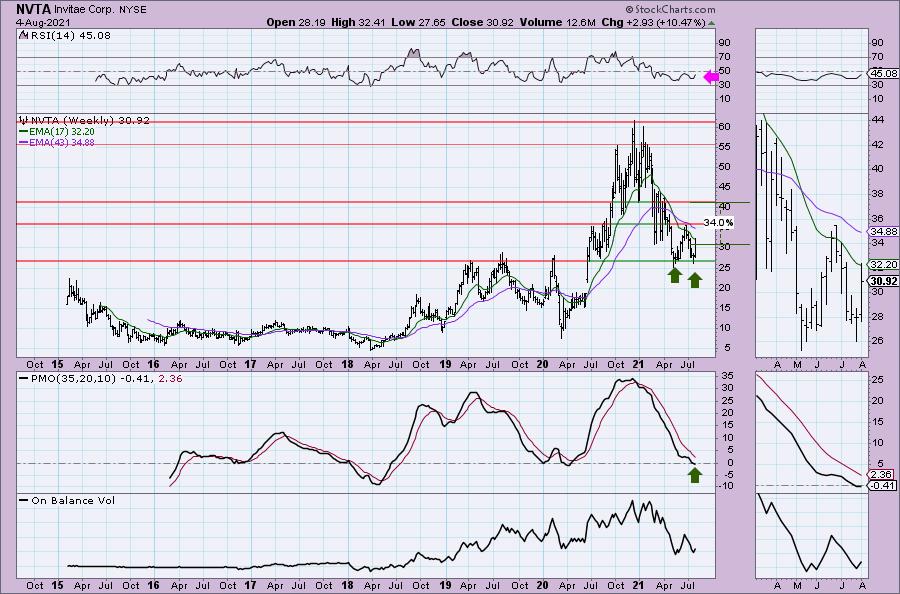

iShares Nasdaq Biotechnology ETF (IBB)

EARNINGS: N/A

IBB tracks the performance of a modified market-cap-weighted index of US biotechnology companies listed on US exchanges.

IBB is up +0.20% in after hours trading. I covered IBB in the April 22nd 2020 Diamond Report. The stop never even came close to hitting so the position is up +40.6%.

I like the group and this is one way to reap the rewards without being tied to a volatile stock. You'll notice that some of the holdings aren't strictly Biotechs, but all of them have merit. I was tempted to add REGN and RGEN which I've covered before in the Healthcare space. There are only two problems with the daily chart: an overbought RSI and price hitting overhead resistance. The PMO is configured with a crossover BUY signal and room to run before getting overbought. The OBV is confirming the rally out of the May low. The SCTR has just entered the "hot zone" above 75. Finally we can see on the chart the relative outperformance of this group based on IBB. The stop is at my typical 8%, but it does match up with support and resistance.

The weekly chart looks better than most that we look at in Diamonds. The RSI is positive and the weekly PMO is rising after a fairly recent crossover BUY signal. Its flirting with new all-time highs so we don't have an upside target on the chart. Double the stop level and look for a 16% gain as an upside target. It could certainly move past that given the favorability of this weekly chart.

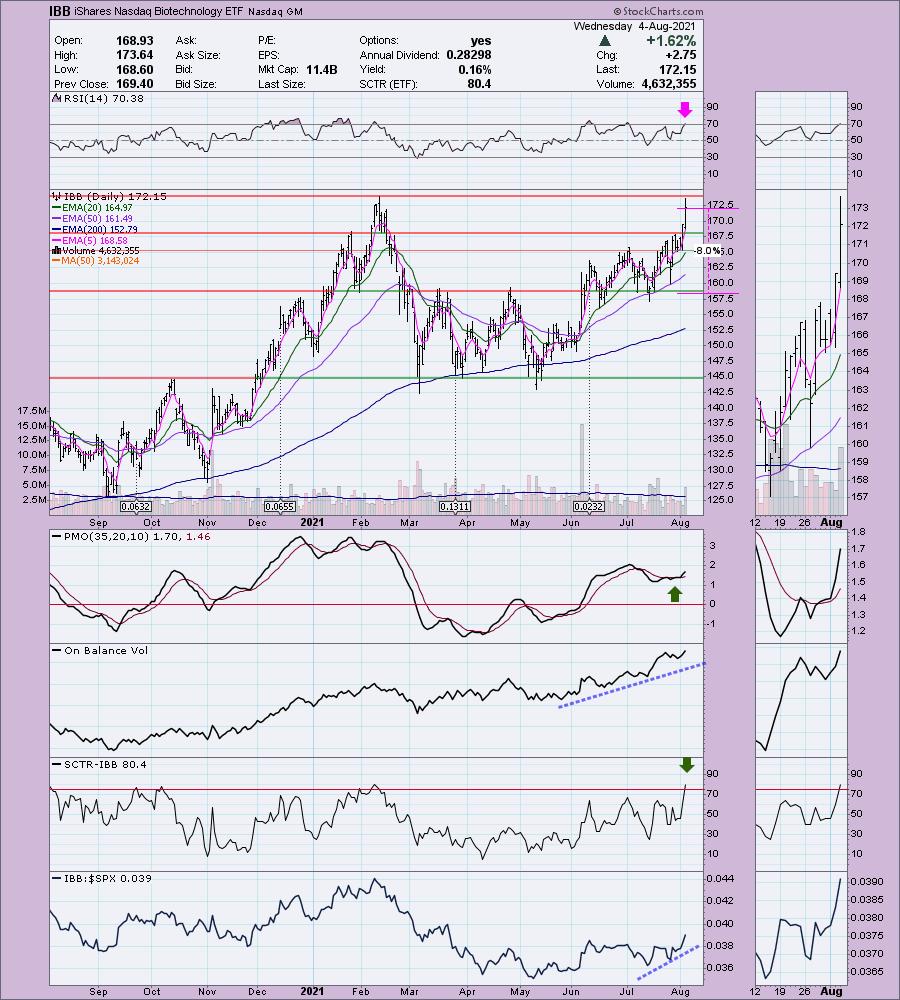

Invitae Corp. (NVTA)

EARNINGS: 11/4/2021 (AMC)

Invitae Corp. engages in the provision of genetic information into mainstream medical practice. It includes comprehensive panels for hereditary conditions in cancer, cardiology, neurology, pediatric, and rare diseases. The company was founded by Randal W. Scott and Sean E. George on January 13, 2010 and is headquartered in San Francisco, CA.

NVTA is up +1.55% in after hours trading. It reported earnings yesterday and the street obviously likes what they heard. Even though this one was up 8.49% today, I believe it has a lot of potential. Many times gaps up on earnings are a signal that the stock will continue higher over time and this one is poised perfectly. The RSI is positive and the PMO just triggered a crossover BUY signal. It's a Biotech so obviously we are seeing some outperformance. Notice the positive OBV with rising bottoms to match price bottoms that are about even, that is a positive divergence that suggests follow-through. We also have a double-bottom forming as price bounced off strong support at the May low. It just beginning to outperform. The stop is deep, but I think you could tighten a bit to align with gap support. The problem is its 8.5% move today.

The weekly chart is improving as well (and you can see that double-bottom forming here too). While the RSI is negative, it is rising. The weekly PMO is bottoming in oversold territory. Even if it just gets to that December 2020 low, that's a 34% gain, but I suspect it could do more based on the double-bottom pattern, which has a minimum upside target around $45.

Shoals Technologies Group Inc. (SHLS)

EARNINGS: 8/10/2021 (AMC)

Shoals Technologies Group, Inc. provides electrical balance of system solutions for solar energy projects. Its EBOS components include cable assemblies, inline fuses, combiners, disconnects, recombiners, wireless monitoring systems, junction boxes, transition enclosures and splice boxes. The company was founded by Dean Solon in November 1996 and is headquartered in Portland, TN.

SHLS is unchanged in after hours trading. This one came up on a scan and I'd honestly never had heard of it. I love the chart and it is quite tempting, but I do note they report earnings on 8/10, so if you get in, keep that in mind. The RSI is positive and rising and the PMO just triggered a crossover BUY signal just below the zero line. It's too young to have a SCTR, although if you ask StockCharts to start calculating it, they might. Volume is coming in based on the OBV and price has broken above resistance at those late January-early February lows. The 5-EMA just crossed above the 20-EMA for a ST Trend Model BUY signal. Relative performance is excellent. The stop is set just below the mid-July tops and the mid-June lows.

Not much information on the weekly chart given its youth, but OBV bottoms are rising and the weekly RSI is very close to positive territory.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Current Market Outlook:

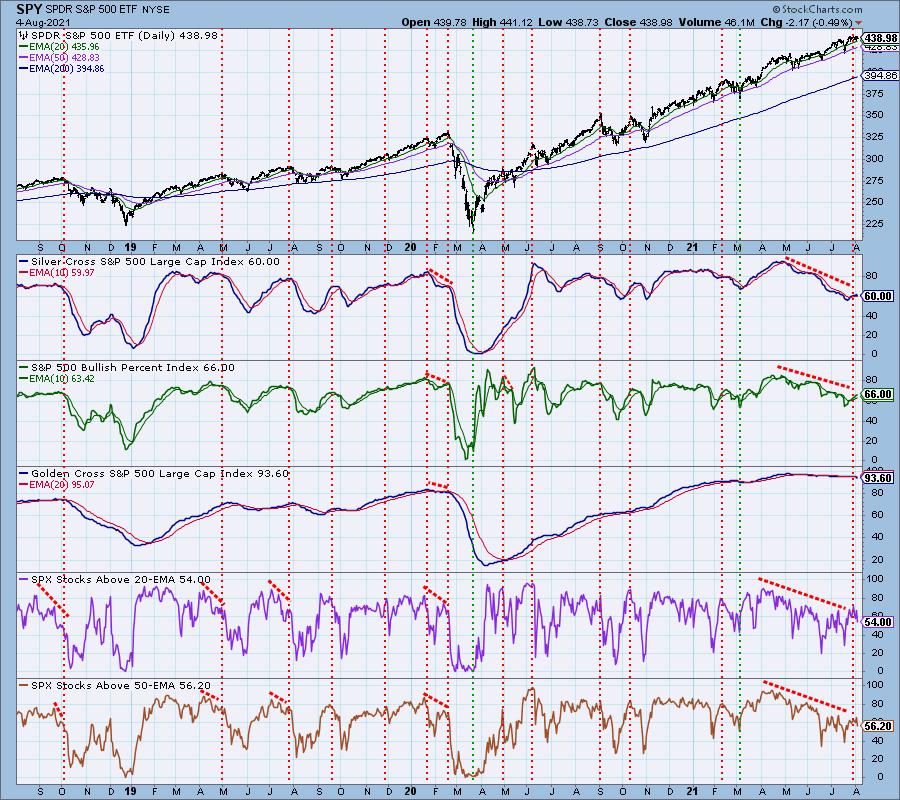

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com