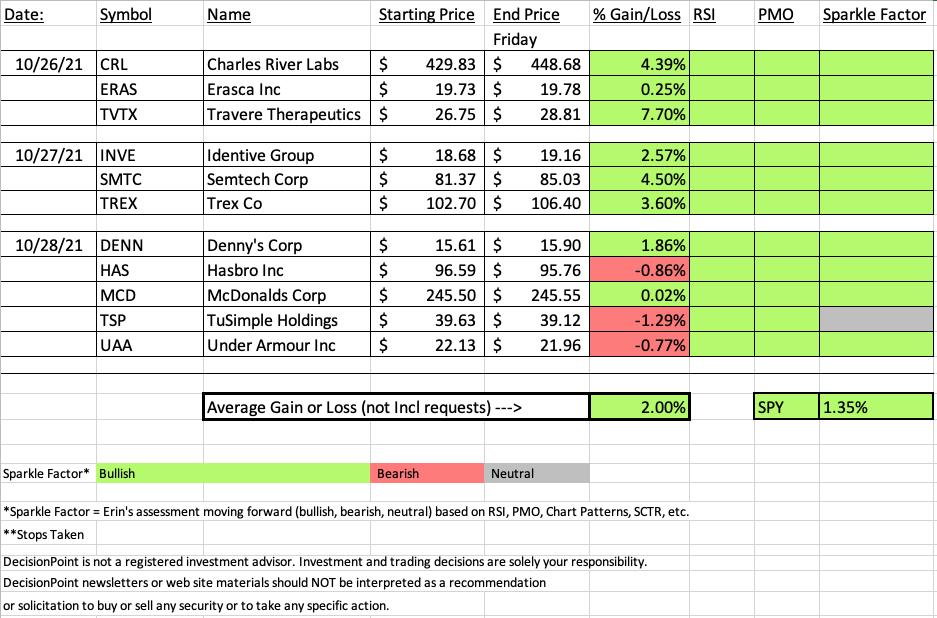

"Diamonds in the Rough" shined up well! The only losing positions were three reader requests from yesterday. They only got one day to mature so keep them on your watchlists for next week. There is only one stock that I'm not bullish on moving forward of this week's 11 picks. And, on that stock, I'm only "neutral" on the Sparkle Factor.

Biotechs were my emphasis on Tuesday and all of those positions by the end of the week were green. Our "Darling" is from Tuesday, Travere Therapeutics (TVTX). While I've have picked a different "industry group to watch" this week, I believe Biotechs are still an area to focus on next week.

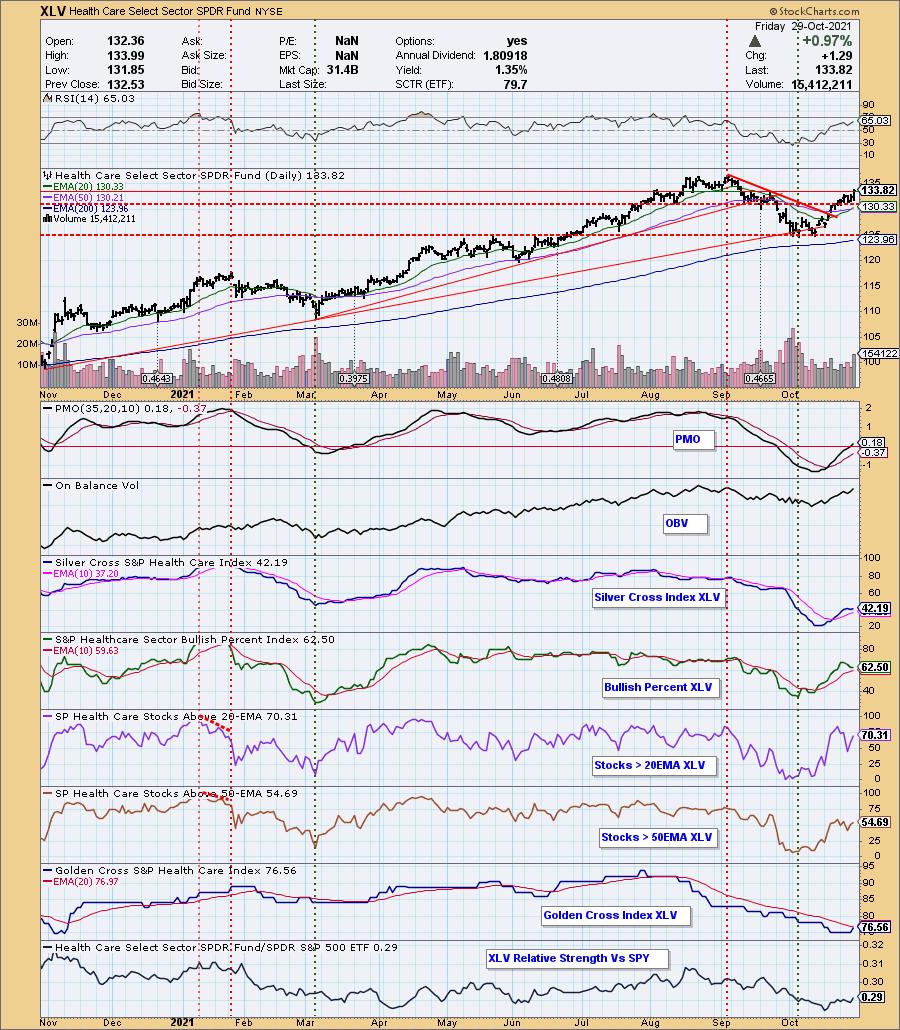

Basically Healthcare (XLV) in general is looking very bullish. Nearly every industry group looks bullish moving forward.

This week's "Dud" was TuSimple Holdings (TSP) which was down -1.29% today. As I mentioned above, it had one day and given it had closed up over 11% yesterday, a 1.29% pullback is fairly inconsequential. Still we don't have a breakout on it so that is why I listed it as "neutral" going forward.

Don't forget to download the free eBook that I contributed to for the "Naughty or Nice" Online Trader's Summit sponsored by Westmark Trading and Trade Thirsty. As part of this you will be granted entry to the presentations on November 3rd-4th. I'll be presenting on November 3rd at 5:00p ET! Thank as always for your support of my projects.

Hope everyone has a great weekend!

RECORDING LINK Friday (10/29):

Topic: DecisionPoint Diamond Mine (10/29/2021) LIVE Trading Room

Start Time: Oct 29, 2021 09:00 AM

Meeting Recording Link HERE.

Access Passcode: October@29

REGISTRATION FOR FRIDAY 11/5 Diamond Mine:

When: Nov 5, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (11/5/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (10/25) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Oct 25, 2021 09:00 AM

Meeting Recording Link HERE.

Access Passcode: October#25

For best results, copy and paste the access code to avoid typos.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Travere Therapeutics, Inc. (TVTX)

EARNINGS: 10/28/2021 (AMC)

Travere Therapeutics, Inc. is a biopharmaceutical company. It engages in the identification, development, commercialization, and distribution of therapies to people living with rare diseases. The firm's products include Chenodal, Cholbam, and Thiola. The company was founded by Martin Shkreli on February 8, 2008 and is headquartered in San Diego, CA.

Predefined Scans Triggered: Moved Above Upper Price Channel, P&F Double Top Breakout and P&F Ascending Triple Top Breakout.

Below are the commentary and chart from Tuesday:

"TVTX is unchanged in after hours trading. Please note that it reports earnings on Thursday night. I like the look of this chart for a few reasons. The RSI is positive and not yet overbought. Price is breaking out above strong resistance at the October high, but also the April highs. The PMO has turned back up. Price bounced off the 20-EMA and its "personality" suggests that it likes to pullback to the 20-EMA and rally. Stochastics are rising and overbought. With Stochastics, when it moves above 80 and stays there, it suggests internal strength. This stocks shows great relative strength v. the market and the industry group. I've set the stop below the 20-EMA."

Here is today's chart:

Today's gap up on earnings suggests this one will continue to travel higher. Today saw a beautiful gap up breakout. The RSI is overbought, but it was overbought for an entire month previously so that isn't a huge problem. Stochastics are strong and relative performance is still spot on.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

TuSimple Holdings Inc. (TSP)

EARNINGS: 11/3/2021 (AMC)

TuSimple Holdings, Inc. engages in the operation and development of autonomous trucks. It develops autonomous technology specifically designed for semi-trucks, which build the autonomous freight network in partnership with shippers, carriers, railroads, freight brokers, fleet asset owners, and truck hardware partners. The company was founded by Mo Chen and Xiao Di Hou in 2015 and is headquartered in San Diego, CA.

Predefined Scans Triggered: Parabolic SAR Buy Signals, Elder Bar Turned Green, New CCI Buy Signals, Bullish MACD Crossovers and Entered Ichimoku Cloud.

Below are the commentary and chart from Thursday:

"TSP is down -1.59% in after hours trading. I don't like to see after hours trading suffering on "Diamonds in the Rough", but there you are. It did have a huge 11%+ rally today, so consider this an opportunity to buy on a pullback if it does continue lower tomorrow. It's in a trading range, but today was the first time that it has closed above the 50-EMA since it dropped below back in early September. The PMO has triggered a new crossover BUY signal on today's big rally. Be aware they do report earnings next week. Stochastics are just starting to rise. The group has been killing it but this one not so much. However, it is beginning to get some love. Because we had an over 11% move today, the stop is really deep, but you can adjust that if you get in lower. I'd want to set it below this trading range."

Below is today's chart:

For a "Dud" this one is still quite bullish. I opted to go with a "neutral" Sparkle Factor mainly because it hasn't broken out yet. However, indicators are still quite positive. The PMO is rising nicely and should hit positive territory soon. The RSI is positive, but it has turned over. Still not a big concern. Price is staying above the 50-EMA so a breakout seems likely. It is beginning to outperform, but the group has been on fire, so this one should've seen more action. Overall... not much of a "dud".

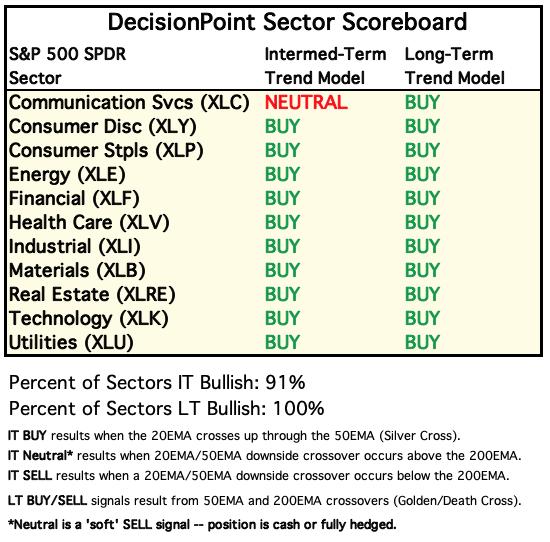

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

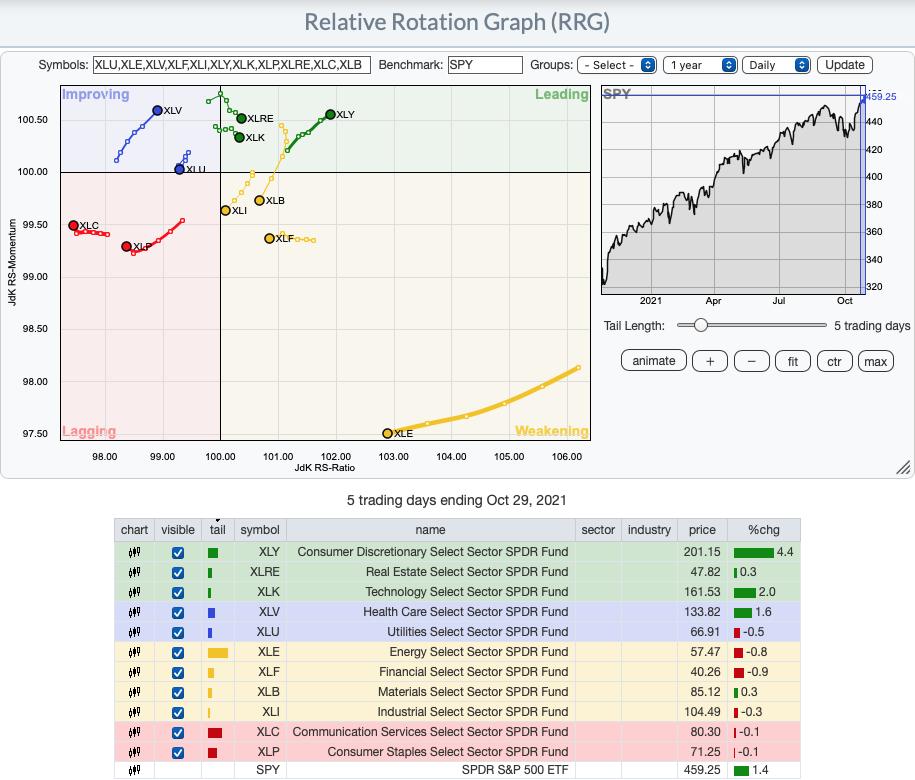

Short-term RRG: XLY is the clear winner on the daily RRG, however, those in the DP Diamond Mine trading room know that the technicals under the surface are little bit suspect. I'm not saying its run is over, just that it could be cooling. XLK and XLRE while not traveling in the bullish northeast heading are still firmly planted in Leading. XLU was the one to watch last week. It's relative strength has begun to wane and it is now close to hitting the Lagging quadrant. XLV look excellent with its bullish northeast heading. It appears that the areas of prior strength, XLI, XLB, XLE and XLF are moving out of favor. My portfolio is heavy in XLB and XLE so I will likely be reevaluating my exposure to those sectors next week.

Sector to Watch: Health Care (XLV)

It wasn't that hard to decide on the "Sector to Watch" for next week after I viewed all 11 sectors "under the hood". Remember you do have access to these charts. Just go to the Blogs and Links page on our site and in the upper lefthand corner you'll find in bold the three DP ChartLists that you have available. XLV had a short-term breakout above resistance last week. Today it closed just past short-term resistance at the August/mid-September tops. Today we saw an IT Trend Model "Silver Cross" BUY signal on XLV as the 20-EMA crossed above the 50-EMA. The RSI is positive and the PMO has just reached positive territory. The BPI and Silver Cross Index (SCI) had started topping, but today turned back up. Participation in the short term improved greatly. %Stocks > 50-EMA is improving slightly. I do want to see that indicator rising more deliberately as that is key to keeping a rising SCI. GCI is at a bullish 76% and is rising now. This sector is the clear winner in my humble opinion.

Industry Group to Watch: Pharmaceuticals ($DJUSPR)

After reviewing the industry groups within Healthcare, there were three standouts; Pharmaceuticals, Biotechs and Medical Supplies. The other two, Medical Equipment and Healthcare Providers were just "okay". Pharma has broken above the 20/50-EMAs and is now zeroing in on a "Silver Cross" BUY signal. The RSI is positive and the PMO just entered positive territory today. Stochastics are strong as oscillation above 80 is a sign of internal strength. Relative strength is already there. I'll be keeping an eye on this group next week. Here are few to look at: CVS is getting ready to breakout. Pfizer (PFE) is breaking above the 50-EMA. Catalent (CTLT) is on a new PMO BUY signal.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting! Next Diamonds Report is Tuesday 11/2.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 85% exposed to the market. Looking to shuffle a few positions. Nat Gas is looking iffy so I tightened my stop.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com