Today it was the Banks that dominated my scans. I'm finally starting to get some production from my scans which bodes well as market participation of %Stocks > 20/50/200-day EMAs expands. There are still some problems, but we could eke out some more upside. All of your positions should be considered short-term investments right now. The market is volatile and weak, but there are pockets of strength to exploit. I think Banks are one of those pockets of strength. We also know a rising rate environment tends to favor Banks.

I have a handful of stocks and an ETF to present today, but I also like the "Stocks to Review". Use your own analysis process and determine if you like some of them too. I'm contemplating adding a Bank to my portfolio.

Today's "Diamonds in the Rough": ACBI, AX, KBE and SSB.

Stocks to Review (No order): BOKF, BPOP, FBNC, KRE and IAT.

RECORDING LINK (2/3/2022):

Topic: DecisionPoint Diamond Mine (THURSDAY 2/3) LIVE Trading Room

Start Time: Feb 3, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: February@3rd

REGISTRATION FOR Friday 2/11 Diamond Mine:

When: Feb 11, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (2/11/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Topic: DecisionPoint Trading Room

Start Time: Feb 7, 2022 09:01 AM

Meeting Recording Link.

Access Passcode: February#7

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from the StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Atlantic Capital Bancshares, Inc (ACBI)

EARNINGS: 4/21/2022 (AMC)

Atlantic Capital Bancshares, Inc. is a holding company, which engages in the provision of commercial banking services. The company offers an array of credit, treasury management, and deposit products and services. It also provides capital markets, mortgage banking, and electronic banking services to its corporate, business, and individual clients. The company was founded in 2006 and is headquartered in Atlanta, GA.

Predefined Scans Triggered: P&F High Pole.

ACBI is unchanged in after hours trading. Today it confirmed a small double-bottom formation as it broke above the confirmation line drawn along the center of the "W". There was a nice positive OBV divergence that led into this rally. The RSI is positive and rising. The PMO is nearing a crossover BUY signal. Stochastics are rising strongly and you can see that the Banks group is outperforming the SPY. This bank has also been a steady performer against the Banks group as a whole. The stop is set below the 50-day EMA.

The weekly RSI is positive and not overbought. The weekly PMO is currently on a crossover BUY signal. It is near all-time highs so I would consider a 14% upside target around $36.18.

Axos Financial, Inc. (AX)

EARNINGS: 4/28/2022 (AMC)

Axos Financial, Inc. is a holding company, which engages in the provision of banking and financing services. It operates through the following segments: Banking Business and Securities Business. The Banking Business segment includes online banking, concierge banking, prepaid card services, and mortgage, vehicle, and unsecured lending through online and telephonic distribution channels. The Securities Business segment is involved in the clearing broker-dealer, registered investment advisor, and introducing broker-dealer lines of businesses. The company was founded on July 6, 1999 and is headquartered in Las Vegas, NV.

Predefined Scans Triggered: Bullish MACD Crossovers, Entered Ichimoku Cloud, P&F Double Top Breakout and P&F Bearish Signal Reversal.

AX is unchanged in after hours trading. Price broke strongly above the 50-day EMA and overhead resistance at the October high. This rally was also accompanied by an intermediate-term positive OBV divergence. The RSI is entering positive territory. This one is the strongest as far as outperformance goes this past week. It is outperforming both the group and the SPY. The PMO is nearing a crossover BUY signal. Stochastics are rising and have hit positive territory above net neutral (50). The stop is deep at 8.8%, set below the late October low and December low as well as the 200-day EMA. You certainly don't have to wait for it to hit that level. If it moves to $52, that would probably be a good time to get out too.

The weekly PMO has turned up and the weekly RSI just hit positive territory. It is near its all-time high, so consider a possible target of 15% at around $64.16.

SPDR S&P Bank ETF (KBE)

EARNINGS: N/A

KBE tracks an equal-weighted index of US banking firms.

Predefined Scans Triggered: None.

KBE is unchanged in after hours trading. We have a strong breakout above overhead resistance at the November highs. There was a positive 5/20-day EMA crossover yesterday that gives us a Short-Term Trend Model BUY signal. There is a positive OBV divergence that led into this rally. The RSI is rising in positive territory and is not overbought. The PMO is about to generate a crossover BUY signal. Stochastics are rising strongly above net neutral (50). The stop is set below the closing prices in late January.

The weekly chart shows us that price is in a rising trend channel. The weekly RSI is positive and not overbought. The weekly PMO has turned up. It is near all-time highs so consider an upside target of 15% at around $66.87.

South State Corp. (SSB)

EARNINGS: 4/28/2022 (AMC)

South State Corp. is a bank and financial holding company, which engages in the provision of banking services and products to customers through its subsidiary. Its services include demand, time, and savings deposits; lending and credit card servicing; ATM processing; mortgage banking services; correspondent banking services and wealth management; and trust services. The company was founded in 1985 and is headquartered in Winter Haven, FL.

Predefined Scans Triggered: P&F Double Top Breakout.

SSB is unchanged in after hours trading. This stock actually broke out last week, but given the positive price action coming off a positive OBV divergence, I expect the rally to continue. The RSI is positive and not overbought. The PMO is ready to trigger a crossover BUY signal. Stochastics are rising strongly and should get above 80 soon. This one has been steadily outperforming the Banks industry group since December. It is currently outperforming the SPY. The stop is rather deep so you could opt to set it below the 50-day EMA instead of below support at December highs and January lows.

The weekly RSI is positive, rising and not overbought. This probably is the best configuration of the weekly PMO of all charts today. It is near overhead resistance at all-time highs so consider a 18% upside target (double the stop level) at around $104.76.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

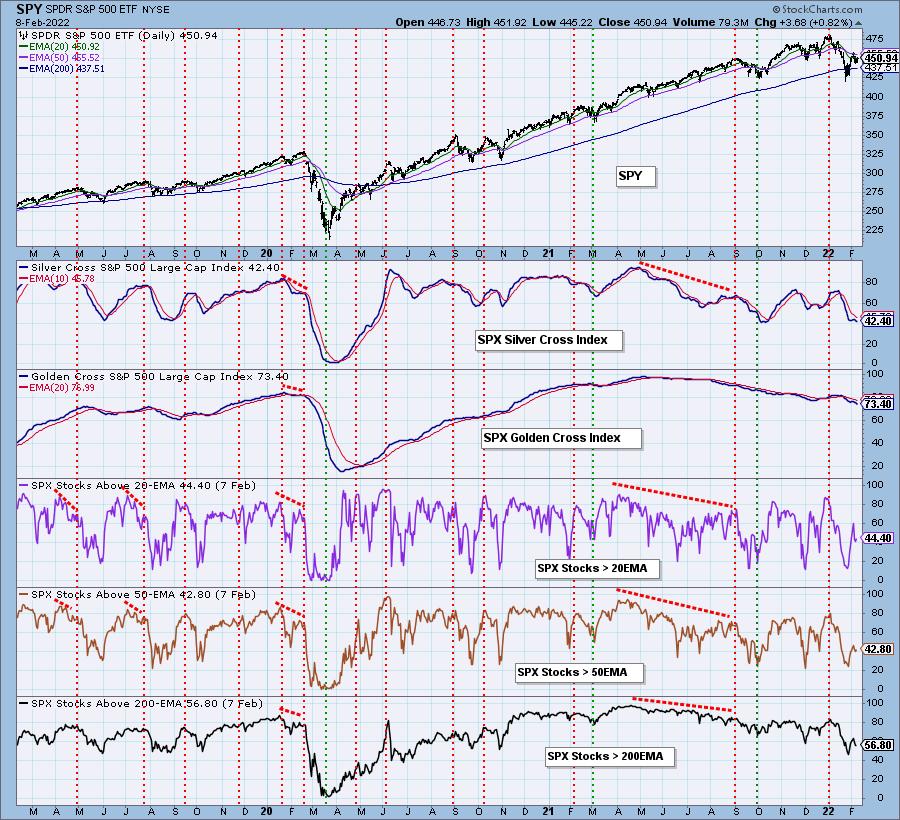

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 15% invested and 85% is in 'cash', meaning in money markets and readily available to trade with. Contemplating a small position in one of these Diamonds tomorrow.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Happy Charting!

- Erin

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com