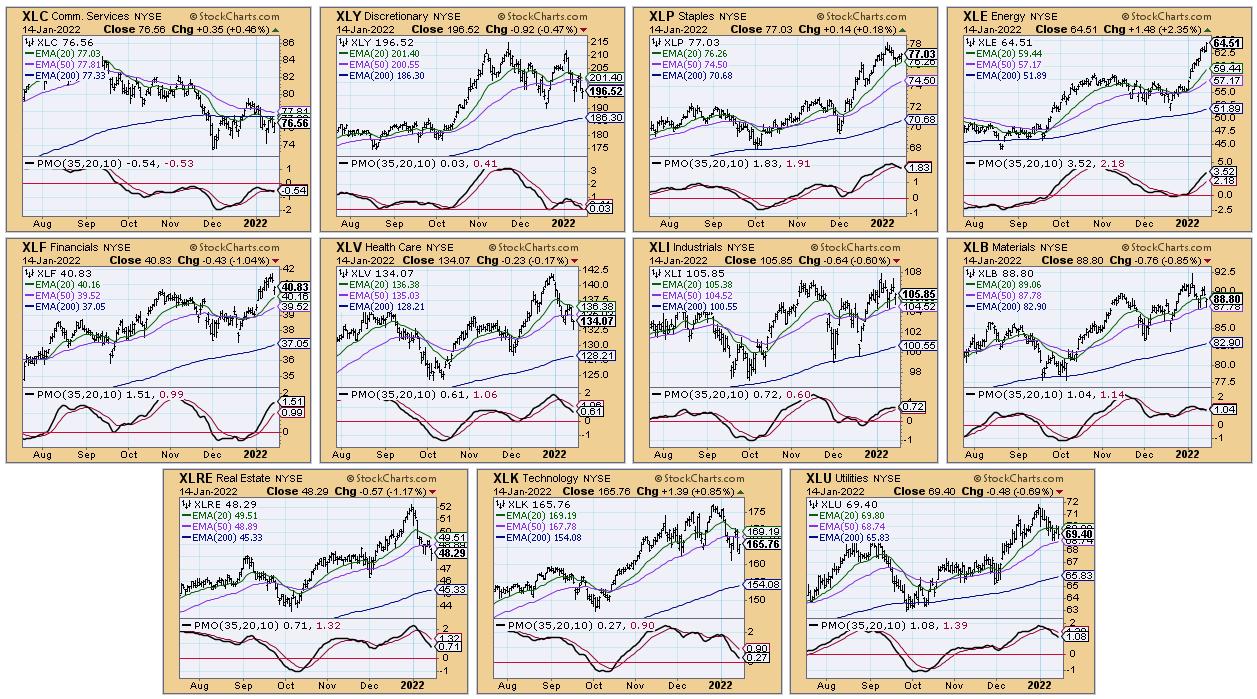

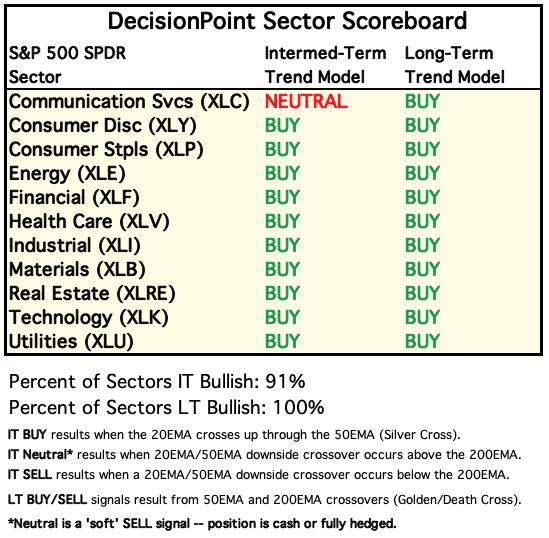

When you review the Sector Summary, you'll note that this week, only two sectors finished higher, Energy (XLE) and Communication Services (XLC). That doesn't tell the whole story. XLE closed the week up +5.17% while XLC barely closed up +0.16% on the week. Newsworthy would be that Technology finished in 3rd place down only -0.10%. We will keep an eye on this sector as I know that investors are chomping at the bit to swoop in and take advantage of the pullbacks and corrections. I just don't think it is ripe enough to be our "Sector to Watch". Finding a "Sector to Watch" with new momentum was impossible this week. You'll see in the CandleGlance of the sectors that there are no "new momentum" sectors:

Therefore, we will use the "winners keep on winning" mentality and make the Energy sector our "one to watch". However, I will say that we had close seconds on XLI, XLP and XLF. However, I couldn't present XLP and XLF given their new PMO SELL signals and XLI while it looks fairly good has a topping PMO and declining participation numbers.

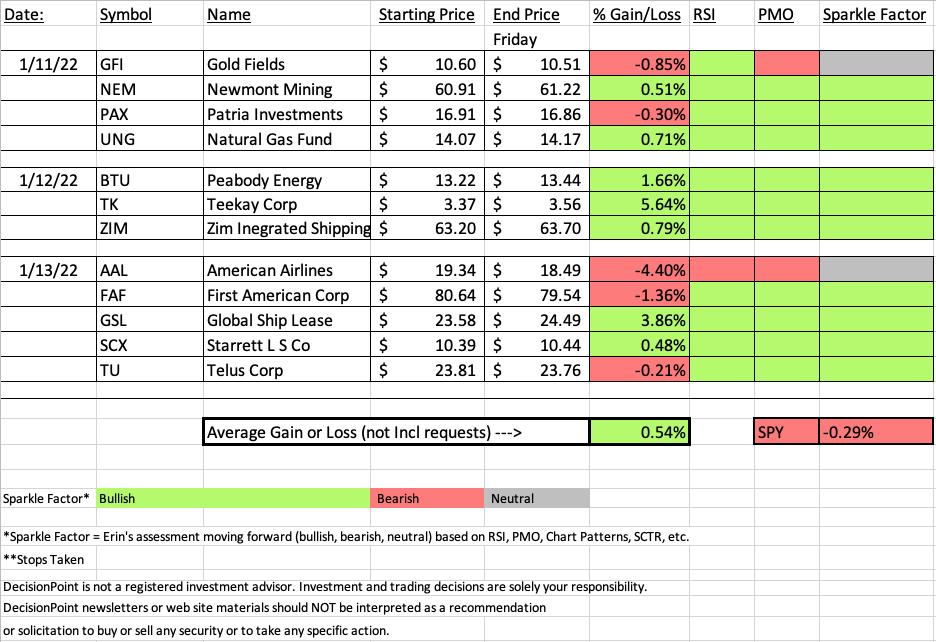

By the time the market closed, "Diamonds in the Rough" were up +0.54% on the week. The SPY was down -0.29%. It's a win and I'll take it, but as I always caveat, "Diamonds in the Rough" don't get to trade for the week like the SPY so we're kind of comparing apples to oranges to some degree. Sometimes that disparity works out, sometimes it doesn't so I don't make it a goal, per se, to beat the SPY.

This week's "Darling" is Teekay Corp (TK), a Marine Transportation stock that has a beautiful saucer shaped price bottom.

This week's "Dud" did not even come close to triggering its stop level, but was down -4.4% on the week. Airlines (JETS) is looking good, but American Airlines (AAL) pulled back to finish the week lower.

Below you'll find the latest Diamond Mine recording link as well as the registration link for next week.

** NOTICE ** The free trading room on Monday has been postponed to Tuesday given the MLK holiday on Monday. Wouldn't be much of a trading room if there aren't stocks moving. The holiday will not impact our Diamonds schedule.

Have a great weekend! The next Diamonds report will be on Tuesday of next week.

RECORDING LINK (1/14/2022):

Topic: DecisionPoint Diamond Mine (1/14/2022) LIVE Trading Room

Start Time: Jan 14, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: Diamond@14

REGISTRATION FOR 1/21 Diamond Mine:

When: Jan 21, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (1/21/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (1/10) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Jan 10, 2022 09:02 AM

Meeting Recording Link.

Access Passcode: Jan#10th

For best results, copy and paste the access code to avoid typos.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Teekay Corp. (TK)

EARNINGS: 2/17/2022 (BMO)

Teekay Corp. is an investment holding company, which engages in the provision of international crude oil and gas marine transportation services. Its lines of business include offshore production (FPSO units), LNG and LPG carriers and conventional tankers. The firm operates through the following segments: Teekay LNG; Teekay Tankers and Teekay Parent. The Teekay LNG segment comprises of the liquefied natural gas and liquefied petroleum gas carriers. The Teekay Tankers segment offers conventional crude oil tankers and product carriers. The Teekay Parent owns floating production, storage, and offloading (FPSO) units and a minority investment in Tanker Investments Ltd. The company was founded by Jens Torben Karlshoej in 1973 and is headquartered in Hamilton, Bermuda.

Predefined Scans Triggered: Stocks in a New Uptrend (Aroon).

Below is the commentary and chart from Wednesday (1/12):

"TK is unchanged in after hours trading. We have another rounded price bottom and a breakout. The RSI is positive. The PMO is rising on a crossover BUY signal. Stochastics are oscillating above 80. Price rallied above all of the key moving averages. This prevented a "death cross" of the 50/200-day EMAs. Relative strength is strong, although the group is cooling somewhat after reaching relative highs. The stop is deep, but lined up below the late December lows."

Here is today's chart:

The saucer shaped price bottom is very bullish and price is continuing higher as expected. Since it was presented, the PMO has now entered positive territory. The RSI is still positive and not overbought yet. Stochastics are still strong and suggest it might not be too late to get in on this one.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

American Airlines Group Inc. (AAL)

EARNINGS: 1/20/2022 (BMO)

American Airlines Group, Inc. is a holding company, which engages in the operation of a network carrier through its principal wholly-owned mainline operating subsidiary, American. The firm offers air transportation for passengers and cargo. It operates through the following geographical segments: Department of Transportation Domestic; Department of Transportation Latin America; Department of Transportation Atlantic; and Department of Transportation Pacific. The company was founded on December 9, 2013 and is headquartered in Fort Worth, TX.

Predefined Scans Triggered: Elder Bar Turned Green, New CCI Buy Signals, Moved Above Ichimoku Cloud and P&F Double Top Breakout.

Below is the commentary and chart from Thursday (1/13):

"AAL is down -0.10% in after hours trading. I've covered AAL once before on May 18th 2021. The position was up about 10% at the June top, but ultimately dropped and triggered the stop. One issue for me on the chart is that price hasn't closed above the 200-day EMA yet; however, given the positive indicators, in particular the accelerating PMO, I believe it has merit. The RSI is positive and Stochastics are in positive territory and appear ready to move higher again. We want to see them get above 80 quickly. The group is certainly starting to outperform and AAL is outperforming the SPY. It isn't outperforming its group, but it is trying to break the relative declining trend. I wouldn't give this one too much rope which is why I set a 6.2% stop."

Below is today's chart:

I've listed AAL with a "Neutral" Sparkle Factor. I don't think the chart is bad enough to sell the position and it does offer an interesting entry. However, the RSI has moved into negative territory and the PMO has topped slightly. If AAL can hold this support level and bounces, I'd consider it for entry.

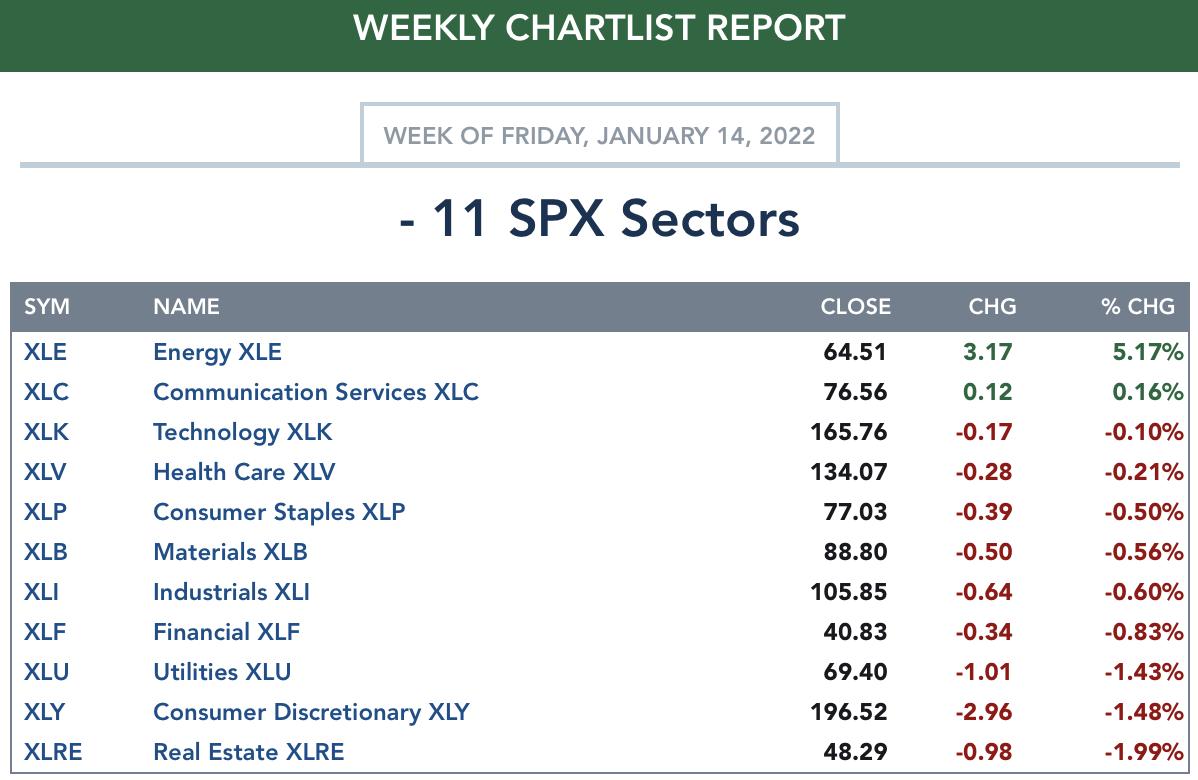

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

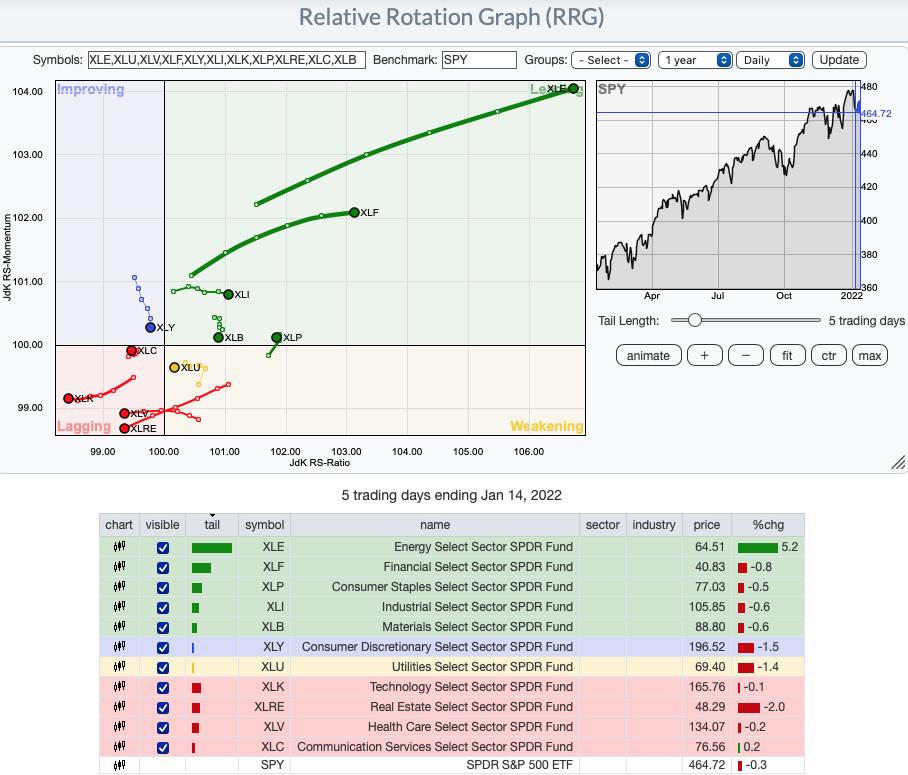

Short-term (Daily) RRG: It isn't surprising that the sectors I concentrated on for the "sector to watch" were XLE, XLF, XLI and XLP. All four are in the Leading quadrant. XLB is still in Leading, but is losing relative strength and is now headed toward Weakening. I think the sector still has merit, particularly Copper, Gold and Miners. XLY was Improving, but is now headed to either Lagging or Weakening, neither is good. XLC is hooking around back toward Improving. This beat down sector has potential, but pockets of strength are hard to determine. XLU is only in Weakening, but it moving toward Lagging after already taking up residence in Weakening. XLK is configured the most bearishly in the short term (not surprisingly) and XLV and XLRE are Lagging and getting more bearish as well.

Intermediate-Term (Weekly) RRG: In the longer term, the all of the sectors, except XLY and XLK (two most aggressive sectors) are moving in the bearish southwest direction. XLF is hooking around toward Improving/Leading which is good in the intermediate term. XLC is Lagging like XLF, but hasn't gotten a bullish northeast heading yet. Still, it is at least making an effort to reach Improving. All other sectors have bullish northeast headings with the exception of XLB which is moving southeast. That's acceptable since it is firmly planted in Leading right now.

Sector to Watch: Energy (XLE)

I went with Energy because there is no denying the internal strength. Based on the SCI, 100% of the sector have 20-day EMAs > 50-day EMAs and with participation of stocks > 20/50-day EMAs also at 100%, the bias is strongly bullish. The long-term is also very bullish. The GCI is at 100% so all of the Energy stocks have "golden crosses" or a 50-day EMA > 200-day EMA. Participation in the long term shows 100% of Energy stocks with price > 200-EMA. If the "winners keep on winning" mentality works, we should continue to see higher prices.

Industry Group to Watch: Coal ($DJUSPL)

I hate to repeat, but this industry group still has a lot of room to run. I picked Coal two weeks ago as the "Industry Group to Watch", but it took until this week to see a solid breakout. If the index can recapture the October high, we will see a 25%+ gain.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend! The next Diamonds Report is Tuesday 1/18.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 30% exposed to the market.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com