This week the "Diamonds in the Rough" only saw three shine up, but moving forward, many of this week's "Diamonds in the Rough" still might begin to sparkle. Overall, it is a rough market out there and it is likely going to get worse. Keeping limited exposure is wise. I'm currently at 10% and despite being tempted this week, I've opted not to try and find a winner amongst so many stocks that are correcting or have bearish biases.

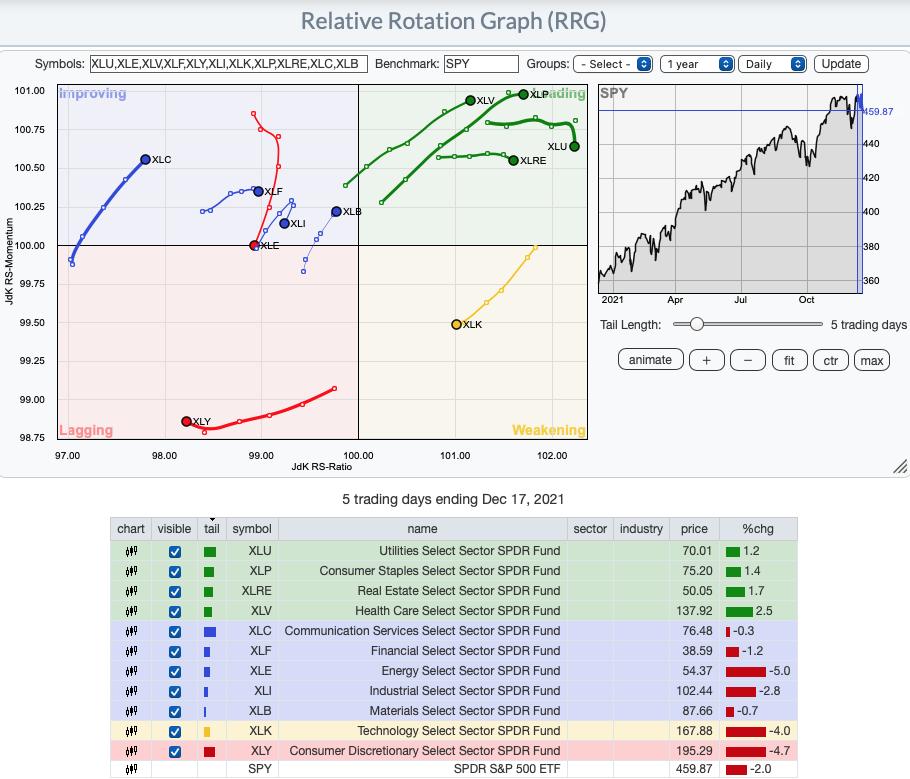

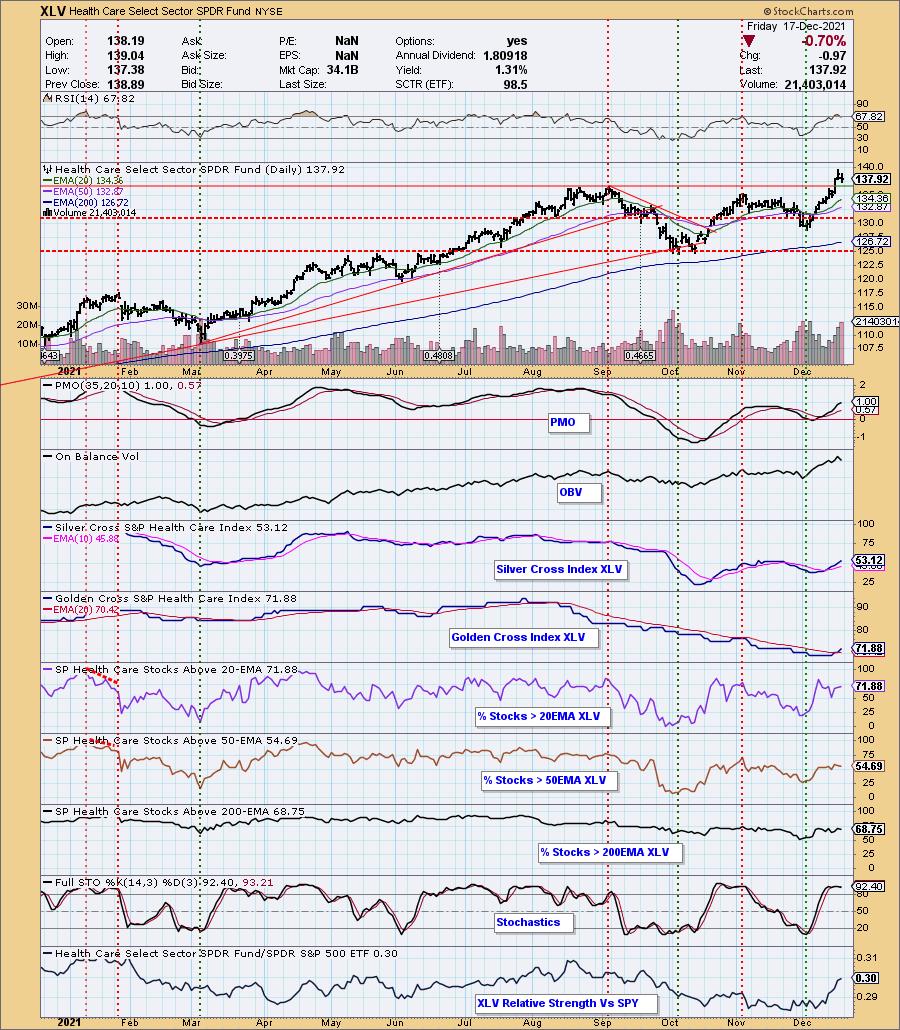

The sector to watch ultimately came down to Utilities (XLU) and Healthcare (XLV). Based on participation and relative strength, I'm going with Healthcare. Comm Services (XLC) is beginning to reverse, but is still firmly below the 200-EMA.

Friday is a holiday so I'm planning on doing the Diamond Mine trading room on THURSDAY December 23rd. The registration link is below with today's recording link.

Hope everyone has great weekend! The next Diamonds report will be on Tuesday of next week.

RECORDING LINK Friday (12/17):

Topic: DecisionPoint Diamond Mine (12/17/2021) LIVE Trading Room

Start Time: Dec 17, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: December@17

REGISTRATION FOR Thursday 12/23 Diamond Mine:

When: Dec 23, 2021 09:00 PM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (THURSDAY, 12/23/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (12/13) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Dec 13, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: December+13

For best results, copy and paste the access code to avoid typos.

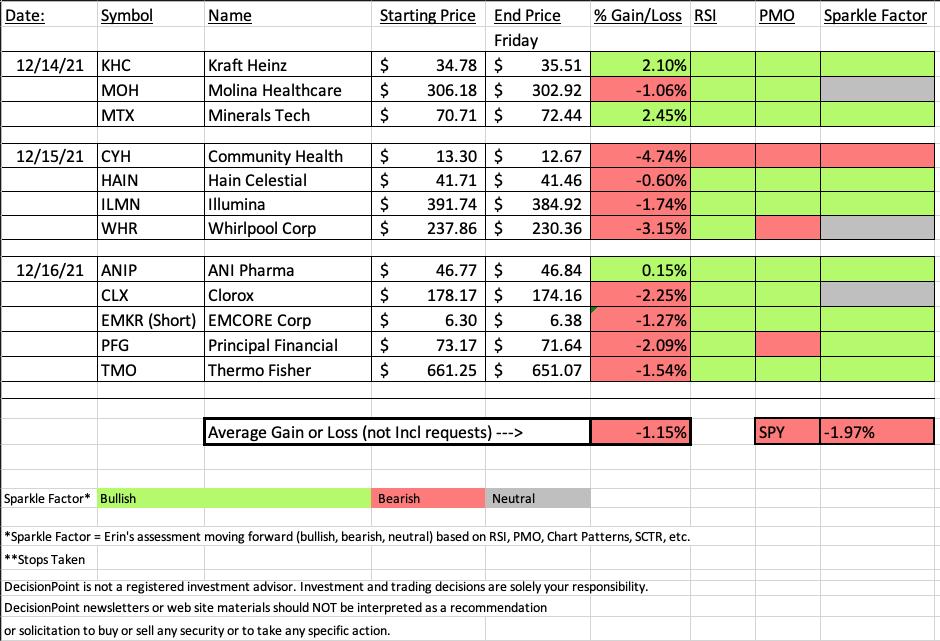

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Minerals Technologies Inc. (MTX)

EARNINGS: 2/3/2022 (AMC)

Minerals Technologies, Inc. is a resource and technology-based company. It develops, produces, and markets a range of mineral, mineral-based, and synthetic mineral products. It operates through the following four segments: Performance Materials, Specialty Minerals, Refractories and Energy Services. The Performance Materials segment supplies bentonite and bentonite-related products, chromite and leonardite. The Specialty Minerals segment produces and sells the synthetic mineral product precipitated calcium carbonate and processed mineral product quicklime, and mines mineral ores then processes and sells natural mineral products, primarily limestone and talc. The Refractories segment produces monolithic and shaped refractory materials and products, and also provides services and sells application and measurement equipment, and calcium metal and metallurgical wire products. The Energy Services segment provides services to improve the production, costs, compliance, and environmental impact of activities performed in oil & gas industry. The company was founded on February 19, 1968 and is headquartered in New York, NY.

Predefined Scans Triggered: Hollow Red Candles and P&F Low Pole.

Below are the commentary and chart from Tuesday (12/14):

"MTX is unchanged in after hours trading. I like the set up here. We have another "V" bottom only this one hasn't retraced as far. It has covered the November gap, although it didn't close above it or above the 200-EMA. It's early, but the RSI is now positive and the PMO triggered a crossover BUY signal today. Stochastics are rising nicely and should get above 80 soon. You can see the that the group is gaining relative strength and MTX is outperforming the group and the SPY right now. You could set a deep stop at the bottom of the "V" or you could set a 5.5% stop at the September low."

Here is today's chart:

The only issue I have with MTX right now is the struggle to overcome resistance at the 200-EMA and the July low/October highs. Still, the indicators are very positive and suggest that a breakout will occur. I would raise the stop level to the September low.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

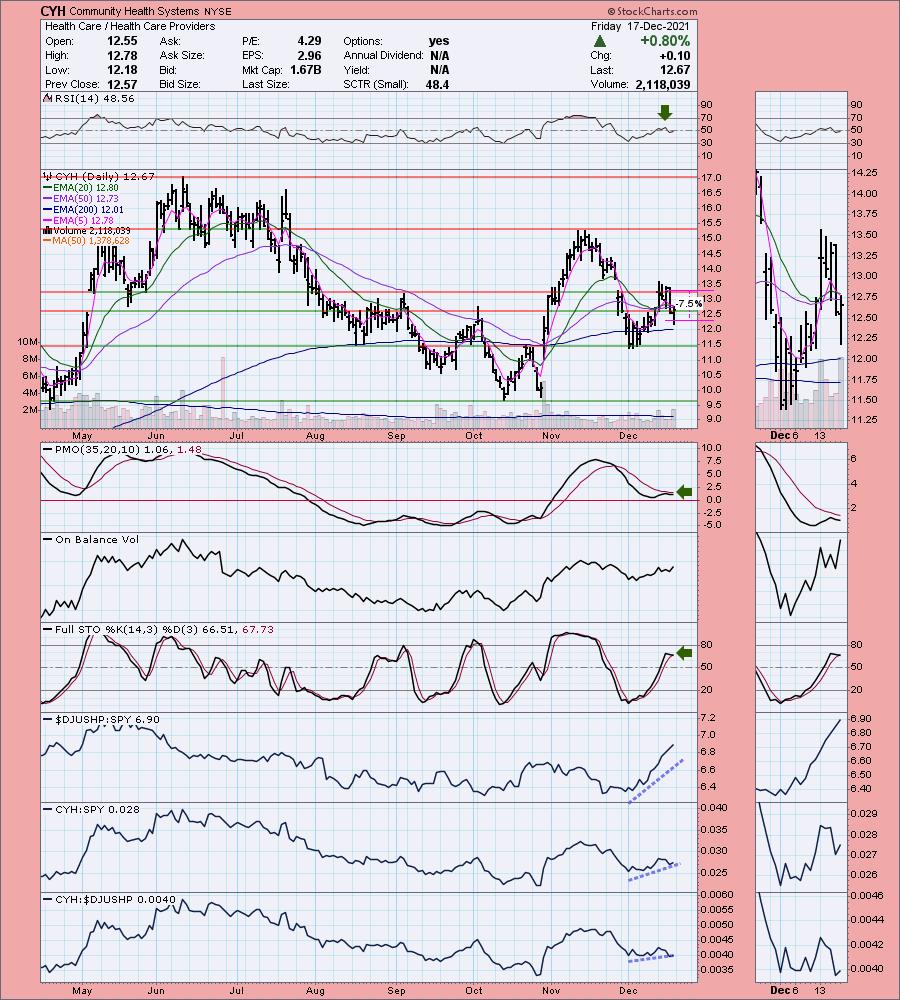

Community Health Systems (CYH)

EARNINGS: 2/16/2022 (AMC)

Community Health Systems, Inc. engages in the management and operations of hospitals. It operates general acute care hospitals and related healthcare entities that provide inpatient and outpatient healthcare services. The company was founded in March 1985 and is headquartered in Franklin, TN.

Predefined Scans Triggered: None.

Below are the commentary and chart from Wednesday (12/15):

"CYH is unchanged in after hours trading. This is in the hot group of HealthCare Providers. Yesterday's MOH was up +2.55% today and it could move higher. After breaking above key moving averages, price is consolidating. The RSI is positive and the PMO is rising toward a new crossover BUY signal. Stochastics are rising strongly and are in positive territory. The group is outperforming the SPY by a mile and CYH is beginning to outperform. I set the stop somewhat arbitrarily at 7.5%. To set it at the December low would have been over 11% and that just doesn't work for me."

Below is today's chart:

The stop nearly triggered and price appears ready to test support at the December low. The group was on fire and continues to outperform, this is simply a "dud". Given that Stochastics have turned down below 80 and the PMO has topped below its signal line, I'm not interested in this one anymore.

THIS WEEK's Sector Performance:

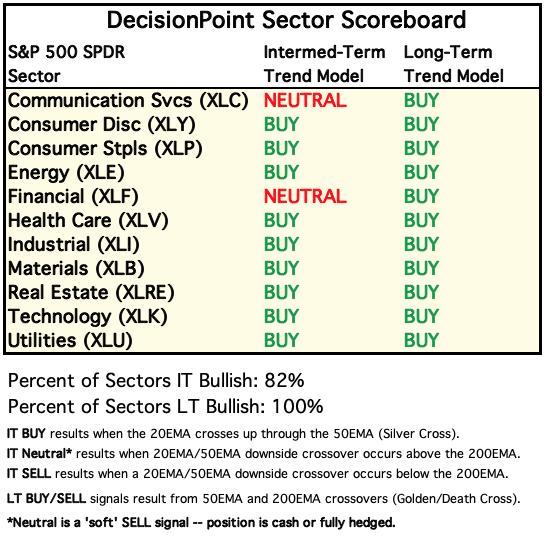

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

Short-term RRG: The defensive sectors are holding court in the Leading quadrant. When defensive sectors outperform... they are the last to perform before a market correction. The two aggressive sectors XLY and XLK are the weakest based on their location and heading, with XLE close behind as it has just reached the Lagging quadrant as it continues in the bearish southwest direction. XLI now has a bearish heading, but is still sitting in Improving. The remainder are in improving and look as if they will stay there a bit longer. Although, XLB could hit the Leading quadrant next week.

Intermediate-Term RRG: XLC continues to get worse on the weekly RRG. In this case, the three weakest sectors on the daily RRG are the only ones in Leading on the weekly with XLK still looking healthy in the intermediate term. XLF also looks very bearish as it has made its way quickly into Lagging and continues moving in the bearish southwest direction. All others look bullish given their northeast headings.

Sector to Watch: Healthcare (XLV)

Runners up were XLP (no new momentum, already outperforming, likely to continue outperforming, but I like "new" momentum), XLB (bias is still neutral to bearish), XLRE (bearish bias despite rising momentum) and XLU (stronger participation but losing stocks > 20-EMAs).

XLV pulled back a bit today. The SCI is rising and %Stocks > 20/50-EMAs have higher percentages, giving us a bullish short- and intermediate-term bias. If I had a beef, it would be %Stocks > 200-EMA is lower than the GCI. However, the GCI is still rising so it is easy to forgive.

Industry Group to Watch: Coal ($DJUS)

This industry group showed up on my radar based on the StockCharts RRG of the top 10 improving groups based on StockCharts Technical Rank (SCTR). This chart is very promising. Nice bottoming formation on top of the 200-EMA and a new PMO crossover BUY signal. The RSI is negative, but should hit positive territory soon. Stochastics are very favorable.

Stocks to review in this industry group? ARCH, AMR, ALRP, and HCC.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting! The next Diamonds Report is Tuesday 12/21.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 10% exposed to the market.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com