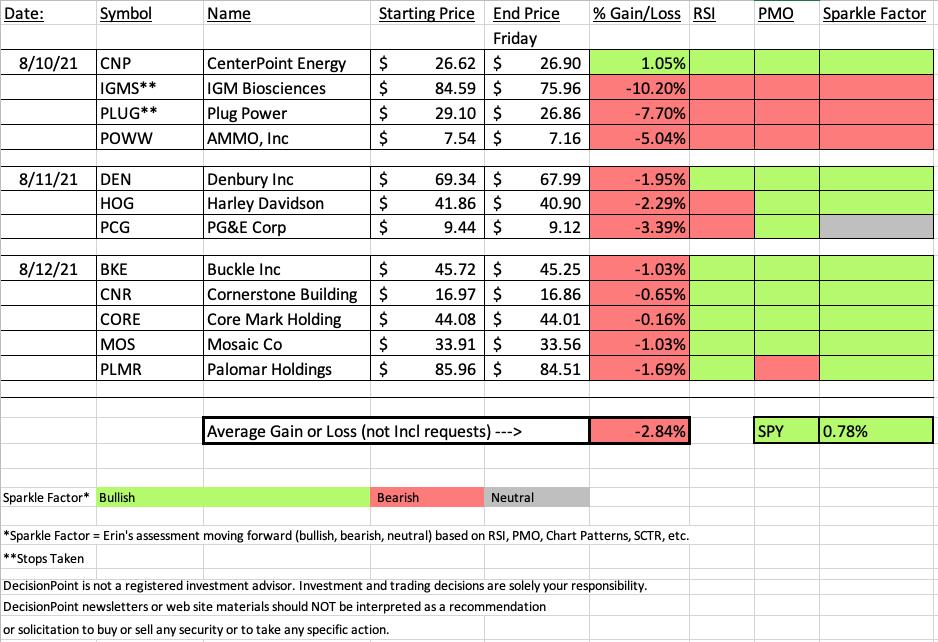

Many of this week's "Diamonds in the Rough" turned out to be very rough. While many of the positions didn't fair well this week, nearly all still have promise moving forward, meaning there are better entries available now. The rapid rotation among industry groups is dizzying as of late. Sector rotation hasn't been particularly helpful as each sector seems to be filled with big winner and big losers.

We will sally on and prepare for next week. I think my pick for sector and industry group to watch will be profitable going into next week. However, as noted above, the rotation is crazy right now.

PCG is my only "Neutral" stock moving into next week. It's at a "decision point" and really could go either way right now, but Utilities are still doing well in general. It is a low-priced higher risk trade so keep that in mind if you want to give it go next week.

HOG has a negative RSI, but the chart still looks favorable. PLUG and POWW got hit hard. In fact, PLUG was one of two positions where the stop triggered. I do not like either moving forward.

This week's "Dud" is IGMS where the 9.8% stop was hit this week. Considering Biotechs were leading going into this week and that chart looked pretty good, I was surprised it was hit so hard. The Biotechs are a diverse group of very volatile stocks and this one turned out to be the wrong one.

This week's "Darling" is CNP. It also happens to be the only position that finished higher this week.

Don't forget to send in your reader requests before Thursday's report! Register for next Friday's trading room below.

RECORDING LINK Friday (8/13):

Topic: DecisionPoint Diamond Mine (8/13/2021) LIVE Trading Room

Start Time : Aug 13, 2021 09:01 AM

Meeting Recording Link HERE.

Access Passcode: August/13

REGISTRATION FOR FRIDAY 8/20 Diamond Mine:

When: Aug 20, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (8/20/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

RECORDING LINK for DP Free Trading Room:

Topic: DecisionPoint Trading Room

Start Time : Aug 2, 2021 08:41 AM

Meeting Recording for free DP Trading Room HERE.

Access Passcode: August/2nd

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

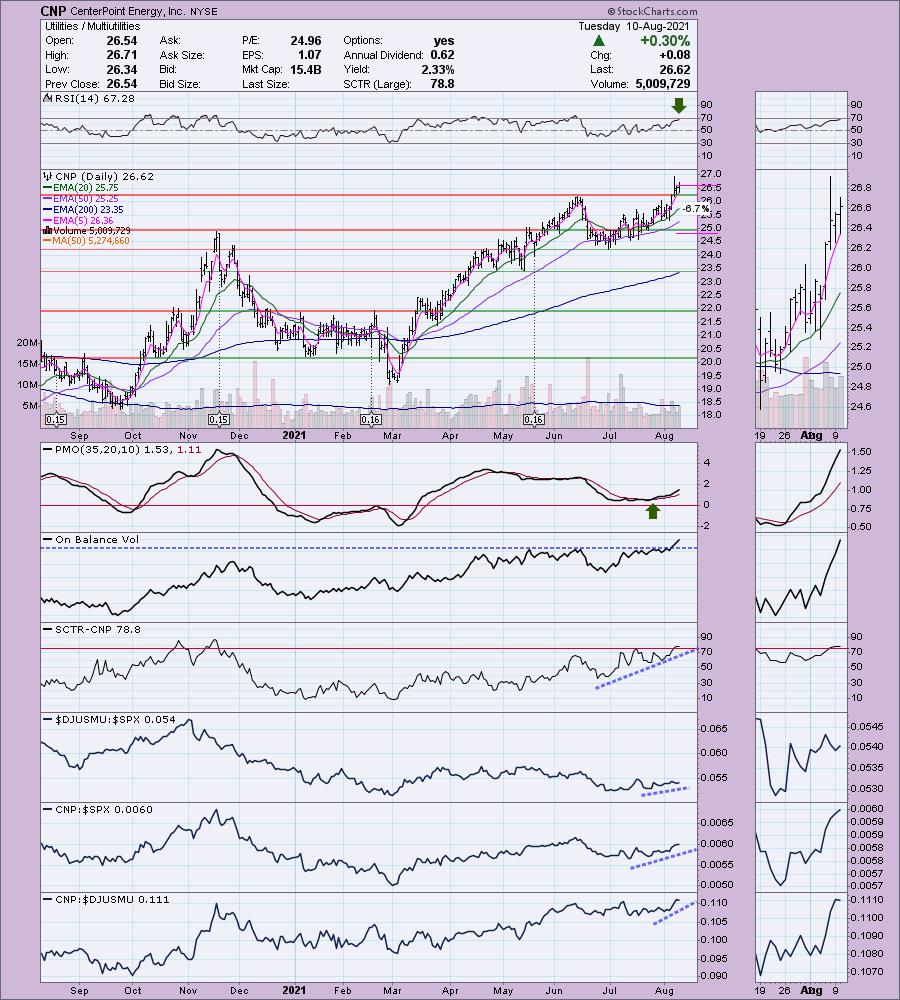

CenterPoint Energy, Inc. (CNP)

EARNINGS: 11/4/2021 (BMO)

CenterPoint Energy, Inc. is a holding company, which engages in the business of power generation and distribution. It operates through the following segments: Houston Electric Transmission & Distribution (T&D); Indiana Electric Integrated; Natural Gas Distribution; Energy Services; Infrastructure Services; Midstream Investments; and Corporate and Other. The Electric T&D segment offers electric transmission and distribution services. The Indiana Electric Integrated segment includes energy delivery services to electric customers and electric generation assets to serve electric customers and optimize those assets in the wholesale power market. The Natural Gas Distribution segment provides regulated natural gas distribution services. The Energy Services segment offers non-rate regulated natural gas sales to, and transportation and storage services, for commercial and industrial customers. The Infrastructure Services segment focuses on underground pipeline construction and repair services. The Midstream Investments segment consist of the equity method investment in Enable. The Other Operations segment comprises office buildings and other real estate used for business operations and home repair protection plans. The company was founded in 1866 and is headquartered in Houston, TX.

Below is the commentary and chart from Tuesday:

"CNP is unchanged in after hours trading. Price broke out above resistance at the June top and has been consolidating the move. The RSI is positive and the PMO is gently rising out of overbought territory on a BUY signal. The OBV broke to a new high with price which confirms the breakout and likely follow-on. The SCTR just entered the "hot zone" above 75. The group is outperforming the market slightly and CNP is outperforming both the market and the group."

Here is today's chart:

Not much to add here. I like the slight pullback it had that took the RSI out of overbought territory. Overall the chart is healthy and a "hold" if you have it. If not, watch the 5-minute chart and time an entry on a PMO crossover and positive RSI.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

IGM Biosciences Inc. (IGMS)

EARNINGS: 11/8/2021 (AMC)

IGM Biosciences, Inc. operates as a biotechnology company, which develops antibodies for the treatment of cancer. It offers IgM platform to expand upon the inherent properties of IgM antibodies and to allow for the rapid development of engineered therapeutic antibodies. The firms product pipe line includes IGM-2323, which is a CD20 x CD3 bispecific IgM antibody designed to treat patients with B cell Non-Hodgkin's lymphoma and other B cell malignancies; IGM-8444, which is an IgM antibody targeting Death Receptor 5 for the treatment of patients with solid and hematologic malignancies; and IGM-7354, which will target the delivery of IL-15 with the goal of inducing immune cell stimulation and proliferation. IGM Biosciences was founded in 2010 and is headquartered in Mountain View, CA.

Here is the commentary and chart from Tuesday:

"IGMS reported earnings yesterday and apparently they were well received. However, this one is down -1.5% in after hours trading so it appears we are getting a pullback toward the breakout point at the 50-EMA. This is a "V" bottom pattern that suggests a breakout above $96 at the March and June tops. We just had a ST Trend Model BUY signal as the 5-EMA crossed above the 20-EMA. It has been a bit of a sideways mover but in the short term we may be able to take advantage of new relative strength. The PMO is about to give us a crossover BUY signal. The stop is set at the 200-EMA."

Below is today's chart:

Nothing of value or redemption here. It pulled back heavily and ended up triggering the 9.8% stop. This level was set as it would put price below support and the 200-EMA. Since it has been breached, the chart is a definite "dog".

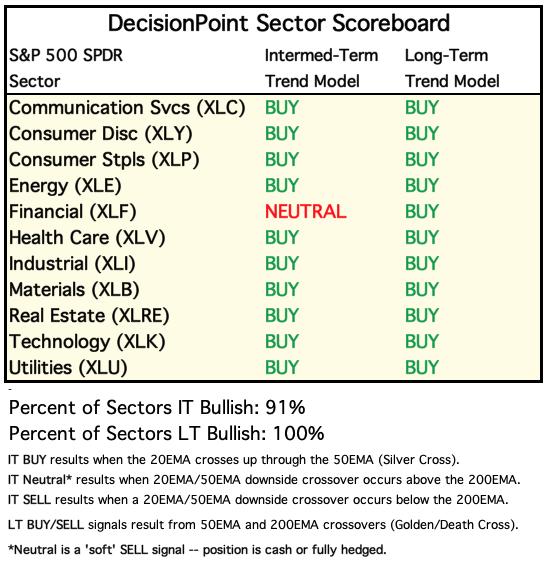

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

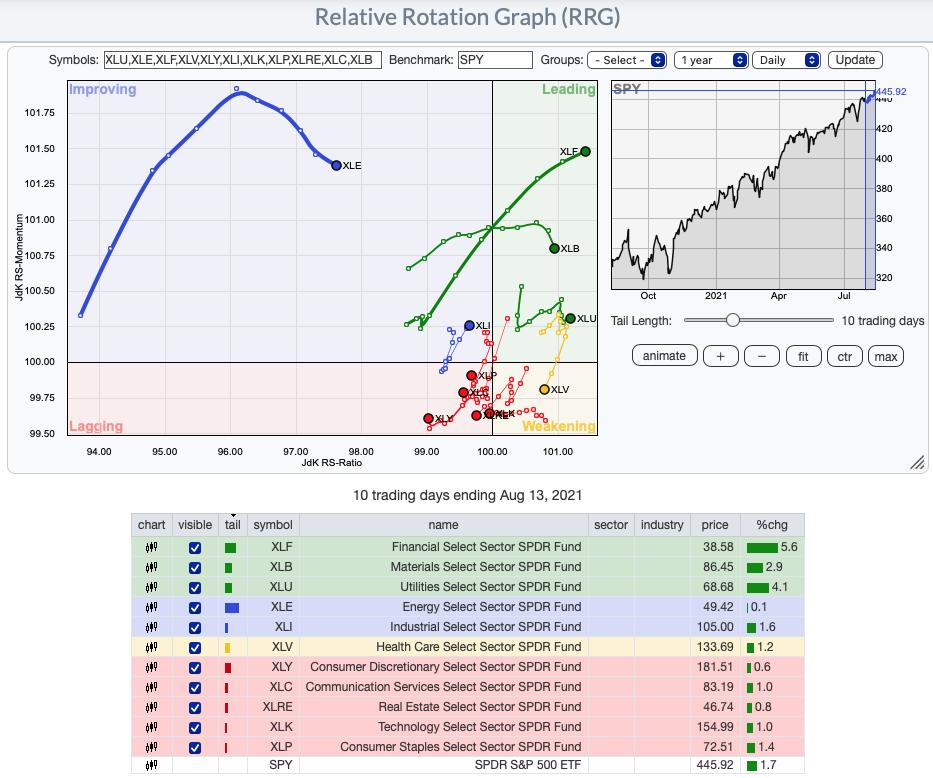

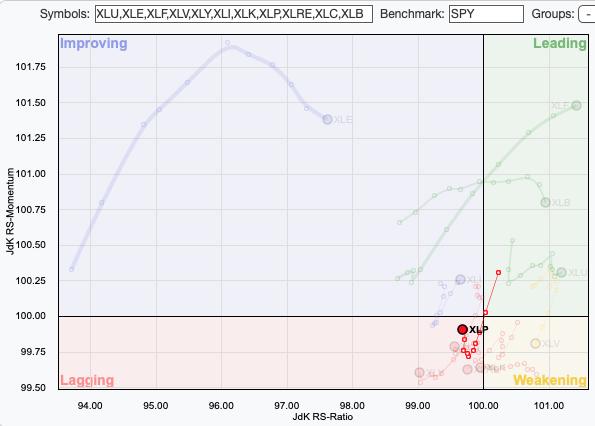

Short-term RRG: Based on my sector chart review this morning, I liked XLI and XLP. You can see XLI has reversed directions and is now heading out of "improving" toward "leading".

However, when it came down to it, I opted to pick Consumer Staples (XLP) as my sector watch. Below I have highlighted XLP since it is hard to see above. It has made and about face and is headed back toward "improving".

Sector to Watch: Consumer Staples (XLP)

I like to find new strength and XLP fits that bill. The price breakout today sold me on this sector. It moved back to a PMO BUY signal. The RSI is positive and not overbought. Most importantly, participation is improving and not overbought. The SCI is bottoming and we have a rising BPI. There are some great industry groups within, but again, I'm looking for new strength.

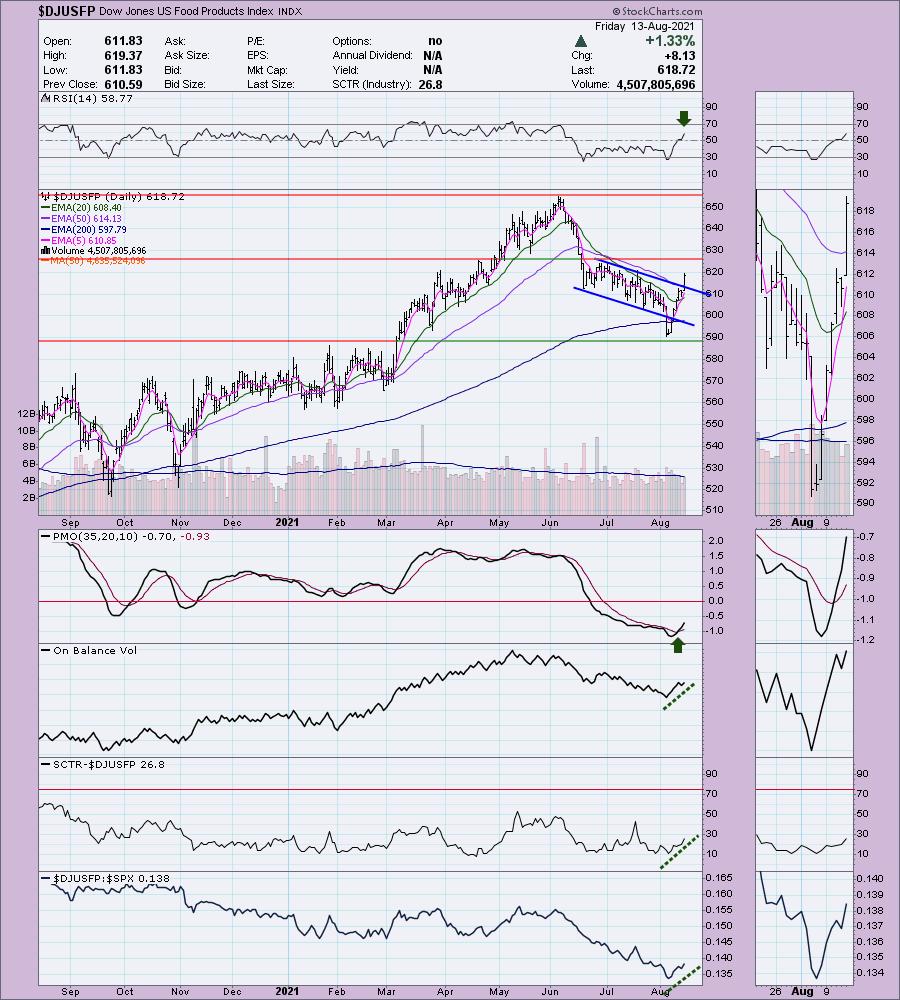

Industry Group to Watch: Food Products ($DJUSNF)

The breakout on the Food Products group is impressive as it breaks out of a declining trend channel. The PMO is on a crossover BUY signal and the RSI just entered positive territory. Relative strength is picking up. Another group of interest was Tobacco. There are industry groups that are killing it right now in this sector, for example Food Retailers, but they have run up very high and are overbought.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting! Next Diamonds Report is Tuesday 8/16.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 50% invested right now and 50% is in 'cash', meaning in money markets and readily available to trade with.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com